Auto Finance Summit

Let's solve your biggest payment problems together.

Too many calls

High cost of acceptance

Time consuming tasks

Fraud & risk challenges

Cost of taking cash

Staying up to date

Payments, meet Progress.

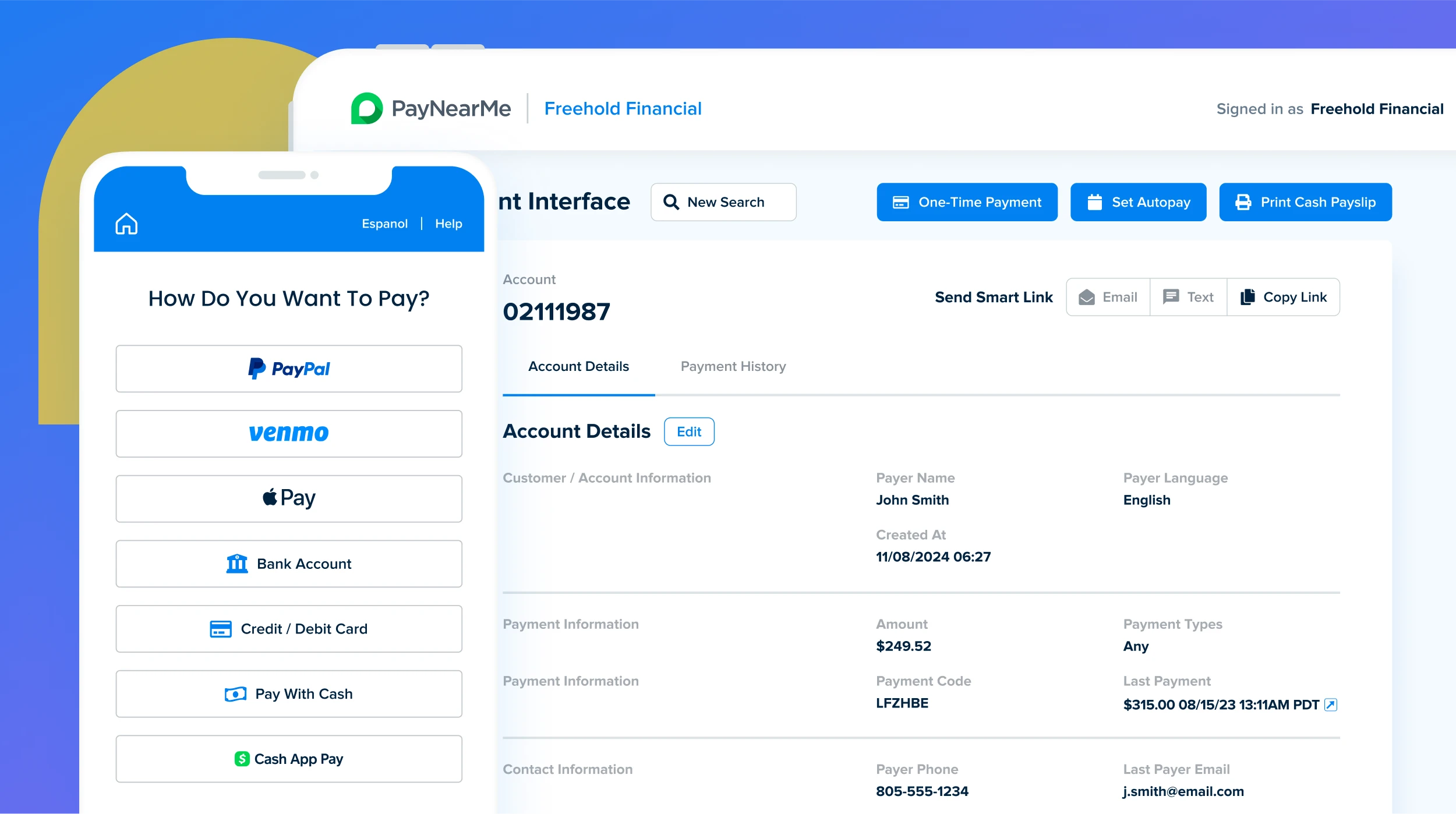

Tired of building workarounds for all the things your current processor can’t do? See what’s possible with PayNearMe, the modern and reliable platform that finally let’s you say yes to every payment.

- Increase on-time, self-service payments

- Provide more payment options in a single platform

- Automate collections with smart payment reminders

- Improve margins by lowering your total cost of acceptance

- Reduce your PCI compliance scope