Prefer a podcast? Listen to the AI audio overview of this white paper.

Payments are the lifeblood of your lending business. With a fixed number of payments per customer over the life of a loan, each transaction has a significant impact on portfolio performance. Looking through this lens, scrutiny around the cost of acceptance is a trait that all successful lenders must adopt in order to squeeze out every last drop of profit.

Unfortunately, hyperfocusing exclusively on a “cost per transaction” approach has led many lenders astray. Best practice has given way to tunnel vision, where the surface level cost of a transaction has dominated decision making around payments strategy. Prioritizing the cheapest rail or the most widely adopted channel may shave a few basis points off your rate, but this approach creates hidden costs that quickly evaporate margins and produce operational headaches.

In reality, the cheapest payments may lead to the most expensive outcomes. Factors such as exceptions, human intervention and delinquency drive up the total cost of acceptance drastically—and are nearly always hidden from the monthly transaction report.

But what if many of these costs and risks could be avoided?

In this whitepaper, we’ll explore a range of factors that drive up the total cost of acceptance —caused by poor payments experiences and legacy technology systems. By the end of this paper, we aim to make the case that a new breed of modern payments software can address these challenges and reduce your cost of collecting payments.

Key takeaways

- Your total cost of acceptance includes more than just transaction fees.

Transaction fees are often the most visible expense, but the real costs of accepting payments include less obvious factors incurred by exceptions. Often overlooked cost-drivers include support calls, limited payment options, poor user experience, additional reconciliation work, and other operational inefficiencies. These less obvious cost drivers can significantly erode your profitability. - A customer’s willingness and ability to pay is highly correlated with the payment experience.

Preventable exceptions—those that emerge from a customer’s choice, rather than circumstance or technical error—are largely driven by poor payment experiences. These exceptions have the most potential to be eradicated by optimizing your payments around a customer’s willingness and ability to make a payment. - Legacy systems are the root cause of poor payment experiences, and a primary driver of higher acceptance costs.

Outdated systems often fail to meet today’s consumer demands for flexibility and convenience. As a result, they generate more exceptions, such as late or missed payments, returns and chargebacks, and increase the need for manual intervention—leading to higher overall collection costs. - Payment experience management solves the biggest problems impacting total cost of acceptance.

By enhancing the payment experience and driving down preventable exceptions, you’ll be able to see ongoing efficiency gains and lower costs across your portfolio. A modern platform enables you to lower costs by making it easier for customers to pay on time the first time, with minimal intervention or roadblocks. This leads to significant cost savings and efficiency.

The low-cost transaction fallacy

After decades of “business as usual”, payments have undergone a transformation in recent years. Consumers have adopted new payment methods, digital payment channels have proliferated, and new points of failure have bubbled up with each combination.

These new variables have created complexity for lenders focused on driving down the total cost of acceptance. A consumer’s financial situation may have been a strong indicator of payment behavior in the past, but today something as simple as a poor mobile web experience can cause the most willing and able customers to fall into delinquency or another costly exception.

Much of the blame for poor payment experiences can be placed on the stagnancy of legacy payment systems. These once reliable systems have failed to meet the changing needs of lenders and customers, creating friction and rigidity in the payment experience. Two key observations lead to this conclusion:

- One-size-fits-all payment strategies don’t work.

Failing to offer each customer the right payment options to increase their ability and willingness to pay on time can lead to more exceptions. Systems built to offer one or two payment options over limited channels can’t account for the rapidly changing expectations the industry is facing. A customer looking to enroll in recurring autopay on their desktop computer has different needs than an individual without a bank account that pays on their phone each month, despite both payments holding equal weight on your bottom line. Trying to force each customer into the same flow is a recipe for increased exceptions and collections over time. - Exceptions are anything that prevents a completed payment, requiring intervention and added cost to collect.

Old definitions no longer apply to a modern lending environment. Exceptions go beyond returns and chargebacks, including any payment interaction that requires a manual intervention above and beyond a straight-through process.

This may include issues like login problems that increase support calls; payments by phone that require the help of an agent; or late payments that occur when a customer can’t move their funds from a digital wallet to their bank in time to complete an ACH transaction. Each exception is exponentially more expensive to remedy than the cost of a successful payment, and repeat exceptions (e.g. a customer that NSFs every month) can quickly drive costs out of control.

A belief that these challenges are simply the cost of doing business leads to a string of decisions that can seriously, and negatively, impact costs and efficiency.

