New Research Offers a Compelling Case for Real-Time Payment Information

In today’s hectic world, it’s common to forget to pay a bill—particularly if that bill gets buried in an email inbox or a pile of mail. Having the right information, at the right time, across the most convenient channels is more important than ever to keep consumers on track with their payments.

This all leads us to an insight learned from our most recent study on consumer bill pay preferences: Offering real-time access to payment information is no longer a luxury, but a requirement for today’s billers.

What the Data Says

Our April 2021 consumer research survey and resulting “How Consumers Pay Bills: Expectations vs. Reality” report showed that 28% of consumers either “agree” or “strongly agree” that bill pay causes them stress and anxiety, with 44% wishing the bill pay process was easier.

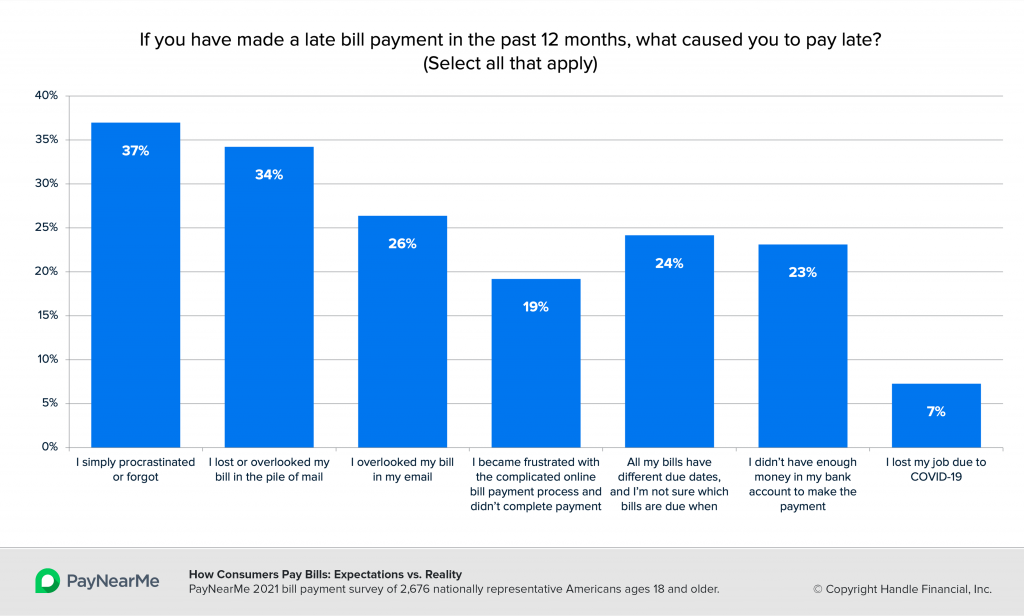

Unsurprisingly, the survey revealed that this stress causes many consumers to pay late. While you might expect “lack of funds” to be a top driver for missed due dates, the results show that keeping track of due dates and other forms of disorganization are more likely to be the cause of most late payment issues. Remembering logins and passwords was top of the list, with 51% of respondents finding this issue particularly challenging.

How Real-Time Information Helps Customers Stay Organized

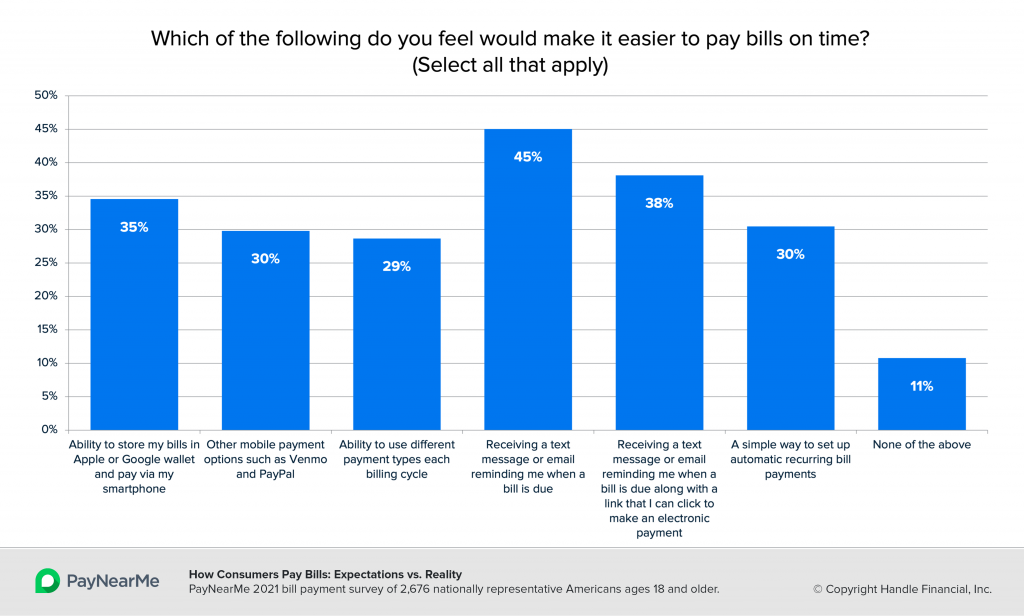

So, what can you do to help your customers stay more organized, improve their bill pay experience and increase on-time payments? The survey provides us some clues. The common theme? More information and more options, across more channels to meet their desire for instant access to bill pay data.

