Prefer a podcast? Listen to the AI audio overview of the buyer’s guide.

Starting the buying process

As payments continue to get more sophisticated, the process of selecting a partner becomes even more difficult. Requirements spill into more departments. Buying committees grow. Use cases that were once top of mind take a backseat to new priorities.

But alas, decisions must be made, software must be purchased and transactions must continue.

We assembled this buyer’s guide to help businesses like yours get up to speed on what’s happening in the world of bill payment software so that you can confidently decide on your next provider. In this guide, we present our view as to what’s changed in the payments landscape, what problems are most commonly addressed with a modern payments system and learn how to assemble a list of requirements before you undergo a purchase cycle.

Using this guide

First, let’s define the scope of this buyer’s guide. Like shoes and insurance, payment software is never one-size-fits-all. The needs of an ecommerce business will vary greatly from the needs of a lender, and there is no payment system that can accommodate every business.

This guide is aimed at helping those who regularly bill a set of known customers after a service is provided. This includes businesses such as automotive lenders, toll agencies, mortgage servicers, utility companies and similar organizations. We’ll refer to this group as “billers” throughout the guide to keep things consistent.

In addition, this guide is primarily for businesses who directly service consumers; B2B organizations may have different requirements. To limit the scope, we’ll focus on the U.S. market to avoid the many different requirements that international billers must consider when purchasing a global payments platform.

The state of bill payment software

In the last decade, the requirements for choosing a bill payment software have changed significantly. These changes have been driven by many trends, but in particular by a few macro trends.

Consumer behavior

Many billers benchmark their payment experiences against industry peers and standards. But consumers don’t perceive things the same way. They are comparing every payment interaction they have on an equal basis. That means your payment experience is being compared to the likes of Uber, Amazon, Starbucks and Venmo.

These UX-centric brands have set new standards that have shaped consumer payment behavior. Some of the shifts include:

- Mobile-first: The ubiquity of smartphones and connected devices have caused a shift in the way consumers use the web. Mobile payment experiences are now the standard, with desktop and offline payments falling more out of favor every day.

- Alternative finance: There was a time where most consumers could pull out their checkbook to pay you. Today, many younger generations are migrating to non-bank financial institutions to send, store and receive funds—including wallets such as PayPal, Venmo and Cash App Pay.

- Faster everything: Smartphones and modern apps have reduced the need to remember, well, anything. Consumers don’t want to fill out long forms, remember account numbers or due dates, or even login. They expect payments to be as fast as swiping to order an Uber or a pizza.

Technology advancements

Changing consumer expectations have increased the complexity of payment systems that businesses need to offer. This desire to have everything faster, more secure and more convenient has caused the underlying technology to change by leaps and bounds.

New payment rails have introduced complexity in the integration, processing and settlement process for many billers, leaving many perplexed on how to offer an archaic rail like ACH alongside a proprietary one offered by P2P wallet providers.

Payment systems are no longer standalone systems, either. With the proliferation of the cloud and APIs, it’s expected that a wide variety of software platforms “talk” to each other. Payment technology must now speak to a system of record (such as a CRM or Loan Management System), while also passing data back to a data warehouse, a messaging platform, a business intelligence platform and dozens of other mission critical systems.

Interconnectedness is no longer a perk, but a base requirement.

Regulatory considerations

In response to changes in the previous two change-agents, regulatory agencies have become much more aware of—and involved in—the way billers administer payment systems.

A highly engaged CFPB and FTC, for example, have released a flurry of new guidance related to FCRA, UDAAP and other regulations to protect consumers from a variety of payments and collections practices. Many of these guidelines have added requirements that must be built into payment systems to ensure compliance and avoid costly regulatory actions.

Bottom Line: These trends, among others, have significant implications when selecting a payments provider. For those who haven’t engaged in the buying process in a few years, selecting a partner can be a complex and foreign process.

Modern use cases

Let’s start with the basics: a modern bill payment platform should seamlessly move money between your business and your customers with minimal manual intervention, integration management or interruption. The payments software you never think of is the one that is working as planned.

