Bridging the Generational Divide in Toll Payments: Why Modern, Flexible Payment Options Keep Drivers Happy

A new era of tolling behavior

Tolling agencies are facing a generational crossroads. With the rise of All Electronic Tolling (AET), agencies are faced with mounting revenue leakage problems due to unpaid toll invoices from unregistered drivers, or growing frustration over difficult payment portals from even those who are registered—with both of these issues stemming from payment experience problems. Today’s drivers expect timely communication, flexibility and convenience when it comes to invoicing and payments. And the rise of mobile apps, digital wallets and real-time notifications has transformed how people want to pay for everything, including tolls.

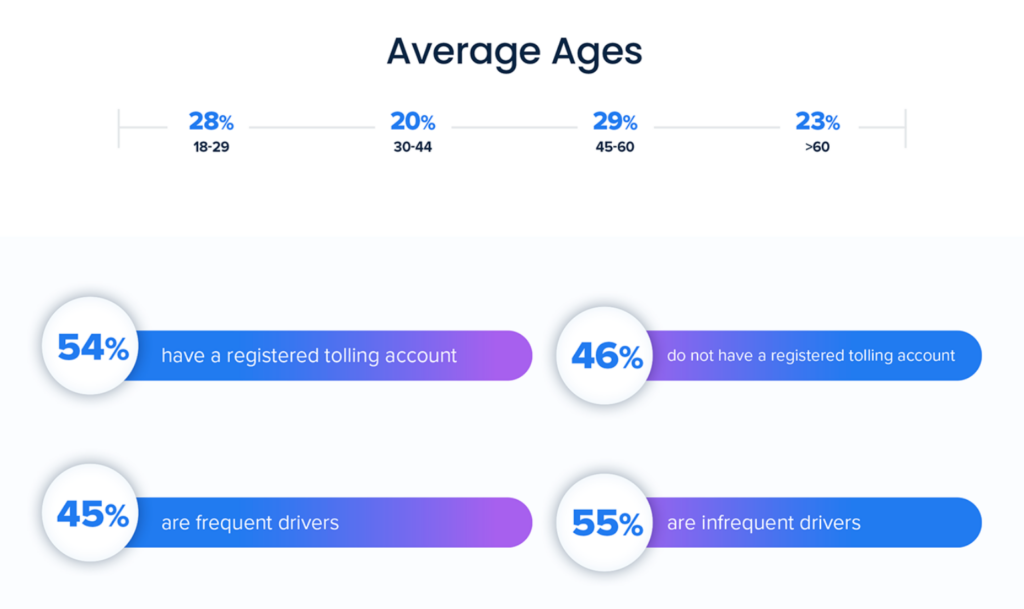

PayNearMe’s 2025 survey of U.S. drivers reveals a sharp generational divide in toll payment preferences. Younger drivers (Millennials and Gen Z) are mobile-first and expect instant, digital convenience. Older drivers (Gen X and Baby Boomers) remain comfortable with legacy systems and steady billing routines. Understanding this divide isn’t just an academic exercise. It’s the key to improving collections, reducing missed payments and increasing customer satisfaction across every age group.

The data behind the divide

The data tells a clear story. A majority of younger drivers (ages 18–29) already have toll accounts—around 57–60%—and an impressive 75% regularly use digital wallets such as Apple Pay, Google Pay or PayPal. This is the group most ready for a digital-first tolling experience.

Older Millennials and Gen X drivers (30–44) are close behind, with about 60% holding toll accounts and 60% using digital wallets. By contrast, the 45–60 bracket (mostly older Gen X) shows lower adoption, with only 44% using digital wallets. The biggest gap appears among Baby Boomers (60+), where just 26% use digital wallets and fewer than half have a tolling account.

The same split appears in how people interact with tolling agencies. Younger drivers receive more invoices, with nearly half having received a toll invoice in the past year, while older drivers (especially those 60+) rarely do. The takeaway? Younger, more mobile drivers are engaging with toll systems more frequently and expect those interactions to feel as modern as the rest of their digital lives.

