How Consumers Pay Bills: Expectations vs. Reality

About this research

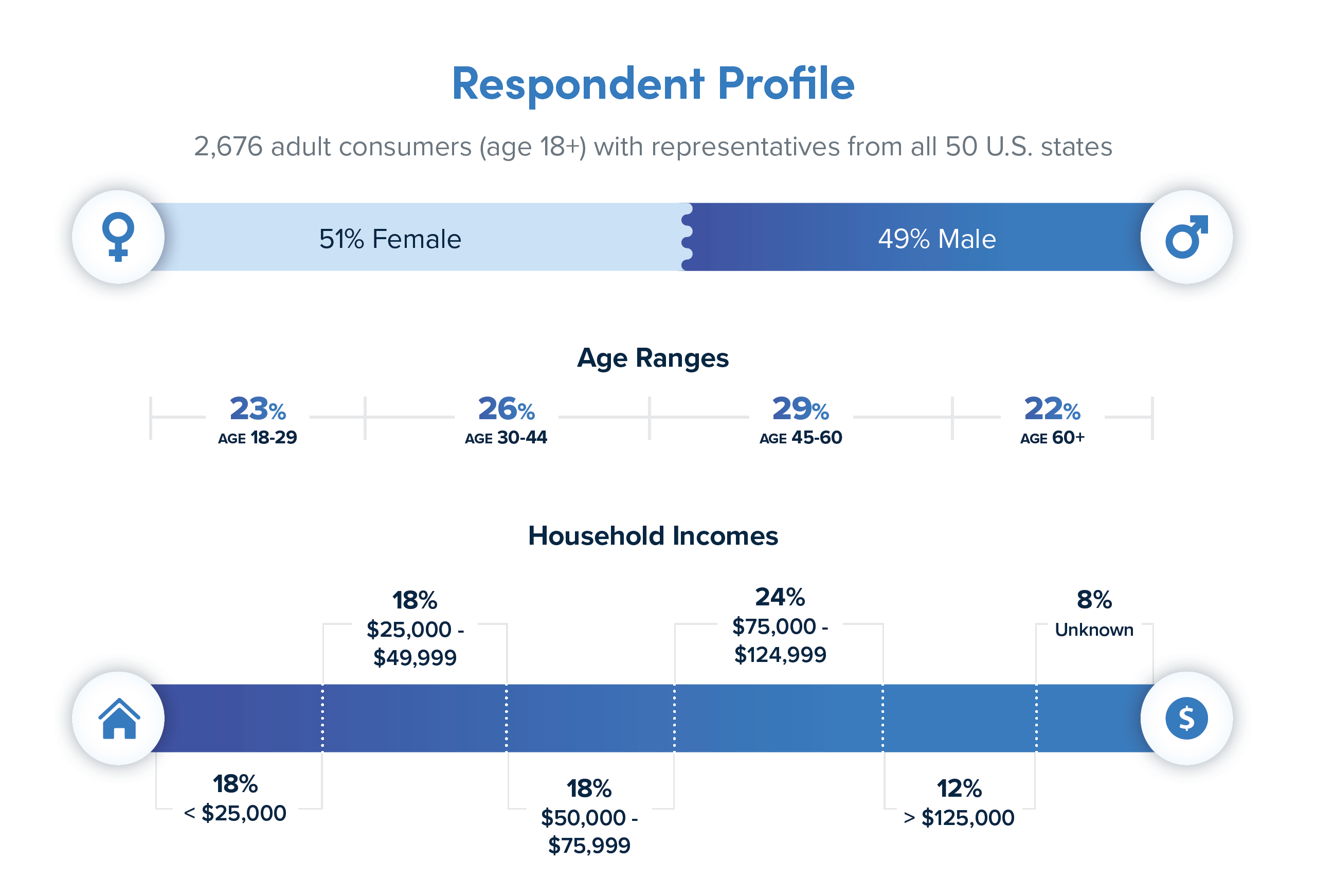

PayNearMe conducted an online survey in April 2021 to determine perceptions and preferences for how U.S. consumers want to pay their bills.

What we aimed to learn:

- How consumers want to pay their bills

- What types of features and functionality would make payments easier

- What consumers expect from their bill pay experience

- How businesses must adapt to meet shifting consumer expectations

Interested in downloading the charts?

