Card Breaking: A Booming Hobby Undermined by Outdated Payments

The rise of card breaking

Card breaking has emerged as one of the most dynamic and engaging trends in the world of collectibles. Whether it’s sports cards, Pokémon, or other trading card sets, the model is simple: buyers purchase a “spot” or team in a sealed box or case break, and the host (or “breaker”) opens the product live on stream. Participants receive the cards associated with their slot, often hoping to land a rare or high-value hit. The experience is a mix of entertainment, community, e-commerce and a little luck.

In a typical card break, a single sealed box worth hundreds or thousands of dollars is split among multiple buyers, making it more accessible to a broader audience. Platforms like Whatnot, Fanatics Live and independent websites have capitalized on this model, enabling breakers to host real-time events streamed via Twitch, YouTube, Facebook and proprietary platforms.

Image credit: Jay L. Clendenin / Los Angeles Times

The scale and value of the industry

While reliable public estimates are difficult to pinpoint, industry insiders suggest that daily consumer spend on card breaking could range in the hundreds of thousands—possibly even exceeding $1 million on some days. Marketplaces like Whatnot have reported more than $2 billion in total GMV (gross merchandise value), much of which is driven by collectible card transactions, including breaks. Companies like Backyard Breaks, Mojobreak and Layton Sports Cards each host dozens of breaks weekly, with hundreds or even thousands of buyers participating in real time.

The industry has matured rapidly, evolving from hobbyists on Facebook Live to full-blown media productions with studios, marketing teams and logistics operations. Despite this growth, one area remains critically underdeveloped: payments.

The payment problem in card breaking

Many card breakers still rely on outdated or fragmented payment systems, which present several problems:

- Lack of payment diversity: Most platforms only accept credit/debit cards—excluding the millions of customers who prefer other payment methods such as digital wallets or cash.

- Fraud and chargebacks: Randomized results and high-ticket items often lead to disputes, which traditional processors aren’t equipped to handle.

- No unified wallet: Consumers who participate in multiple breaks across platforms often need to re-enter card info, track refunds manually, or manage balances off-platform.

- Higher-risk payment methods: Peer-to-peer payment apps are common among smaller breakers, especially on Instagram or Facebook, but they offer minimal buyer protection and are not built for commercial transactions. Some platforms offer in-app wallets or balances, but only work within their ecosystem and still rely on traditional funding sources like credit cards or bank transfers.

- Manual credit card processing: Some breakers use basic ecommerce tools like Shopify or Squarespace, but these platforms often require manual reconciliation of buyers to break spots.

All of these issues introduce unnecessary risk, friction and fragmentation. Buyers face uncertainty with no consistent checkout experience while sellers deal with chargebacks, fraud and delays. For a tech-forward hobby, the payments infrastructure feels stuck in the past.

What breakers need in a payments partner

As card breaking continues to professionalize, breakers need a payment system that is:

- Low-risk: Built-in fraud prevention and compliance controls

- Flexible: Capable of supporting both digital and cash-based buyers

- Streamlined: Integrated with CRM and fulfillment tools

- Mobile-first: Designed for the platforms where buyers actually transact—phones, tablets, and social media

- Familiar, yet secure: Gives users a sense of trust without sacrificing protection