The following chart looks at various tolling behavior and preferences while breaking down the population surveyed in the research project by age, income and frequency of toll usage.

| Demographic Group | Have a Toll Account (%) | Received Toll Invoice in Past Year (%) | Regularly Use Digital Wallet (%) |

| Age 18–29 (Gen Z / young Millennials) | 57–60% (majority have accounts) | ~42% | ~75% (high digital wallet use) |

| Age 30–44 (Older Millennials & Gen X) | ~59% (most have accounts) | ~46% (nearly half) | ~60% (prefer digital payments) |

| Age 45–60 (Gen X) | ~58% have accounts | ~46% (half have gotten invoices) | ~44% use digital wallets |

| Age 60+ (Boomers) | ~43% have accounts | ~20% (few receive invoices) | ~26% use digital wallets |

| Low Income (< $50k) | ~50% have accounts (est.) | ~45% received invoice (est.) | ~40% use digital wallets (lower banking access) |

| High Income ($100k+) | ~60%+ have accounts (est.) | ~30% received invoice (est.) | ~55% use digital wallets (higher tech adoption) |

| Frequent Toll Users (≥ monthly) | 87% have accounts | 36% received invoice (many use tags) | ~50% use digital wallets (for general payments) |

| Occasional Users (≤ yearly) | ~30% have accounts (most pay per trip) | ~50% received invoice (half rely on mail) | ~40% use digital wallets (many unbanked/older in this group) |

Younger drivers demand digital convenience

Millennials and Gen Z grew up managing their lives on screens. They order food, transfer money and book travel through apps—and they expect tolling to be just as seamless. Many even view tolling as outdated when it requires waiting for an invoice or logging into a clunky website.

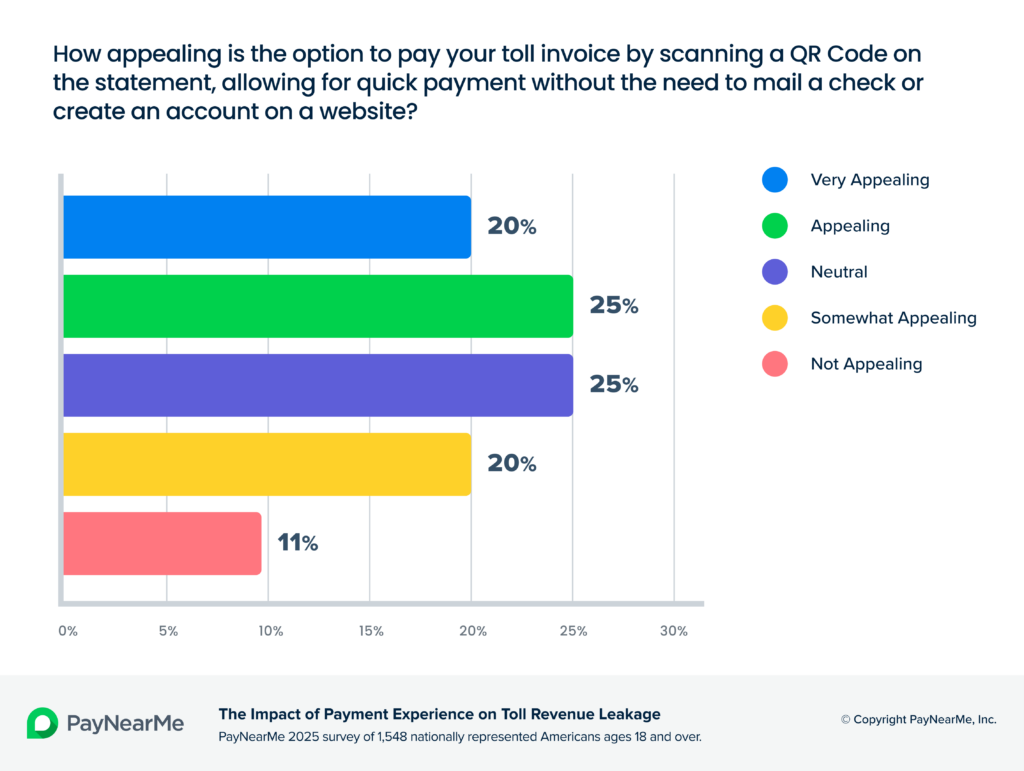

Nearly half (45%) of all drivers said they’d like to pay a toll invoice by scanning a QR code—and that figure skews heavily toward younger age groups. It’s a clear signal: when even a paper bill must offer a quick, app-like experience, digital expectations have become universal.

