About this survey

PayNearMe conducted an online survey in February 2025 (“survey”) to identify perceptions and preferences for how U.S. drivers pay their toll invoices and violations, and how they add funds to their registered toll accounts. The survey captured responses from a broad distribution of 1,548 drivers aged 18+ (“respondents”).

The survey aimed to uncover:

- What challenges prevent drivers from making toll invoice payments

- The importance of convenience and alternative payment options in the toll payment experience

- The gaps between drivers’ payment preferences and current toll collection methods

- What would make toll invoice and past-due violation payments easier for drivers

Key findings

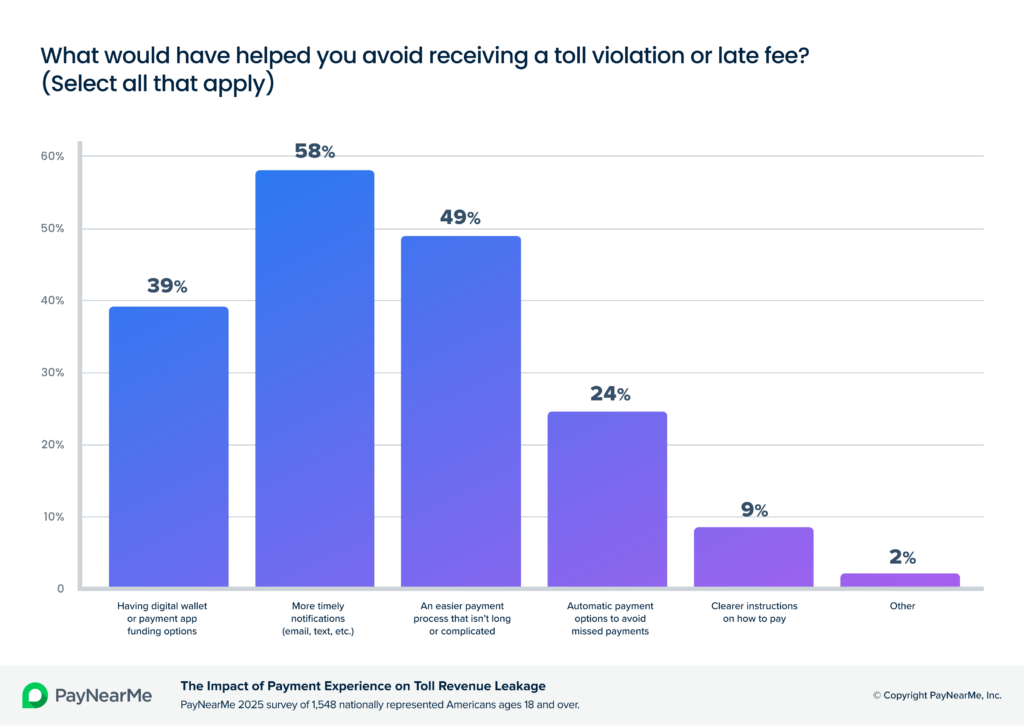

- Friction in the payment process is a leading cause of past due violations. When asked what would have helped them avoid receiving a past-due toll violation, 49% of respondents said, “an easier payment process that isn’t long or complicated.”

- Drivers struggle with toll websites. Nearly 2 in 5 respondents (39%) report difficulty accessing toll agency websites or payment portals, creating a significant barrier to payment.

- Drivers with registered accounts face payment challenges—especially when it comes to funding their accounts. Nearly one-third (32%) say it’s difficult to fund their accounts because they can’t use digital wallets or non-bank payment apps (e.g. PayPal, Venmo, Cash App Pay, etc.)

- Poor payment experiences are driving unnecessary call volume. More than a third of respondents (38%) contacted support for account or payment issues—including 37% of registered account holders who needed help replenishing their accounts.

- Digital wallets can mitigate missed toll invoice payments. 30% of respondents who missed toll invoice payments blame the absence of digital wallet payment options; 39% said they could avoid past-due violations if toll agencies offered digital wallet options.

- Cashless tolling created unintended equity outcomes. 42% of drivers surveyed believe toll agencies have a responsibility to provide accessible payment options for unbanked and underbanked populations.