But simply moving money between parties reliably should be the baseline for your decision-making process. Modern platforms can, and should, touch many parts of your business and allow you to deploy valuable capital and resources toward growth, cost reductions and profitability.

When picking a new payments provider, the platform should allow you to do the following:

Enable fast, frictionless payments

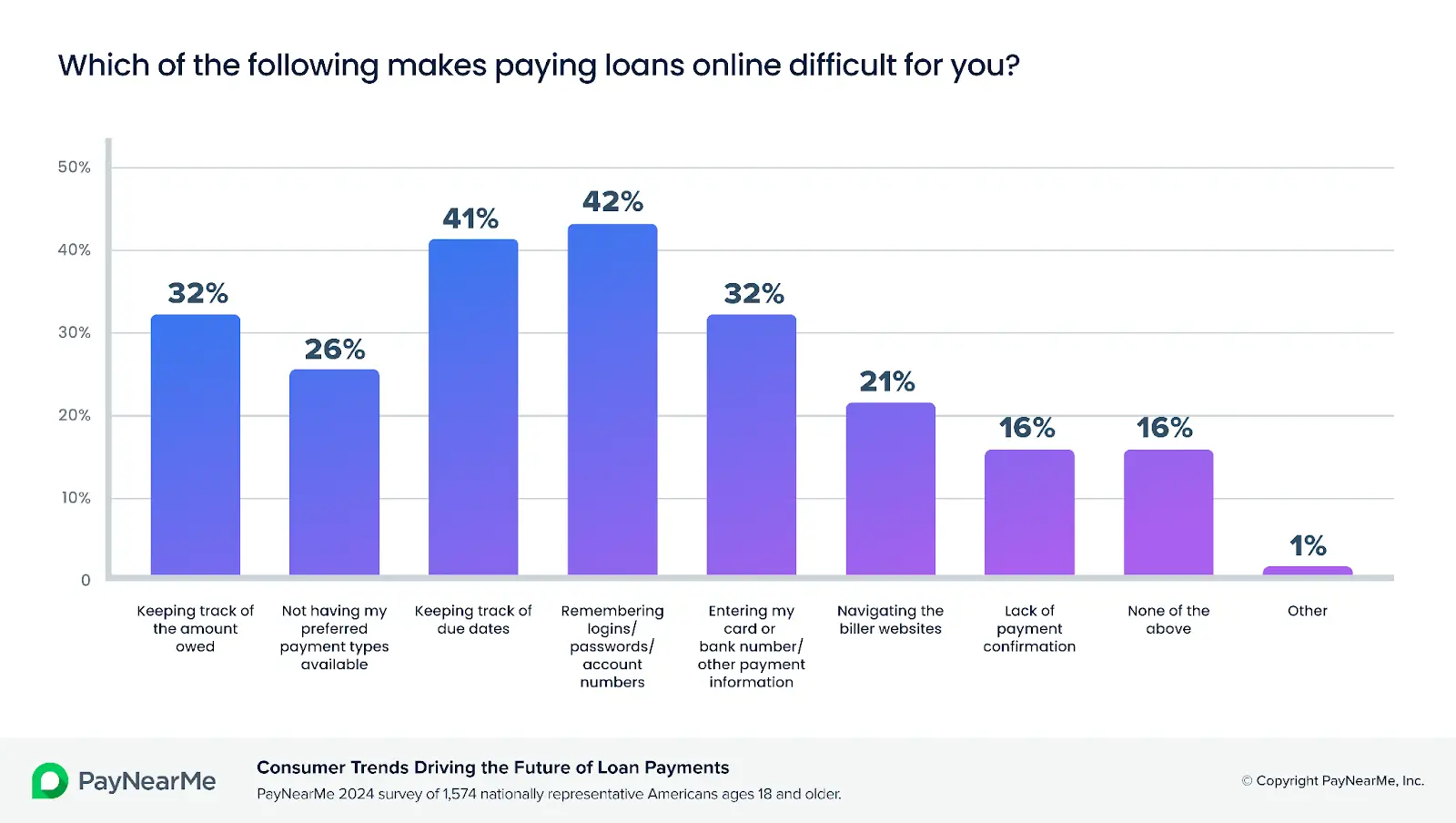

The more difficult it is for your customers to pay, the less likely they’ll be to pay on-time and in-full. For example, consumer research conducted by PayNearMe in the lending industry showed that “Remembering logins, passwords and/or account numbers” was the top response to the question, “What makes paying bills online difficult for you?”

