3 Tolling Payment Trends to Watch in 2026: Why Unified Payment Experience Management Is the New Imperative

The tolling industry is at a pivotal moment. As agencies modernize collections infrastructure, move beyond legacy toll booths, and embrace all-electronic tolling (AET), one critical area has lagged behind: payments.

For years, agencies have relied on a patchwork of processors, portals, vendors, IVR systems and disparate notification tools to bring in revenue. While each solution may have been “best-in-class” for its narrow function, the overall result has been a fragmented payment ecosystem—one that frustrates drivers, strains back-office teams and leads to mounting revenue leakage.

In 2026, that model is no longer sustainable.

The future is clear: tolling agencies will shift to unified payment experience platforms that centralize payment flows, automate engagement, reduce leakage and operational struggle—and ultimately drive higher collections at lower cost.

This shift isn’t just a technological upgrade; it’s a strategic necessity. Based on recent industry insights and PayNearMe’s own research on payment behavior, this blog will dive into the various themes that will shape tolling payment trends in 2026, and why Payment Experience Management is emerging as the backbone of modern tolling ecosystems.

But first: What is Payment Experience Management?

Payment Experience Management is a combination of software and money movement services which optimizes the end-to-end payment journey across customers, support and operations. It goes beyond the transaction, ensuring every stakeholder in the payment process has an easy experience.

By optimizing across all three stakeholder categories, Payment Experience Management can improve cash flow and profitability by accelerating payments and reducing the total cost of acceptance.

Understanding Payment Experience Management is only the beginning. As we look toward 2026, the principles behind it—simplicity, automation and unified workflows—map directly to the challenges tolling agencies are facing in the real world. From rising customer expectations to the operational strain created by AET and multi-vendor systems, the industry is reaching a tipping point. With this context, let’s explore the key trends driving the shift toward more intelligent, streamlined payment experiences.

Theme: Rising expectations for seamless, self-service payment experiences—for both customers and agencies