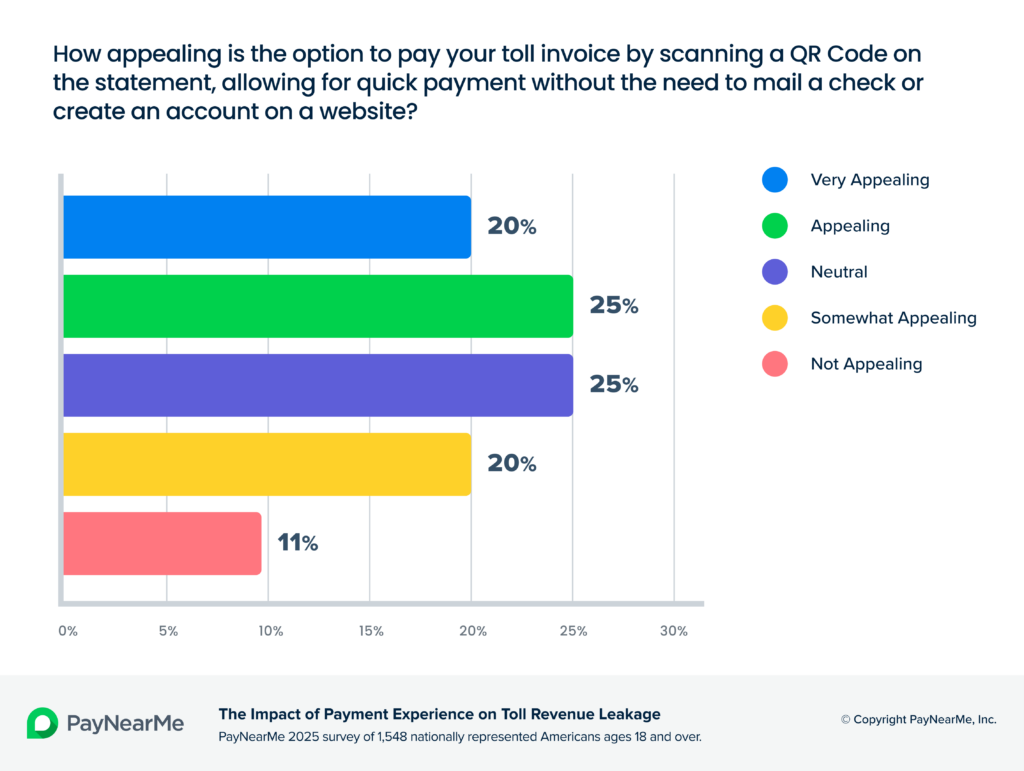

- Scan-to-pay QR codes appeal to drivers receiving paper invoices. Nearly half of respondents (45%) said paying toll invoices by scanning a QR code is appealing.

Introduction

Tolling systems in the U.S. are facing a quiet crisis. Despite the promise of all-electronic tolling (AET) to improve efficiency and reduce traffic congestion, agencies are losing an estimated $2.24 billion annually in uncollected toll revenue, according to Deloitte. This isn’t just a technical glitch—it’s a systemic failure in how toll payments are presented, processed and collected.

To understand why so many payments are missed, PayNearMe surveyed more than 1,500 U.S. drivers. The results are clear: poor payment experiences—ranging from clunky websites to insufficient payment options—are contributing to late and missed toll invoice payments across the board.

This report reveals the root causes behind revenue leakage, highlights the disconnect between how drivers want to pay and how they’re allowed to, and outlines practical solutions agencies can implement to modernize the toll payment experience.

This research uncovers key reasons drivers don’t pay their tolls and identifies how reducing payment friction and offering more convenient payment options can help toll agencies reclaim lost revenue.

Barriers to toll invoice payments

Friction in the invoice process is a major source of revenue leakage for agencies. According to the survey, in the past year, nearly 1 in 4 drivers (23%) admit to delaying, forgetting or avoiding a toll invoice payment that later became a violation. Once invoices became past-due violations, a staggering 73% of drivers delayed payment.

A root cause of this issue is the experience for unregistered drivers—those without a transponder or tolling account—who are forced to wait for paper invoices. Nearly 1 in 3 drivers (32%) said they didn’t receive these invoices in a timely manner. This delay increases the likelihood of missed payments and violations.

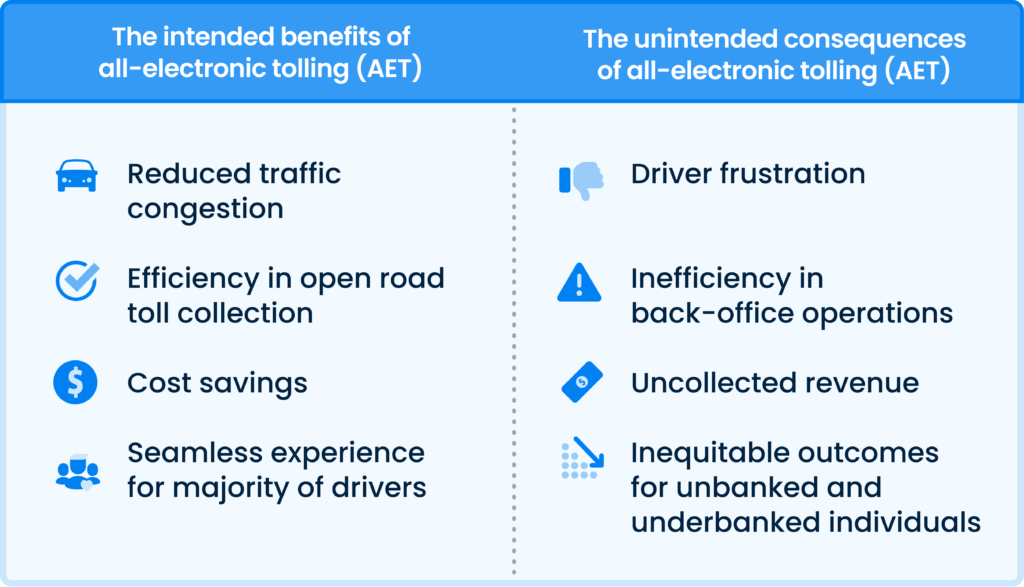

Receiving an invoice does not guarantee ease of payment. In fact, many drivers still encounter significant challenges during the payment process. When attempting to pay online, nearly 2 in 5 respondents (39%) report difficulty accessing the website or payment portal. This aligns with findings from the research report, “Why Consumers Pay Late,” which revealed that more than 1 in 4 consumers (27%) said navigating biller websites that are not user-friendly makes paying bills more difficult.