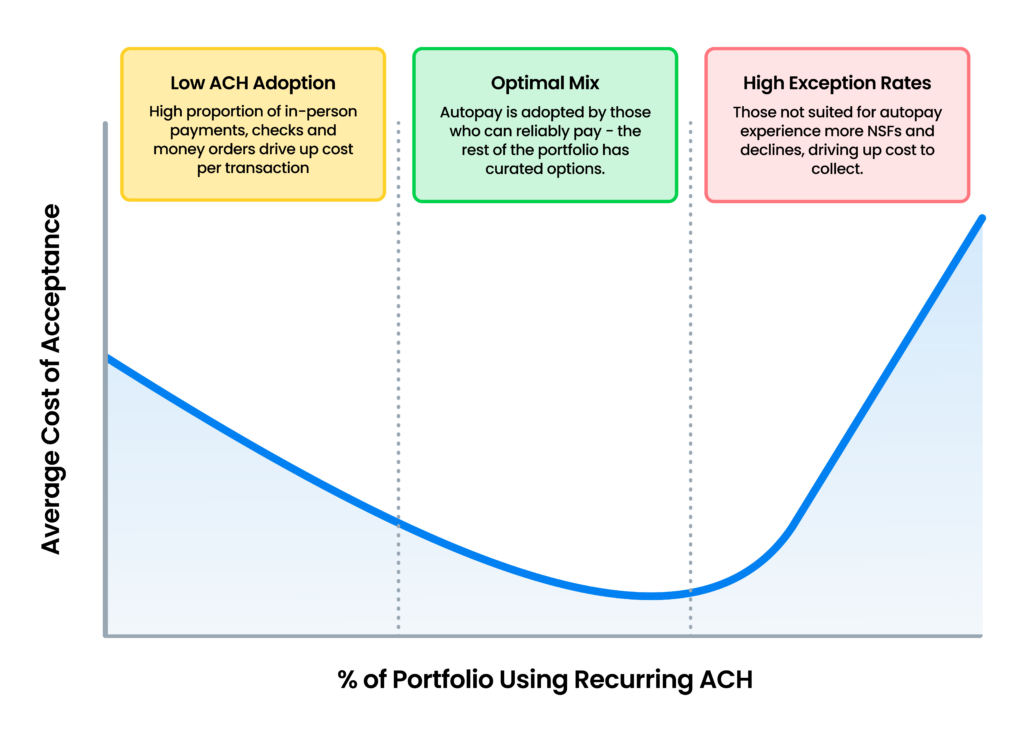

For example, recurring ACH is often touted as the most desirable payment option for a lending portfolio because of its low transaction costs and its popularity with consumers. But what happens when you push ACH on a customer who is much less likely to have funds available in their bank account at any given time. What if a customer primarily stores money in PayPal, Venmo or Cash App? Or if they have a history of non-sufficient funds (NSF) failures?

These situations make them a poor candidate for recurring ACH, and increase the probability of returns and related costs. Suddenly, your $0.07 ACH transaction has become a $20 payment recovery, requiring several outbound calls and internal resources to remedy the situation. A single NSF may offset the cost savings of several dozen successful ACH payments, negating the cost-savings as exceptions grow.

Consider the graph below to illustrate this point. At first, prioritizing recurring ACH generally results in early returns on the cost of acceptance curve. However, over time the cost of servicing each exception can reverse the trend, as expensive collection calls, manual intervention and write-offs begin to offset the majority of good payments. In this example, while the cost for each individual transaction appears low on financial statements, the true cost begins to grow in other areas of the business.

Contrast this approach with a more dynamic model, illustrated by the blue line. Modern platforms give you more opportunities to course correct and lower costs. Using the same example of NSFs, a modern platform can stop a customer from becoming a repeat offender by turning off future ACH payments and redirecting the customer to a payment type and channel that fits their ability to pay. When you apply this methodology across all customers and all exceptions, the total cost of acceptance continues to move downward across your portfolio over time.

Make no mistake: continuously optimizing your payments mix is highly complex and is often a moving target. But the costs of getting it wrong are an even bigger problem in the form of more exceptions, delinquencies, support costs, staff intervention, and other issues.

