How changing your collection methods can improve cash flow

Maximizing profits was the theme for this year’s EUCI 12th Annual Credit & Collections conference in New Orleans, which I attended with Tim Fox, our national sales manager for the utility and municipality business unit here at PayNearMe.

But official theme or not, maximizing profits has always been a focus for municipalities and utility companies – that’s not what made this conference special. What we found interesting this year was the examination of how utility companies are using technology and statistical payment behavior modeling to improve collections.

As the slow economic recovery continues to put pressure on utility companies to minimize bad debt and the rate of delinquencies and losses continues to rise, it is imperative that utilities become more strategic about how they improve collections as a strategy to increase cash flow.

Tim spoke on a panel that included several collection agencies and a collections software provider about innovative methods to boost the rate of successful collections. For a long time, collections methods were limited to accepting credit and debit cards online or via phone, and accepting cash was done in a limited number of payment offices – these methods have just about peaked in their level of effectiveness.

It was clear among the audience and panelists that it was time to think outside of the box, and one thing that all utilities and municipalities should be carefully evaluating is how easy they are making it for their constituents to pay.

One way to open up the payment channels is to look at the traditionally underserved unbanked or underbanked population. There are 68 million American adults who fall into this category, and cash is their default method of payment.

There are still more Americans who, for budgeting or security reasons, prefer to pay in cash. However, the current payment ecosystem makes it very difficult for these folks to pay in cash, and they often have to spend more time and effort than their card-using counterparts to pay recurring bills.

The panel also talked about the role that mobile devices play in servicing the un- and under- banked. Contrary to popular belief, 57 percent of the underbanked has access to an Internet-enabled phone, compared to only 44 percent for the overall population.

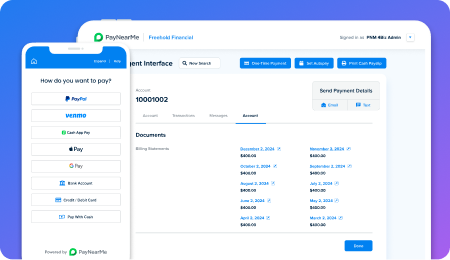

For the customers who fall into this category (and perhaps even those who do not), making it easy for them to check bills and manage their accounts on their phone can be a less expensive and more convenient to improve customer satisfaction and rates of bill payment.