A Simple Guide to Challenging (and Winning) Chargeback Disputes

By Shemika Jones, Chief Compliance Officer / Chief Risk Officer

Chargebacks are a lot like termites; the best way to beat them is to avoid them altogether. But even the most proactive lenders will eventually need to challenge illegitimate chargeback disputes. Knowing how to handle each of these, whether frivolous or fraudulent, can make a big difference in your ability to accept card payments in the future.

But before we dig in, let’s review some chargeback basics for the uninitiated.

What Are Chargebacks?

A chargeback is a card payment reversal triggered by a consumer complaint; disputed payments are synonymously referred to as chargebacks. It is the consumer’s legal right to dispute any payment that they deem unauthorized. There are many legitimate reasons that a consumer may dispute a card charge in lending, such as:

- Duplicate charges

- Wrong amount keyed in

- Unauthorized payment

- Canceled recurring transaction

- Stolen card / fraud

- Unrecognizable payee description

While chargebacks are necessary to protect consumers against human error, technical mistakes, and downright bad actors, they also open the doors for “friendly fraud”. This euphemism refers to improper use of the dispute process in order to cancel a transaction (or in rare cases, are the result of outright consumer fraud.)

Processing chargeback activity comes with operation costs and in some cases, severe penalties for merchants. Your business must spend valuable internal resources to challenge disputes, and typically have to deal with additional processing and/or network fines that subtract even more from the bottom line.

Repeated chargebacks can result in rate hikes, tighter underwriting requirements or even a ban from accepting cards completely.

Tips to Win More Chargebacks

Card networks and financial institutions do their best to reduce friendly fraud, but they also tend to give the benefit of the doubt to consumers who initiate disputes. This means the burden of proof typically falls on the lender to fight an uphill battle when challenging disputes. Knowing what to expect, which information to gather and how to take action are all required to have a shot at consistently winning your challenges.

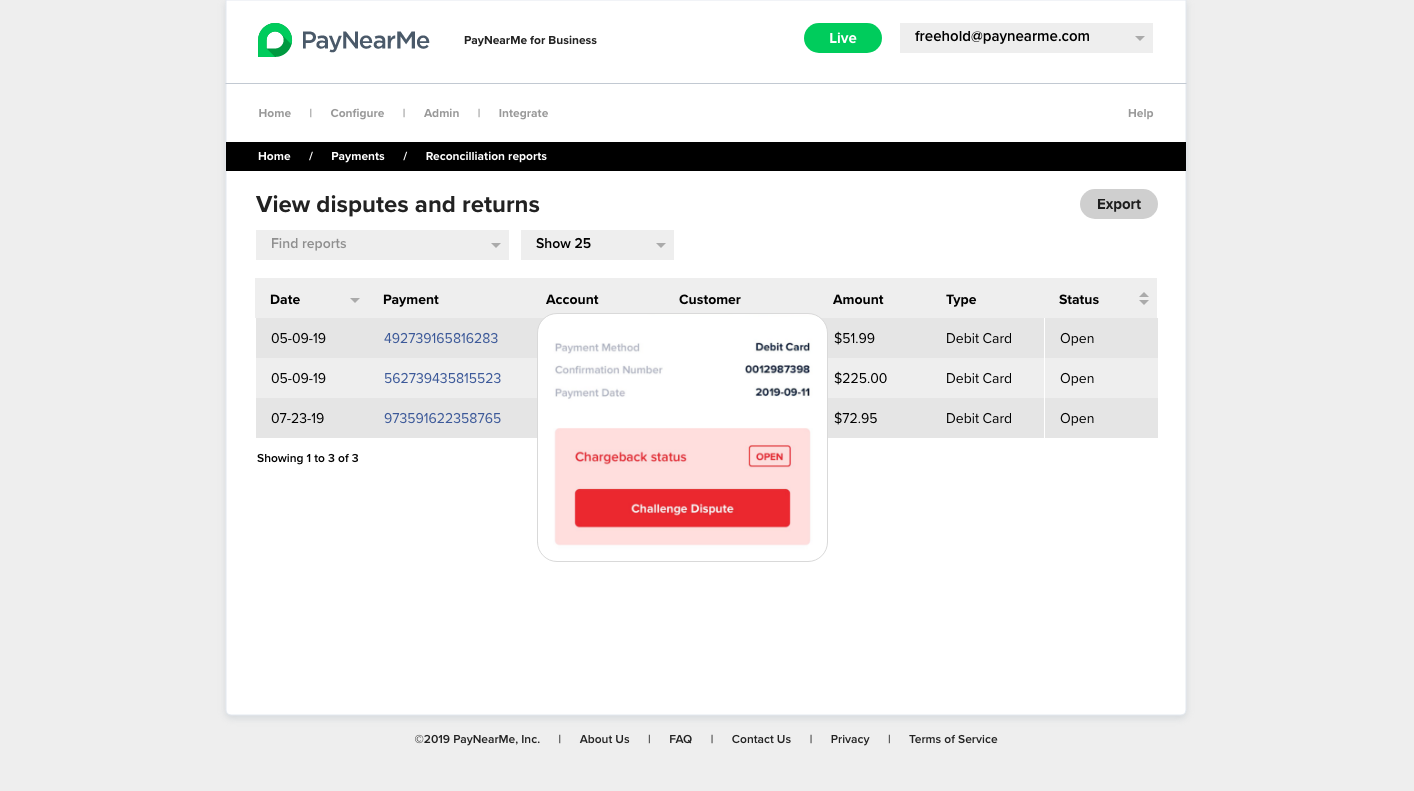

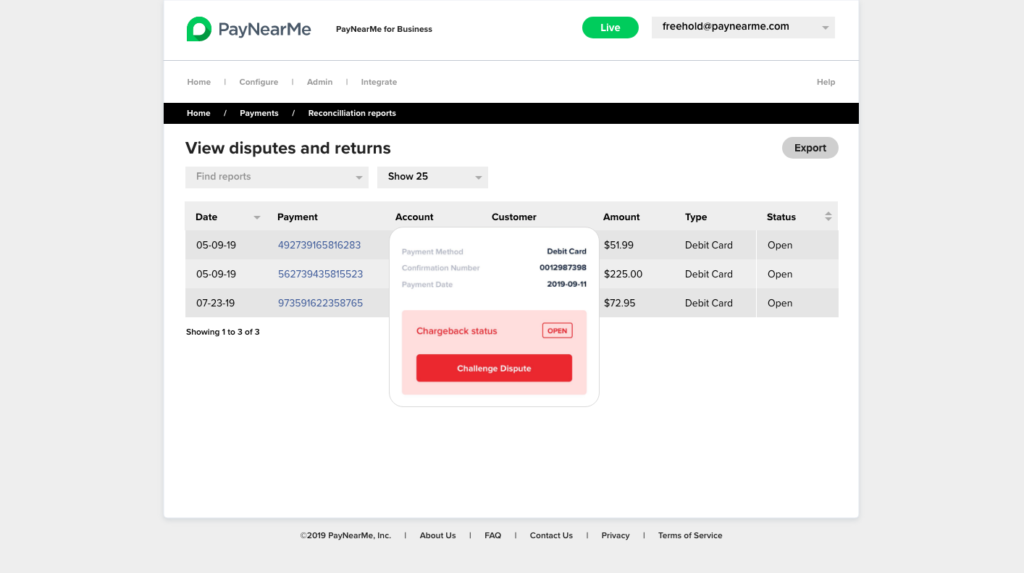

The following recommendations are pulled from our internal Dispute Rebuttal Guide, which we use to help PayNearMe customers challenge and win more chargeback cases.

Organization is Critical

As you’ll see below, the most important thing you can do to win a chargeback rebuttal is to collect and maintain the right information for every transaction you process. Without proper documentation, your chances of winning are slim to none in most cases.

