Nine Ways Loan Servicers Can Benefit from AI in the Payments Stack

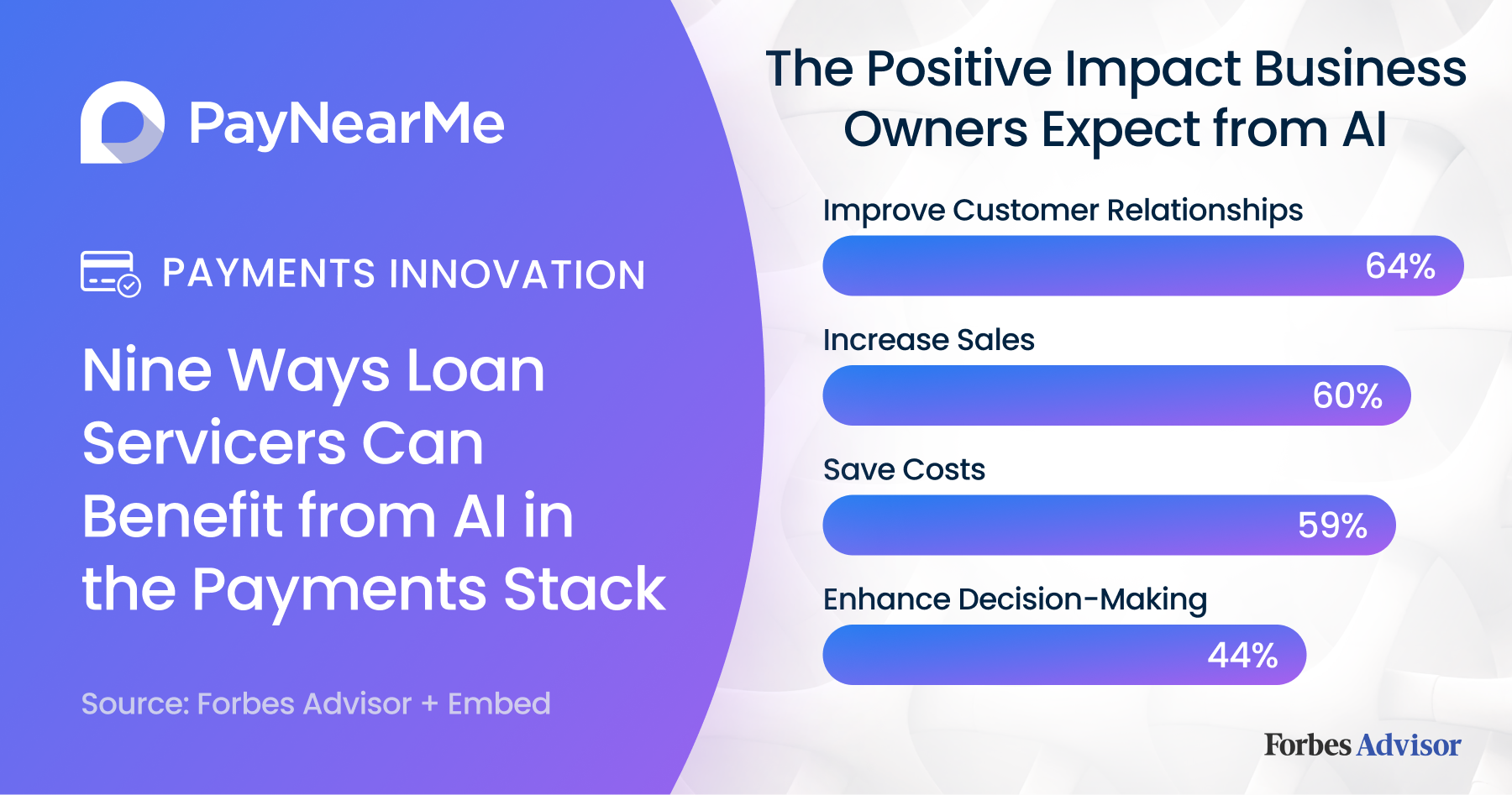

For companies that rely on payments as a lifeline, AI and ML has the potential to dramatically improve business outcomes and bottom-line profitability. 64% of companies expect AI to increase productivity and cost-efficiency, according to Forbes studies. Perhaps even more important in the consumer finance world is how AI/ML can improve acceptance rates, while reducing risk.

A key part of it is keeping pace with consumer expectations. 55% of Americans interact with AI at least once a day, often through AI-driven personalized experiences. Modern payment technologies that tap the power of AI/ML enable billers to make it easier and more flexible for customers to pay – and pay on time.

This begs the question: what kind of bill pay challenges can AI help solve?

PayNearMe is evaluating a wide range of scenarios where we believe AI and ML may provide significant benefits over manual or rule-based processes to solve pain points. Here we’ll highlight several use cases – which we detail further in our new POV white paper: How AI is Transforming Bill Payments.

Increase acceptance rates with flexible payment experiences

- Dynamically personalize payments. AI can be used to adapt a payment interface to a user’s behaviors and preferences to focus on what matters for each customer. For example, AI can dynamically reorder payment options to match a customer’s frequent choices to simplify the interaction and increase the likelihood of completing a payment.

- Customize one-click payments. AI should enable PayNearMe Smart Links™ to get even smarter. Currently, our platform can push a personalized Smart Link (via text or email) to customers for instant access to self-service payment options. We’re now testing enhancements, such as using AI to rapidly identify previously-used payment methods to customize the list of options, and dynamically show different information that’s most relevant to a given customer.

- Convert calls to self-service pay. Using an ML model, we might identify customers waiting in the call center queue, and auto-push a text message or email with a personalized Smart Link for bill pay. If that was the reason for their call, the customer could use the link to directly access a self-pay payment screen with a variety of payment options.

Increase efficiency with automation

- Adjust payment due dates. AI can automatically engage frequent late-payers before their due date, with options to make it easier to pay on-time. For example, move the due date to coincide with the customer’s payday, or offer the option to split payments within a month rather than pay one lump sum.

- Intelligent retries for autopay. AI/ML can improve on the standard process for retrying automatic payments at different times. Models can use a variety of inputs to determine the best time and frequency to retry for a particular customer to increase success rates.

- Automate collections activities. To reduce the cost and complexity of collections, AI can help choose the best methods for engaging a given customer, and automatically contact them before involving an agent. Using automation to cover basic tasks can free up staff to focus on more complex or urgent customer support needs.

Minimize default risk and fraud

- Predict and reduce delinquency. By tracking patterns of payment behavior over time, ML models can identify the best times and channels for engaging often-delinquent customers before due dates. A delinquency prediction dashboard can keep the organization informed and prepared to take pre-emptive action.

- Dynamically restrict payment options. AI can automate solutions that help protect against costly ACH returns and chargebacks. For instance, an ML model can identify when customers hit a set threshold (like 2 or more ACH returns in 6 months), and automatically change a related business compliance rule to require the person to pay with cash or card.

- Identify patterns that indicate potential fraud. AI/ML can analyze volumes of payments data to flag unusual events and possible threats, and alert the payments platform in real time to dynamically tighten security measures as needed.

Putting AI use cases in action

At PayNearMe, we’re taking an AI-centric approach to innovate personalized payment experiences for consumers, and empower our clients with cost-saving automation and data-driven decisions. To learn more about our approach, read about our AI and ML philosophy here.