About this survey

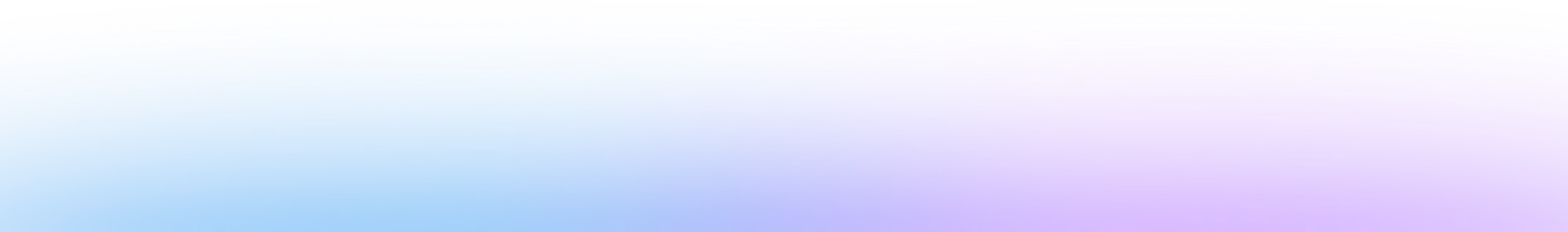

PayNearMe conducted an online survey in March 2024 (“survey”) to identify perceptions and preferences for how U.S. consumers pay their loans. The survey captured responses from a broad distribution of nearly 1,574 consumers aged 18+ (“respondents”).

The survey aimed to uncover:

- What challenges make it difficult to pay loans for consumers across the generational divide

- How consumers across generations manage and pay their loans

- How important convenience and personalization in the payment experience is to consumers

- The gaps between consumers’ expectations and their current loan payment experience

- What features would make loan payment easier for consumers in each generation

Key findings

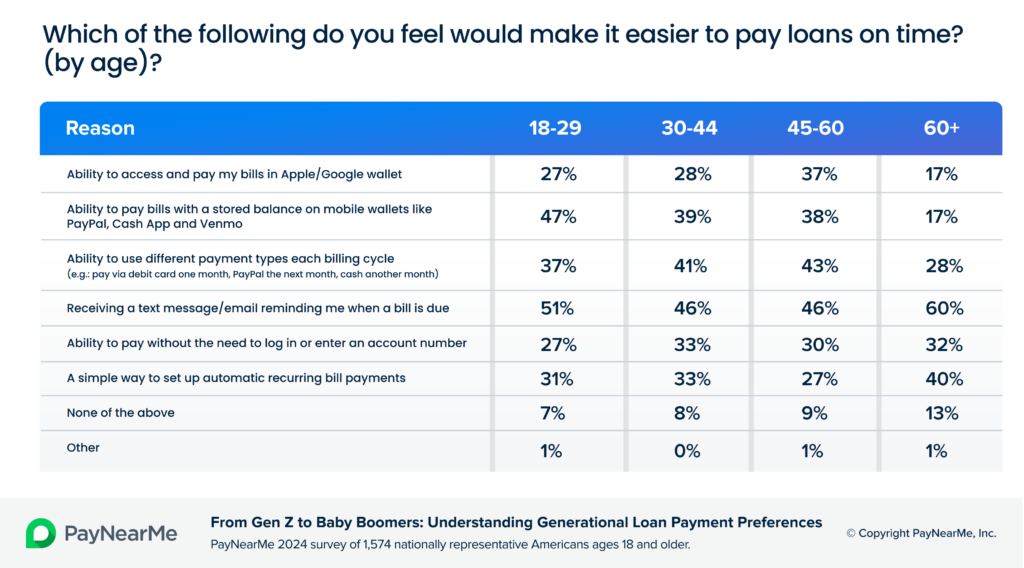

- Gen Z (ages 18-29) prefers mobile-centric payment solutions, and 47% feel the ability to pay loans with a stored balance would make it easier to pay on time.

- Millennials (ages 30-44) have a strong desire for easier and less stressful loan management, with 48% saying that managing and paying bills causes them stress and anxiety.

- Receiving payment reminders is crucial for all age groups, but particularly with Millennials, with 45% indicating that reminders would help them pay on time.

- Gen X (ages 45-60) borrowers demonstrate a paradoxical relationship with payment options. 52% feel overwhelmed when presented with many payment options, yet this same cohort considers it important to have many alternative payment options.

- 46% of baby boomers (ages 60+) use smartphones to pay their loans, but struggle with entering payment information (33%). Given this struggle, 77% consider pre-populated payment details important.

