Why Winners Walk Away: The High Cost Of Slow Withdrawals

There’s a moment every iGaming operator spends millions trying to create: The win.

It’s the emotional peak of the player journey—when players feel rewarded for their time, skill or luck. It’s also the point at which loyalty should be cemented and when trust in an operator should be reinforced.

Instead, for many operators, the moments that follow the win are where the experience quietly breaks. Slow, unclear, or inconsistent withdrawals can turn a winning experience into a frustrating one. While deposits are often instantaneous, withdrawals frequently lag behind, creating a disconnect players notice immediately.

From the player’s perspective, the message is clear: We were fast to take your money. We’re slow to give it back.

The withdrawal experience is part of your brand

Operators invest heavily in acquisition and gameplay, but payments are often treated as a backend function rather than a core part of the player experience. From a player’s perspective, however, deposits and withdrawals are inseparable from the product—and brand—itself.

When withdrawals are fast and predictable, players associate winning with trust and reliability. When they’re slow or opaque, doubt creeps in. Add to that a lack of communication regarding the delay, and you immediately get players questioning whether they’ll actually receive their funds—and whether they should continue playing on that platform.

That emotional shift matters. The moment immediately after a win should reinforce confidence. Instead, slow withdrawals often introduce friction—and even suspicion—at the point where players are most engaged.

The mistake: optimizing deposits but neglecting withdrawals

The industry’s focus on deposits makes sense. Faster funding increases conversion, session starts, and wagering activity. But this emphasis has created an imbalance.

Withdrawals are frequently burdened by manual reviews, batch processing, limited payout methods or unclear timelines. While many of these controls are designed to manage risk, they can unintentionally create a poor player experience when not paired with speed and transparency.

The gap between deposit speed and withdrawal speed is noticeable to players—and it sends an unintended message. When money moves in quickly but comes out slowly, trust erodes.

Slower withdrawals, lower LTV

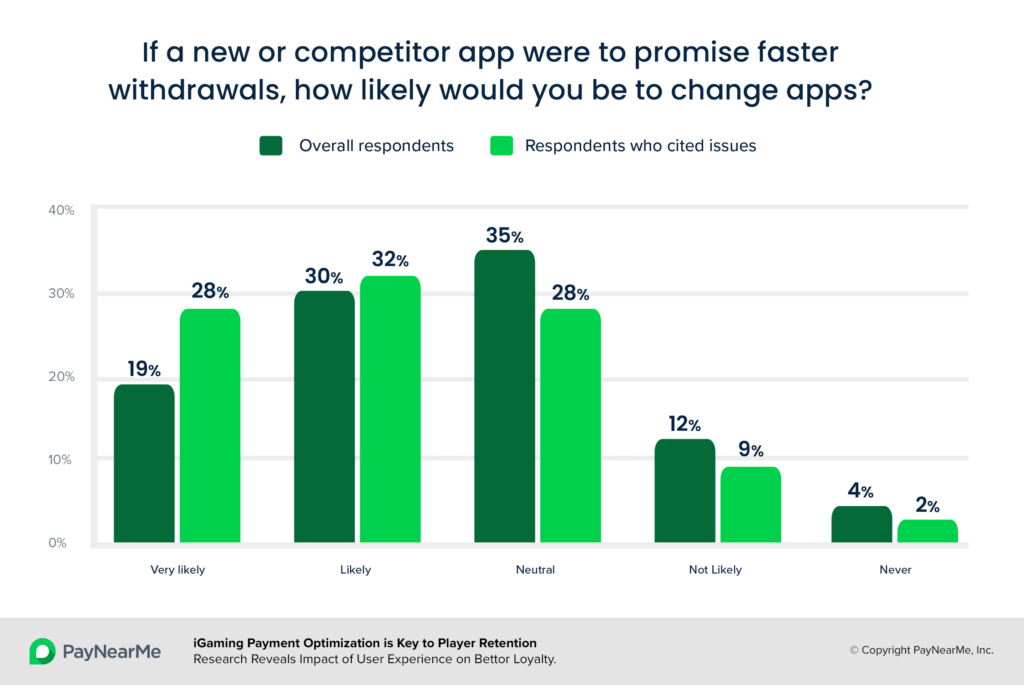

PayNearMe consumer research shows just how costly this friction can be. Nearly 60% of players who experienced payment issues said they would be likely to switch to a competitor if that competitor promised faster withdrawals. That represents a significant risk to player lifetime value driven by a single touchpoint.

Withdrawal issues don’t just influence player sentiment; they drive behavior. Players who feel uncertain about payouts are less likely to continue wagering, less likely to return and more likely to test alternative platforms.

Once a player leaves due to a poor payment experience, re-acquisition is expensive—and often unsuccessful.

