Demand more from your payments platform

New! PayNearMe Partners With Trustly to Enhance Open Banking Technology

Learn more

Comprehensive money movement

Make money movement a breeze with a single platform that manages the end-to-end payments and disbursements experience.

-

One platform for payments & disbursementsAccept and disburse funds with a unified user experience

-

Simplified technology managementSpend less time and money managing your payments with a single vendor, contract and integration

-

Reduce operational strainAccess powerful tools for managing compliance, risk, reporting and more

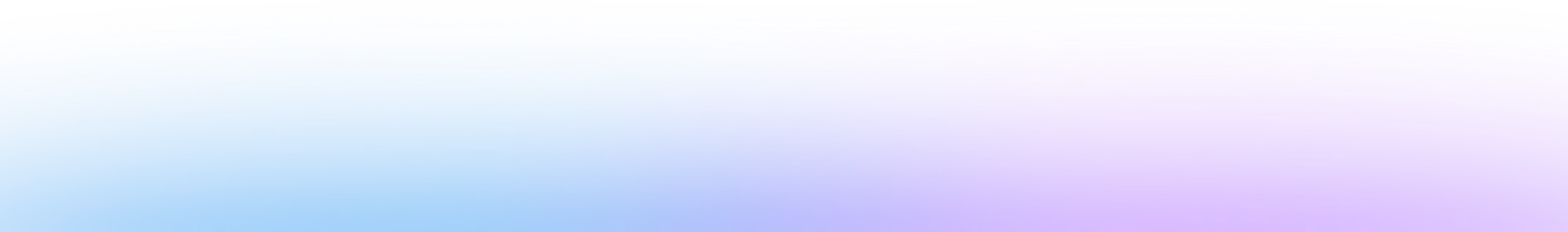

Unlock the full potential of your payments data

Monitor, report and take action on your payments data with a suite of analytics and reporting tools.

-

Turn data into decisionsIdentify opportunities in your payments data that can be used to drive operational improvements

-

Understand your customersTrack important payment behaviors and trends over time

-

Simplify reportingVisualize your data with insightful reports for non-technical users