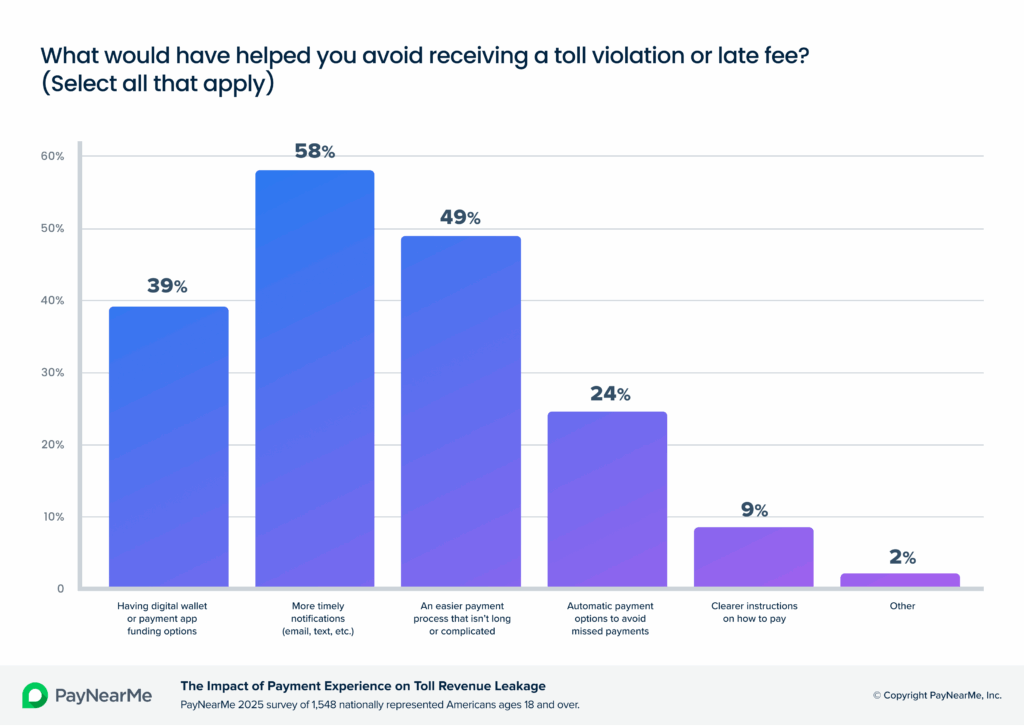

In 2026, agencies can no longer treat “modernizing payments” as innovation—low-effort payments are table stakes. Drivers increasingly compare every toll payment experience to the speed and simplicity of ecommerce checkouts, and PayNearMe’s tolling research shows that long, complicated flows are a leading reason people delay or avoid paying toll invoices. Nearly one in three drivers say the payment process itself is difficult or inconvenient, and many cite limited payment options—especially the absence of digital wallets—as a source of frustration.

Trend #1: Agencies will move toward frictionless, mobile-optimized, low-effort payments from a unified platform

We’ll see agencies begin to prioritize:

- Single-screen mobile web payments that eliminate redirects, logins, and multi-step forms

