9 Myths About the Underbanked – Debunked

What you don’t know about your underbanked customers could be hurting you – and your bottom line. If you’ve overlooked cash-preferring customers because of time constraints, overhead, or other concerns, you’re missing out on $1 trillion in buying power. We’ve made a short list of the most common misconceptions (and facts) about the underbanked to help you tap into the enormous potential of this market and learn how to better meet these consumers’ needs.

Myth #1: The underbanked are underemployed, low-income earners.

Fact: Approximately 28% of the underbanked are middle income earners with an average household income of $50,000 or more, only slightly below the U.S. median household income of $52K.

Myth #2: Underbanked consumers are less tech-savvy.

Fact: A higher percentage of the underbanked use smartphones and mobile banking than their traditionally banked counterparts. In fact, underbanked consumers prefer mobile banking to online banking, even though online banking offers more robust options and account features.

More underbanked consumers use alerts via text messaging (SMS) than traditionally banked consumers, so if you’re working with this population, text reminders or push notifications may be helpful in ensuring a timely, regular payment schedule.

Myth #3: Because underserved consumers rely primarily on cash, they are not likely to use more modern forms of payment.

Fact: While many unbanked consumers regularly use cash, they represent a tech-savvy customer base. In addition to being users of mobile banking services, they are also frequent users of prepaid credit and debit cards. In fact, they are more likely than traditionally banked households to use their prepaid cards to pay bills and receive payments online, or make everyday purchases such as buying groceries or gas.

Myth #4: When the underbanked use bank services, they use them in the same way traditionally banked consumers would.

Fact: Banked households primarily use bank tellers and online banking for transactions, whereas underbanked consumers are more likely to use mobile banking for basic transactions, and use bank tellers for more sophisticated transactions.

The underbanked most commonly use mobile banking features to check their pre-paid card or account balance, look up bill payment statuses or conduct bill payments, or check loan repayment details. These consumers are also likely to use a variety of service providers and mobile apps, in contrast to banked households who typically rely on one or two online banking providers that offer a full suite of services.

Myth #5: Only those without bank accounts use Alternate Financial Services (AFS) like check cashing or payday loans.

Fact: Over a quarter of all U.S. households use these services. The largest percentage of consumers using check cashing services – 37.8% – cash their checks at grocery, liquor, or convenience stores. By contrast, only 24.3% of AFS users go to a standalone AFS provider.

Consumers use AFS because traditional banking services don’t offer sufficient options. For example, some consumers are unable to cash their checks at a bank because they work during banking hours, others simply have no bank in close proximity to where they live or work.

Myth #6: The unbanked don’t want bank accounts because of fees or distrust of banks.

Fact: High fees and distrust of banks are cited as some of the reasons for being unbanked, however they are not the most common reasons for being unbanked – that would be income loss. What’s more, many unbanked consumers are looking to re-open a bank account. 57.5% of unbanked consumers cite falling below minimum balance requirements as the reason they became unbanked. Many unbanked households that return to banking do so to take advantage of services like direct deposit of paychecks.

The longer a household stays unbanked, the less likely they are to change their banking status in the future, so it’s important to reach these consumers early with payment options that can improve their financial mobility.

Myth #7: The financially underserved are an unprofitable segment because they are significantly worse off than the general population in terms of education and language skills.

Fact: Contrary to popular belief, 44% of the financially underserved have some college education and 81% of these consumers are U.S.-born citizens.

This population is also incredibly diverse, so don’t assume that a one-size-fits-all approach will work when serving this vibrant market. Here is how they identify:

- Almost 50% of un- and under- banked households identify as White

- 26% identify as Black

- 20% identify as Latino

Myth #8: Most of the financially underserved live in coastal states, those hit hardest by the 2008 Financial Crisis.

Fact: A third (32.7%) of all underbanked and unbanked citizens live in the South – in states such as Alabama, Texas and Mississippi. By contrast, the Midwest region has the lowest population of un- and underbanked consumers.

Myth #9: The financially underserved represent an insignificant portion of the U.S. population.

Fact: More than a quarter of U.S. households are financially underserved. These 34 million households have more than $1 trillion in annual buying power.

—————-

The payments landscape is continually evolving, and consumers have more options than ever. Businesses and financial institutions need to offer services that inclusive of the many consumer preferences. As evidenced by our myth debunking exercise, the underbanked market presents enormous opportunities.

If faulty assumptions caused you to write-off the underbanked consumers as irrelevant to your company’s business, we hope our article has challenged those assumptions. Perhaps, it has even sparked an idea or two on how you can uncover new revenue streams and fuel your company’s growth.

If you’re already serving the un- and underbanked, but doing so ineffectively, it is likely costing your business tens of thousands of dollars in unnecessary overhead costs. With the information above, you can evolve your business to better serve this $1 trillion market segment, while promoting greater economic inclusion to consumers who are frequently excluded from the advances in digital payments and electronic commerce.

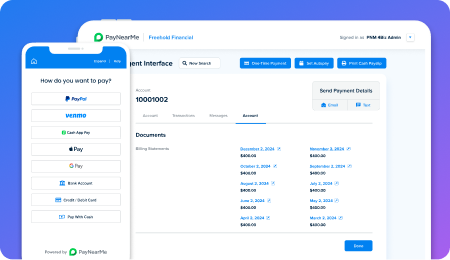

Want to learn more about how you can better serve the underbanked at your business, check out PayNearMe.

—

Sources: