Consumer Trends Driving the Future of Loan Payments

Download all the charts and graphs from this report directly.

View here

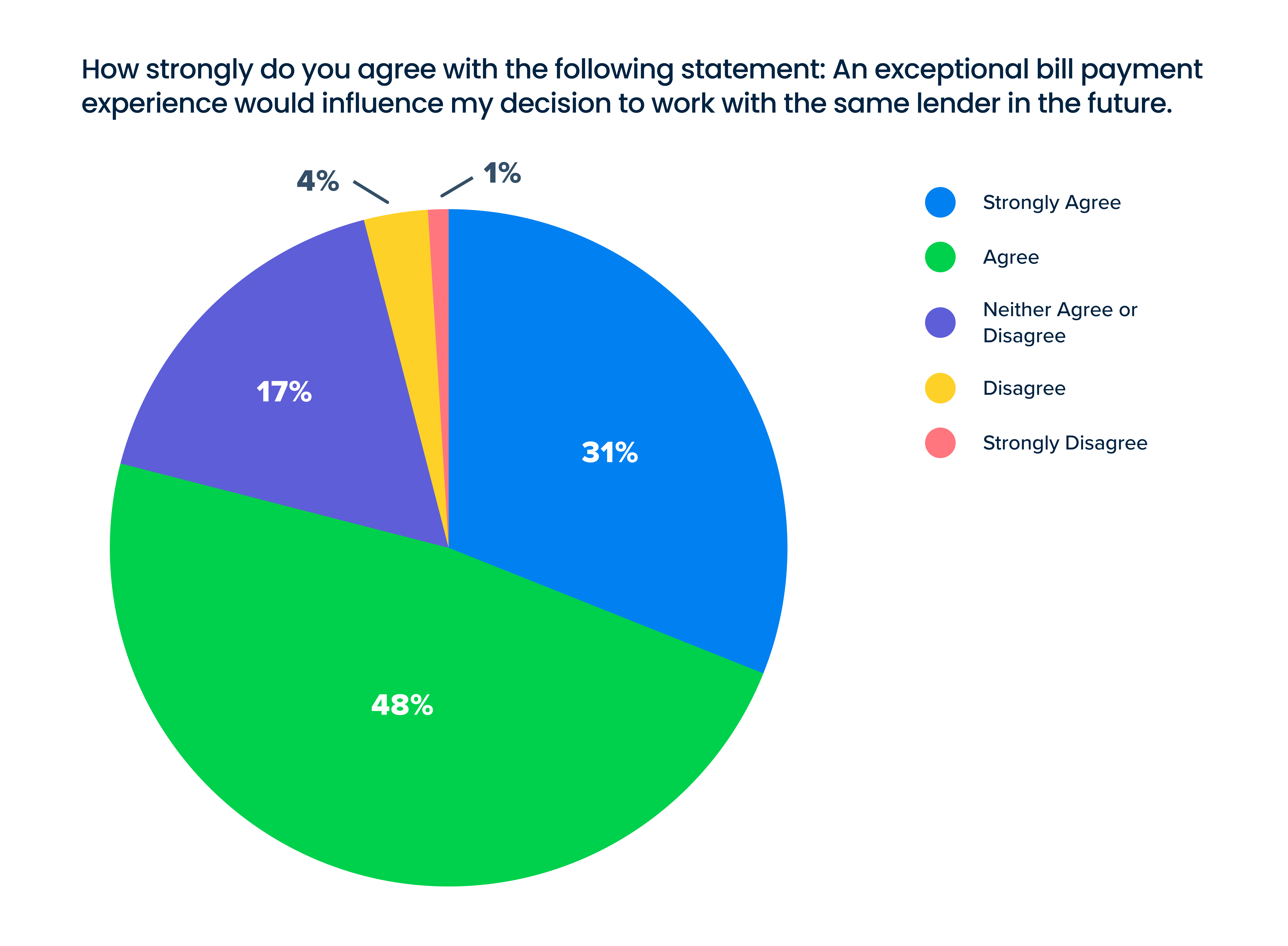

Delivering a personalized, convenient loan payment experience is critical for customer retention.

The research revealed that 82% of survey respondents would work with a different lender in the future if they had a poor loan repayment experience.

Conversely, 79% said an exceptional experience would incentivize them to work with the same lender again in the future.

Read the Full Report

Fill out the form on this page to download the full study.

Interested in featuring this research? Email insights@paynearme.com to connect with the PayNearMe research team.

About This Research

PayNearMe conducted an online survey of more than 1,500 consumers in March 2024 to determine changing attitudes toward payment types, and to understand how important hyper-personalized interactions are when it comes to their relationship with their lenders.

The survey aimed to uncover:

- What makes paying loans difficult for consumers

- What payment methods consumers would prefer to make their loan payments

- If paying loans and payment preferences changed—for better or worse—for consumers from our 2021 survey