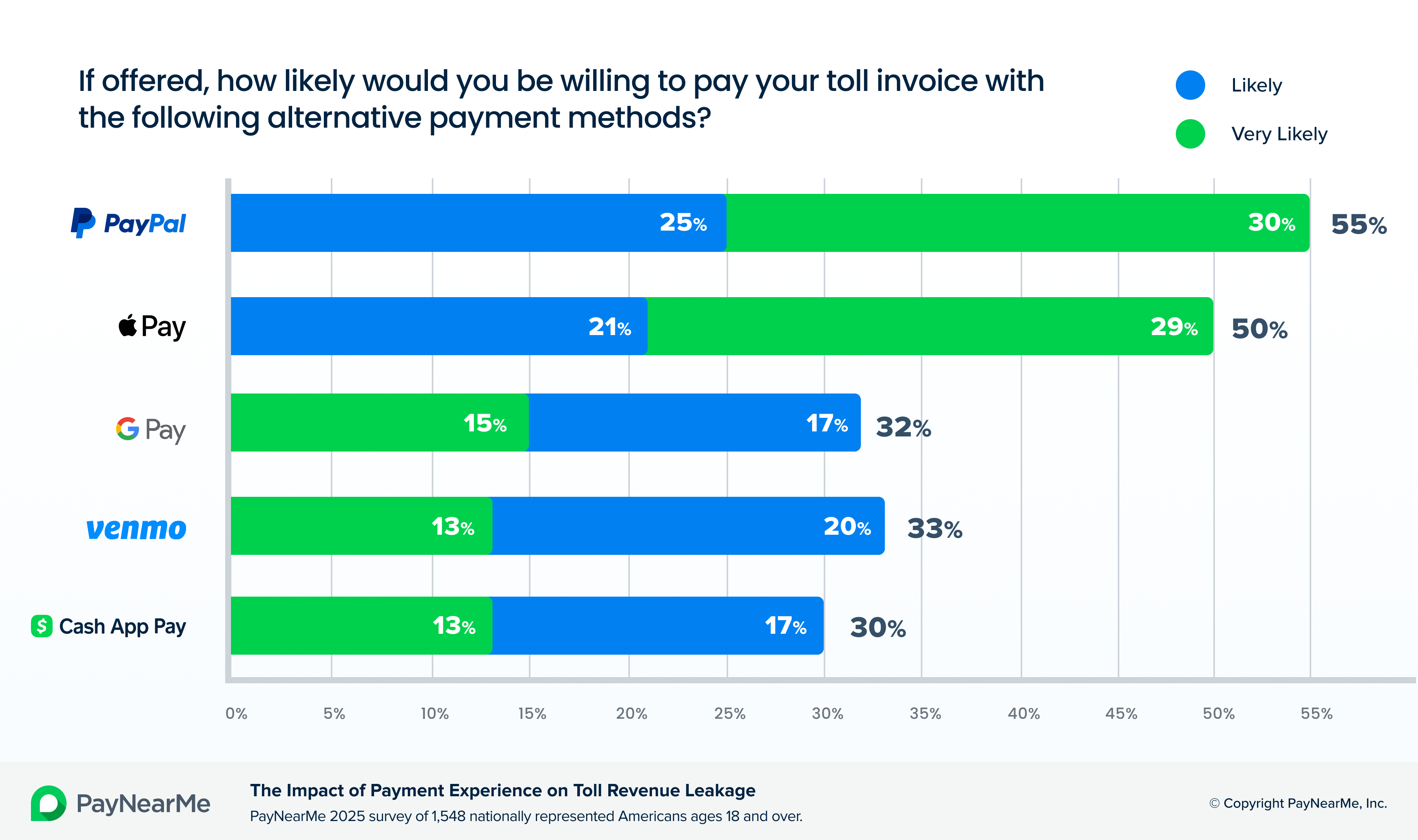

- Apple Pay, Google Pay, PayPal, Venmo and other “native” digital wallets, which consumers repeatedly cite as missing from today’s toll payment experience

- Customer engagement that links directly to their personalized payment flow with pre-filled customer data (account or invoice numbers) to reduce user effort and prevent payment abandonment

- Embedded payment links inside notifications (email, SMS, push)—more than half of drivers (61%) said they’d prefer to pay directly from a text message rather than navigate a website

- Instant confirmation and simplified user flows to reduce errors, customer service calls, and repeat attempts

Modern consumers expect payments to be quick, intuitive and familiar—mirroring the one-tap, app-like experiences they already use daily. Generational preferences are a key factor that’s reshaping the tolling payment landscape. Younger drivers overwhelmingly prefer mobile-first, cashless, and instant digital interactions.

Generational differences dramatically influence preferred payment channels, preferred communication channels, tolerance for friction and more. When agencies don’t offer flexible options that appeal to their wide audiences, the resulting friction directly drives nonpayment, violations and operational costs.

Those that don’t modernize will find themselves competing not against other agencies, but against the convenience norms set by every other digital experience in a driver’s life.

Why legacy multi-vendor stacks fail here

When agencies stitch together multiple payment processors, online portals, notification systems and data vendors, the customer journey becomes disjointed. One vendor powers texts, another handles cards, another runs IVR, and none of them share UX standards. This creates friction that can cost millions in leakage.

Agencies are realizing they need to look for:

- Fewer vendors to manage

- Unified reporting

- End-to-end accountability

- Lower operating costs

- Simplified security & compliance

- Faster innovation cycles

The tolling market is recognizing a pattern long seen in consumer finance, insurance and government payments: consolidation improves both efficiency and customer experience.

With Payment Experience Management, agencies end up with a simpler, more predictable operational environment—and customers finally get a unified experience.

Theme: Payment Experience Management becomes a core revenue strategy

The next frontier in tolling isn’t just adding new payment methods. It’s about managing the entire payment journey, from the moment a toll is incurred through final settlement. Recent tolling agency RFPs for payment processors have more frequently begun to include requirements such as digital access to all settlement, reconciliation and chargeback reporting, fraud prevention tools and measures, and access to all digital payment methods.

This is where a platform built for Payment Experience Management rises above traditional payment processors.

