Case Study: How Drive Now Acceptance Cut Call Volume 32% in 30 Days

Below is a transcript pulled from our recent webinar, “Automate Collections & Get More On-Time Payments in 2020”, featuring Bruce Gaskill from PayNearMe and Lisa Patterson from Drive Now Acceptance.

Listen along:

Bruce Gaskill: For many of you, tax season tends to be the busiest time of year. Buy Here Pay Here dealers are always looking for new ways to stay efficient and capture more revenue during this crucial time of year.

We brought in a subject matter expert with us today who has done just that. She’s agreed to share her insights, techniques and ideas with all of you on how her business was able to cut costs and improve customer relations with PayNearMe. I’d like to introduce you all to Lisa Patterson, COO of Drive Now Acceptance.

Let’s get started. Lisa and I met more than a year ago…

Lisa Patterson: More like five!

Bruce: Yes, yes. I came to you in a sales role, trying to win your debit business. Since then, I’ve learned so much about you and your approach to business. But before we get into that, why don’t you share a little bit about your business so our audience can get a sense of who you are and what you do.

Lisa: I run a related finance company that does financing for three Buy Here Pay Here locations in the state of Illinois. We have 2,000+ customers that we service out of one location on behalf of the three different dealership locations.

Bruce: Let’s dig a little bit deeper. When we first met you had multiple payment processors. We were lucky enough to have your cash business, but recently you consolidated to a single payment processor—PayNearMe.

Lisa: We love PayNearMe. Our [call center] collectors absolutely love it, and as you know Bruce, they were hounding me to get everything up and running once they heard we were switching all our payments to your company.

Something interesting we’ve done is making two of our locations completely cash free by running all cash payments through PayNearMe, which is also integrated with our Dealer Management System.

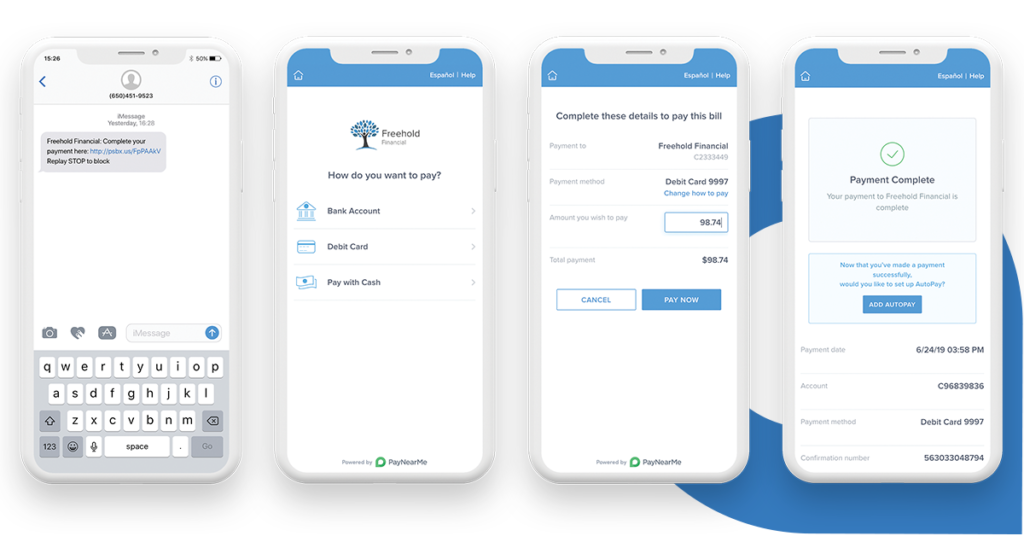

We literally just send the customer a text message link to pay. Our customers like that they’re able to sit at home and make their payments. The ones who want to pay cash have not given us any pushback; they like that they can walk into their local CVS, 7-Eleven or Casey’s General Store, which is pretty much in every one of our dealers local neighborhoods. There’s one of those three places is within less than a mile of where our entire customer base is located.

