Payment Experience Management

For too long, payments have been treated as a cost of doing business. But that's all changing. With Payment Experience Management, businesses are finding new ways to improve cash flow and profitability by accelerating payments and reducing the total cost of acceptance.

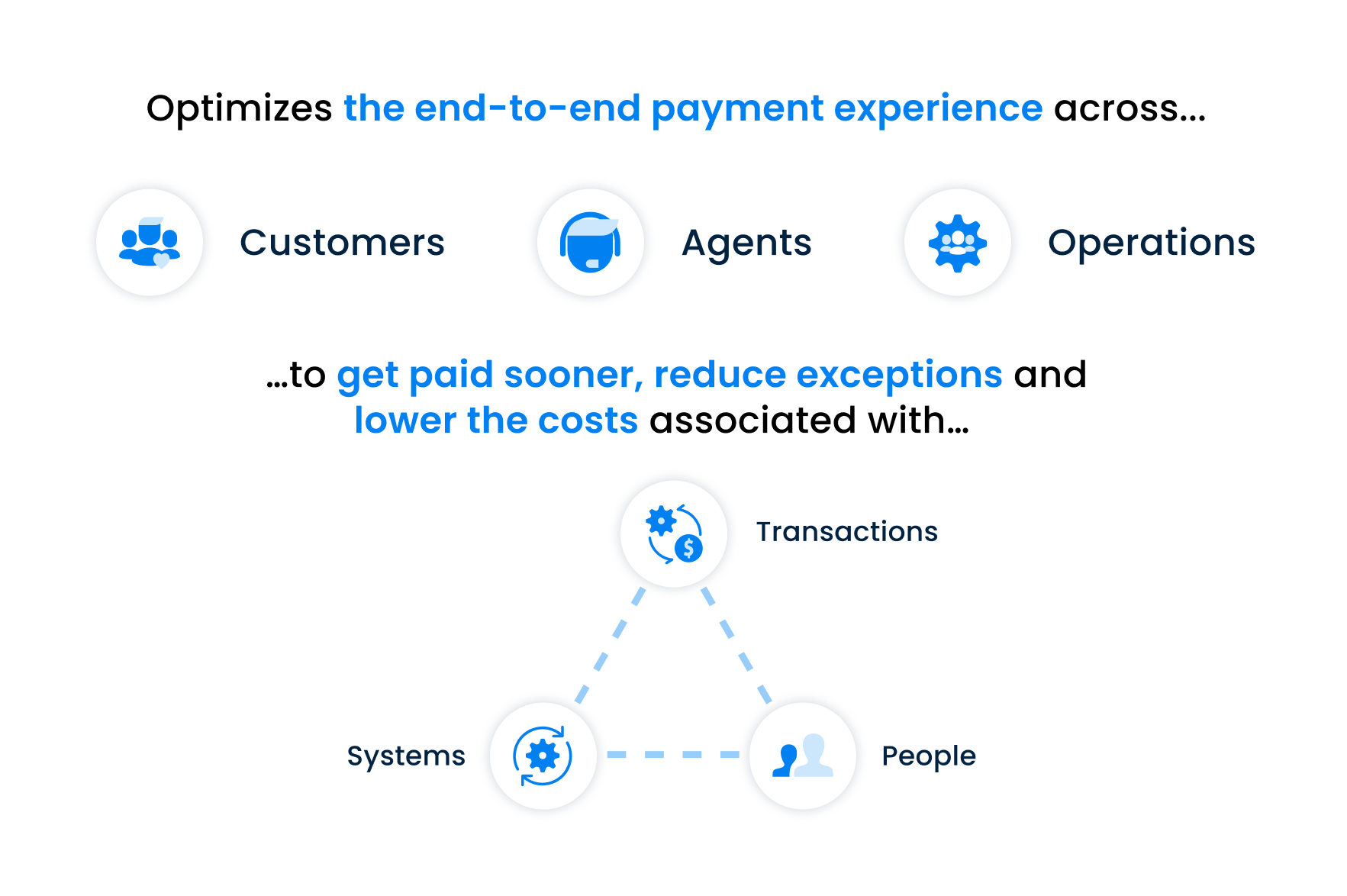

What is Payment Experience Management?

