PayNearMe and Allied Business Systems Partner to Offer Lenders a Wide Range of Modern Bill Pay Options With a Single Integration

ABS clients can now accept cash, card and ACH payments, as well as the most popular mobile payment types, all through a single platform

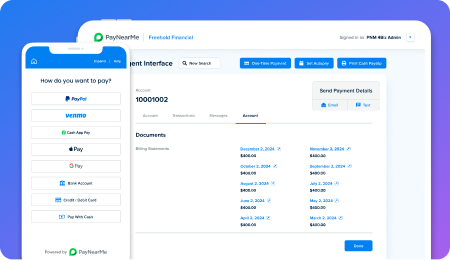

SANTA CLARA, Calif., March 21, 2023 – PayNearMe, a fast-growing fintech company radically improving the customer payment experience, and Allied Business Systems, LLC (ABS), a leading software solution for the consumer finance industry, announced a partnership that will make it possible for ABS clients to offer their customers a wide range of modern bill pay options with just one technology integration. The partnership will offer ABS clients a single platform to process traditional payments such as cash, card and ACH, as well as popular mobile payment options, including Apple Pay, Google Pay, Venmo and PayPal.

“Our clients range from small regional lenders with a few brick-and-mortar locations to large lenders with hundreds of branches across the country. PayNearMe can successfully service them by providing more ways to engage consumers via modern payment methods encouraging increased self service and more on-time payments,” said Miranda Price, Vice President of Business Development, ABS.

ABS clients have countless borrowers that still walk into branch locations and make cash payments, which are among the most expensive payments to process. “With PayNearMe, these lenders can eliminate in-branch cash payments by digitizing cash,” explained Michael Kaplan, Chief Revenue Officer, PayNearMe. “Our technology enables ABS clients to accept both cash and electronic payments, and gives borrowers the freedom to choose their preferred payment method through a user-friendly interface.”

The integration of PayNearMe into absVision® consolidates payments made through any channel, such as agent, web, mobile, IVR or mobile wallet into a single ledger. This streamlines the reconciliation process for ABS clients that accept any or all of the payment types PayNearMe offers.

“We’re excited about PayNearMe’s Smart Link™ technology, which enables our clients to offer borrowers an easy and fast way to pay on a smartphone via a QR code, email, text or push notification,” Price said.

“This integration meets the needs of every ABS customer segment,” she continued. “It allows our clients to offer borrowers a broad choice and flexibility in repayment options, while reducing the need to maintain multiple loan payment processing platforms.”

About PayNearMe

PayNearMe develops technology that drives better payment experiences for businesses and their customers. Our modern, flexible and reliable platform helps businesses increase customer engagement, improve operational efficiency and drive down the total cost of accepting payments. PayNearMe enables more ways to pay by offering all major payment types and channels in a single platform.

PayNearMe today processes a wide range of payment types including cards, ACH, Apple Pay, Google Pay, PayPal and Venmo, and has enabled cash payments through our proprietary cash network since 2009. PayNearMe cash payments are accepted at more than 40,000 retail locations in the U.S. including participating 7-Eleven®, Walmart®, Family Dollar®, Casey’s General Stores® and ACE Cash Express®, among others.

Thousands of businesses partner with PayNearMe to manage the end-to-end customer payment experience in industries such as Consumer Finance, Property Management, Insurance, Utility and Municipality and iGaming and Sports Betting.

To learn more about PayNearMe, please visit www.paynearme.com. Follow PayNearMe on Twitter, LinkedIn and Facebook. The PayNearMe service is operated by PayNearMe MT, Inc., a licensed money transmitter.

About Allied Business Systems, LLC

Allied Business Systems (ABS) is the leader in financial software. The company has been providing solutions for the consumer lending industry for 45 years. ABS offers top of the line exclusive technology for all types of consumer lending: traditional consumer finance, sales finance, auto finance and real estate. Its loan management software solution, absVision®, enables financial services customers to protect their data, make their offices more efficient, simplify financial analysis and increase profitability. Visit www.alliedbiz.com to learn more. Follow ABS on LinkedIn and Facebook.