3 Payment Innovations That Improve Toll Collections

All-electronic tolling (AET) is rapidly becoming the standard across U.S. highways. Its promise is clear: reduced traffic congestion, improved safety, and increased operational efficiency. But while automation has streamlined traffic flow, it hasn’t guaranteed revenue collection. In fact, AET has unintentionally introduced new hurdles in payment experience that are leading to costly revenue leakage for tolling agencies.

According to Deloitte, an estimated $2.24 billion in toll revenue is lost annually due to breakdowns in the payment collection process. Many drivers simply miss or delay payments—not out of malice, but because current systems aren’t designed to match modern consumer behaviors and preferences.

It’s time for tolling authorities to rethink the payment experience. Here’s why—and how—three innovative approaches can help agencies recapture lost revenue, improve customer satisfaction, and drive more timely payments.

The challenge: Friction and fragmentation in toll payments

Toll road usage patterns have shifted dramatically. A recent PayNearMe consumer research survey found that 55% of drivers are infrequent toll road users, meaning they may only receive an invoice once every few months. These drivers are less familiar with tolling agency systems, less likely to proactively monitor for toll notices, and less motivated to sign up for an account or preload funds.

This irregular interaction results in a perfect storm of delayed payments, missed invoices, and ultimately, more expensive collection efforts. In fact, 49% of drivers said a less complicated payment process would have helped them avoid past-due violations.

The solution lies in adapting payment methods to the way today’s consumers already manage their money. Below are three impactful innovations that tolling agencies can implement to improve collections and reduce friction in the process.

1. Digital wallet payments

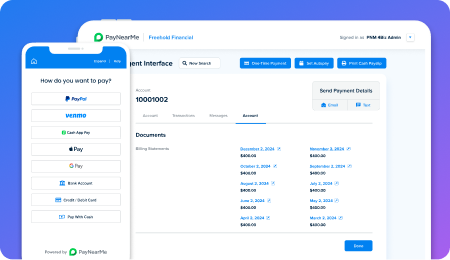

Digital wallets like Apple Pay, Google Pay, PayPal, and Venmo have become staples of modern commerce. They’re convenient, secure, and increasingly the first choice for consumers making day-to-day payments.

The research shows that 39% of drivers believe they could have avoided past-due violations if toll agencies accepted digital wallet payments. And 32% say it’s difficult to fund their toll account specifically because these apps are not supported.

This is a crucial gap to address. Many younger or underbanked consumers don’t rely on traditional checking accounts—they store their money in wallet apps or alternative platforms. By excluding these payment methods, toll agencies effectively erect a barrier between themselves and a sizable share of their potential payers.

In fact, broader consumer research shows that digital wallet adoption continues to climb, with nearly 60% of U.S. consumers using at least one digital wallet, according to a 2024 FIS Global Payments Report. Offering these options isn’t just a nice-to-have—it’s quickly becoming an expectation.

Opportunity: Tolling authorities should ensure their payment systems integrate with leading digital wallets. This will not only streamline the experience for the user but also help capture payments from those who previously found it too inconvenient—or outright impossible—to pay on time.

2. Cash payment at retail locations

While digital options are essential, it’s equally important not to overlook the needs of cash-preferred or cash-only consumers. According to the PayNearMe research, 42% of drivers believe toll agencies have a responsibility to support unbanked and underbanked populations with accessible payment options.

This is supported by a broader consumer sentiment: a recent Federal Reserve study found that 80% of U.S. consumers think it’s important to be able to pay bills with cash. For many, it’s not about a lack of access to digital tools—it’s a budgeting choice. In fact, 48% of respondents who prefer cash say they do so specifically because it helps them control their spending.

The solution? Enable cash payments at convenient retail locations like drugstores, grocery stores, or big-box chains. These partnerships allow consumers to walk in, present a barcode or QR code, and pay their toll bill using cash—without the need to mail money orders or navigate confusing websites.

Opportunity: By offering walk-in cash payment options through retail partners, toll agencies can serve a broader demographic, reduce mailing and processing delays, and improve collection rates from hard-to-reach drivers.

3. Scan-to-pay smart QR codes on paper invoices

One of the most intuitive and low-friction innovations for tolling agencies is the use of smart QR codes on mailed invoices. This bridges the gap between the offline and online worlds, allowing drivers to pay immediately with their mobile device—no account, app download, or manual data entry required.

Nearly 45% of drivers say that being able to scan and pay toll invoices via QR code is appealing, according to the study. For infrequent toll road users, this method removes multiple steps from the payment journey: no logging in, no remembering an account number, no need to type in a long web address.

A smart QR code leads to a mobile-optimized payment page with prefilled invoice data, allowing for a seamless checkout experience in seconds. This modern approach directly targets the #1 driver complaint—complexity—and turns a traditionally manual process into a one-scan digital experience.

Opportunity: Agencies can drastically reduce late payments and call center inquiries by embedding QR codes into printed materials. These scannable codes empower users to pay from anywhere, anytime, without friction.

Conclusion: It’s time to modernize the toll payment experience

Toll agencies are operating in a consumer-first world where convenience and accessibility shape whether—and when—people pay. The data is clear: outdated payment processes are costing billions in lost revenue and damaging public perception.

By embracing three key payment innovations—digital wallets, cash pay at retail, and smart QR codes—agencies can meet consumers where they are, reduce operational inefficiencies, and ultimately drive more successful collections.

As more drivers adopt hybrid and infrequent toll usage patterns, payment systems must become just as flexible. These innovations are more than just tech upgrades—they’re essential infrastructure for the future of tolling.

Looking for all the research insights? Read the paper here.