Important information to collect in your database may include:

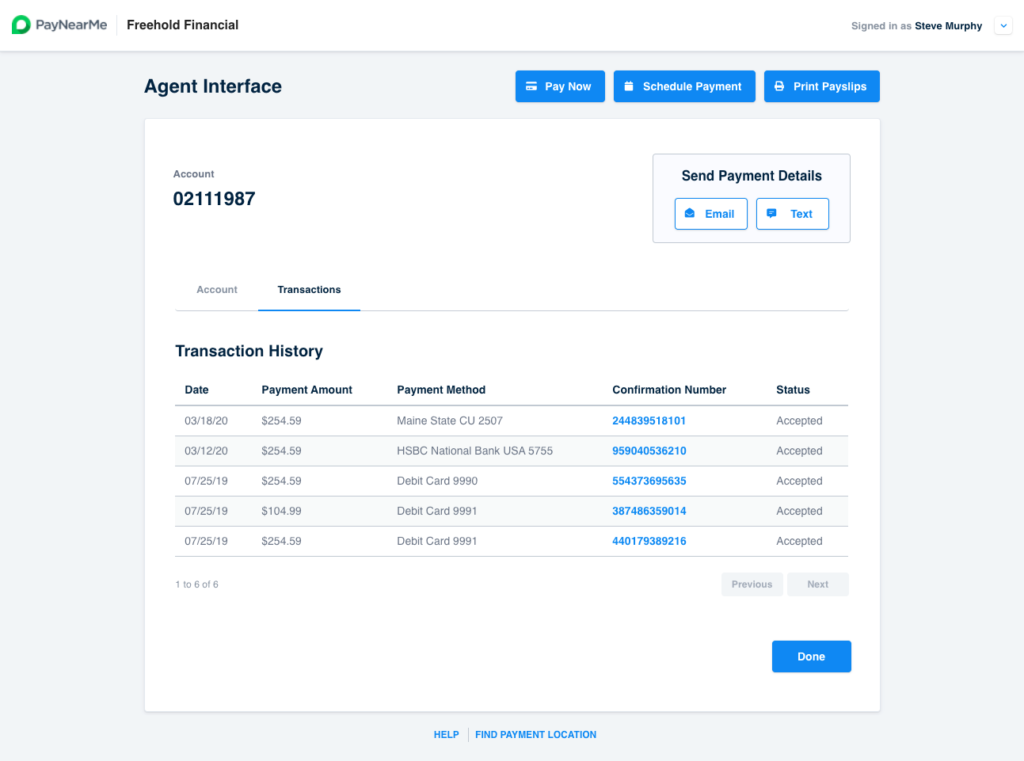

- Accurate consumer contact information

- Written communications with the consumer (i.e. emails, letters, chats, transcripts)

- Past transaction data and historical payment trends

- All loan documents with terms and conditions

Provide Ample Evidence

Because your business has much more to lose, you must go above and beyond to prove your case. Here is a list of items that can help you build your case.

- Evidence on how consumer was CIP (Consumer Identification Program)-verified

- Full consumer name, DOB, phone number, billing address, email address

- Evidence of loan documentation

- Copy of all parties on the loan and references listed.

- A relevant document or contract showing the consumer’s signature.

- Evidence of consumer communications

- Written communications are preferable but notations based on verbal conversations are also useful

- Any communication with the consumer that you feel is relevant to your case (e.g., emails proving that they received the product or service or communication with the consumer where the consumer admits the dispute was a mistake)

- Any receipt or message sent to the consumer notifying them of the charge (SMS, email, mailed letter, etc.)

- Evidence of disputed card transactions

- Has the card been used in your company before the dispute?

- Documentation of non-disputed transaction receipts with that same card number

- Card Present or No Card Present transaction.

- Was the card used in person at any brick-and-mortar locations before the dispute was made?

Build a Clear Case

In addition to providing evidence around the specific chargeback, you’ll want to make sure your submission is clear, concise and easy to understand. After all, this evidence needs to be reviewed by a human, and making that person’s job easier can only help your case.

Here are some of the guidelines we share with PayNearMe customers when finalizing submissions:

- Ensure all images and text documents are clear, in focus and easy to understand—blurry submissions are often grounds for losing a case

- Keep all evidence relevant to this particular case

- Include proof of consumer payment authorization(s)

- Include a copy of your terms of service

- If applicable, include a copy of your refund policy

Steering Clear of Future Chargebacks

We can’t reiterate this point enough: the best way to avoid chargeback penalties is to avoid chargebacks proactively. Keeping your consumers informed, staying organized, providing multiple customer service channels and establishing predictable payment patterns can help lenders steer clear of many chargebacks.

Talk to PayNearMe to see how we can provide you with the technology and operational knowledge to collect every payment, every time.