Case Study: How a Leading Non-Prime Auto Lender Cut Its ACH Return Rate in Half with PayNearMe

Rising ACH return rates are an alarming metric for auto lenders, especially in the non-prime market. Figuring out how to reduce ACH returns practically (and profitably) is something many lenders grapple with on a regular basis.

This was one of the biggest issues one of our clients, a leading non-prime auto lender, aimed to address when the company began working with PayNearMe. The lender challenged our team to rethink how technology could solve this well-known business problem.

The Challenge

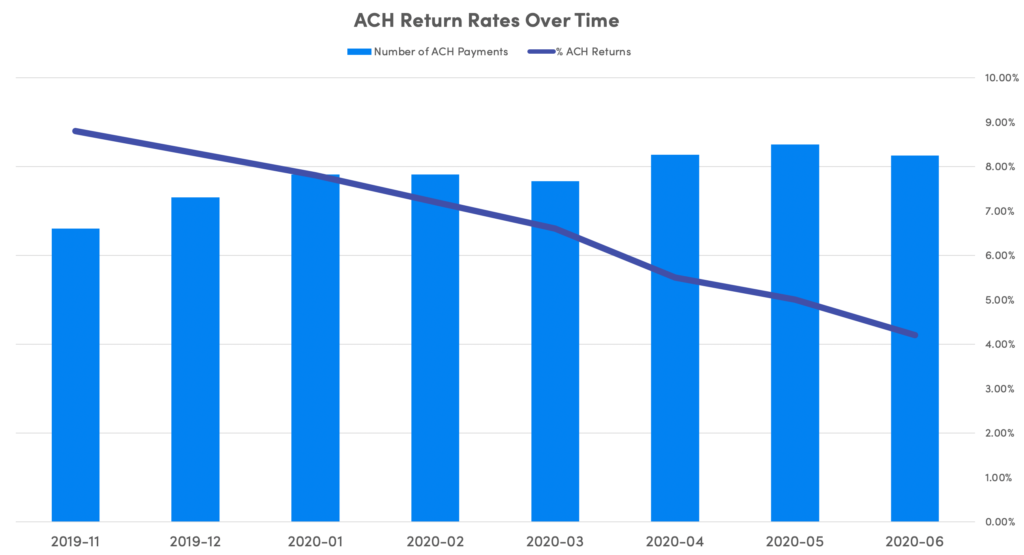

While the majority of loan payments are made without issue, every month a percentage of payments made via ACH are returned. Prior to partnering with PayNearMe in 2019, the client noticed a troubling trend—the more ACH payments it received each month, the greater the rate of ACH returns.

The Problem with ACH Returns

On the surface, the fees associated with payment returns can range from $2-$5 per payment on average (although fees for fraud-related payment reversals can reach $25). But this cost doesn’t tell the whole story.

For every returned payment, one of the lender’s employees needs to contact the customer to secure an alternative form of payment. Depending on where the customer is in her loan repayment schedule, collecting the outstanding debt can be exceedingly difficult. Thus, the real cost of a returned payment ends up much higher than the initial return fee.

Additionally, the National Automated Clearing House Association (NACHA) sets limits on payment return rates. Lenders experiencing a higher-than-allowed rate of payment returns face the risk of fines — critically impacting their bottom line.

Payment returns are also bad news for loan customers. Failed ACH payments result in NSF and late payment fees for the customer. These can add up quickly, frustrating the customer and decreasing lender satisfaction.

Understanding The Problem

During its first three decades in business, this non-prime auto lender observed a number of trends that helped to predict the likelihood that an ACH payment would be returned. Yet in spite of this critical business intelligence, the company had not figured out how these trends could be cost-effectively operationalized to prevent returns before they happened.

The solution came in the form of PayNearMe’s Business Rules. These logic-based rules give platform users the power to automate processes based on any custom fields the user uploads.

In this case, the client soon realized that it could use learnings from its past to prevent the chance of future returns—effectively driving down return rates over time. For example, knowing that a customer who has had two NSFs in a year is much more likely to repeat, the lender could choose to show this customer alternative payment options such as debit cards or guaranteed cash payments.

Operationalizing Insights to Drive Action

The client presented PayNearMe with a list of operational challenges it thought could be solved with logic-based business rules. Since these rules could be deployed without any custom code or core architecture changes, PayNearMe was able to check off every item on the list in a matter of weeks.

“We’re a company focused on helping our customers solve business problems. We were excited to help our client harness the power of our platform to demonstrate it’s more than just simple payment processing,” explained Michael Kaplan, Chief Revenue Officer at PayNearMe. “This is a great example of our team delivering on its promise to help our customers drive successful business outcomes and operational efficiency.”

Smarter Payments Yield Better Results

The impact of PayNearMe’s Business Rules on the lender’s ACH return rates was apparent almost immediately, and the rates have continued to improve over the past six months.

“This isn’t a ‘one-and-done’ kind of project,” said Kaplan. “We’ve worked with our lending client over the last six months to help optimize these automated rules to further drive down ACH returns.”

Now, with even more rules in place, customer payment options are dynamically assigned based on payment history, loan status and other factors.

Next Steps: Advanced Business Logic

With ACH return rates now down to their lowest level in years, the non-prime lender is looking to the future. Next up: how to leverage new data points to continue to optimize its payment processes.

If your business needs to optimize payment metrics, we can help. Check out this quick Platform Overview or request a demo to see the platform in action.