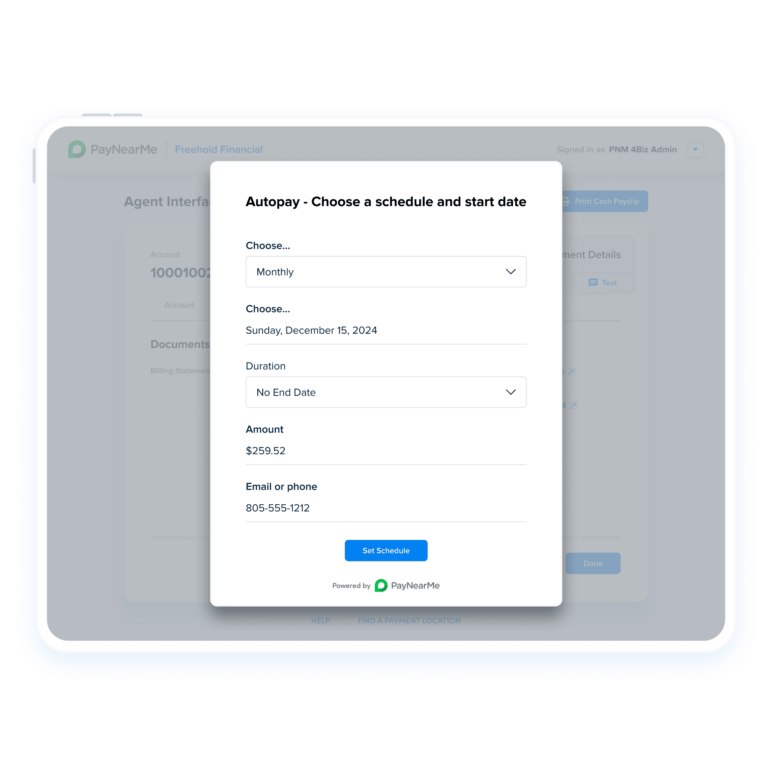

For everyone else, they just go online and make the payment through PayNearMe on their mobile phones. We still do have some customers that walk in to make payments at our locations, and they like being able to set up recurring payments. We have seen a large increase in customers that are automatically making payments on their own.

Bruce: Automatically doing it on their own—I like the sound of that. So you said something about eliminating cash from your dealership, but I think you just eliminated all payments, right?

Lisa: We have eliminated in-store payments at two dealerships, yes. And for the last dealership, we’re actually 100% cash-free and debit-free. No customers come into the other locations anymore, 45 days after we completely turned off all in-store payments. We have been able to reduce some staff that way, too.

Bruce: You already mentioned the benefit earlier [in the webinar] as far as not having salespeople getting involved in payments and not being able to focus on sales, or the service department dealing with minor service issues. It seems like it’s really been a very smooth transition.

Lisa: It was a little smoother than we thought it was going to be! We were expecting some push back from some of the customers. But now the salespeople can focus on sales, service can focus on the real service needs, not things like, “I have a light bulb out in my car.”

We also don’t have any misunderstandings now between what the finance company actually requires versus what may be said by a salesperson. We have also reduced a lot of overhead by eliminating the cashier position.

Bruce: You just completely separated sales and service even though you are owned by the same business.

Lisa: And it’s nice too because now we’re making a very definite distinction that the dealership is Superior, while Drive Now Acceptance is the finance company. We [the finance company] don’t want to be involved in service stuff.

Bruce: What techniques are the collectors using to help improve their efficiency and your profitability?

Lisa: By having these text to pay links and letting all our customers know it’s happening, we’re able now to focus on our more challenging customers. Being a Buy Here Pay Here, every Friday and Saturday are huge paydays. The collectors aren’t able to get to those challenging customers because all they’re doing is dealing with somebody saying “Okay, thank you for your payment. Have a good day.”

When you’re taking 700 to 800 payments between four collectors on a Friday, they can’t get through their calls that they need to get through. So it’s nice to have PayNearMe because it’s improving our ability to focus on who we need to get to, while good paying customers still can pay without having to deal with us on the phone.

Bruce: Do these customers have to wait on hold to get through to you?

Lisa: No, not anymore. Our call volume has dropped drastically and the payments post automatically because again, we’re integrated [with our DMS]. The payments are made and they post automatically and my collectors don’t even have to worry about those customers anymore.

Bruce: So how much do you think call volume has dropped in the one or two billing cycles you’ve been doing this?

Lisa: Just this week I ran the numbers to and we were just over 32% drop in call volume of inbound calls.

Bruce: Well that’s awesome.

Lisa: Yeah!

Bruce: We’ve been seeing that pretty consistently for our clients—between 30% and 50% drop in call volume. It takes a little time to educate consumers about how easy it is to pay at home on their smartphone, but the benefits real. Now your collectors have time to talk to your most challenging customers.

It’s not uncommon to hear these type of business issues and see these types of results: customers waiting on hold to pay collectors, trying to get through call after call with good customers who would have paid anyway.

I think the thing that surprised me the most was that there was really no noise. You were able to just roll this out to your customers and they generally accepted it.

Lisa: Yeah that’s correct. At 60 days out [from our cash-free initiative], we started putting flyers out to get in everybody’s ear. And we could see when customers would call and get the automatic payment link, we could gradually see the amount of walk-in customers slow down. Then after we went completely live and shut it off, it wasn’t it wasn’t anything that was surprising.

You know, we didn’t just spring it on the customers. We started hearing the good feedback and which just made everything go very smooth.

Bruce: You stopped taking payments at your dealerships. Did you bring on another collector for the extra call volume?

Lisa: We were actually in the process of interviewing for another collector that was going to strictly take payments on-site. Now we do not have to fill that role, which is a big chunk of overhead just to wait for payments. As of yesterday we no longer have to use staff as cashiers at our other locations either. That overhead is gone now.

Bruce: Well, congratulations. Thank you Lisa!

Lisa: Thank you Bruce!

See PayNearMe in Action

Want to see how PayNearMe can help your BHPH cut overhead and improve the customer experience?