What’s driving your total cost of acceptance

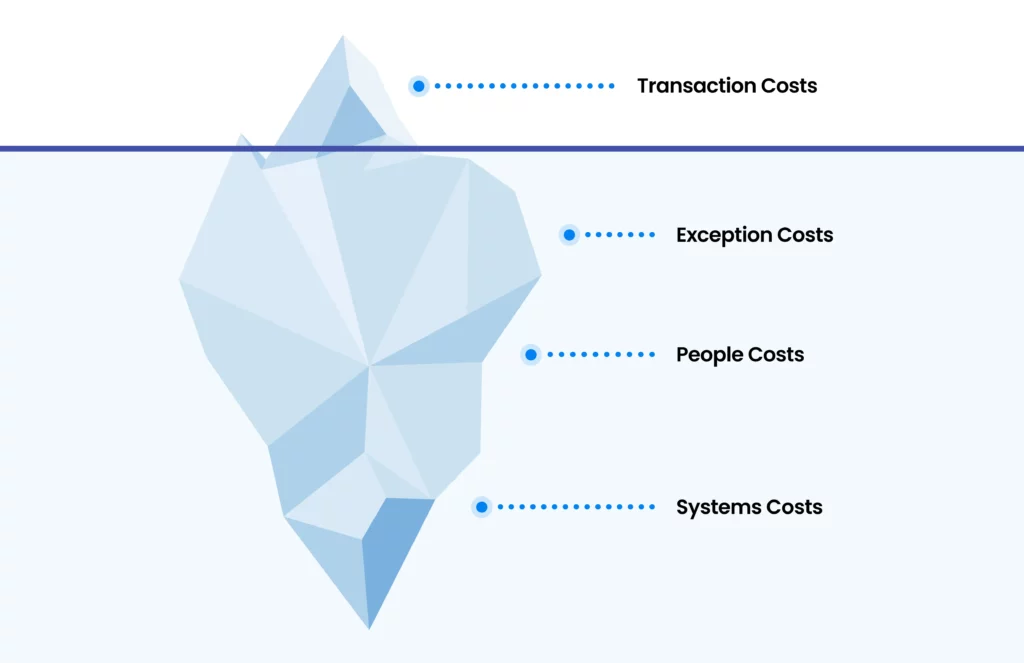

Focusing only on the direct costs of collecting payments can be risky. Those are just ‘tip of the iceberg’ costs that you can readily see. Below the waterline are many other factors that may contribute to your overall cost—particularly with a legacy system.

Consider the following perspectives on where a variety of costs are coming from:

Often the costs associated with exceptions and delinquencies are submerged, so your business may not realize how much operating expense and risk you are incurring that could be avoided.

Let’s explore the primary components of the total cost of acceptance.

Transaction costs

Base transaction fees—the hard costs set by the networks—are often difficult to optimize and should be considered the least practical to optimize around. These fees can change from provider to provider, but different entities (such as card networks, issuing banks, acquiring banks, and others in the value chain) will always command a share of each transaction.

Every major payment method has its place in your payments mix. That’s why it’s critical to drive customers to the right payment type for them to minimize the total cost of each transaction.

- Traditional ACH is typically a low cost option (often under $0.20 per transaction), but these lower costs come with tradeoffs. ACH is not real-time and can take a few days to settle. And because bank balances fluctuate and customers may store money elsewhere, ACH can result in a high number of NSFs or administrative error exceptions.

- Debit cards enable lenders to see whether a transaction can be processed in real time, but this method can be subject to chargebacks and fraud.

- Apple Pay and Google Pay (or pass-through wallets) can house debit and credit cards and process at a debit card cost, and may be a customer’s preferred card option that can improve likelihood of payment. They may be vulnerable to some of the drawbacks of traditional debit cards, but offer additional layers of security and documentation that improve their reliability for card not present transactions.

- PayPal, Venmo and Cash App Pay (a mix of pass-through and stored value wallets) are potentially the highest per transaction fee, but for people who store a balance in a wallet, it can be the lowest cost way to enable them to use the funds for bill payment. If accepting wallets gets you paid on time, or helps you avoid exceptions like ACH declines, then your end cost for those transactions is much less.

Lowering the total cost of acceptance is about more than promoting the cheapest rail in your payment flow. It’s about meeting customers where they are and offering flexible options that make it easier for them to pay and reduce the likelihood of exceptions.

Transaction fees are only the tip of the iceberg. With a legacy system, it can take many successful payments to offset the time and cost of resolving just one exception. High exceptions disrupt cash flow, making it harder to manage daily operations, budget effectively or plan for growth.

Now let’s review the three areas below the line that are often overlooked and can be reduced or prevented altogether by a payments experience management platform.

Exception costs

Lending would be the best business in the world if 100% of payments were made on time, every time. But exceptions happen. And they may occur more often as consumers push back on rigid processes that make it harder for them to pay bills. Let’s look at some common exceptions that can have a ripple effect of added costs—and what lenders are doing about it to recapture profits.