Introduction

To stay ahead of current trends and consumer payment preferences, PayNearMe conducts survey-based research to keep a pulse on consumer bill payment behaviors and preferences. Our goal is to uncover how various hurdles may impact consumers’ payment habits and offer practical advice for lenders to enhance customer experiences.

In today’s competitive lending landscape, understanding the diverse payment preferences of your customers is essential. In our previous report, we shared that nearly 8 in 10 loan consumers (79%) indicated they would return to a lender after an exceptional bill payment experience, while 82% would consider switching lenders after a poor one.

When we analyzed payment behaviors across different age groups, meaningful differences emerged, revealing that a one-size-fits-all approach simply won’t suffice.

Crafting payment experiences to align with your customer mix—and strategically targeting growth areas—can lead to a more tailored experience that drives on-time payments, reduces exceptions and fosters brand loyalty.

In this report, we’ll dive into key findings from the survey, highlighting the differences in payment preferences across four distinct age groups: Gen Z (18-29), millennials (30-44), Gen X (45-60) and baby boomers (60+). By analyzing these age-specific insights, we aim to reveal how consumer expectations vary by generation and identify opportunities to deliver a more engaging, personalized payment experience for each demographic.

Gen Z’s loan payment challenges

Gen Z (ages 18-29) is just getting started in their financial lives, and money may be tight for many in this group. According to Pew Research, median annual earnings for 18-24 year olds is $20,000 and $43,000 for 25-29 year olds. Meanwhile, according to Credit Karma, this cohort carries an average total debt of $16,283. Given these financial pressures, it’s no surprise that staying on top of payments is a significant challenge for this generation.

In our last consumer report, we learned that 41% of all survey respondents struggle to remember payment due dates. For the youngest group of respondents, though, this sentiment jumps up to 48%. In fact, Gen Z led all groups in nearly half the categories when asked what makes paying loans online difficult. This group noted that some of the areas that make paying loans difficult include navigating lender websites (31%), entering payment information (34%) and not having their preferred payment types available (35%).

Interestingly, Gen Z has the easiest time remembering passwords and login info (36%). It’s quite possible that this is due to their comfort with technology and willingness to use their phone and browser password manager tools.

Optimizing the loan payment experience for Gen Z

Given the difficulty in remembering due dates, Gen Z would likely benefit from automated reminders and alerts. More than half (51%) of respondents in this age group said receiving text reminders when their loan payment is due would help them pay on time. Text message reminders, push notifications and email alerts that provide timely reminders and direct links to payment flows could drastically improve this age group’s payment experience.

Lenders can personalize the experience even further by dynamically populating key information customers need so they can simply choose their payment method and tap to pay. Nearly 7 in 10 (67%) Gen Z respondents agree that this level of personalization is important to them.

Gen Z respondents noted that mobile payment types are important to their loan payment experience. PayPal is seen as an important payment option to more than half (52%) of this cohort, followed by Apple Pay (47%) and Venmo (37%). Additionally, 61% indicated they would be willing to make their loan payment with a digital wallet.

This age group also indicated the highest desire to pay their loans with a stored mobile wallet balance (47%). According to Inc, 53% of U.S. Gen Z workers are full time freelancers. In other words, a significant portion of your loan portfolio could have a portion of their income that doesn’t go directly into their checking account. If the consumer prefers to pay with stored funds first, they may prioritize any lender willing to accept this payment—potentially putting them at the top of the priority ladder.

Millennials’ loan payment challenges

Millennials (ages 30-44) have their own set of financial challenges. This cohort faces significant obstacles in achieving financial independence and managing debt. According to Magnify Money, 58% of millennials are living paycheck to paycheck. Meanwhile, 76% of millennials say that high levels of debt interferes with their financial goals. Amidst these financial pressures, practical issues also complicate their payment experiences.

One of the primary payment challenges faced by millennials is remembering logins and passwords, with 42% identifying this as a major hurdle in paying bills. Additionally, they struggle with remembering due dates (43%).

What would help this age group overcome these challenges? Turns out, a simple reminder could go a long way. In fact, 45% of millennial respondents indicated that receiving payment reminders would help them manage their payments more effectively. Further, a whopping 79% consider having a personalized link with pre-populated payment details that would allow them to avoid the login process entirely, is important.

According to the Federal Reserve, six in 10 consumers find that convenience and ease of use are the most desirable qualities in payments. Knowing this, it’s no surprise that personalization and convenience are also important to millennials, with 68% noting that they value a personalized loan payment experience. This includes features that recognize their preferences and tailor billing information accordingly, a sentiment only surpassed by Gen X respondents (ages 45-60). Post-payment, 61% of surveyed millennials want to receive personalized recommendations, such as options to set up autopay or refinance their loans.