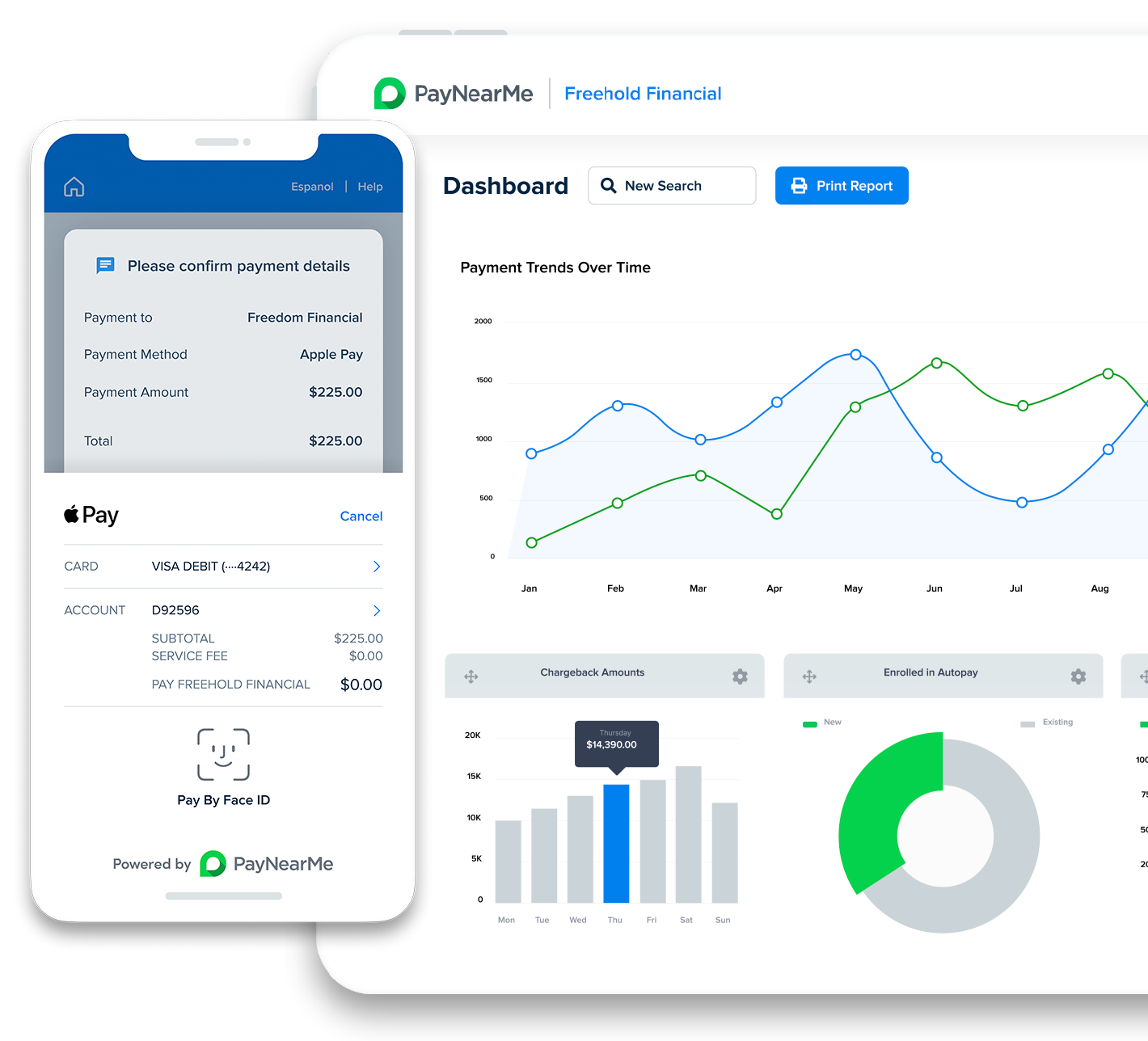

Security & compliance made easy

SOC1 and SOC2 Compliant

PCI compliant

Money transmission

AML & OFAC

Risk & fraud

Secure

Payments you can depend on

Collect more payments and drive up acceptance rates with features that mitigate downtime and prioritize availability.

-

Improve uptime with redundant processingSeamlessly route payments between multiple processors to maximize uptime

-

Zero downtime releasesStay up to date without having to schedule maintenance windows or planned downtime

-

Dynamic scalingAdjust for spikes in payment volume automatically

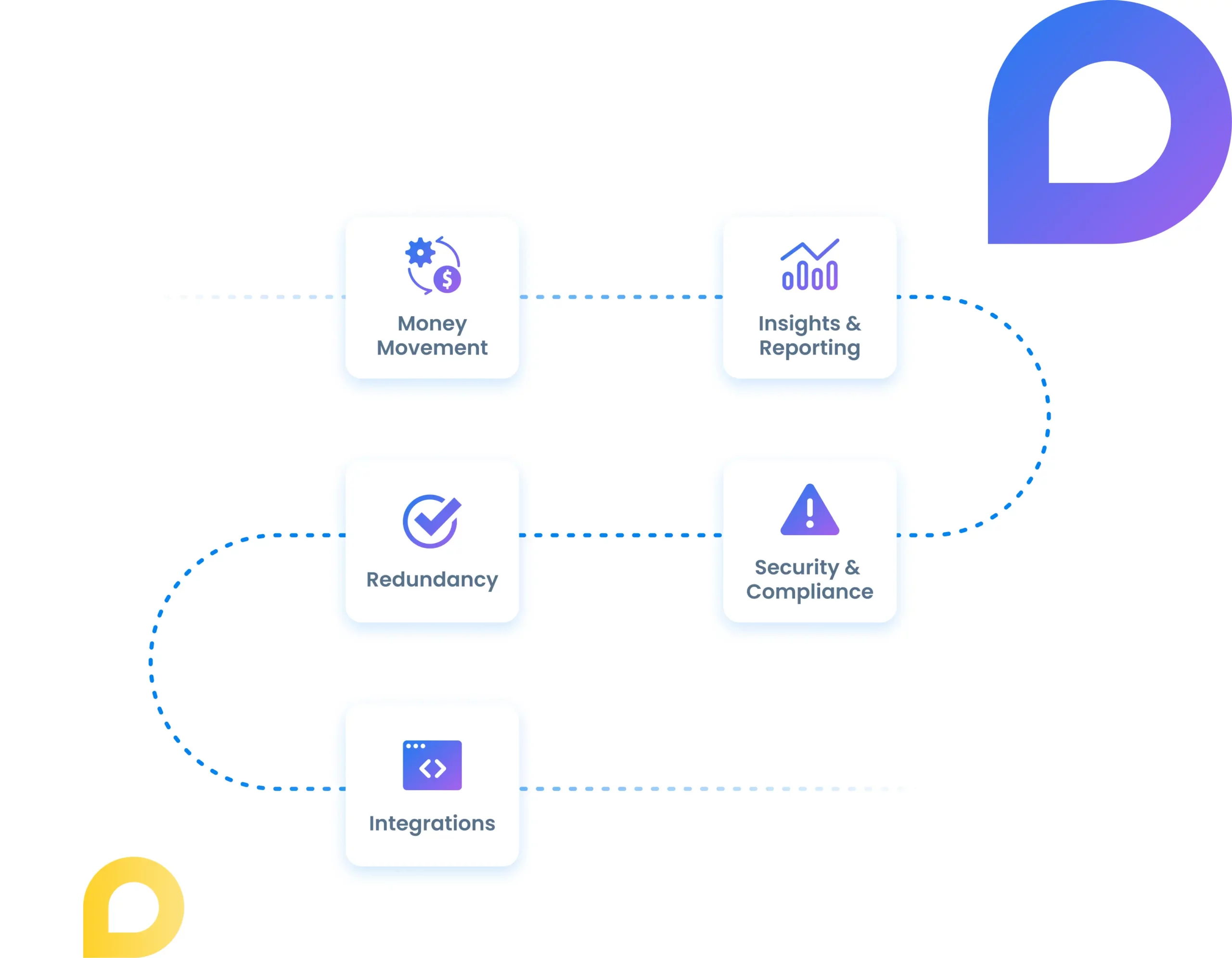

Connect & expand with ease

Working with a modern payments stack means being able to easily connect to the applications, services and internal systems that matter to your business.