First, it’s important to point out the two primary categories that emerge: traditional (or true) exceptions, and experiential exceptions. True exceptions are often the result of customer circumstances. These include chargebacks, NSFs and similar failures. Experiential exceptions are those that emerge from poor payment experiences, often confusing customers enough to either force them into a manual payment process or forgo the payment altogether. This second type of exception is impacted by the customers willingness and/or ability to pay, making them primary candidates for optimization through payments experience management.

NSF returns

NSF (non-sufficient funds) exceptions can occur with various payment methods, including ACH, debit, account transfers and paper checks.

Let’s examine ACH in particular. When successful, ACH transactions are cost-effective, with a median cost ranging between $0.26 and $0.50, and as low as $0.11.10 ACH is a great option when it’s offered to a customer with consistent surplus in their account balance. However, returns can be a significant expense driver for ACH transactions. Based on our records, this could cost up to $5 per return. If multiple retries are required to collect, your costs can climb up to $15. Additionally, we’ve seen that involving a collector to call the customer could add around $10 per call, including staff time. What begins as a potential $0.20 transaction can end up costing you over $20—a 100x increase per exception.

Another unique challenge with ACH is that it operates on a delayed network. Lenders may not discover issues—whether due to NSFs, administrative errors, or other causes—until two or three days after the exception occurs, making recovery more time sensitive and difficult.

Despite these challenges, many companies consider NSFs as an unavoidable cost of doing business. They often overlook the full impact of these exceptions on the overall cost of acceptance. But it’s a crucial component that is undermining your overall profitability—and it’s avoidable.

Automated ACH retries and advanced features from a modern payments technology partner can significantly reduce the time and expense associated with NSF exceptions. By proactively addressing the root causes, companies can influence better outcomes and minimize the occurrence of returns.

Chargebacks

Chargebacks are another common exception, often initiated when customers notice an unexpected debit or an unfamiliar charge on their bank or card statement. Chargebacks occur for various reasons: the customer may have forgotten their autopay due date and was caught off-guard when the payment was processed, or they missed a due date and a late fee was charged. Other times it could be related to a user error, system error, or something more complex.

Chargebacks can be one of the most expensive and challenging payment exceptions to manage. With older bill pay systems that have little or no visibility into the data, it can be difficult for the business to respond quickly with the necessary evidence to win disputes. With access to the right data and tools, lenders can resolve, and even win, many non-fraudulent chargebacks.

Preventing chargebacks is far more cost-effective than resolving them. Many can be avoided by implementing fraud detection and risk management tools. Unfortunately, legacy systems often lack these features, resulting in more disputes and significantly increasing the total cost of acceptance. Preventing some chargebacks can even be as simple as making sure the name of the business matches the name of the biller on the customer’s card or bank statement.

Reducing and preventing chargebacks is key to reducing collection costs. A modern bill payment platform, equipped with advanced fraud prevention, visibility and automation, can make a significant difference. By addressing the root causes of disputes, lenders not only reduce costs but also enhance the overall payment experience.