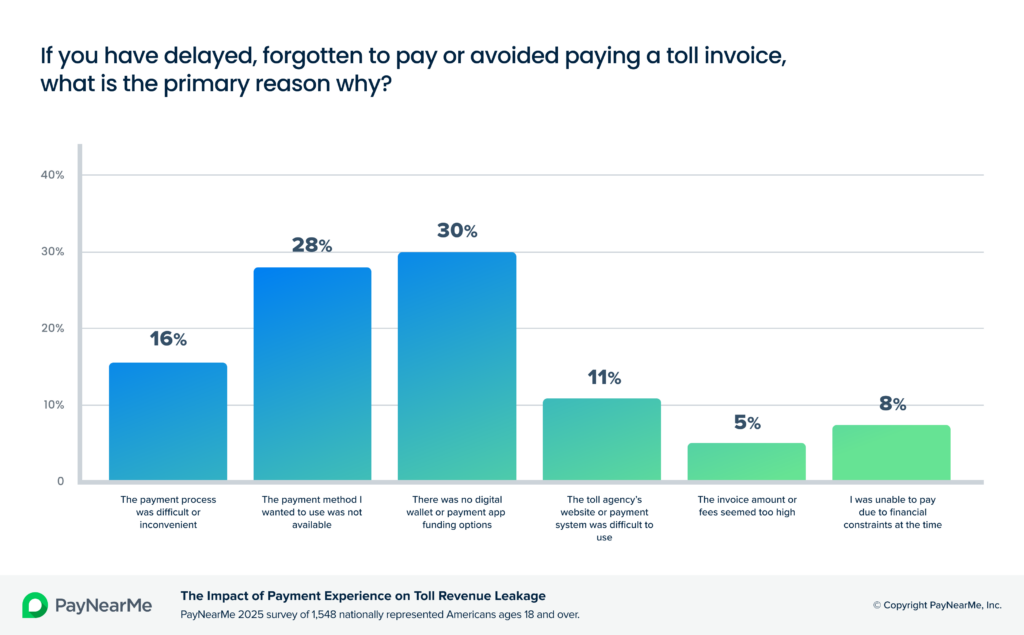

The lack of flexible, preferred payment options adds another layer of friction. For example, of those who can successfully navigate toll agency payment portals, 26% expressed frustration with limited payment options. When asked why they missed toll invoice payments, 16% of respondents said the payment process was difficult and inconvenient and 28% responded, “The payment method I wanted to use was not available.”

When payment hurdles arise—such as not having bank account information handy—21% of drivers seek alternative payment methods such as digital wallets or cash. When those options aren’t available, payers are unable to complete the transaction, which can lead to late or missed payments and eventually, a violation. When asked what would have helped them avoid receiving a past-due toll violation, 49% of respondents said, “an easier payment process that isn’t long or complicated.”

The evidence is clear: outdated and inconvenient payment experiences are harming drivers and agency bottom lines.

To overcome these barriers, toll agencies should consider implementing simpler, more intuitive payment tools—starting with the paper invoice itself. Almost half of surveyed drivers (45%) said they find scan-to-pay options—such as scanning a QR code on an invoice—very appealing or appealing. This suggests that a personalized QR code that takes the user directly to their payment flow—no password or login required—could be a powerful bridge between paper and digital, allowing drivers to bypass login portals and pay quickly using the method of their choice.

Registered users also encounter significant payment friction

While it’s clear invoiced-based tolling presents serious challenges, our research shows that payment problems extend beyond this group. Even drivers who proactively register for toll accounts face friction that can result in delayed or missed payments. In fact, 38% of missed toll invoice payments later became violations. When asked what makes managing their registered toll account frustrating, respondents cited the following challenges:

- Issues with accessing the toll agency’s website or payment portal (34%)

- A lack of digital wallet or payment app options such as Apple Pay, Google Pay, Venmo, etc. (32%)

- Problems with automatic payments not working properly (23%)

Meanwhile, 37% of registered drivers who experience account replenishment issues call customer support—adding operational strain and driving up costs for agencies. On average, a customer service call can cost up to $8.01 and take roughly 8 minutes to resolve, while a self-service interaction costs as little as $0.10. This highlights the substantial savings tied to reducing call volume through better self-service experiences.

37% of registered drivers with account replenishment issues contacted customer support.

The findings reveal that even registered users—those most engaged with the system—are frustrated by the account management complexity, limited payment options and a lack of intuitive experiences. This reveals a systemic problem that spans the entire tolling ecosystem, from paper invoice payers to transponder users. The result? Frustrated drivers and revenue leakage for agencies.

Frequent drivers, frequent friction

Frequent drivers—those who travel on toll roads daily, weekly or monthly—are arguably the most critical segment for toll agencies. They account for the majority of toll road usage and are the most likely to have registered accounts. In fact, 87% of surveyed frequent drivers said they had a registered account.

It’s particularly concerning that this cohort of drivers—arguably the system’s most engaged users—routinely experience payment friction. This group reported they are most frustrated by:

- Difficulty navigating websites to access account balance or transaction history (37%)

- Lack of digital wallet options (37%)

- Automatic payments don’t work properly (28%)

These frustrations translate into higher operational costs. When account replenishment fails, 43% of frequent drivers resort to calling customer service—evidence that current self-service tools are falling short.

43% of frequent drivers call customer service when account replenishment fails.

The consequences of friction

Poor payment experiences, for both frequent and infrequent drivers, don’t just impact revenue—they create a downstream burden on agency operations. When drivers can’t easily pay or manage their accounts, they turn to customer service for help. As mentioned before, this drives up call volumes and operational costs.