Take advantage of a fully extensible system with a variety of APIs and pre-built integrations that connect you to the apps you care most about—now and moving forward.

Built to work for you

Avoid complex workarounds and expensive custom development costs. PayNearMe is highly configurable to meet the needs of your business.

-

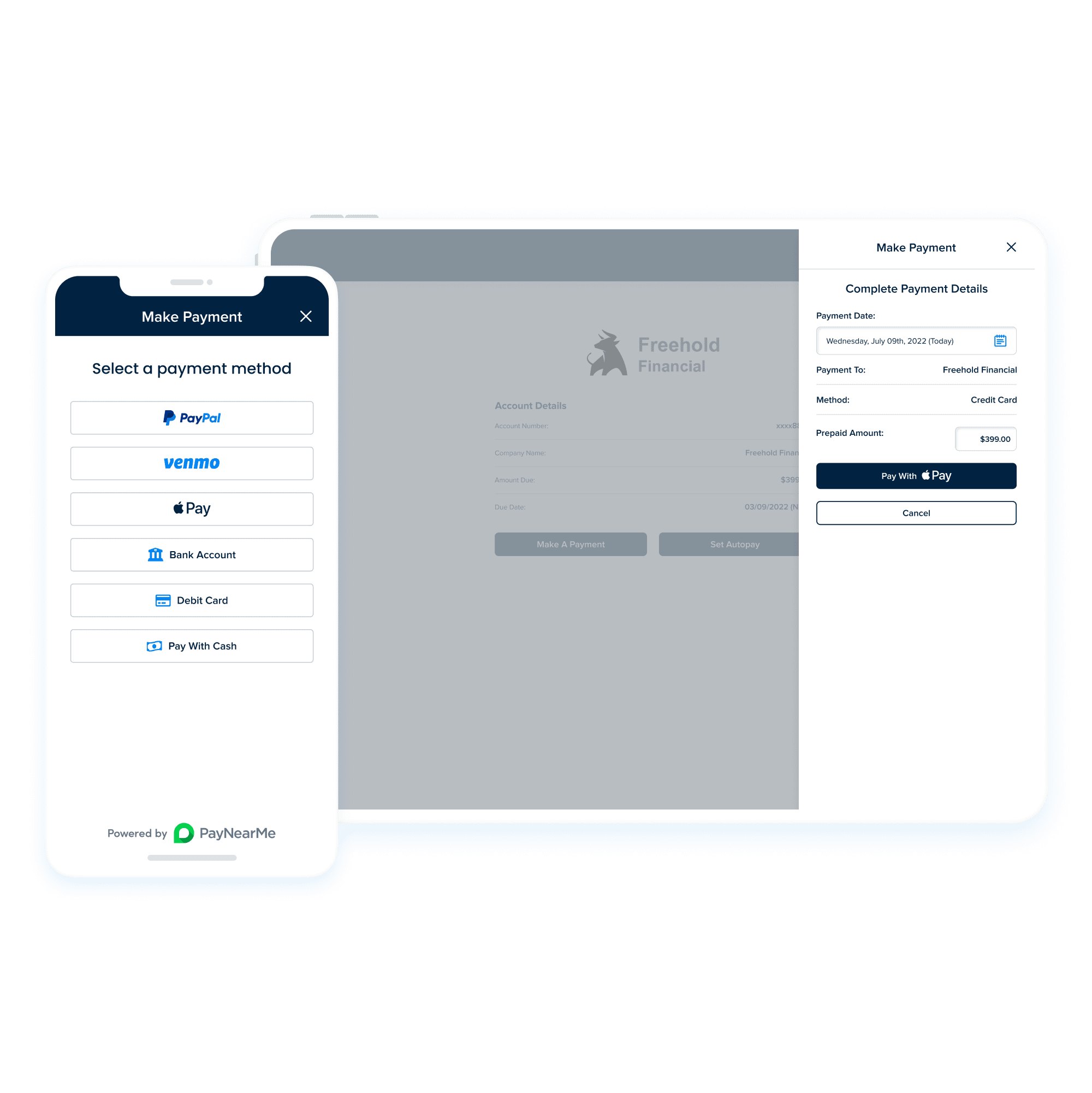

Multiple implementation optionsGet started quickly with a fully hosted solution, or embed PayNearMe within your existing workflows

-

Build automated rulesCreate no-code triggers and automations based on any fields in the system to streamline repetitive tasks

-

Craft a personalized experienceTweak nearly every part of the payment experience to build your ideal workflows