U.S. Consumers Expect More Mobile Options for Bill Pay

Download the charts in the report, along with charts from previous research reports.

View hereRead the full report

Get all the insights and stats in a single PDF by filling out the form to the right. By filling out the form, you’ll also gain access to related research, including:

- How Consumers Pay Bills: Expectations vs. Reality

- Driving On-Time Payments: What Makes Customers Pay Late

- What the Newest Generation of U.S. Consumers is Saying About Bill Pay

Want more analysis? Watch for the webinar that analyzes the results and shares best practices.

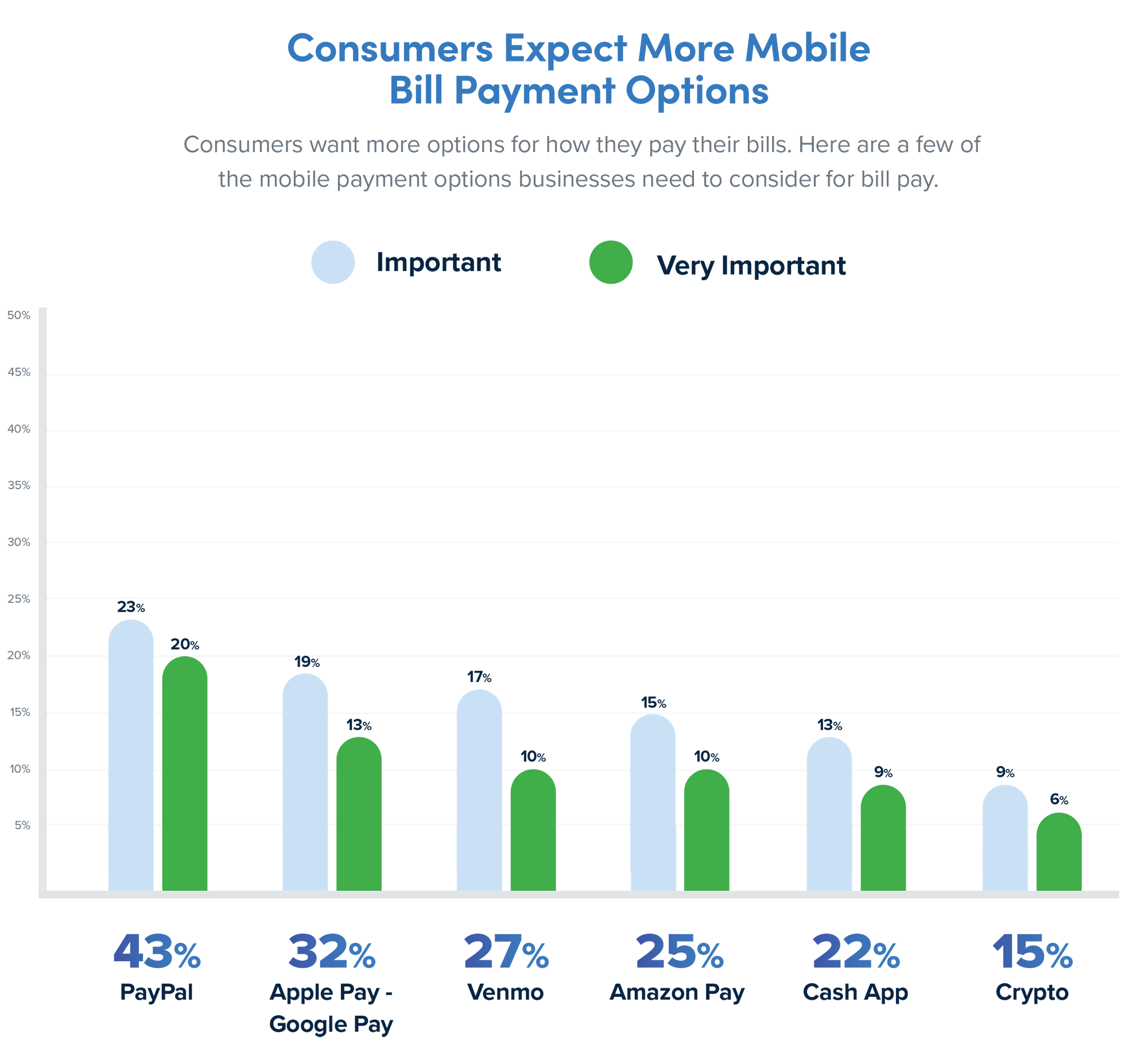

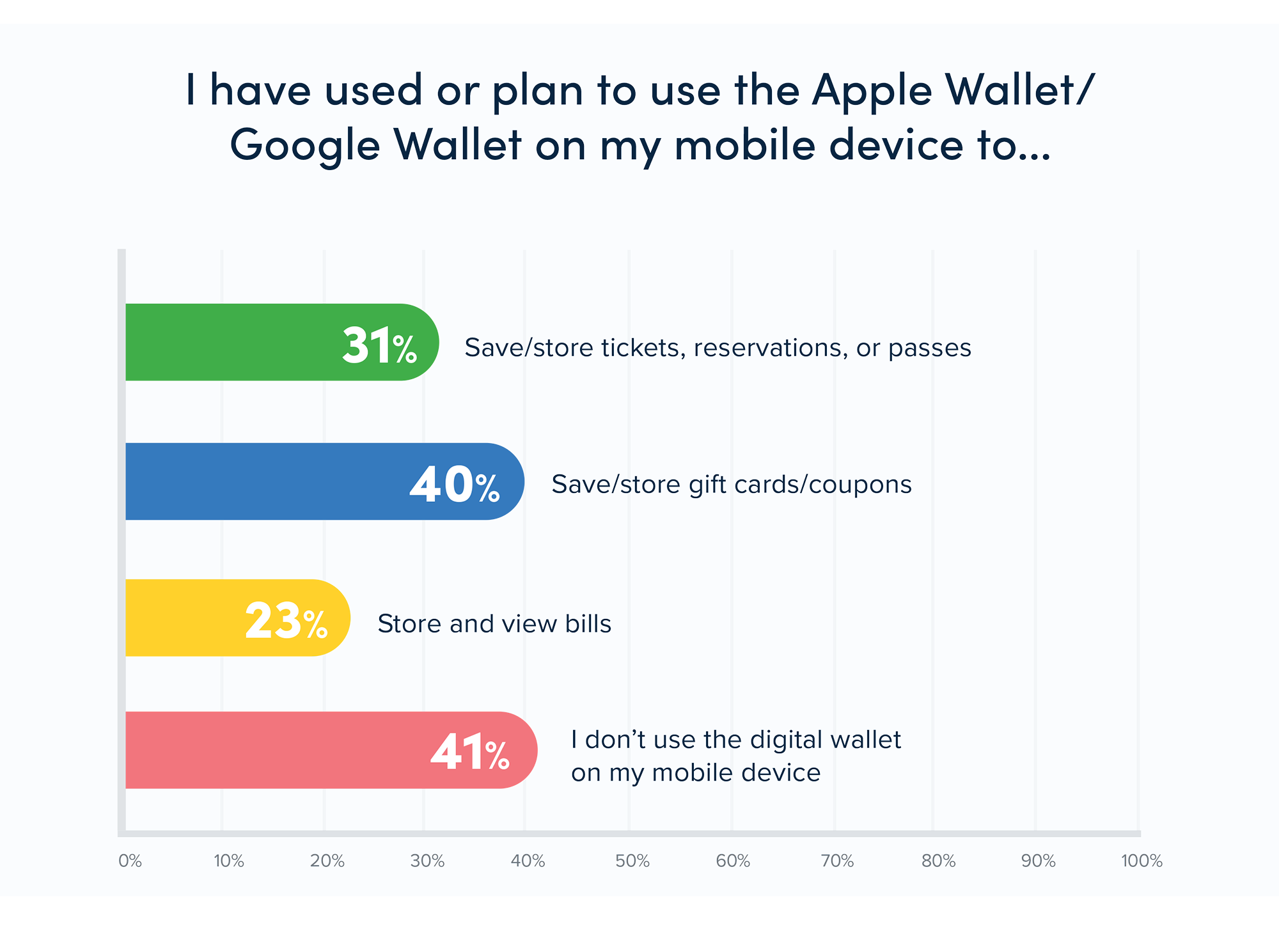

The rise of digital wallets

An overwhelming majority of smartphones come pre-loaded with digital wallets—most notably Apple Pay, Google Pay and Samsung Pay. Consumers expect wallets to play a much larger role in the bill pay process, and smart billers are taking note of this trend.

-

Wallet spending is on the riseAccording to Juniper Research, global wallet spend will exceed $10 trillion in 2025 - up from $5.5 trillion in 2020.