Optimizing the loan payment experience for millennials

Based on our survey results, lenders seeking to appeal to the payment preferences of millennials should double down on their communication efforts. Lenders should provide ample payment reminders through multiple channels such as SMS and email, placing customers directly into their payment flow. Removing the hurdle of remembering and typing in logins and passwords by using personalized links could also help reduce stress and ensure timely payments.

By tailoring alerts to customer preferences for frequency and communication channel, lenders can not only remove some of the manual intervention required with collection efforts, but also provide their customers with the personalization they desire, significantly enhancing their payment experience.

Gen X’s loan payment challenges

According to Money.com, Gen X (ages 45-60) consumers face the highest levels of debt with an average of $158,556 non-mortgage debt, compared to $125,047 for millennials, $94,880 for baby boomers and $29,820 for Gen X. Carrying debt and financial uncertainty typically comes with feelings of stress and anxiety for consumers.

Overall, 56% of Gen X respondents noted that the process of managing and paying bills causes stress and anxiety. However, this figure jumps to 64% for Gen X respondents with an annual household income of $100,000 or more. This demonstrates that frustrations with the loan repayment process aren’t necessarily due to lack of financial resources; it could rather be the overall tedium and inefficiencies in the process. It’s clear that both consumers facing high debt and those with more financial resources appear to be struggling with the bill payment process.

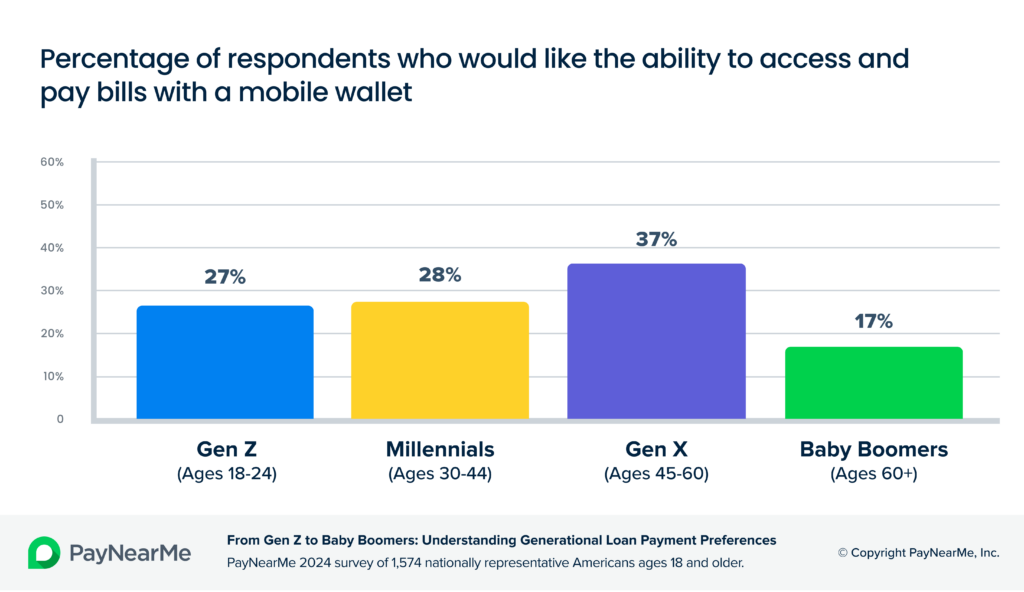

Despite these challenges (or perhaps because of them), our survey indicates that Gen X is leading the charge in alternative payment adoption. Gen X indicated the highest preference for making loan payments with alternative payments such as Apple Pay, Venmo and PayPal—outpacing their youngest cohorts in the 18- to 29-year-old range. Additionally, more than half (51%) of Gen X respondents ranked Venmo in their top three payment choices, followed closely by PayPal (48%).

Gen X also indicated the highest desire for having access to pay their bills with a pass-through mobile wallet such as Apple Pay and Google Pay (37%), compared to Gen Z (27%) and millennials (28%). Gen X shows a clear preference for modern payment methods, suggesting that lenders should not overlook or make assumptions about this age group’s technological adaptability.

Optimizing the loan payment experience for Gen X

Gen X indicated a strong desire for using convenient, tech-savvy payment options that offer ease of access and use. Interestingly, this generation of payers demonstrates a paradoxical relationship with payment options. 52% said they feel overwhelmed when presented with many payment options, yet this same cohort considers it important to have many alternative payment options.