Our survey found that 38% of respondents contacted customer service for account or payment-related issues. This isn’t limited to invoice payers—37% of registered drivers (those with a transponder or tolling account) called support specifically for account replenishment problems. This reveals a systemic problem in the toll payment experience that impacts both registered and non-registered drivers.

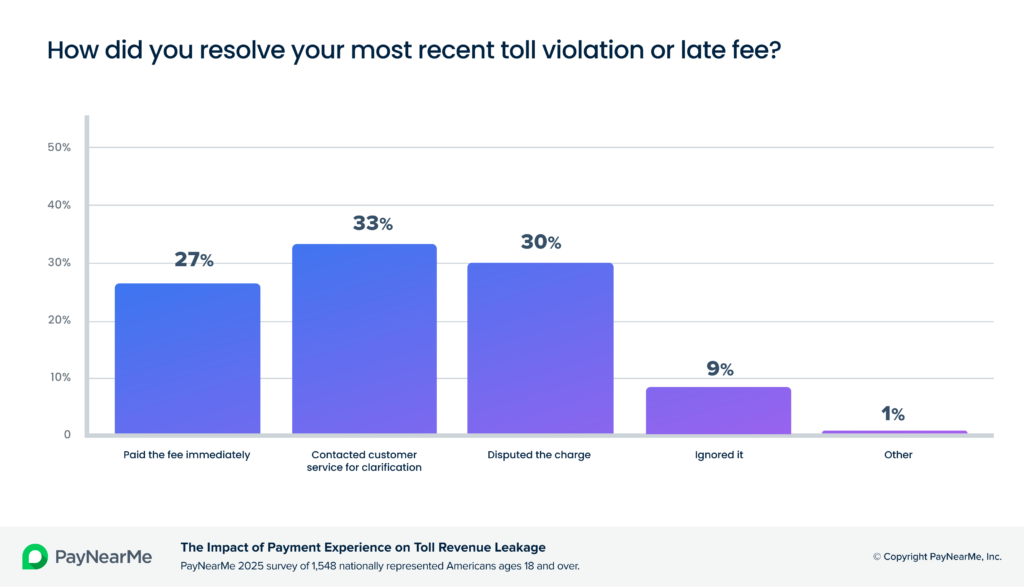

63% of registered drivers that received toll violations called support or disputed the charge.

When toll invoices go unpaid and become violations, it adds another layer of friction. Among respondents who received a violation, 33% contacted customer support. Unfortunately for operators, violations often linger. In fact, 73% of respondents noted they didn’t pay violations right away, while 63% eventually called support or disputed the charge.

The bigger picture? Every instance of friction in the payment process can turn into a support call that strains staff, increases costs and frustrates drivers.

Cashless isn’t inclusive

Beyond operational strain, there’s another critical consequence of a broken toll payment experience: it disproportionately impacts unbanked and underbanked drivers who are already on the margins of the financial system.

Cashless tolling has made it significantly harder for these individuals to pay tolls, creating serious issues for the 5.6 million unbanked and 19 million underbanked households in the U.S. Unlike toll booths, current systems often require inconvenient workarounds like mailing checks or visiting toll agency offices to make toll invoice payments.