View here

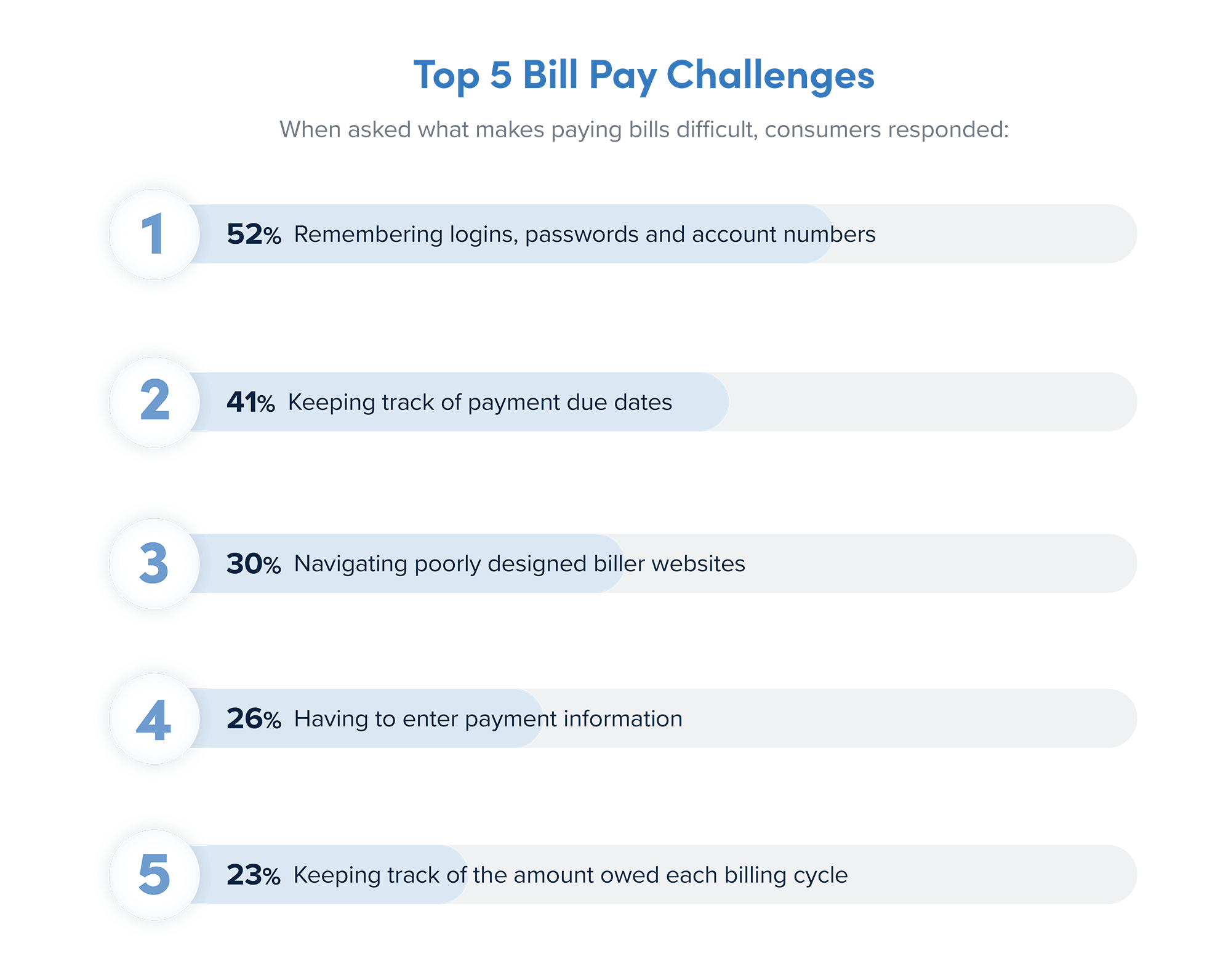

What makes paying bills difficult

Managing and paying bills is hard. It’s thought to be so annoying that 38% of adults would rather fold and put away laundry than pay their bills, and nearly 1 in 3 adults (29%) say that paying bills causes them stress and anxiety.

-

Disorganization tops the listA majority (52%) of those polled said remembering logins, passwords and account numbers makes paying bills difficult.

-

Poor UX drives dissatisfactionFor nearly a third (30%), navigating poorly designed biller websites or apps creates difficulty in the bill pay process.