Enter PayNearMe: built for real-money, real-time commerce

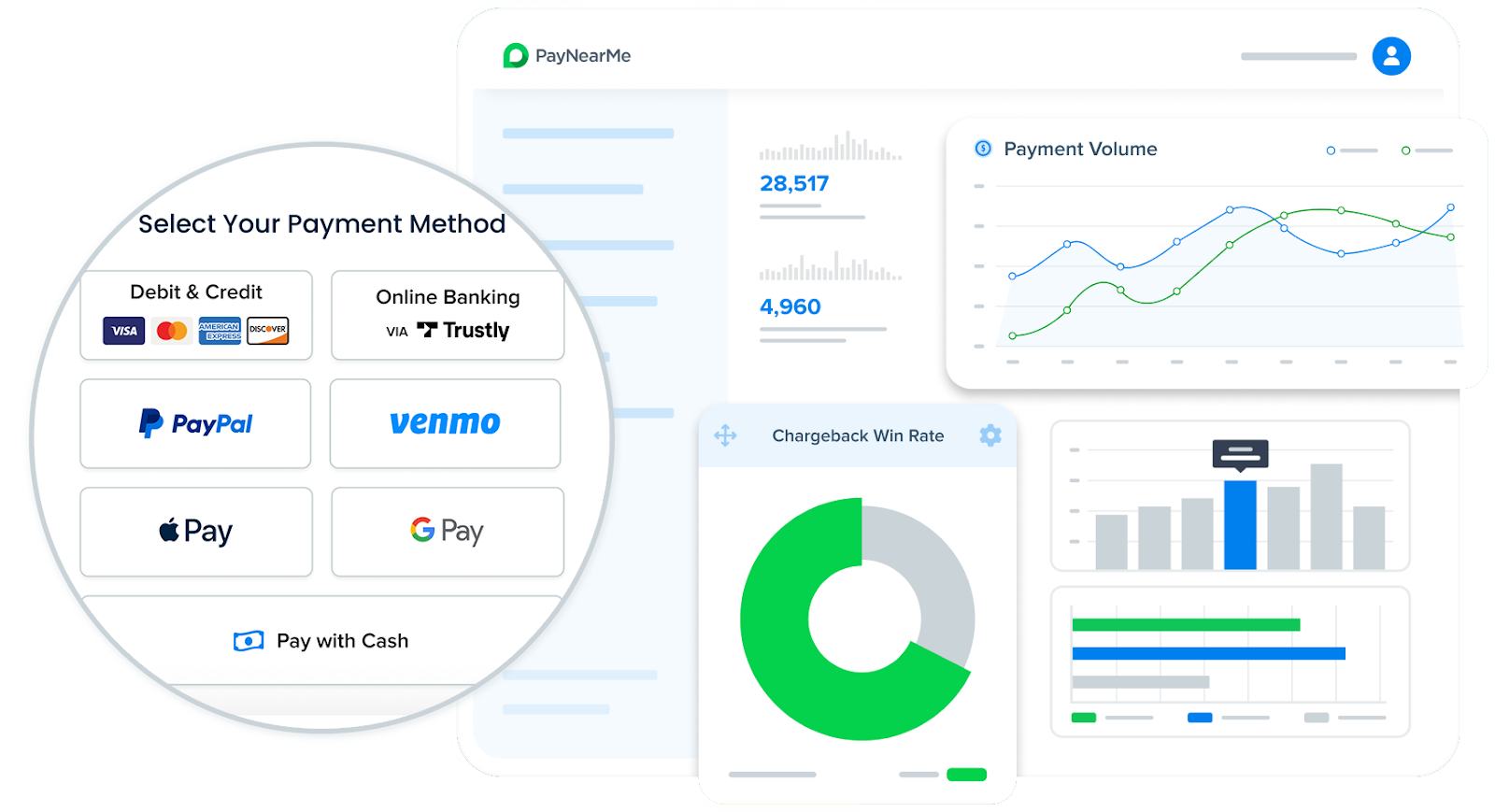

PayNearMe offers a modern payment platform that aligns perfectly with the needs of card breakers:

- Optimized payment stack PayNearMe enables payments through cards, ACH, Apple Pay, Google Pay, PayPal and even cash at over 62,000 retail locations nationwide. This is a game-changer for buyers who prefer not to use cards or P2P apps.

- Built-in compliance and fraud tools The platform includes tools to minimize fraud and streamline KYC/AML practices—critical in a hobby where high-value transactions occur daily. PayNearMe also offers transaction-level monitoring, audit-ready reporting and custom VIP limits. The company has extensive experience navigating state-by-state regulatory nuances, which is a must for the rapidly-changing gaming landscape.

- Custom checkout flows Breakers can embed PayNearMe into their websites or apps, allowing for seamless purchases of spots, random team assignments or personal boxes.

- Real-time payment confirmation Payments are confirmed instantly, so breakers don’t need to waste time verifying Venmo usernames or reconciling Zelle screenshots.

- Recurring and scheduled payments For high-frequency buyers, PayNearMe enables saved payment methods and recurring purchases—perfect for subscription breaks or weekly drops.

- Cash support at scale For buyers who are prefer cash, PayNearMe’s cash barcode system allows payments at CVS, 7-Eleven, Walgreens and more. This opens the hobby to a broader demographic.

Rethinking payments has a real impact

In addition to providing a better experience for customers that boosts loyalty and retention, modern and diverse payment options can have a major impact on business operations. For starters, offering guaranteed cash payments can lead to higher conversion rates and a wider audience. On top of that, built-in fraud tools and sophisticated risk-scoring lead to fewer chargebacks. And with a single payments partner and single integration, back-end tasks like reconciliation become streamlined. All of this results in easier, more cost-effective payment management for card breakers.

The bottom line: It’s time for payments to catch up

Card breaking is no longer just a side hustle—it’s a full-scale live commerce industry with massive growth potential. But its continued success hinges on modernizing the infrastructure that powers it, especially when it comes to payments. Without a scalable, secure and flexible payments foundation, even the most innovative breakers will hit a ceiling.

PayNearMe is uniquely positioned to elevate the card breaking experience, offering the tools to power this industry’s next wave of growth, while reducing friction, managing risk and meeting the needs of both users and regulators.

Want to learn more? Reach out to the team.

Sources:

- Cardboard Nerds: https://cardboardnerds.com/sports-card-breakers/

- Whatnot GMV estimates: https://techcrunch.com/2023/07/13/whatnot-funding-valuation/

- Cardboard Connection Guide to Breakers: https://www.cardboardconnection.com/online-case-breakers-guide