Exceptions driven by poor payment experiences

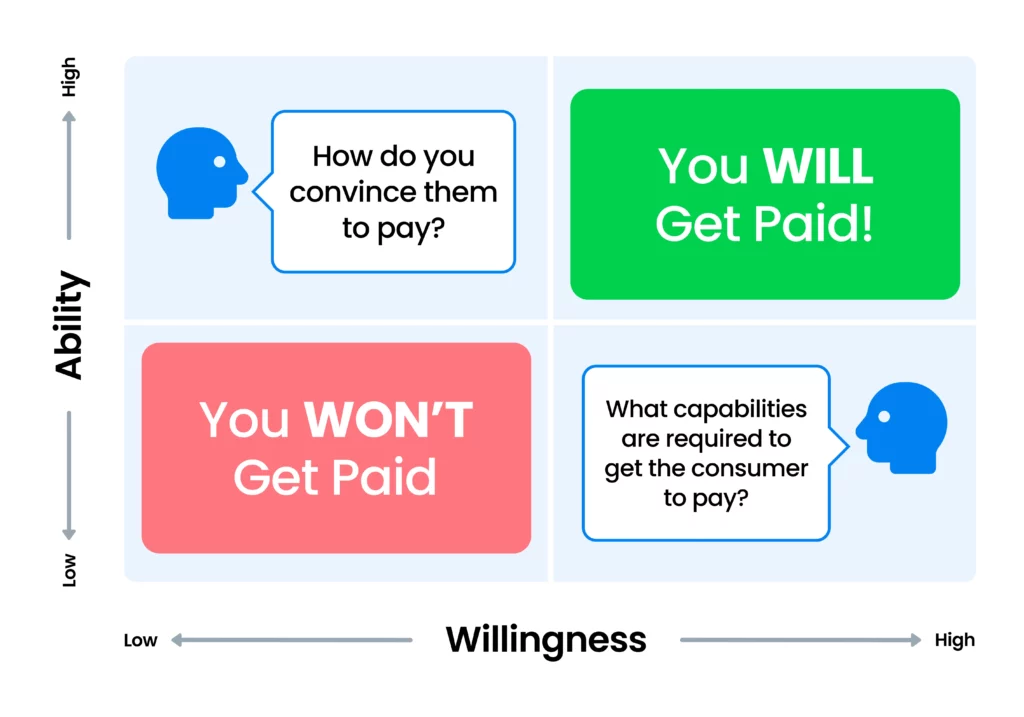

Experiential exceptions introduce more nuance and complexity than traditional exceptions. In order to understand what drives this newer category, it’s important to see how poor payment experiences can affect a customer’s position in the classic “Willingness & Ability” matrix.

In this model, poor payment experiences can create confusion or frustration, leading to preventable exceptions that require manual intervention from your team to resolve. For example, a customer that is able to pay, but unwilling to invest effort into setting up an online payment, may choose to “just call and pay tomorrow”—a decision that often leads to a costly customer service interaction or a forgotten payment. Your goal is to deliver payment experiences that meet a customer’s needs or preferences, ideally preventing them from slipping into an exception state.

Consider how payment experiences affect willingness and ability to pay. For those who can and will pay, how can you make it as simple and cost-effective as possible? For those willing but less able, how can you provide more options and flexibility to help them pay? And for those able but unwilling, how can you remove friction to reduce resistance and encourage timely payments?

Late or missed payments

Lackluster payment experiences can be a leading cause of late or missed payments, forcing you to initiate a collections exercise that costs time and money to remedy. Here are a few ways this can play out:

- Poor user experience. Consumers expect seamless payment experiences like those in eCommerce. Confusing or complicated bill payment processes—requiring login credentials, invoice numbers, or lengthy account details—can frustrate customers, especially on mobile devices. The more time and effort it takes a customer to make a payment online, the more likely they will be to abandon the self-service process.

- Limited payment options. Many consumers now prefer to use mobile wallets, such as PayPal, Venmo or Cash App, as their primary bank account. Lenders that only accept ACH or cards create unnecessary friction that can trigger exceptions. Consider this scenario: a customer is holding a stored balance in their Venmo account, but you only offer ACH and debit. If they cannot pay directly from Venmo, they will need to transfer these funds from their digital wallet to their bank account, adding unnecessary hassle and time. Apply the same logic to other wallets, or even cash on hand, and you can quickly see how many payments can be missed or delayed by not being able to pay with these alternative payment methods.

This issue is particularly significant for low-income or underbanked borrowers who need or prefer to pay with mobile wallets or cash—and may even have the need to tap into different payment sources each month. Offering limited payment types can increase your delinquency rates or NSFs, and push costs even higher. - Lack of information and communication. A number of late payment exceptions are simply because many people find it hard to keep track of due dates. Late payments frequently result from poor communication, such as unclear due dates or confusing error messages for failed payments. Providing actionable reminders and clear explanations for declines can empower customers to resolve issues on their own, reducing support calls and speeding up payment completion.

Increased call volume

Abandoned web payments that turn into inbound calls are a more common exception than you might think. Customers may abandon an online payment if they forget their password, find the website confusing, cannot use their preferred payment method, or want to dispute something on their bill. These frustrations translate into higher costs for your business.

Each transactional call you field comes with a real cost. According to Gartner, the cost of an average customer service interaction is around $8, while a comparable self-service interaction may cost only $0.10. This 80x increase in cost can be one of the biggest cost drivers for your business, especially as the size of your portfolio increases.

This doesn’t factor in the opportunity cost faced. Each agent dedicated to taking inbound calls can’t fulfill another responsibility, be it making outbound collection calls, handling more complex customer support requests, or assisting in other areas of the business.

Brand and reputation damage

Poor payment experience can lead to far more than increased exceptions—it can damage your reputation, hinder growth and leave your business struggling to keep up with competitors.