Trend #2: Toll agencies adopt platforms to optimize collections while transforming back-end operations

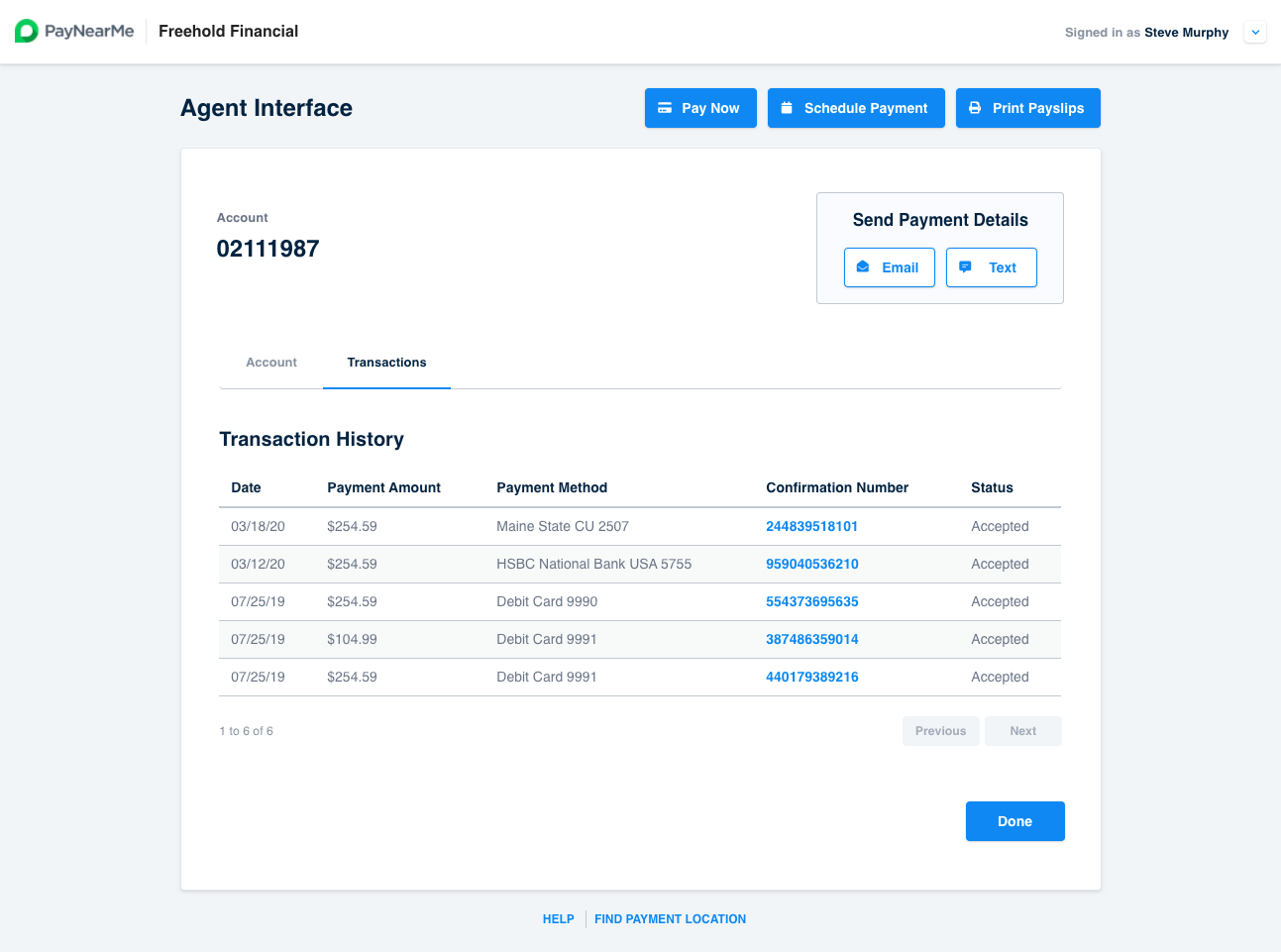

Payment Experience Management’s role in tolling extends far beyond simply processing payments. Instead, it optimizes every touchpoint for customers and agencies, including:

- Automated, intelligent notifications (SMS, email, push, IVR)

- A single, consistent payment experience across all channels

- Simplified workflows for back-office teams

- Integrated reporting and analytics

- Real-time payment visibility

- A/B testing and optimization to increase payment rates

- Fraud mitigation and intelligent retries for failed payments

How this approach revolutionizes operations

Toll agency payment ops teams routinely struggle to manage every aspect of the payment process, including what occurs after an attempted or successful payment. Tasks such as reconciling multiple vendor reports, handling payment disputes, managing transaction failures and supporting confused customers all drain time, increase costs and hamper collections.