Payment providers should remove as many barriers to payment as possible by eliminating common roadblocks.

Examples may include:

- Limited payment types / channels

- Remembering usernames and passwords

- Forcing consumers to download an app

- Navigating confusing biller websites

- Excessive typing (i.e. amount owed, account number, etc.)

Prioritize low-intervention, self-service payments

Payments collected by your employees can drastically increase the cost of acceptance. According to research by analyst firm Gartner, the typical agent-led customer service interaction is 80x more expensive than self-service ones.

Gartner’s 2019 Customer Service and Support Leader poll identified that live channels such as phone, live chat and email cost an average of $8.01 per contact, while self-service channels such as company-run websites and mobile apps cost about $0.10 per contact.

Self-service should be built into as many parts of the payments process as possible. For example, this may include:

- Enabling 1-click payment reminders via text message or email

- Tools to let call center agents push payment links to customers

- Flexible autopay options with self-service enrollment

- Alternatives to in-person cash acceptance

- Scan and pay functionality on printed statements

Reduce costly exceptions

Like manually collected payments, exceptions are a major cost driver in payments. Every non-sufficient funds error (NSF), chargeback, decline or other exception can drive up the average cost of acceptance. A modern payments platform should have tooling in place to both reduce exceptions as well as ways to speed up resolution.

For example, the ability to set custom rules that prevent recurring issues (such as NSFs from the same cohort of customers each month) can result in a significant reduction in ACH failures. Automated retries can then recover failed payments without intervention from a collector or admin.

Automate and speed up back-office processes

Much of the cost and hassle associated with payments happen somewhere after the transaction. A clear example is cash acceptance; once a cash payment is collected, it must be secured on-site, transported to the bank to deposit and manually reconciled. Recurring ACH authorizations are another common bottleneck. Many businesses still have not digitized authorizations and require manual paperwork to remain compliant.

Your payments provider should aim to automate processes that eat up employee time and effort, instead enabling those employees to focus on more pressing tasks.

Eliminate the need for excessive point solutions

Stacking point solutions onto your payments experience can quickly add friction to the process and drive up costs. A third party text messaging platform may seem enticing, until you realize that the costs of messaging, vendor management, integration and security management can all add up. In addition, adding third party payment types or channels can create inconsistent user experiences for customers, driving them to call support or default to less desirable payment options.

Aim to find a platform that incorporates native functionality for mission critical applications such as messaging, IVR, fraud, chargeback management, reporting and more.

Provide flexibility for tomorrow’s needs

Today’s bleeding edge can quickly become tomorrow’s legacy technology. It’s critical to choose a payments platform that is extensible and configurable to meet your needs as your business grows and the payments landscape inevitably evolves. For example, your platform should be able to add new payment tenders as they become mainstream, or be able to add redundancy as your card processing volume increases.

In addition to flexible technology, it’s important to partner with a provider that has a roadmap and support structure that aligns with your vision. The old cliche rings true here: pick a partner, not a vendor.

Purchasing considerations

When you’re ready to begin evaluating your options, it’s important to know what to look for in a provider that can help you solve your biggest problems.

There are countless decisions you will need to agree on internally, and it’s not practical to include every single feature or capability in this guide. Instead, focus on these 10 critical areas while you make your decision:

- Payment options

- Money movement

- Customer experience

- Back-office / management tools

- Reliability

- Integrations

- Configurability

- Support

- Risk, compliance and security

- Pricing structure

We’ll dig into the main evaluation criteria for each of these capabilities, and provide a set of seed questions you can use to influence your purchase process or build an RFP.

Payment options

How will your customers pay you? This is often the first and most obvious capability to look for in a provider. Gone are the days of simple gateways that only enable payments by ACH and card. Today’s customers expect to pay how, when and where they choose, with a variety of payment methods and channels.

