Are We Ready to Say Goodbye to Cash (And Do We Need To)

The debate around cashless stores has reached a fever pitch in recent weeks, with state governments frantically drafting legislation to prohibit private businesses from banning cash payments in stores. No one knows how this will all shake out in the end, but it does beg an interesting question: Are we ready for a cashless society?

Cold Hard Facts

Contrary to mainstream media narratives and millennial musings, cash is far from dead. The average consumer uses cash for more than 35% of transactions, though the total value of those transactions amounts to only 15%. It’s not just Snickers bars and magazines that make up these transactions; more than 10% of bills are still paid with cash each month.

Add in the fact that more than 25% of the population is unbanked or underbanked, and one can safely assume that the use of cash is alive and well in the United States.

Despite all this, it’s clear that there are still significant issues with analog currency in a world that has gone digital.

The Case Against Cash

Retail stores and opponents of cash have good reason for making a ruckus. There are legitimate concerns about cash that can drastically affect how business is conducted.

Cash can be slow. We all know the feeling of getting stuck in line at the grocery store behind someone paying with exact change. Seconds feel like hours as your patience melts faster than the ice cream in your cart. Cash needs to be counted, verified and changed, which can take significantly more time than digital alternatives like cards and mobile payments.

Cash can’t be used for remote transactions. Unfortunately, cash can’t be stuffed through a computer or phone screen, making it difficult to use for transactions that don’t happen in person. (Though PayNearMe has invented a new delivery method for cash…more on that later.)

Cash is scarce. For larger transactions, cash is usually not an option due to its physical nature. Making large cash transactions requires planning, security and a wallet large enough to handle the paper. More importantly, carrying large sums of cash can be dangerous – for both the consumer and the merchant.

Elimination Is Not the Solution

Opponents of cash argue that the simplest solution is to eliminate it completely. But it doesn’t require an economics degree to know why this is a bad idea in many circumstances. Doing so would be like eradicating bees in order to picnic without fear of being stung; a seemingly effective solution that comes with horrible side effects.

The most prominent implication of excluding cash involves the potential for discrimination. Banning cash negatively affects unbanked and underbanked Americans more than any other group, and thus disproportionately affects them adversely

There’s also the question of privacy. Many consumers use cash to avoid discussing their purchase histories with others, including spouses. Also, some Americans don’t want their purchase histories tracked and stored in private business’ database. Major data breaches – not to mention privacy scandals in social media – have ushered in a new era of justifiable paranoia.

Rethinking Cash

Pretending that a simple solution exists that addresses all the issues discussed here would be naive, but there are options available to appease both sides of the cash debate. One such solution is tackling the distribution of cash payments.

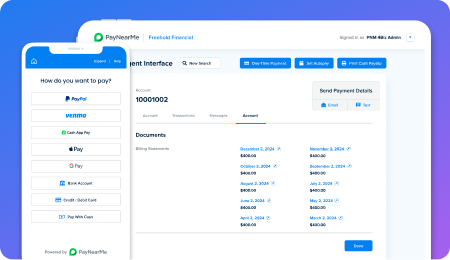

At PayNearMe, we’ve developed a novel way to digitize cash that enables businesses and government agencies to separate where it’s paid from whom it pays. Merchants send digital barcodes to customers via text or email which they use to complete cash transactions in real-time at retail locations in our network who welcome the foot traffic and know how to handle cash. Once the cash transaction is completed at the local retailer, the ultimate beneficiary (e.g. a lender, property manager, or government agency) is credited in real-time – solving for many of the challenges on both sides of the debate.

And because every payment matters, we enable consumers to pay electronically via card or ACH in addition to cash when their preferences or needs change.

While not the only solution, our technology can bridge the gap between analog and digital payments, helping to build a world that rethinks cash rather than rejecting it. We don’t need to say good-bye to cash, or allow electronic payment technologies that were designed to improve our lives drive a wedge between the banked and the un- or under-banked.