PayNearMe Launches PayNearMe Insights, an Industry-Leading Suite of Tools to Democratize Data for Clients

The analytics suite will make payments and consumer behavior data more accessible, allowing PayNearMe clients to understand the health of their business, predict outcomes and adapt payments strategies

“Data shouldn’t be locked in the hands of a few,” John Minor, Chief Product Officer, PayNearMe, said. “There are billions of data points that live within the PayNearMe ecosystem. We are democratizing payments and consumer behavior data for our clients, making it possible for them to access and apply it in new and innovative ways.”

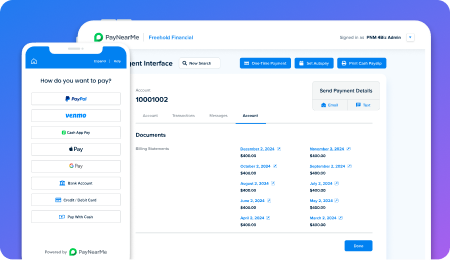

PayNearMe Insights will enable billers and gaming operators to measure and benchmark their payments data with aggregate industry data, track payment and consumer trends as they unfold in their market or location, and predict the impact on their business. Additionally, the ability to connect with third-party data partners can bring in a wealth of external data, delivering actionable insights that enable clients to react and adapt their payments strategies at a granular level.

This approach provides the necessary structure for utilizing consumer behavior data in predictive modeling and machine learning. Analyzing patterns in data sets will enable billers and gaming operators to forecast customer payment behavior and optimize strategies for increasing self-service, eliminating friction and improving customer satisfaction.

In addition to the robust dashboard capabilities currently available, billers and gaming operators will be able to ingest and segment data in near real time. This will allow them to examine consumer behaviors from different perspectives and identify opportunities to improve the user experience. This payments analytics suite unlocks the full potential of data to drive business decisions.

“Until now, payments and consumer behavior data have not been easily accessible to learn from and drive operational improvements,” Minor said. “With PayNearMe Insights, our clients will be able to access a treasure trove of actionable data and use it to make better informed decisions.”

“Internally, we’ve been using payments and consumer behavior data to consult with clients on how we can help them achieve their individual business KPIs,” he continued. “We are excited to make these tools accessible to our clients so they can quickly and easily analyze large data sets to better understand the health of their business, predict outcomes and adapt their strategies for reducing operational expenses and driving more profitable revenue.”

About PayNearMe

PayNearMe develops technology that drives better payment experiences for businesses and their customers. Our modern, flexible and reliable platform helps businesses increase customer engagement, improve operational efficiency and drive down the total cost of accepting payments. PayNearMe enables more ways to pay by offering all major payment types and channels in a single platform.

PayNearMe today processes a wide range of payment types including cards, ACH, Apple Pay, Google Pay, PayPal and Venmo, and has enabled cash payments through our proprietary cash network since 2009. PayNearMe cash payments are accepted at more than 40,000 retail locations in the U.S. including participating 7-Eleven®, Walmart®, Family Dollar®, Casey’s General Stores®, and ACE Cash Express®, among others.

Thousands of businesses partner with PayNearMe to manage the end-to-end customer payment experience in industries such as Consumer Finance, Property Management, Insurance, Utility and Municipality and iGaming and Sports Betting.

To learn more about PayNearMe, please visit www.paynearme.com. Follow PayNearMe on Twitter, LinkedIn and Facebook. The PayNearMe service is operated by PayNearMe MT, Inc., a licensed money transmitter.

This press release contains forward-looking statements regarding product development. The development release and timing of future product releases remains at PayNearMe’s sole discretion. Any such referenced products do not represent promises to deliver, commitments or obligations of PayNearMe MT, Inc. PayNearMe assumes no obligation and does not intend to update these forward-looking statements.