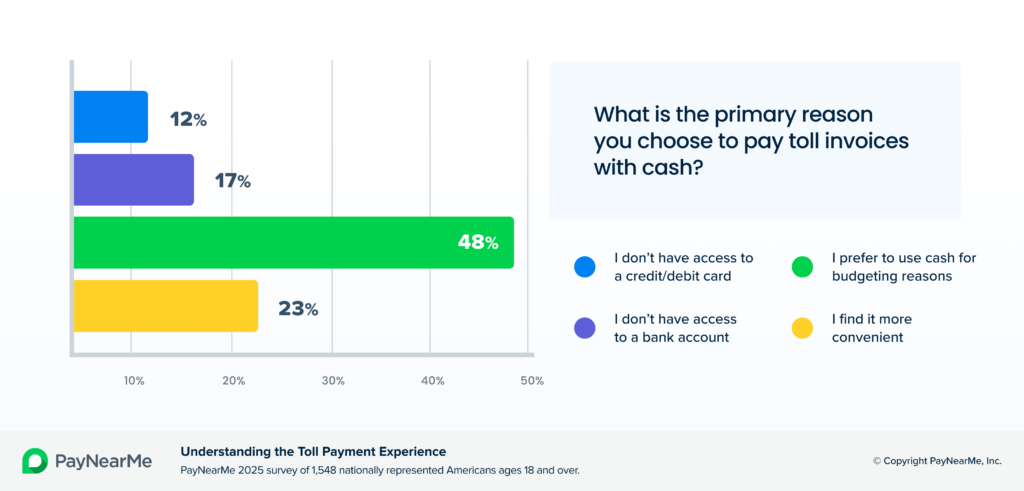

When analyzing the subset of drivers who paid a toll invoice with cash during the past year, the data reveals:

- 48% did so because they prefer to use cash for budgeting reasons

- 23% find it more convenient

- 17% chose this option due to not having a bank account

- 12% did so because they didn’t have access to a credit or debit card

Even frequent drivers with registered accounts cite cash as important—20% noted the absence of cash funding options as a major pain point. This signals a broader need for tolling systems to accommodate diverse financial behaviors and preferences. Notably, there’s been a shift in how unbanked and underbanked consumers manage their money.

Many now rely on nonbank payment apps, such as Cash App Pay and Venmo, storing funds in these platforms instead of traditional bank accounts. For these individuals, payment apps can serve as an effective cash alternative. By enabling access to these stored funds, toll agencies can significantly increase the likelihood of timely and complete payments from cash-dependent drivers.

48% of cash payers said they prefer cash for budgeting reasons.

As public conversations around equity and financial inclusion gain momentum, 42% of drivers surveyed said toll agencies have a responsibility to provide accessible payment options for unbanked and underbanked populations.

All-electronic tolling unintentionally excludes vulnerable populations. Without physical toll booths or cash-at-retail options, this segment faces insurmountable payment barriers. Cash acceptance is not optional—it’s a necessity for equity and inclusion.

The digital wallet gap

Another key finding from the survey is drivers desire the same fast, flexible and mobile-friendly payment options they experience in other e-commerce or bill pay transactions. Despite consumer demand, toll agencies have been slow to adopt payment innovations—resulting in missed revenue opportunities and increased operational costs.

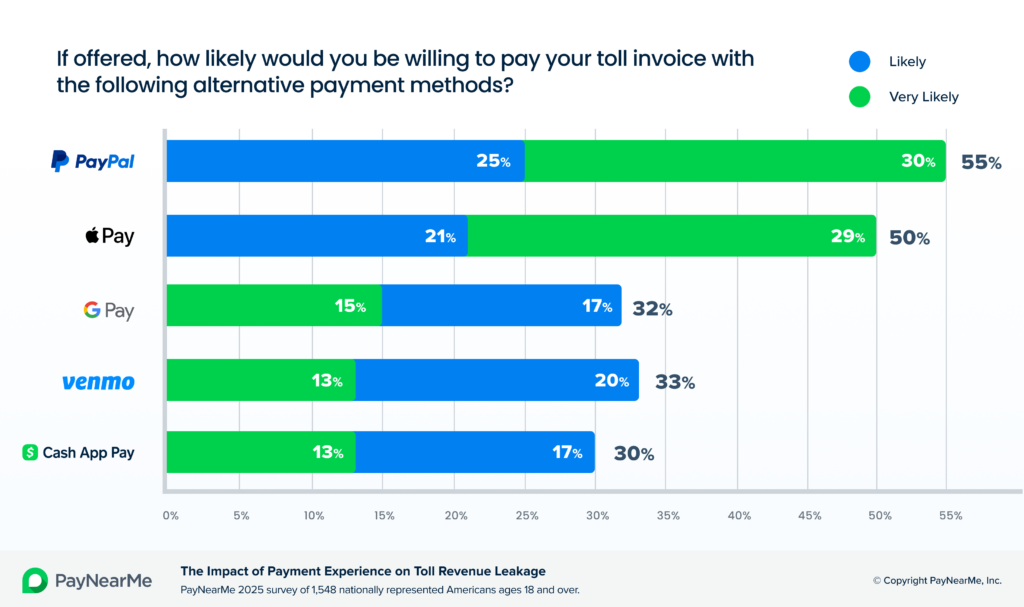

The research uncovered that drivers are more likely to pay toll invoices when they have access to their preferred payment methods. Nearly 2 in 5 (39%) respondents said digital wallet payment options would help them avoid past-due violations, while 30% who missed payments cited the lack of these options as a primary barrier.