Today, the most widely expected options for bill pay include:

- Debit and credit cards

- ACH

- Pass through wallets, such as Apple Pay and Google Pay

- Stored value wallets, such as Venmo, PayPal and Cash App Pay

- Cash payments (via an off-site cash at retail network)

In addition, consumers want to be able to use these payment methods from a variety of channels. These most commonly include:

- Web payments, on all compatible mobile and desktop devices

- IVR

- Mobile wallet

- Phone payments via a customer service agent

- In-person

By enabling customers to pay any way they can, you’ll be able to collect more on-time payments, lower your cost of acceptance and drive down exceptions.

Questions to ask

- What tender types are included in the platform?

- Do you have native integrations with passthrough and stored value mobile wallets?

- Do you have a cash at retail solution for our unbanked or cash-preferred customers?

- Do you offer a mobile-first, web based payment experience for our customers?

- Does your platform include IVR, mobile wallets and other channels?

Money movement

Understanding how money flows in and out of the platform can have serious implications in your decision process. Consider how the payment provider manages the flow of funds, how quickly they can settle funds back to you and if they can handle the volume of transactions you plan to process.

In addition to this, you may find that you need a partner that can also handle your disbursements out of the platform. Like payments, disbursements must meet the needs of your customers while offering safeguards for your business.

Modern platforms should offer multiple disbursement options, such as debit, ACH, and alternative payments such as Venmo and PayPal. This gives you several real time options to move funds quickly and securely, cutting down on paper checks and long wait times.

Questions to ask

- Are you a licensed money transmitter in all required states?

- How quickly do you settle funds back to our account?

- Which sponsor banks or partners do you work with downstream?

- What clients do you currently have that can match the number of transactions we process each month?

- Do you have built-in disbursement capabilities?

- What payment methods can you disburse to?

Customer experience

Earlier, we talked about changing consumer expectations driven by frictionless experiences from companies like Uber, Amazon and Starbucks. These companies have made payments seamless, reducing the amount of data entry, clicks and time required to complete a transaction.

The less friction in the payment experience, the more likely an individual is to complete the transaction on the first attempt.

You should strive to choose a platform that emphasizes frictionless payments across all touchpoints. For example, you may focus on the following features when making an evaluation:

- Personalized links that don’t require a login or password to complete a guest payment

- Remembering past payment accounts and preferences to speed up future payments

- Flexible autopay that offers multiple options for due dates, schedules and more

- Automated SMS, email and wallet notifications for timely payment reminders

- Tight integrations with wallet providers that keep customers in the payment flow

- Multiple languages to meet the needs of all customers

Frictionless payments are the crux of driving more self-service transactions and reducing manual intervention in the process and therefore reducing your overall expense.

Questions to ask

- Do you offer 1-click, personalized payment links?

- What options do you have for sending payment reminders?

- Which scheduling options are available in your automatic payments?

- Can you provide bilingual support for messaging, web and IVR payments?

- Can you show a demo of the payment flow for your different payment options?

- What accessibility standards does your platform adhere to?

Back-office / management tools

While customer-facing experiences often get touted first and foremost by payment providers, the tools for managing payments can be equally important in your evaluation process. After all, every minute spent managing your payments is a minute withheld from another critical area of focus at your business.

Look for a platform that offers a robust set of back-end tools that improve operational efficiency, automate repetitive tasks and give you more control over the payments experience.

Reporting is one area to key in on. You’ll want to make sure that daily tasks such as reconciliation and settlement are easy to complete, especially if you find your team currently reconciles multiple payment files from different partners today. A single file with all payment types and channels, and clear delineation of exceptions (such as chargebacks and returns) can be a boon for your accounting and finance teams.

In addition, you may want to use your payments data in other systems, such as third party BI tools or data warehouses. Having a strong set of reporting capabilities and export options will enable you to do more with your payments data—allowing you to optimize your payments mix, lower costs and use payments data to improve other parts of your business.