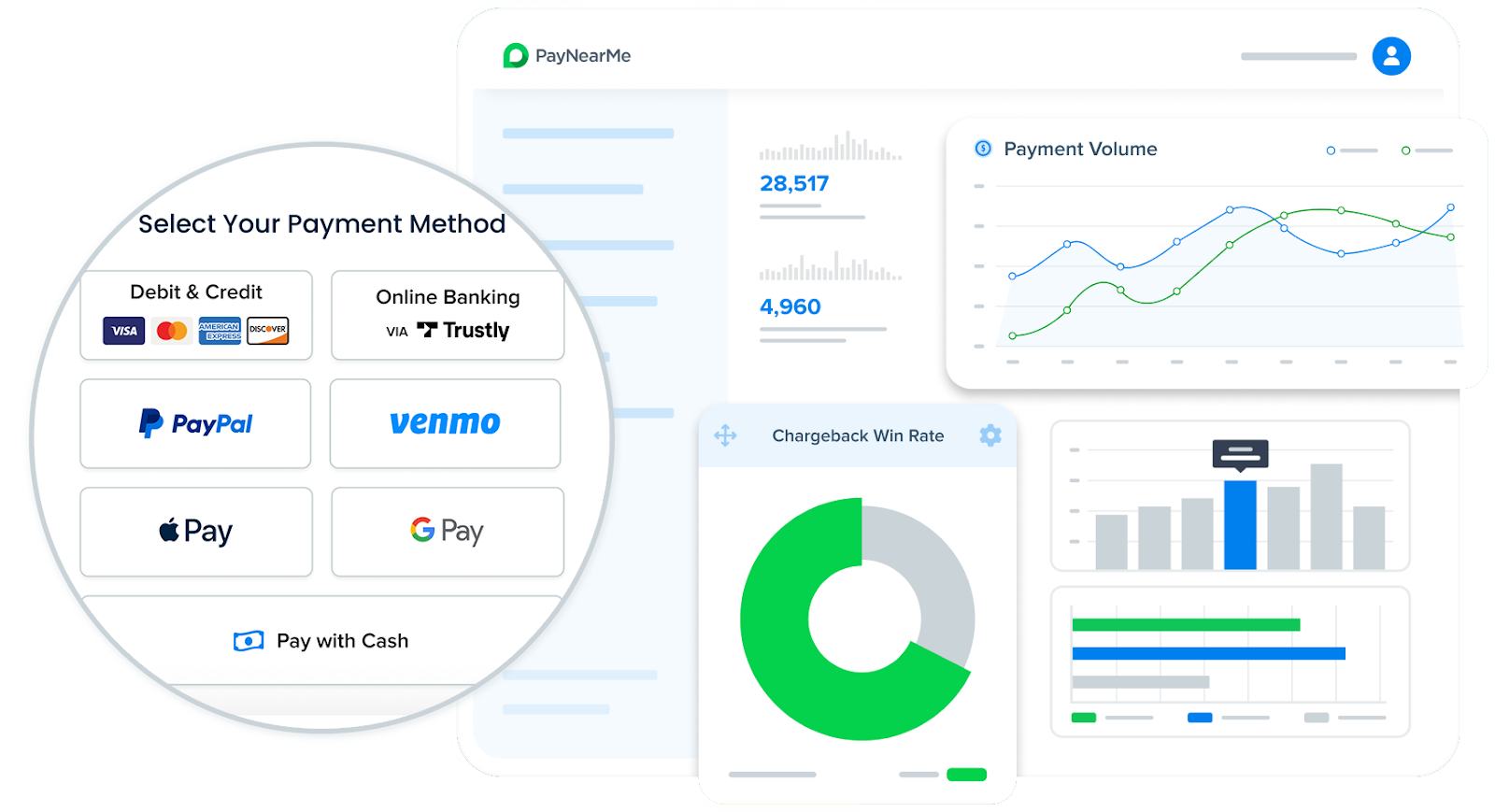

Payment Experience Management is a combination of software and money movement services which optimizes the end-to-end payment journey across customers, support and operations. It goes beyond the transaction, ensuring every stakeholder in the payment process has an easy experience.

For customers, it removes friction and combines all the ways they want to pay in a single interface to improve payment completion. For support staff, it provides tools that reduce call times and improve resolution rates. For operations, it creates visibility, streamlines reconciliation, and cuts the cost and complexity of managing payments.

By optimizing all three, Payment Experience Management can improve cash flow and profitability by accelerating payments and reducing the total cost of acceptance.

