Why Lenders Need Payments Data to Stay Competitive

In the crowded and competitive landscape of banking and lending, financial institutions (FIs) are increasingly challenged with how to differentiate. More and more, it’s coming down to delivering personalized experiences—yet all too often, FIs don’t have the data-driven insights to make improvements that will move the needle.

It’s not that data isn’t available. Every payment customers make can contain hundreds of valuable data points. Particularly for lenders, payments data represents a wealth of information to better understand borrower behaviors and preferences in order to improve engagement and outcomes. If organizations lack the means or expertise to capture actionable insights, they may be left behind.

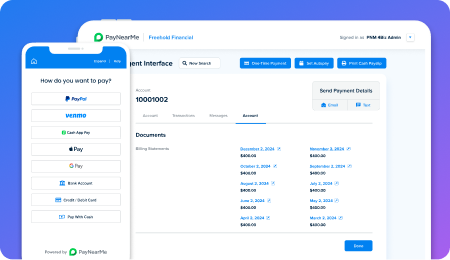

Another factor in the customer experience (CX) equation is meeting new demands for faster, more flexible payment methods. Providing more payment options is not only better for CX, it provides the business with a treasure trove of valuable data. However, even if FIs offer multiple payment rails, many are unable to collect, aggregate and analyze payments data from across many diverse platforms.

Investing in data-driven practices is now a top priority for many FIs, but they often don’t know how or where to start, or how to prove the value. A recent study of lending executives dove into this issue. Through surveys and interviews conducted by Datos Insights, we explored top challenges and trends for lenders struggling to improve CX and drive growth.

Insights are out of reach

The importance of harnessing data-driven insights to improve personalized customer experiences was clearly recognized by all of the lending executives surveyed. However, a common theme was the lack of usable data and an inability to take advantage of the data they do have.

75% of lending executives agreed or strongly agreed that access to better payments data would benefit their organization

For example, 77% of lenders who manage multiple payment platforms agreed that the biggest complication was collecting data from all the various sources. As a result, they are losing opportunities to improve customer engagement and operations, from payment processes and loan servicing, to collections and risk management.

Beyond limited data access, the majority of those surveyed said they don’t have the analytic infrastructure and skill sets to transform all their data into actionable insights.

Unplugged from the power of AI

In our current era of unprecedented tech innovation, many financial institutions are scrambling to tap the potential of AI and machine learning (ML). But taking the leap can be daunting for many organizations. Of the lenders surveyed, all acknowledge AI and ML could be valuable, but none have the resources in-house to apply advanced analytics to their data.

One of the powerful benefits of ML is the ability to analyze across multiple diverse data sources to gain insights that represent a more holistic picture of what’s going on. Being able to combine payments data with additional transactional, credit, census, underwriting and demographic data can provide customer insights across the entire lending life cycle.

The rising imperative to personalize

With data-rich insights out of reach, how can banks and lenders stay competitive and profitable? Across many other lifestyle activities, consumers have grown accustomed to seamless, highly personalized experiences, based on interactions with industry giants like Amazon, Starbucks and Uber. Financial institutions have considerable catching up to do.

Many consumers now wonder why their bank can’t give them the same quick, easy—and personally relevant— interactions they get elsewhere. A big part of the answer is that the companies that do it well excel at capturing and leveraging data. If financial institutions want to match and exceed consumer expectations, they will have to accelerate their data maturity.

Capitalizing on data can enable FIs to lean into “hyper-personalization.” This approach uses data-driven insights to personalize interactions and functionality to meet individual customer needs across the entire lifecycle. Lenders, for example, can personalize loan payment options, marketing, call center interactions and collections to improve customer satisfaction and outcomes.

Many FIs are making it possible—and doing it faster and with minimal IT effort—by partnering with third-party experts and leveraging fintech innovation. In particular, partners with AI/ML and payments expertise can help FIs solve specific problems with the right technology solutions and data science projects.