Other areas to keep in mind when evaluating back-office and management features include:

- User provisioning and roles

- Approval flows

- SSO

- Data configuration / field mapping

Questions to ask

- What do your reporting and analytics capabilities look like?

- Can I export data into a third party system (such as Snowflake)?

- How do you simplify reconciliation and reporting for my team?

- What user access controls do you have in place?

- Do you offer SSO?

Reliability

Every minute your payments provider is down can result in a significant loss for your business. Choosing a reliable partner can be difficult to evaluate, but is a crucial piece of the buying process.

First, aim to minimize preventable downtime. Look for a partner that does zero downtime product releases that don’t require planned maintenance windows every time a new feature or update is pushed. These should ideally be done in the cloud and without intervention from your IT or development team to complete.

Unplanned downtime is more difficult to evaluate for, as many factors can contribute to an issue. In general, you may look for a payments provider that has multiple safeguards in place to mitigate unplanned outages. These may include:

- Cloud-based architecture with multiple server locations

- Scalable architecture to account for spikes in payment volume

- Redundant card processing to route transactions in the event of a downstream outage

- Proactive monitoring and alert systems

- Multiple acquiring banks to protect against solvency issues

- Defined processes for failover testing

- A strong business continuity plan

This is even more critical for businesses with strong seasonality or heavy processing days, such as lenders who expect a majority of payments on certain days of the month or week.

Questions to ask

- What kind of redundancy do you have built into your system to mitigate downtime?

- Can you provide a copy of your business continuity plan?

- How much planned downtime or maintenance did you schedule for clients in the past year?

- What kind of reporting and monitoring do you have in place in the event of an outage?

Integrations

Being able to send and receive payments data across other systems has become vitally important for billers. Strong integrations can reduce manual data inputs, improve employee workflows and reduce the risk of double payments, support calls and other costly scenarios.

At a bare minimum, you’ll want to choose a payments partner that has the ability to send daily data files to your system of record and other technology providers, with files that seamlessly map to those systems.

As you go up the priority chain, you may also wish to have full, two-way integrations that can push and pull data in real-time, enabling you to post payments in all systems, create real-time automations and rules and display real time balance information to customers to avoid confusion.

More sophisticated billers should also look for open APIs and strong documentation to build new integrated capabilities, allowing you to connect to other third party systems that require access to payments data. This might include a third party texting platform, print and mail solutions or internal tooling.

Questions to ask

- What systems of record in my industry do you integrate with?

- What functionality do you offer with my specific system of record to help facilitate seamless payment experiences?

- Do you have a library of APIs and proper documentation to use them?

- What other systems do you natively integrate with?

- What systems are on your current integration roadmap?

Configurability

Having the ability to customize your payments platform is tempting, but true customization comes at the cost of heavy development costs, rigorous testing and not benefiting from real-time updates.

Instead, opt for a platform that allows for enhanced configurability. This gives you the ability to adjust the platform to your needs without requiring changes to the core code. Basic configurability will allow you to white label the platform with your branding, colors, company or industry specific language and other surface level adjustments. These ensure the platform remains true to your brand and doesn’t confuse customers or employees who expect consistency with your other systems.

More advanced configurability goes deeper than surface level, enabling you to change underlying systems to meet your needs. You may consider the following when looking at your options:

- Risk and fraud thresholds

- Logic-based business rules builders

- Reporting schedules / formats

- Custom field mapping

- Minimum and maximum payment amounts

Questions to ask

- Can I configure the platform to look and sound like my existing systems?

- Do you have the ability to create logic-based business rules?

- What adjustments can we make to risk and fraud thresholds to meet our unique business requirements?

- Does the platform have any level of self-service configurability?

Support

A payments platform is only useful when it’s working properly for your business. This is where you must evaluate the actual partner you’re working with, in addition to the technology they provide.

For example, if an issue arises during peak processing times, how quickly can it be resolved? If you need to extend your capabilities or create a more complex configuration, what resources are available to you?