In many cases, the payment experience defines the overall customer experience. Poor payment experiences can do more damage than increasing exceptions. A frustrating or outdated process can create negative sentiment, tarnishing your brand and making it harder to attract new customers or retain existing ones. This is especially significant for local and regional subprime lenders, who often rely on lasting customer relationships to drive referral and repeat business.

82% of consumers surveyed said a poor loan payment experience would influence their decision to switch to a different lender in the future.8

By partnering with a payments innovator, you can offer the flexibility and personalization customers now expect. Nearly 70% of consumers say they would be very likely or likely to recommend a lender if it offered a highly personalized experience.9 Modernizing your payment process is not just a cost-saving measure—it’s an investment in future revenue and customer loyalty.

The high stakes of exceptions

Controlling exceptions is one of the most impactful levers lenders have to reduce operating costs and improve efficiency. Unlike transaction costs, there’s a high number of adjustments that can be made to optimize the payment experience and influence exception rates. But that’s simply not possible when relying on legacy technology providers that don’t offer intuitive, flexible solutions to identify and manage exceptions.

Businesses that rely on decade-old technology risk being outpaced by competitors using the latest capabilities and AI advancements. Legacy platforms lack agility, making upgrades costly and complex, and many lenders lack the in-house expertise to extend existing systems to leverage these emerging payment technologies.

People costs

Staff-related costs are often not factored into payment costs, but they are a major contributor driving up the total cost of acceptance. Think of “people costs” as anything that requires hands-on interaction. The more people (and time) needed to intervene to collect payments, the more expensive acceptance will be.

- Payment support calls. These calls, often required to resolve exceptions, can quickly become exceptions themselves. For example, when agents help customers log in or locate payment details to complete a payment, what should have been a self-serve online payment of less than $0.50 now could cost more than $5. Calls to take payments by phone—often due to confusing online processes—are even more costly, with Gartner5 estimating they can be up to 80x more expensive than self-service interactions.

Does your system unintentionally make paying by phone easier than using self-service? That’s a cost you want to avoid when, on average, each call lasts about 8 minutes and costs up to $8, while a successful self-service payment may cost only $0.10 each. 7 - Complex manual reconciliation. Disparate payment systems can generate separate reports for each exception type (e.g., ACH returns or chargebacks), and provide only minimal transaction data. That may result in many more hours of manual work for your accounting staff, a cost that’s often overlooked as part of the overall expense of accepting payments.

- Development costs. Legacy payment systems require more maintenance and workarounds than modern systems, creating the need to hire developers to keep the trains running on time. These resources should instead be used to innovate in other areas of the business, such as onboarding, loan origination or scalability.

- Employee churn or added overhead. Legacy payment systems often generate high volumes of support calls, which may lead to staff burnout and eventual turnover. A modern, self-service payments platform significantly reduces call volumes, enabling more cost-efficient workflows. This allows you to operate with fewer entry-level staff while reallocating experienced collectors to focus on personalized customer engagement to improve recovery for delinquent accounts.

For example, an Illinois-based BHPH dealership using the PayNearMe platform grew 17% without needing to hire more collectors.6 By reducing customer payment calls and minimizing outbound collections, the company achieved sustainable growth and improved profitability without increasing overhead.

System costs

System costs refer to the operational expenses associated with the tools and applications your business uses to interact with customers and collect payments. These include costs for your print and mail vendor (for both core billing and late notices), customer service tools, and other related resources. While such costs are a standard part of the billing process, they are often significantly higher with older bill payment systems.

Legacy payment systems typically require more integrations and additional tools to perform tasks that modern systems can handle seamlessly. They may require “bolting on” of additional point solutions. This reliance on numerous connections and add-ons increases integration costs and operational complexity.

By contrast, a modern platform often consolidates functions, enabling greater efficiency and improved outcomes. For instance, it might integrate tools like advanced fraud detection or detailed monitoring features, helping you strengthen your capabilities while reducing the complexity of managing multiple systems. This consolidation not only cuts down on system costs but also improves the overall payment process.

Reduce exceptions and lower the total cost of acceptance

At the end of the day, your ultimate goal is to have 100% on-time payments with no exceptions and no manual intervention. However, legacy systems keep this goal much farther out of your reach.

Modern payment platforms offer the tools to reliably accept payments while minimizing costs. By leveraging payment data, businesses can gain insights into customer behaviors, allowing them to offer the right payment options at the right time to reduce exceptions and improve efficiency.

