Avoid Payment Outages This Football Season

The close of summer means the commencement of several highly-anticipated seasons: 1. Back to school 2. Spooky and 3. Football.

With NFL season on the horizon, sportsbook operators are anticipating the return of high-volume weekends where outages are a looming concern. Besides the negative impact to an operator’s profits, their brand reputation takes a massive hit with many disgruntled bettors taking to social media to express their displeasure.

It’s no secret that some of the most recognizable names in sports betting have faced major outages during high-volume game days. So why are the biggest operators with the most resources regularly facing these problems?

The problem, and the (inefficient) current solution

Many operators work with a single merchant processor to handle their card transactions. Unfortunately, relying on a single processor makes operators more susceptible to unpredictable outages and performance issues. These outages may prevent bettors from making deposits during big sporting events—leading to poor player experiences, lost revenue and throttled support channels.

The economic and reputational damage of a single outage can be a devastating blow to operators who are trying to remain competitive in a crowded market.

Some operators try to mitigate the damage of a card processing outage by redirecting bettors back to the cashier and suggesting they try different tender types. This is frustrating, especially to a frequent bettor attempting to place a time-sensitive bet. Since many deposits are based on the progress of a live game, it’s not feasible for operators to follow up with bettors with failed card transactions.

In an attempt to avoid outages altogether, operators may source an additional merchant processor as a backup to their primary processor. While this sounds practical in theory, it typically increases costs, requires the use of critical development resources and complicates reconciliation and reporting.

A better way to boost uptime

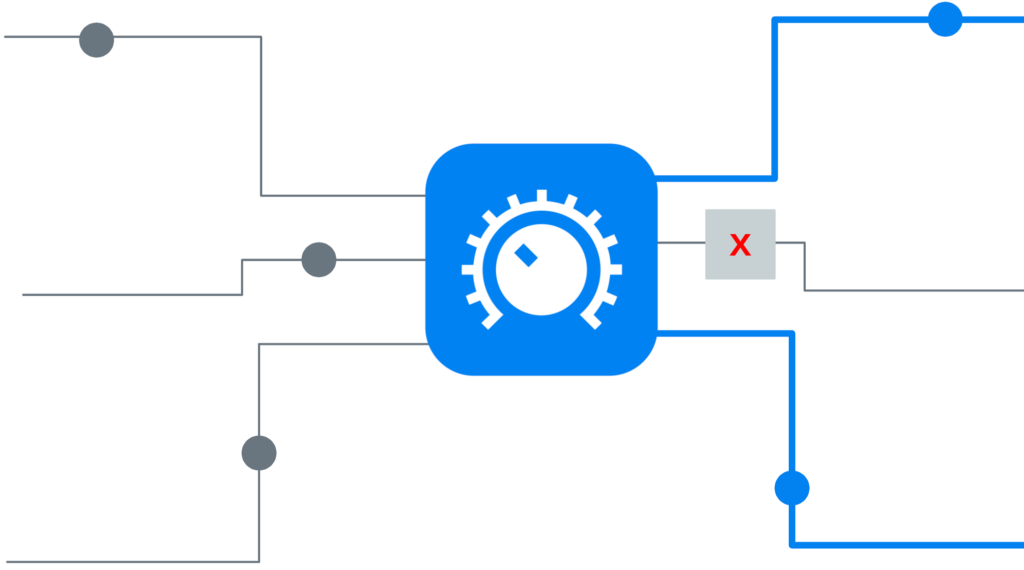

PayNearMe’s Smart Switch is a new, first-to-market technology that provides full card processing redundancy with a single integration and single contract for operators. It protects operators by minimizing the impact of a failed processor with multiple backup providers and seamless switching, ensuring higher acceptance rates and reducing the likelihood of failed payments.

Smart Switch Benefits:

- Reduce downtime: Reduce downtime from unpredictable outages and unplanned downtime.

- Zero effort: Data is collected in real-time ensuring transactions are routed through an active merchant processor – no manual intervention required.

- Extensible: Future-proof your payments and business with redundancy and scale your card transactions with confidence – especially during peak times.

- Seamless: There is no impact on your contract, settlement, or reconciliation reports when you failover to the backup processor.

Smart Switch protects revenue, lowers costs and preserves reputation by eliminating the risk of a single point of failure.

How Smart Switch works

PayNearMe clients are onboarded to multiple merchant processors through a single integration and a single contract. Our Smart Switch technology collects data in real time, and in the event of an outage, transactions are seamlessly routed to another downstream processor, minimizing failed transactions and maintaining uptime.

It all happens with zero effort for clients. Operators can scale confidently knowing that even in peak betting times, deposits and payouts can keep flowing, creating better player experiences and more profitable business outcomes.

The benefits of a payments partner with built-in redundancy

Besides ensuring uptime during high-volume betting events like football Sundays, there are a plethora of bigger-picture benefits that sports betting operators can gain from choosing a payments partner with redundant processing technology.

- Increased Operational Efficiency: It reduces disruptions and increases productivity, allowing operators to focus more on core activities.

- Cost Savings: Choosing trustworthy vendors saves money over time by avoiding expensive problems and mistakes, even if they’re not the cheapest option at first.

- Stronger Brand Reputation: Choosing a trustworthy partner makes businesses more dependable, boosting the company’s reputation and success.

- Strategic Partnership Development: Working with reliable and experienced vendors can open doors to new business opportunities and competitive advantages.

- Risk Mitigation: Trustworthy vendors have proven track records of adherence to industry standards and regulations, helping to safeguard the business against operational, financial, and reputational risks.

Trust PayNearMe to protect from costly outages

Redundancy isn’t a novel concept for operators and many choose to build it internally. However, some overlook the stability of a fragmented payment stack to reduce processing costs during their vendor research and selection process.

PayNearMe’s dependable end-to-end payments platform gives operators a complete deposit and payout solution—including cards, guaranteed ACH, PayPal, Venmo, Apple Pay and cash at retail—that maximizes your revenue by boosting player satisfaction, lowering conversion costs, improving reliability and future-proofing your business.

With built-in processing redundancy via our Smart Switch technology, embedded risk and fraud tools and payment data insights, PayNearMe goes beyond a basic payment gateway to lower the cost of business operations while increasing bettor retention.

To learn more, contact our team or request a platform demo.