Support can be broken down into several areas that should be evaluated in your buying process. These include:

- Initial onboarding and implementation

- Account management for ongoing training, usage tips and best practices

- Professional services for advanced configuration and technical support (i.e. if you plan to migrate to a new system of record or add a new integrated point solution)

- Emergency support for critical issues (phone, email, tickets, real-time messaging)

- Self-service support and documentation

A strong support structure ensures that your investment is protected, and enables you to continue extracting value from your payments system long after the time of purchase.

Questions to ask

- What does the typical onboarding process and timeline look like for a company like mine?

- Do you offer dedicated 1:1 account support throughout the life of our agreement?

- What is your cadence for adding new features and updates to your platform?

- What kinds of ongoing training do you provide to ensure adoption and best practices?

- How quickly can we expect a response when submitting a support request via phone, ticket or email?

- Do you have a self-service support portal with robust documentation?

- Is there a professional services team available for ongoing development or configuration work?

Risk, compliance and security

For most organizations, a separate and thorough information security and compliance review will take place to cover a wide range of requests. Most buying committees should default to their internal security, risk management and compliance teams for this process, yet there are basic areas that can be covered up front to ensure the platforms and partners you are evaluating meet base level requirements.

For example, all modern payment platforms should adhere to PCI-DSS, NACHA and other industry compliance standards. Ensuring you have a Level 1 PCI partner is a simple question that can help you evaluate smaller providers from more established partners, as this tier is based on card volume and audits.

In addition, look for platform features that reduce your risk and compliance scope, such as:

- Mechanisms to digitally capture autopay consent and authorizations

- Built-in tools for managing chargebacks, returns and other exceptions

- Risk management thresholds to remain within industry compliance standards

- Capabilities to reduce card payments taken over the phone

- Business rules that can mitigate large-scale fraud or malicious practices

Security, risk and compliance failures may seem rare, but any of these can disproportionately affect the livelihood of your business and can come with significant fines, penalties and losses. Choosing a partner with meticulously audited and documented safeguards is important for businesses of all shapes and sizes.

Questions to ask

- What security and compliance certifications do you currently hold?

- Can you share documentation from your most recent risk and security audits?

- What tools or features do you have in place to minimize exceptions?

- Can you adjust your standard risk rules to meet the needs of our business?

- What PCI-DSS tier are you?

- How do you protect sensitive customer payment information and PII?

Pricing structure

It’s no surprise that cost will play a role in your decision to choose a payments provider. However, if you’ve made it this far into the guide, it should be obvious that cost alone can not drive your decision on choosing a payments platform.

When looking at cost, it’s important to go beyond the advertised per-transaction rate and dig deeper into the different ways the platform can affect your total cost of acceptance. For example, if you can eliminate several point solutions from your current payment stack (such as text messaging, IVR or digital wallet integration costs), these should be factored into your decision process.

Depending on your industry, you may also explore if there are special programs the partner can tap into in order to lower your rates. Billers in the lending industry can benefit from programs like Visa’s Debt Repayment discount program, while utilities and government organizations can have similar rate reductions. Choosing a partner that specializes in your industry increases your chances of benefiting from these programs.

Finally, there are many ways to offset the cost of acceptance based on how transactions are billed. Some billers choose to attach a convenience fee for certain types of transactions that typically come at a higher cost, such as call center or in-person transactions. The right payments partner can give you flexibility to charge convenience fees for certain payment types and channels, while keeping more desirable channels (such as self-service web and IVR payments) free to the consumer.

Questions to ask

- Does the partner only charge for transactions, or are there other fixed or variable costs associated with using the platform?

- What kind of ROI can I expect from switching to your platform?

- Do you have the ability to charge convenience fees by payment type and/or channel?

- Which interchange discount programs can you apply for our type of business?

- What value-added services are included at no extra charge?

- Are there any volume discounts we can expect as we grow?

Conclusion

Choosing the right payments provider can be a complex and incredibly important decision for billers. The right provider will partner with you to ensure you are successful and should be motivated to help you increase operational efficiency, drive down the cost of acceptance and delight your customers at every step of the payments process.

At PayNearMe, we’re dedicated to making payments easy, safe and reliable for our clients and their customers. We encourage you to use this guide to evaluate all your options, but welcome your interest in choosing us to become your payments partner for the long-term.