Support costs rising? Blame payout friction

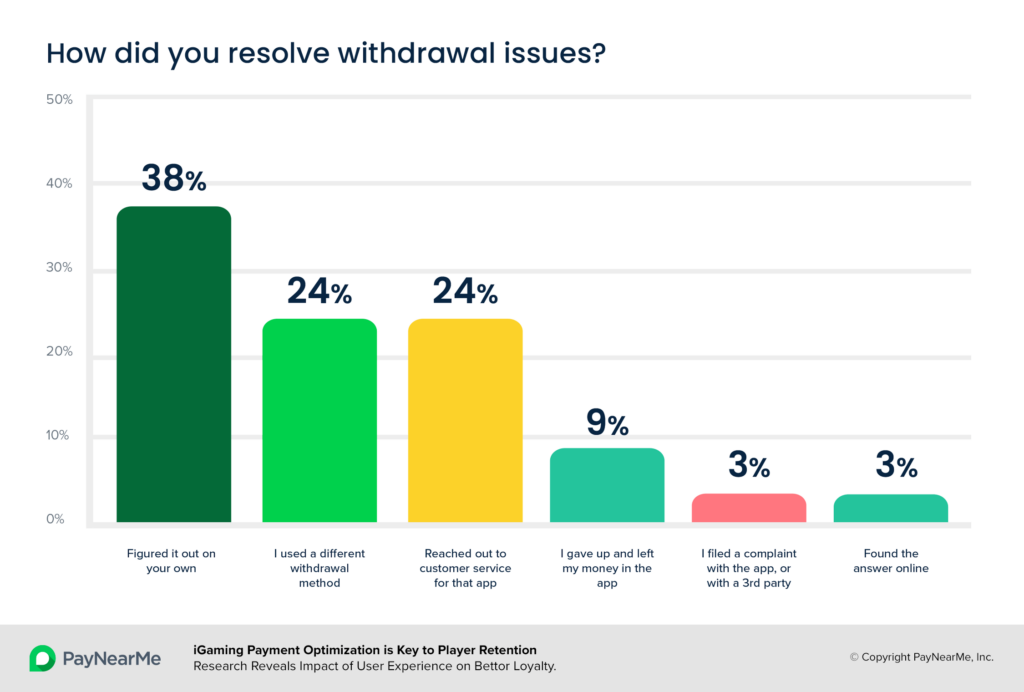

The operational impact of slow withdrawals is just as significant. According to PayNearMe research, 24% of players who experienced withdrawal issues contacted customer support.

Most of these inquiries are simply looking for more information on timing, status or confirmation surrounding one root question: “Where’s my money?” While simple in nature, these interactions consume agent time, increase ticket volume and create downstream escalation costs.

In many cases, the issue isn’t that the withdrawal is delayed—it’s that the player doesn’t know what’s happening. Lack of visibility and unclear expectations turn routine processing into a support burden.

When withdrawal experiences are faster and more transparent, support teams see fewer tickets, lower costs and improved customer satisfaction.

The true cost of slow withdrawals is often underestimated

Some operators view withdrawal speed primarily through a cost lens. Faster payouts may involve higher transaction fees or investment in modern payment infrastructure. But this perspective often overlooks the broader financial impact.

Player walkaway, reduced engagement, bonus overuse to re-activate churned players and increased support volume all carry significant costs. In many cases, these costs outweigh the incremental expense of faster, more efficient payout methods.

Operational excellence isn’t just about minimizing transaction costs—it’s about maximizing retention and lifetime value while reducing avoidable friction across the organization.

Faster withdrawals: A competitive differentiator

As the iGaming market becomes more competitive, product features and promotions are increasingly similar across operators. Payment experiences, however, still vary widely—and players notice.

Operators that enable fast or near-instant withdrawals stand out. Over time, payout speed becomes part of brand perception, influencing where players choose to play and where they choose to stay.

Research highlighted in PayNearMe’s iGaming player retention studies shows that payments play a meaningful role in how players evaluate platforms beyond gameplay alone. A smooth withdrawal experience reinforces trust and encourages repeat engagement.

A fragmented payout process is bad for business

Slow withdrawals are rarely caused by a single issue. More often, they stem from fragmented systems, manual processes and limited visibility across the payment lifecycle.

Without an end-to-end view of payouts, operators are forced to react to problems instead of proactively managing them. This leads to longer processing times, higher error rates and inconsistent player experiences.

Addressing withdrawal friction requires a more holistic approach to payments—one that prioritizes both player experience and operational efficiency.

Winning should reinforce loyalty, not create friction

Players may not remember every bet they place, but they remember how they felt when they won—and what happened next. Slow withdrawals interrupt that positive moment. Fast, reliable payouts reinforce it.

Betting requires fast deposits to make a bet quickly before an event happens, and withdrawal needs to be more timely because people who want to spend their winnings on something else want security in what they won.

– Surveyed bettor from PayNearMe 2023 research

For operators focused on long-term growth, improving the withdrawal experience isn’t just a payments initiative. It’s a retention strategy, a cost-reduction lever and a competitive advantage.

Improve the withdrawal process for your players, your team and your bottom line

For iGaming operators, the true cost of payments extends far beyond what shows up on a statement as “transaction fees.” As PayNearMe’s Beyond Transaction Fees white paper explains, the real drivers of cost are often the hidden and avoidable inefficiencies that stem from a poor payment experience—things like exceptions, manual intervention, customer service overhead and system fragmentation.

Payment Experience Management reframes how operators should think about these costs. Rather than fixating only on per-transaction rates, Payment Experience Management looks at the holistic payment journey—from the moment a player funds an account to the moment they receive a payout—and identifies where friction drives abandonment or adds manual work.

Fast and reliable withdrawals are a key part of that equation. When payouts are delayed or unclear, it creates a slew of problems that ultimately inflate costs and drive down lifetime value. By modernizing the withdrawal process within a broader payment experience strategy that doesn’t compromise risk aversion or scalability, operators can turn what is often a cost center into a differentiator.

With Payment Experience Management at the core of your payments strategy, operators can deliver faster payouts with confidence, streamline internal workflows and ultimately unlock more value from every player interaction.