Communication preferences reinforce the point. A majority of drivers under 30 want toll notifications via text or email, not mail or phone. Only about 5% of them would ever want a call from a tolling agency. Boomers, meanwhile, still appreciate mailed notices and personal phone outreach—though even among them, email is now widely accepted.

For tolling agencies, this generational divide poses a challenge. If a system doesn’t accommodate in-app payments, digital wallets or real-time updates, younger drivers are more likely to delay or forget payments—or simply grow frustrated. In other sectors, 64% of Gen Z and Millennials say they’d switch providers if an app lacked digital payment options. Toll roads may be monopolies, but user frustration can still damage compliance and reputation.

The growing aversion to “snail mail” toll invoices

One of the biggest sources of friction for younger drivers is the mailed toll invoice. Over 30% of surveyed drivers cited “I don’t receive invoices in a timely manner” as a major pain point, with those under 44 making up the largest portion of survey participants selecting that option. The younger generations, who rarely check physical mail and frequently move for work or school, are especially likely to miss or misplace paper bills, leading to late payments. In fact, drivers under 30 were the most likely to report that they forgot to pay a toll invoice by the due date, triggering a violation.

This mismatch between traditional billing and modern lifestyles creates unnecessary tension. A driver who paid instantly through Apple Pay for a coffee last week doesn’t expect to wait three weeks for a toll invoice to arrive. Agencies that digitize this process by offering email or text alerts, online portals and one-tap mobile payments can eliminate the frustration and reduce collection costs at the same time.

Barriers to tolling account sign-up: A tale of two generations

Why do some drivers still not have tolling accounts or transponders? The answer depends heavily on age.

For younger drivers, the problem isn’t distrust, it’s inconvenience. Among 18–29-year-olds without accounts, 69% say they don’t use tolls enough to justify one, but a significant 21% cite the upfront cost or prepaid balance, and 19% say the sign-up process is too complicated. These drivers are used to instant, low-friction digital onboarding. Waiting for a transponder in the mail or funding a minimum balance feels archaic.

Older drivers, on the other hand, are more likely to say they simply don’t need an account (82% of non-account holders 60+). A small number express mild distrust of automatic deductions, but few find the system confusing. In short: younger drivers want modern simplicity while older drivers are satisfied with consistency, but could be swayed with better education.

Frequent vs. occasional drivers: Different needs, shared frustrations

Driving frequency also shapes expectations. Nearly 90% of frequent toll users—commuters, delivery drivers and regular travelers—already have accounts. But that doesn’t mean they’re fully satisfied. About 31% said they’re frustrated by the lack of alternative payment methods like PayPal or Apple Pay, and 43% reported difficulty using toll websites.

These drivers use toll systems frequently and notice every inefficiency. For them, smoother digital experiences translate directly into better compliance and fewer customer service calls.

Occasional toll users, meanwhile, tell a different story. Only about 30% have accounts, meaning most rely on mailed invoices or one-off online payments. This group skews older and lower-income, and many say they forget to pay or misunderstand due dates—a leading cause of violations. Simpler, mobile-friendly payment options could dramatically reduce these incidents.

Trust and transparency: The universal currency

Regardless of age or income, trust remains at the heart of the tolling relationship. But what “trust” means varies by generation.

Younger drivers trust digital systems but question institutional transparency. They want to see charges in real time and receive instant confirmation of payment. When they don’t, they fear being overcharged or penalized unfairly. Push notifications or app-based transaction histories can solve this instantly, improving both confidence and compliance.

Older drivers take the opposite view: they trust established systems but may not notice if something goes wrong. If an auto-replenishment fails due to an expired card, they often miss the warning signs and end up with violations. For them, proactive alerts and simple digital interfaces can provide reassurance and prevent costly surprises.

The path forward: One system, many options

The generational and behavioral differences among toll users aren’t obstacles, they’re opportunities. Agencies that meet drivers where they are, with a mix of traditional and modern payment methods, can increase on-time payments and customer satisfaction simultaneously.

A unified tolling payments platform that supports both transponder-based billing and digital wallets, QR codes and text-based notifications creates a seamless bridge between generations. Older drivers retain the familiar systems they trust, while younger drivers gain the speed and convenience they expect.

The data is clear: flexibility isn’t just a feature—it’s a revenue strategy. By embracing mobile payments, clear digital communication and transparent user experiences, tolling agencies can transform payment from a point of friction into a moment of trust.