Why it matters

Cash flow

Profitability

Satisfaction

Customer experience

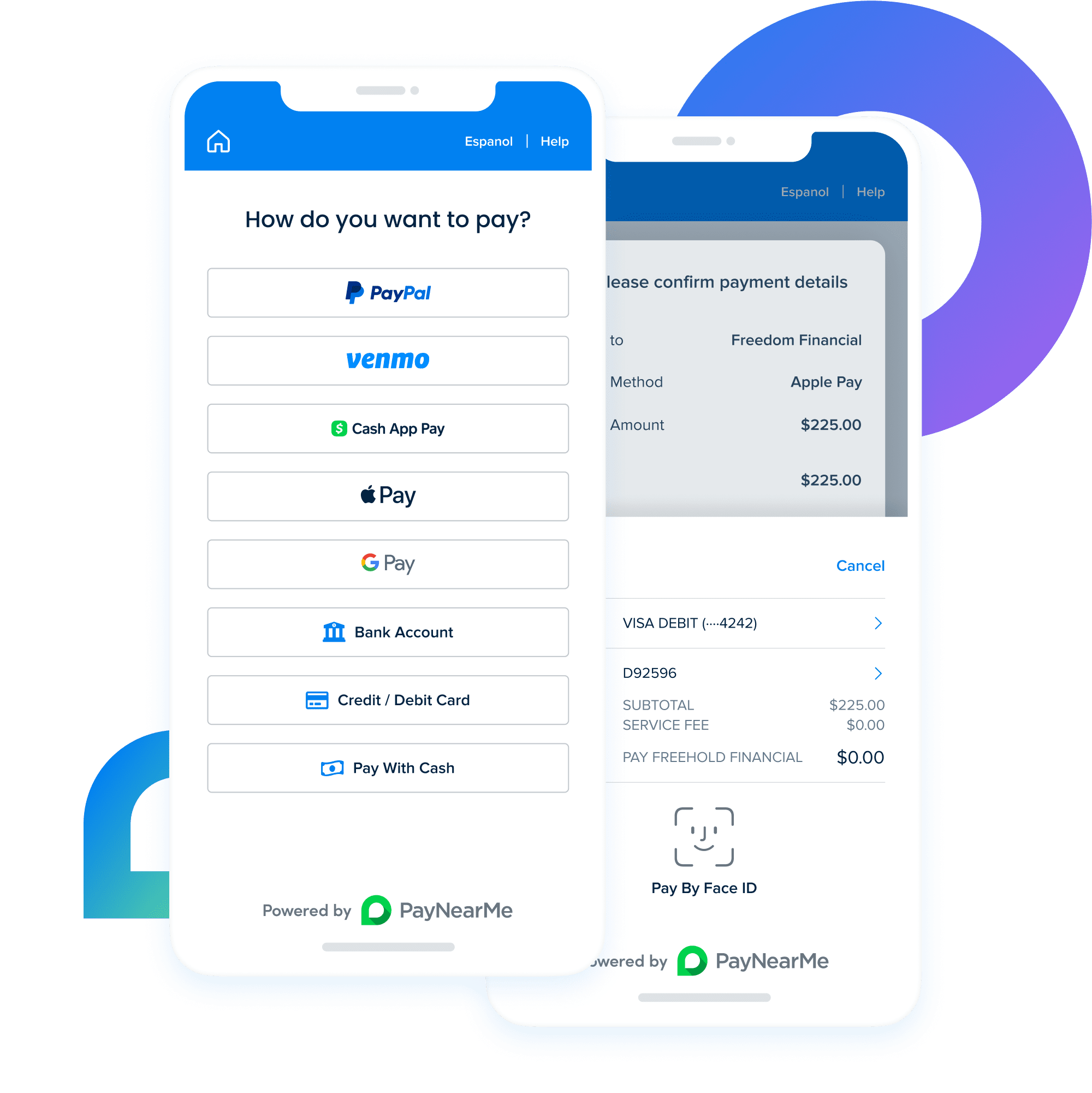

Deliver frictionless and inclusive self-service payment options that allow customers to pay quickly, using any funds they have, regardless of where they are stored, at any time or place.

-

More self-service optionsEnable customers to pay with any tender in their wallet, across more channels, at any time.

-

Frictionless experienceRemove common obstacles such as logins, passwords and manual inputs.

-

InclusiveSay yes to every payment, whether its electronic, cash at retail or digital wallets.