A payment experience management platform’s unified set of back-office resources gives agencies:

- A single source of truth for payments

- Real-time reporting across all channels

- Streamlined reconciliation

- Fewer customer service escalations

- Automated workflows that reduce staff workload

Rather than bolting on new solutions, agencies will increasingly centralize their entire payment lifecycle—from outreach to settlement—to reduce operational complexity and maximize yield. For agencies dealing with staff shortages and rising operational demands, this consolidation is a game changer.

This marks a shift from “payments as a necessary utility” to payments as a strategic driver of revenue efficiency.

Theme: Personalized, targeted payment engagement becomes essential

Not all toll customers behave the same. Millennials prefer text messages. Older drivers sometimes prefer phone calls or mail. Some want autopay, others need reminders. Some need a gentle nudge, others respond better to urgent messaging.

Our research showed that when it came to being notified about registered account balances being low, 59% of drivers wanted text reminders while 48% preferred email and another 17% wanted an automated phone call. When it came to unregistered drivers, 20% still preferred a paper invoice in the mail over any digital option. Regardless of the breakdown, these differences prove one significant point—agencies can’t assume all customers can be supported by one method of communication or engagement. And historically, agencies lacked the tools to personalize communications at scale.

Trend #3: Intelligent engagement based on customer behavior and channel preference

Thanks to modern payment tools, agencies can:

- Trigger reminders based on payment history

- Use dynamic messaging optimized by customer segment

- Test different notification timing and content

- Deliver language-specific communications

- Send one-click pay links tailored to each customer’s device

With the right platform, agencies can even boost transponder adoption with customized messaging, reducing the amount of unregistered drivers who need invoicing.