Modernizing your bill pay process doesn’t disrupt your business—it streamlines it. With technology doing the heavy lifting, you can reduce costs and exceptions while freeing staff to focus on more high-value activities.

A modern payments platform enables you to deliver hyper-personalized, self-service payment experiences that increase the likelihood that customers pay on time, on their own. And you can automate more workflows to reduce the cost of managing exceptions when they do occur.

What does that look like? Let’s dive into specific ways a modern payments solution can solve your biggest payment experience problems and lower your total cost of acceptance.

Tools to prevent exceptions

Automate ACH retries for faster recovery at lower costs.

ACH returns can be expensive, particularly if they require manual intervention from a collector to call the customer. Automating retries shifts responsibility to the platform, reducing staff involvement. With a modern system, algorithms can optimize retry timing and frequency, improving recovery rates.

In a data sample, PayNearMe found that retrying ACH transactions the next day recovered 22% of failures with one retry and 45% with two, saving our client significant costs.

Automate payment optimization with business rules.

Data-driven rules can leverage customer behavior and payment information to help reduce the risk of exceptions and chargebacks. For instance, logic rules can identify customers with multiple NSFs and preemptively offer alternative payment options. Automated rules eliminate manual intervention, turning what could take hours of staff time into a process completed in minutes.

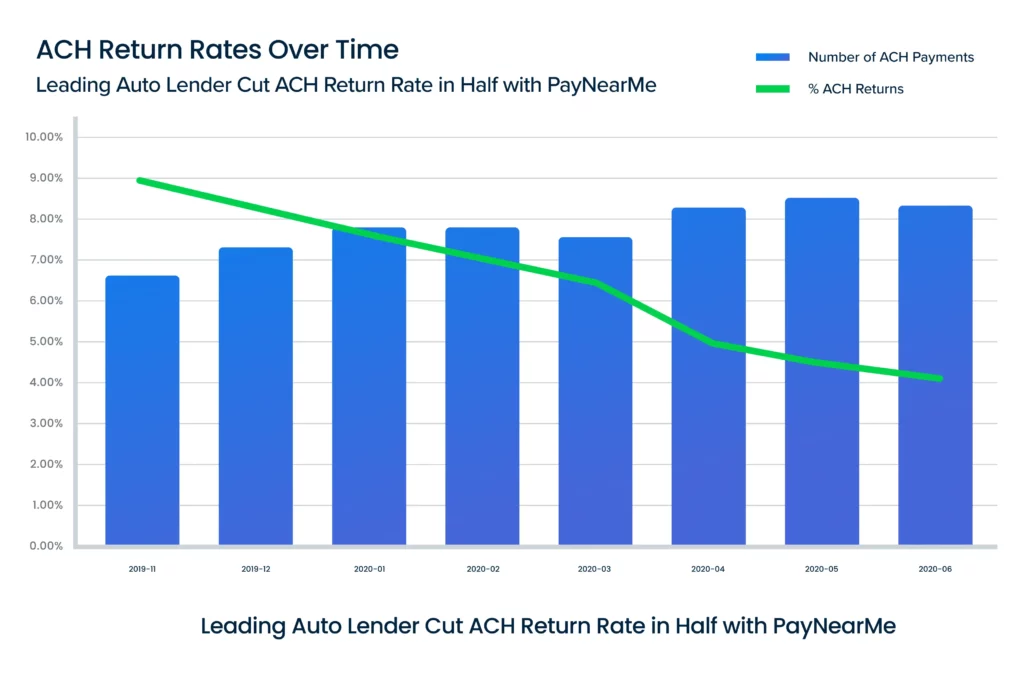

Consider our client, a leading auto lender. Before partnering with PayNearMe, this client had experienced a growing number of ACH payment returns each month. Even more concerning was a troubling trend: as the volume of ACH payments increased, so did the rate of returns. Each failed transaction required staff to contact customers to secure an alternative form of payment. The lender needed a more cost-effective approach, not only to resolve returns but to prevent them in the first place.

With the PayNearMe platform, the lender implemented logic-based business rules tailored to customer payment history, loan status and other factors. These rules automatically adjusted payment options for customers with a history of NSF returns, restricting them to real-time options such as debit card or cash. The results were remarkable—within six months, the lender reduced their ACH return rate by 50%, saving significant time and money while improving overall efficiency.

Reduce downtime with smarter routing

Downtime is especially concerning because it does not discriminate—even your most reliable customers are affected by system outages. And downtime can’t just be measured in minutes offline. Instead, consider the time spent by staff fixing the issue, the number of calls that need to be fielded during the incident, and the efforts required to collect all payments missed as a result of the outage.