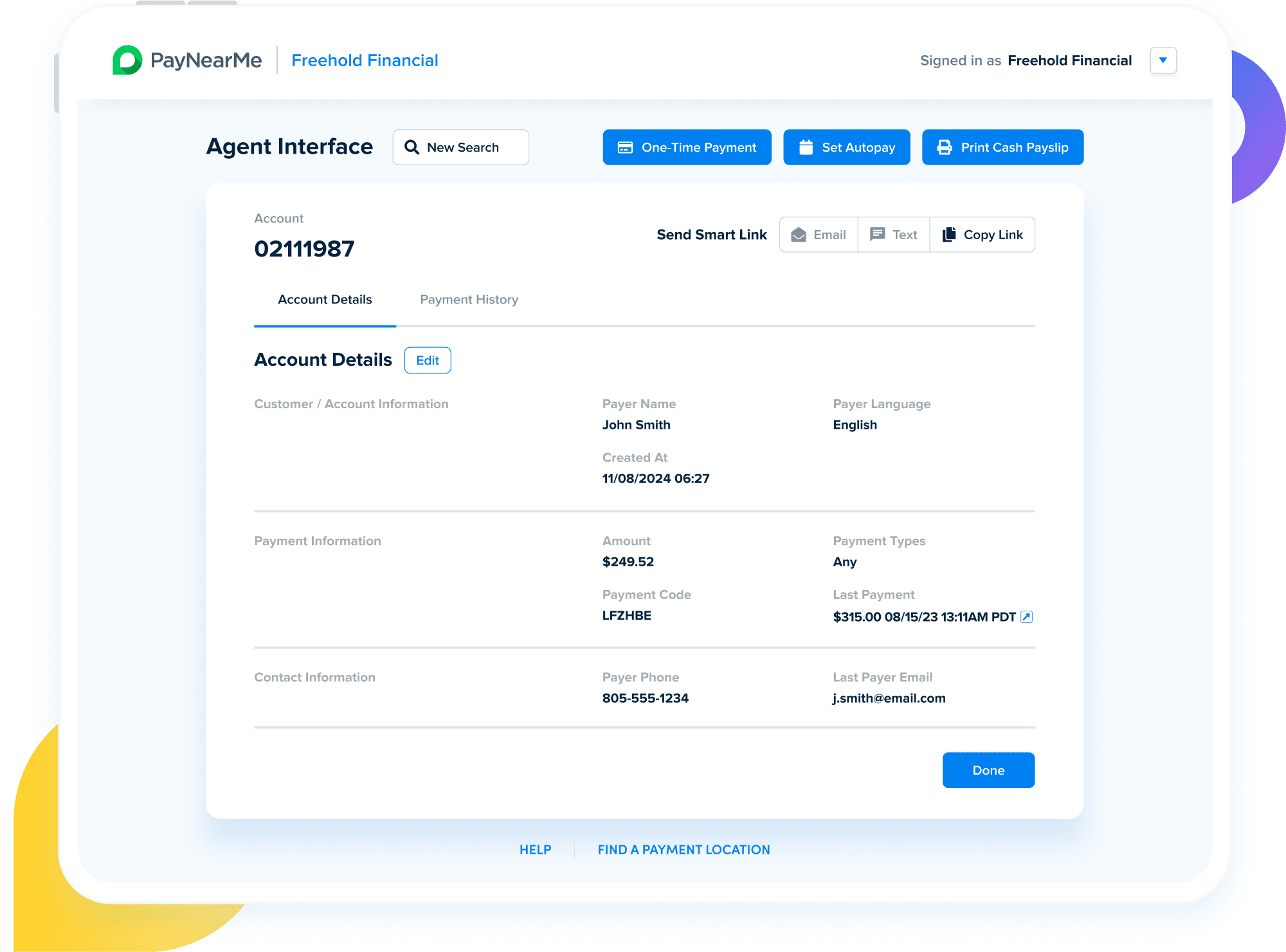

Support enablement

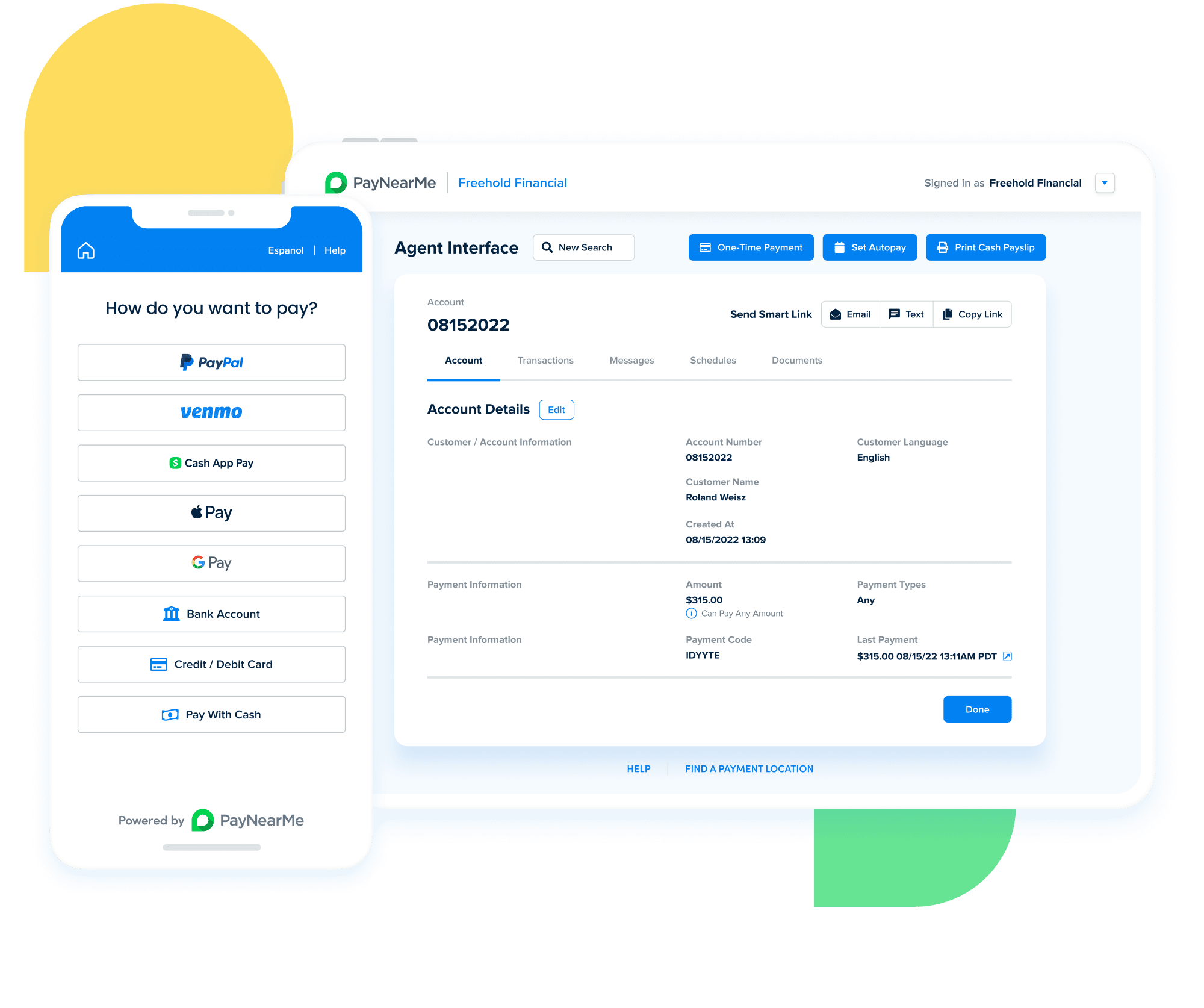

Equip human or AI support teams with tools to resolve calls faster, encourage self-service, and ensure payments are completed and verified during the interaction.

-

Self-service advocacyAllow support staff to push self-service Smart Links customers, while staying with them through the process.

-

Faster call resolutionPut more tools at the fingertips of your support staff to quickly close out customer calls.

-

Secure and compliantReduce PCI compliance burden and mitigate human entry error with fewer over-the-phone payments.

Operational excellence

Automate and integrate payment workflows into existing systems to minimize manual work, speed up reconciliation, and reduce errors across the payment lifecycle.

-

Integrated APIsConnect to all the tools you already use to improve efficiency and lower IT and developer maintenance costs.

-

Configurable rulesCreate if-then rules that automate critical payment-related workflows.

-

Exception managementIncrease acceptance rates and mitigate fraud with smart tools to drive up successful authorizations.

Payment Experience Management in action

See how the PayXM™ platform delivers on the promise of Payment Experience Management.