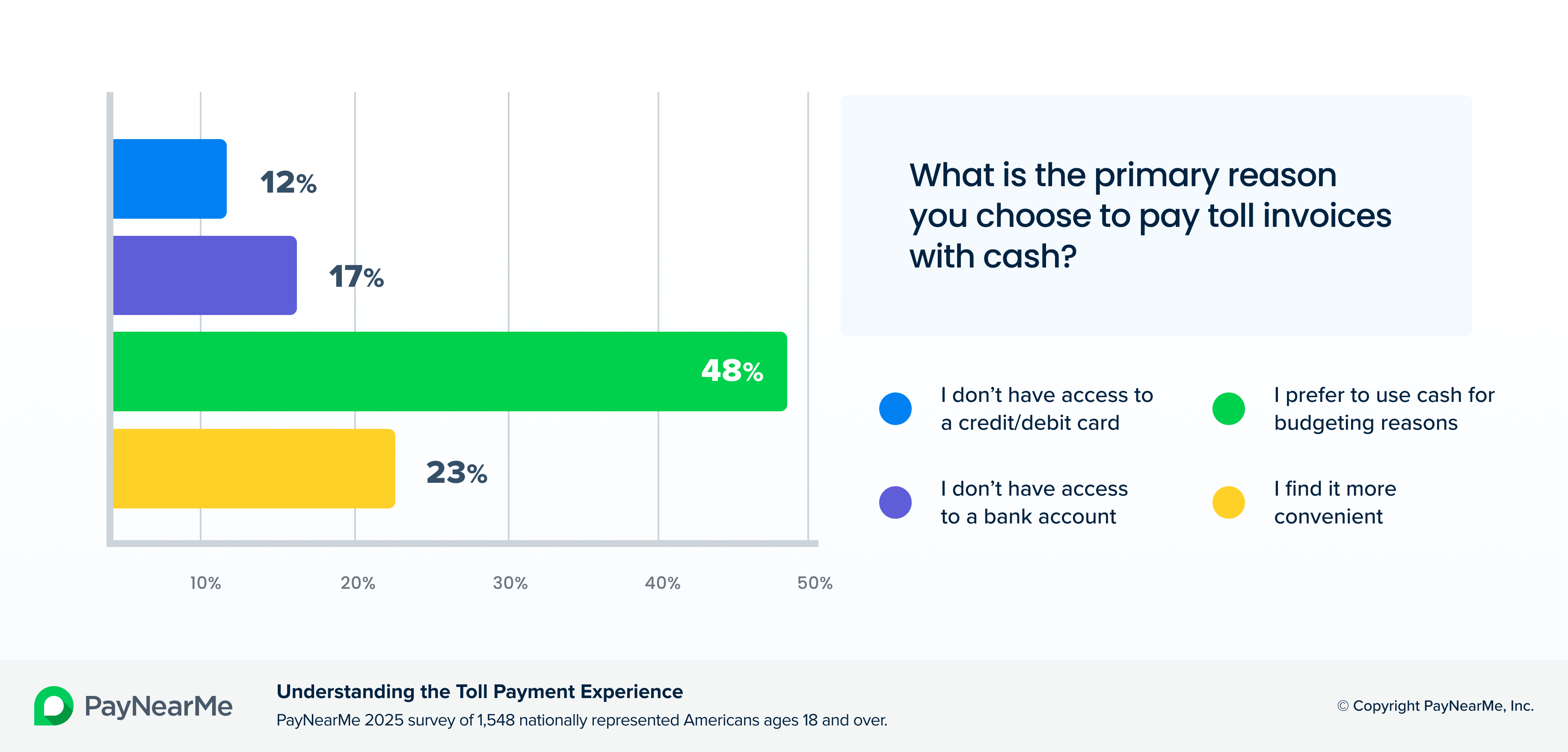

On the opposite side of the coin, agencies still need to engage with customers who may not have access to a mobile device or digital payment methods. So while modern engagement tools are important, agencies cannot forget the millions of drivers who prefer or need to pay with cash.

Cash alternatives and retail cash networks are critical for financial inclusion, and agencies should aim to expand access to cash payments. Through a payment platform with a retail cash network, customers can pay tolls at thousands of retail locations using barcodes or mobile devices with real-time settlement and confirmation. This improves compliance, reduces delinquencies, and supports equitable access for all drivers—without forcing agencies to maintain legacy walk-in centers.

A personalized approach to meeting every customer where they are dramatically increases payment completion rates. The payoff? Better engagement → fewer violators → higher voluntary payments → less enforcement cost.

The bottom line: 2026 is the year tolling agencies take payments modernization seriously

The tolling industry is undergoing a transformation—but to truly maximize revenue and efficiency, agencies must modernize their payment ecosystem, not just their roadside infrastructure.

The emerging trends all point to the same conclusion: A unified Payment Experience Management platform is no longer optional. Instead, it’s the foundation of modern tolling operations.

PayNearMe’s PayXMTM platform gives organizations the tools to design, control and continuously improve every part of the payment journey—so they can improve satisfaction, accelerate payments and reduce the total cost of acceptance.

For tolling agencies, PayXM replaces 5–8 disconnected systems with one modern platform that powers all payment methods, handles engagements, centralizes data and reporting and supports both pre- and post-pay tolling models.

With PayXM, agencies gain:

- Better payment completion rates

- Lower leakage

- Higher customer satisfaction

- Reduced operational burden

- Greater visibility and control across all channels

- A simpler, more scalable technology stack

2026 will be the year agencies finally replace fragmented payment workflows with an integrated, intelligent system that elevates both operational performance and customer experience while lowering the total cost of payment acceptance.