Previous PayNearMe research found that 81% of consumers use at least one mobile payment app and 51% store funds directly in these apps—funds that could be used to pay toll invoices and violations. Despite this demand, many toll agencies have been slow to adopt digital wallet payments.

Even more revealing, 27% of non-registered drivers said more funding options would entice them to sign up for an account. Expanding funding methods to include digital wallets could drive registered account adoption—turning one-time invoice payers into long-term, lower-cost customers with higher lifetime value.

39% said access to digital wallets would help them avoid past-due violations.

This gap between driver preferences and agency offerings highlights a major opportunity. More than half of respondents (55%) indicated they would be likely or very likely to use PayPal. Apple Pay showed similar potential, with 50% expressing they would be likely or very likely to use the wallet. Other digital wallet options also demonstrated strong appeal to drivers: Venmo (33%), Google Pay (32%) and Cash App Pay (30%).

The data is clear: When toll agencies fail to offer digital-first or inclusive options, they miss out on revenue opportunities and drive up their collections costs. To meet this demand—and to recover lost revenue—toll agencies must rethink how they deliver the payment experience.

The path forward: Key recommendations

Toll authorities have made significant operational gains by adopting AET, but outdated and inflexible payment experiences prevent them from realizing the full financial potential. This research uncovers what many drivers feel: toll payments are often confusing, inconvenient and constrained by outdated technology and limited payment options. These recommendations outline a path forward to optimize the payment experience to drive more revenue collection and lower operating costs.

Implement smart QR codes to remove payment friction from paper invoicing. Toll agencies are increasingly adopting QR codes on paper invoices, but most fail to address the underlying poor payment experience. A QR code is only as effective as the experience it leads to. If the QR code leads to the same cumbersome portal with limited options, it fails to address the core barriers to timely payment.

Conversely, a smart QR code is a well-designed experience that enables drivers to scan and pay their toll invoice without the need to log in or enter payment details manually. Nearly half of survey respondents (45%) found the option to pay invoices via QR code appealing or very appealing. By enabling fast, mobile-friendly payment experiences directly from paper invoices, toll agencies can reduce late payments, lower call volume and capture more revenue from drivers without registered accounts.

Expand account funding and invoice payment options to include digital wallets. As drivers increasingly expect payments that mirror e-commerce and mobile banking experiences, toll agencies must adapt. Offering flexible, mobile-first options—such as PayPal, Apple Pay, Venmo, and Cash App Pay—can significantly reduce missed payments and reduce revenue leakage. 39% of surveyed drivers said access to digital wallet options would help them avoid past-due violations, while 30% cited the absence of these options as the reason they missed a toll payment.

Offer cash payments at retail stores to ensure equity and broaden access. Not all drivers have access to traditional banking tools, and toll agencies risk leaving millions behind by removing in-person cash options. Among surveyed drivers who paid toll invoices with cash, 17% lacked a bank account. Enabling cash payments at neighborhood retail stores, such as CVS or 7-Eleven, provides a critical solution for underbanked or cash-dependent drivers. Expanding digital cash payment access not only increases inclusivity but helps agencies recover more revenue from those who would otherwise face payment barriers.

The path forward requires modernizing the payment experience

Toll agencies have done the hard part—removing the physical toll booth. But they’ve left behind a digital payment experience that is inconsistent, inconvenient, and in many cases, inaccessible. This gap is costing billions in lost revenue and putting unnecessary strain on agency operations.

The solution isn’t more enforcement—it’s better enablement. By offering drivers the same modern, flexible, and inclusive payment options they’ve come to expect elsewhere, agencies can transform the tolling experience from a barrier to a bridge.

The tolling industry has a pivotal opportunity: modernizing payment systems to recover lost revenue and deliver a more inclusive, user-friendly experience for all drivers.