Consumer Portfolio Services (CPS) Names PayNearMe as its Primary Payments Partner to Accelerate the Auto Lender’s Digital Transformation

With a focus on fintech innovation, CPS expands its partnership with PayNearMe to deliver a frictionless customer experience across all digital payment types and channels

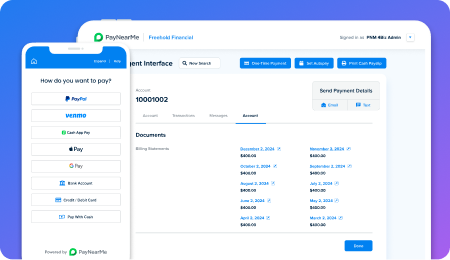

SANTA CLARA, Calif., and IRVINE, Calif, October 18, 2022 – PayNearMe, a fast-growing fintech company radically improving the customer payment experience, announced Consumer Portfolio Services, Inc. (Nasdaq: CPSS) (“CPS”) named PayNearMe as its primary payments partner. This partnership will accelerate the auto lender’s digital transformation and deliver a frictionless customer experience across all digital payment types – cash, debit, ACH and mobile-first payment options including PayPal, Venmo and Apple Pay. PayNearMe also will enable CPS to digitize and simplify payments through every channel, including agent, web, mobile, IVR and digital wallet.

“PayNearMe has proven to be a key partner in our digital transformation,” said Mike Lavin, Chief Operating Officer, CPS. “With its innovative technology solutions, we have eliminated onsite cash payments, dramatically reduced the number of customers who pay by check, and transitioned the majority of our customers to electronic payments through greater pay options.”

CPS is successfully using PayNearMe’s innovative QR code payment technology to give its customers the ability to quickly and easily complete payments with many electronic payment options or with cash via PayNearMe’s extensive retail network.

“Our goal is to make it as easy as possible for CPS customers to make their car loan payments on-time,” said Dennis Esguerra, VP, Customer Success, PayNearMe. “Consumers want the flexibility to use different payment types each billing cycle, such as paying by debit card one month, Venmo the next and cash another month. In fact, our research found that for 29% of consumers, having this flexibility would make it easier to pay bills on time. By adding PayPal and Venmo as payment types, CPS customers will have even more flexibility when they need to make a bill payment.”

Smart Link™ technology also makes it easier for CPS customers to make electronic payments from their smartphone via an email, text or push notification. “PayNearMe’s Smart Link technology is like gold,” Lavin said. “In as few as two taps on their smartphone, our customers can pay their bill using whatever payment type they prefer. That’s the type of innovation that makes it easier for our customers to pay their bills on time and sets PayNearMe apart as a great partner.”

“We chose PayNearMe as our primary payments partner because their team understands our vision for the future, constantly presents us with new ways to create better digital experiences at scale, delivers incredible day-to-day support, and has the industry’s best bill payment technology platform,” he continued. “By expanding our relationship, we can further digitize customer payments, increase self-service transactions, and reduce payment-related call center interactions.”

About PayNearMe

PayNearMe develops technology that drives better payment experiences for businesses and their customers. Our modern, flexible and reliable platform helps businesses increase customer engagement, improve operational efficiency and drive down the total cost of accepting payments. PayNearMe enables more ways to pay by offering all major payment types and channels in a single platform.

PayNearMe today processes a variety of payment types including cards, ACH, Apple Pay, Google Pay, PayPal and Venmo, and has enabled cash payments through our proprietary cash network since 2009. PayNearMe cash payments are accepted at more than 40,000 retail locations in the U.S. including participating 7-Eleven®, Walmart®, Family Dollar®, Casey’s General Stores®, and ACE Cash Express®, among others.

Thousands of businesses partner with PayNearMe to manage the end-to-end customer payment experience in industries such as Consumer Finance, Property Management, Insurance and iGaming and Sports Betting.

To learn more about PayNearMe, please visit www.paynearme.com. Follow PayNearMe on Twitter, LinkedIn and Facebook. The PayNearMe service is operated by PayNearMe MT, Inc., a licensed money transmitter.

About Consumer Portfolio Services

Consumer Portfolio Services is an independent specialty FinTech that provides indirect automobile financing to individuals with past credit problems, low incomes or limited credit histories. We purchase retail installment sales contracts primarily from franchised automobile dealerships secured by late model used vehicles and, to a lesser extent, new vehicles. We fund these contract purchases on a long-term basis primarily through the securitization markets and service the contracts over their lives. Our operational headquarters are in Irvine, California with four additional servicing branches in Nevada, Virginia, Florida and Illinois. Learn more at www.consumerportfolio.com.

Since operations began in 1991 through June 30, 2022, we’ve purchased over $19.1 billion in contracts. As of June 30, 2022 we service a total managed portfolio of ~$2.6 billion with ~162,000 active customers and 799 employees in our branches in five states. We maintain dealer relationships in 48 states. Our common stock is traded on the NASDAQ National Market System under the ticker “CPSS”.