A platform with multiple redundant processing options, smart routing and proactive monitoring can drastically minimize the occurrence and effects of downtime, ensuring that every customer can make payments when they are willing, able and present.

Win more chargebacks with less effort

For the portion of chargebacks that can’t be outright avoided, including friendly fraud, the key is to cut out as much time as possible from the resolution process. Modern platforms make it easier to stay organized, gather evidence and submit dispute responses. In addition, these tools should enable you to track the status of all pending disputes, cutting down the time required to manage the chargeback process.

There’s a growing number of lenders that don’t even bother fighting disputes, leaving money on the table and inviting future chargebacks from repeat offenders. Smarter chargeback tools give you another risk management tool to deter bad behaviors and win more disputes.

Fight back against fraud

One of the most intriguing developments in payments is the introduction of new artificial intelligence tools that can identify and mitigate fraud at scale. AI/ML can amplify the speed, efficiency and nuances of fraud detection to better protect the business, while lowering costs and risk. Platforms with modern, flexible APIs and built-in fraud engines can provide a significant boost to fraud and risk management in a rapidly changing digital environment.

In addition, these tools offer the promise of nuance, helping to push good payers through the payment process while effectively flagging bad actors.

Experiences to prevent exceptions

Offer more options to improve on-time payments

Providing more payment types reduces risk, exceptions and delinquencies by meeting customers where they are. For example, offering PayPal may seem more expensive than ACH, but if it eliminates the risk of an ACH return, it’s more economical in the long run.

A modern fintech platform enables you to accept a full range of payment types, including ACH, cards, digital wallets (PayPal, Venmo, Cash App Pay, Apple Pay, Google Pay), and even cash at retail locations including Walmart, 7-Eleven, Walgreens and others. The goal is to optimize the payments mix for each customer to maximize on-time payments and minimize costs.

Provide personalized links for seamless self-service

Self-service payments can significantly reduce the cost of exceptions. Personalized payment links enable customers to complete payments easily and securely without needing to log in. This addresses a major pain point: 42% of consumers surveyed cite remembering log-in details as the top issue making loan payment difficult.11

This was the challenge faced by our client, a subprime finance company. Frustration with the company’s outdated bill pay system led to a surge in inbound calls from customers needing assistance to make payments. On top of payment processing fees, these calls consumed significant staff time, preventing employees from focusing on revenue-generating activities. Ultimately, the cost of accepting payments began to erode the company’s margins.

By partnering with PayNearMe, the lender introduced an innovative self-service bill pay experience. The solution provided customers with secure, personalized payment links that required no login and enabled flexible payment options with just a few taps. The results were immediate: agent-led payment calls dropped by 40%, and the company saved thousands of dollars in collections over time.

Send digital reminders to reduce delinquencies

Nearly half (47%) of consumers report that receiving a text message or email reminder when a bill is due would make it easier to pay on time.12 Automated, personalized reminders can improve on time payments and streamline follow-ups for past-due accounts collection times.

Hyper-personalize to influence payment behavior

Modern platforms unlock the power of payments data, helping you understand customer behaviors, preferences and trends. These insights allow you to tailor the payment experience to each customer, increasing on-time payment with the least risk of exceptions.

Once you understand who pays, how and when, you can optimize the interface to prioritize the payment options each customer prefers. For example, data may reveal that customers under 30 favor Venmo over PayPal. You can prioritize displaying Venmo as a primary payment option, streamlining the process and reducing friction.

Reclaim your profits by reducing total cost of acceptance

For lenders, innovating the payment experience may not seem urgent—but can you afford to keep operating with a legacy system that drains your profits and slows you down? Efficiency and profitability are essential, yet legacy systems make it increasingly difficult to collect payments at the lowest cost while minimizing exceptions and delinquencies. The real risk isn’t change—it’s standing still while competitors and market demands surge ahead.

How much longer can you afford to let legacy systems hold you back, driving up costs and eating into your margins?

A payments experience management platform like PayNearMe empowers you to tackle these challenges head-on. You can more easily and reliably get paid on time, with significantly less overall cost. Plus, you increase customer satisfaction along the way to drive referrals and repeat business.

By adopting a modern platform, you unlock the potential for greater efficiency, improved staff productivity, and lasting customer loyalty. From seamless self-service and diverse payment options to automated reminders and workflows, a modern platform ensures you’re not just keeping pace—you’re leading the way in delivering better payments experiences for your customers and your business.