Consumers want options around where they get their billing information. When asked what would make the bill pay process easier, 45% of consumers said “receiving a text message/email reminding me when a bill is due” would help, while 35% said the “ability to store my bills in Apple/Google wallet and pay via [their] smartphone” would help. Finally, 78% of consumers said it would be “helpful” or “very helpful” if “to have access to [their] full bill when making or managing online payments.”

Digital Wallets as Living eBills & Other eBill Options

When organizations offer consumers the option to save their billing information to their Apple or Google digital wallet, they get the ability to access eBills and account details in near real-time. This “living” bill is more accurate and easily accessible than a physical bill, and billers can customize their wallet passes to show the most crucial data for their customers.

eBills can also be integrated into biller’s self-service payment portals to give customers access to all of the information they need, should they need it. While some consumers may be happy to log on and quickly pay a bill, others may have questions and need additional information. Providing a full bill option online can help reduce phone traffic to customer service agents.

Automated Reminders & Updates

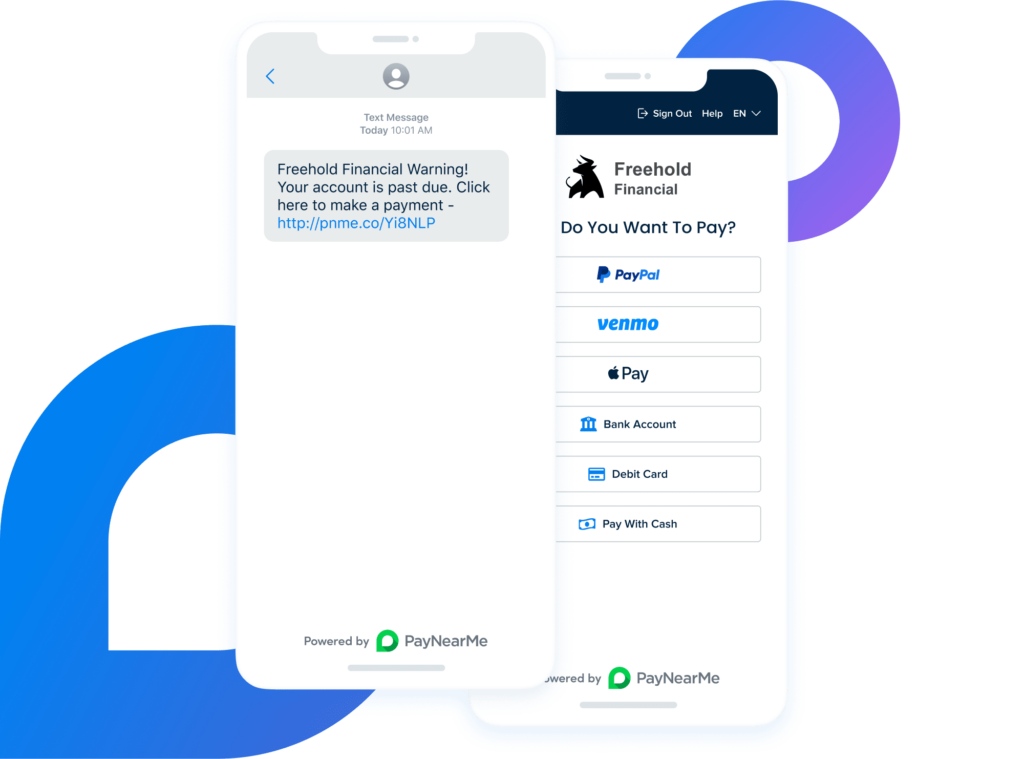

What’s easier than receiving a text message or email, clicking on a link, and going directly to your personalized payment page? That’s exactly what PayNearMe offers with our Smart Link™ technology, enabled through the automated PayNearMe Engagement Engine. This technology satisfies consumers’ wish to receive reminders (as noted in our survey results above) and gives them the tools to make a payment quickly, driving an easy, user-friendly bill pay process that reduces friction.

Compare this process to more traditional bill pay processes such as writing and mailing a check, speaking to an agent or consumers stopping by a biller’s location, and you’ll see the immediate benefits such a solution could bring, including increased customer satisfaction and reduced operating costs.

Keep it Simple, Simon (KISS)

The old middle school adage is still true today, and it goes without saying that easier bill pay processes mean more successful payments. Making it difficult for consumers to access the billing information they need and complete their payments, leads to stressed out customers and missed deadlines.

For more information on how you can satisfy consumer bill pay preferences, check out our PayNearMe research page. Take a look around now, and be sure to bookmark the page for more great research coming soon!