-

Entering information is frustratingHaving to enter payment information each billing cycle had a negative effect on 26% of individuals in the study.

Read the full report

Get all the insights and stats in a single PDF by filling out the form to the right. By filling out the form, you’ll also gain access to related research, including:

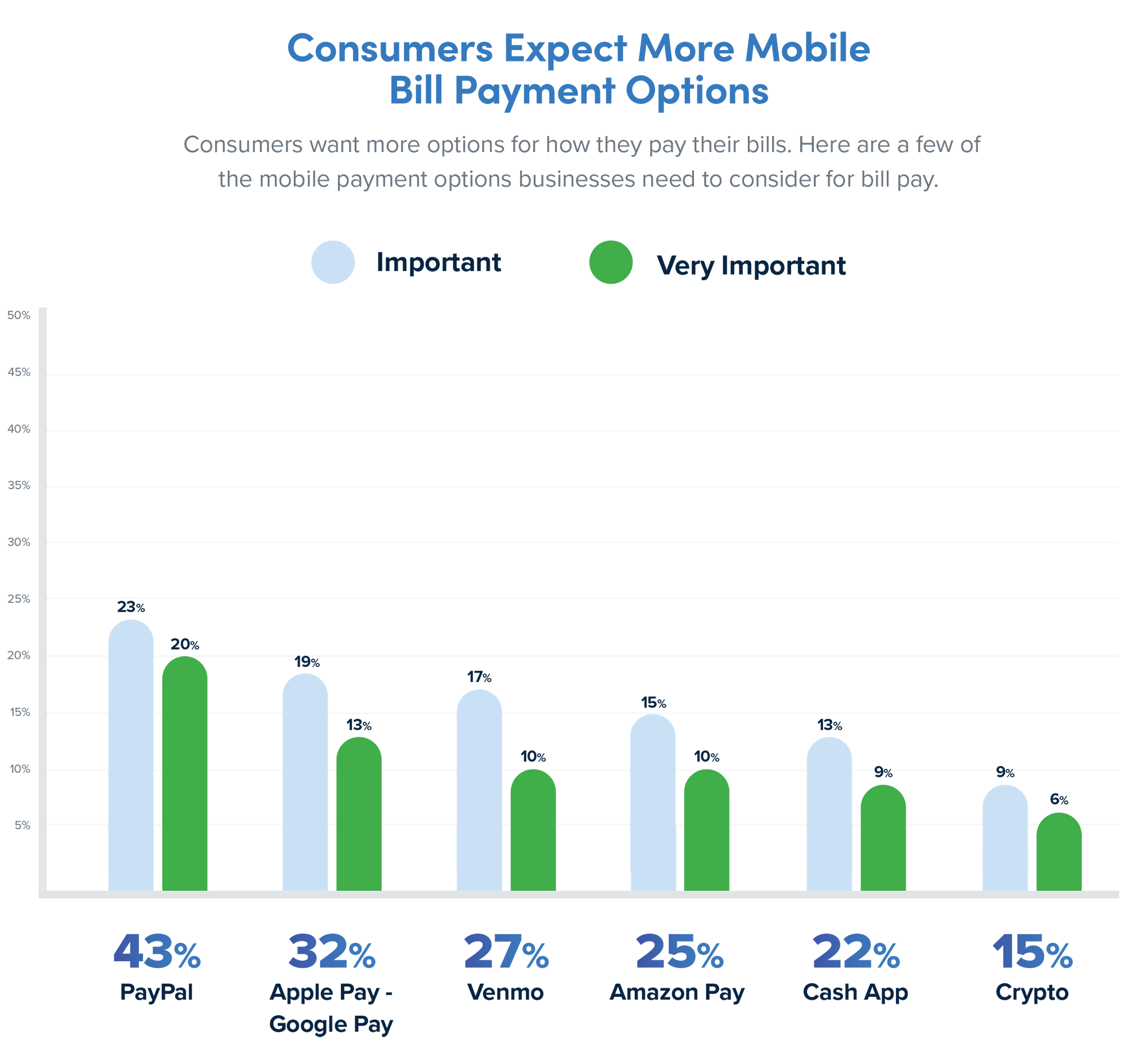

- Consumer Attitudes Toward New Mobile Bill Payment Options

- Driving On-Time Payments: What Makes Customers Pay Late

- What the Newest Generation of U.S. Consumers is Saying About Bill Pay