To account for this dichotomy, lenders can offer a wide selection of payment options, while using dynamic presentation to show each customer the payment methods that may make the most sense to them. This can be done with a collapsible list or by simply prioritizing the list of payment options based on the user’s preferred payment types or past payment behavior.

The survey also found that 50% of Gen X payers have a propensity to use cost- and labor-intensive payment methods—20% pay by mail, 19% call customer service to make a payment, and 11% pay in-person at the lender’s office.

50% of Gen X payers have a propensity to use cost- and labor-intensive payment methods.

Lenders have a clear opportunity to guide this generation of payers to frictionless self-service options such as 1-click payment links to reduce the stress and anxiety tied to the payment experience, all while reducing their overall cost of payment acceptance.

Baby boomers loan payment challenges

Baby boomers are experiencing financial strain as they enter retirement with significant debt and fixed incomes. According to MarketWatch, in 2022, 65-74 year olds had an average mortgage balance of $175,670, while nearly a quarter of adults 75+ held mortgages, the highest percentage since 1989. Financial strain can be exacerbated when the process of paying bills is difficult, demonstrated by the fact that nearly half (48%) of baby boomers surveyed wish managing and paying bills was easier.

Despite being the most financially experienced and the least likely to say they struggle to remember due dates, 60% of baby boomers surveyed said they would find it very helpful to receive text messages or emails reminding them when payment is due—the highest of all age groups.

Baby boomers, more than any group (79%), report they “have a good handle on managing and paying bills.” However, they clearly appreciate tools from their lenders such as payment reminders, which give them reassurance that no bills will fall through the cracks.

Baby boomers surveyed had the lowest percentage of borrowers paying all their loans by autopay (35%), indicating this cohort may have discomfort with giving up control of when their loan payments are withdrawn from their accounts.

Optimizing the payment experience for baby boomers

So does the data agree that baby boomers are avoiding autopay due to a fear of lack of control? Absolutely. In fact, 78% of baby boomers surveyed noted they haven’t set up autopay because they want to control when their bills are paid. Lenders can overcome this challenge by offering more flexible autopay schedules and flexible payment plans.

There is a clear opportunity here for lenders to increase autopay enrollment with their baby boomer customers, improving the overall payment experience for this cohort, while increasing on-time payment rates.

Our survey revealed that 46% of baby boomers use smartphones to pay loans online, but are facing challenges that indicate a lackluster payment experience. For example, 20% reported they had difficulty navigating biller websites and 33% have difficulty entering payment information.

Lenders can optimize the payment experience for baby boomers—and all age groups—by ensuring they provide a simplified interface. This age group noted a strong desire (77%) for pre-populated payment details, which could drastically improve their payment experience and drive on-time payments.

Key recommendations

As our research shows, each generation—whether Gen Z, millennials, Gen X or baby boomers—has unique needs and preferences when it comes to managing and paying their loans. However, despite these differences, many of the challenges consumers face across generations stem from similar issues within the payment process.

Legacy payment systems often fail to meet the diverse expectations of today’s borrowers, leading to frustration and missed opportunities for lenders. By focusing on broad yet impactful areas of improvement, lenders can create a more seamless and satisfying experience for all customers, regardless of age or financial situation. These recommendations are designed to help you optimize the loan payment process, driving higher on-time payments, reducing exceptions and ultimately, strengthening brand loyalty across your customer base.

- Offer a variety of payment methods: Lenders can provide multiple payment options including digital wallets such as Apple Pay, Google Pay, PayPal, Venmo and Cash App Pay to appeal to all age groups. This flexibility accommodates different preferences and ensures that all customers can use their preferred payment method.

- Implement robust payment reminders: Across all age groups, survey respondents noted a desire for payment reminders to make the loan payment process easier. Lenders can leverage communication across all channels including text messages, emails and push notifications to remind customers of upcoming payment due dates. This can help reduce missed payments, particularly for younger and older customers who may have trouble remembering due dates.

- Remove friction with personalized links: Lenders can leverage personalized links in QR codes and other delivery channels, placing customers directly into their payment flow. These customized links, embedded with each customer’s unique account details, can mitigate the stress of having to remember logins and passwords. Personalized links can also be sent directly to customers via email or text message, allowing them to pay in as little as two taps.

- Offer more flexibility and control: Lenders can offer greater flexibility and control over the loan repayment process. This includes introducing more customizable options for autopay, dynamically presenting payment options tailored to individual preferences and expanding choices in how, when, and where customers can make their payments. By empowering customers with these flexible solutions, lenders can improve the overall payment experience, reduce friction and drive higher rates of on-time payments across all age groups.

Paying attention to what your customers want at different ages and stages will earn you their satisfaction—and on-time payments—now and in the future.