-

The bill pay gapEven though 42% of those surveyed expressed interest in using wallets for bill pay, only 22% are currently doing so today.

About this research

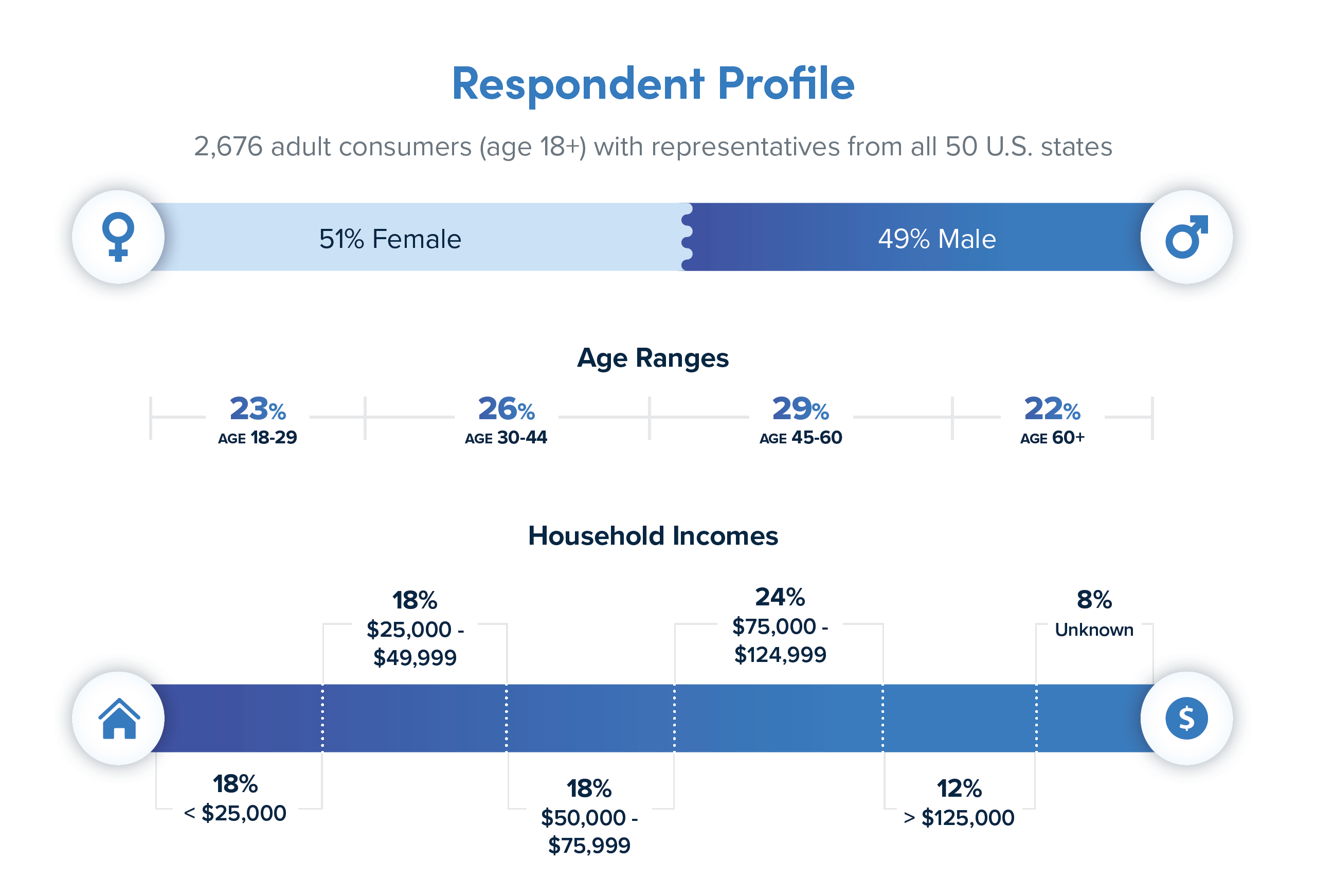

PayNearMe conducted an online survey in April 2021 to determine perceptions and preferences for how U.S. consumers want to pay their bills.

What we aimed to learn:

- How consumers want to pay their bills

- The mobile payment types and channels consumers care about most

- What consumers expect from mobile payment experiences

- How businesses must adapt to meet these new expectations