Card Processing Fees Comparison: Interchange Plus vs. Tiered vs. Fixed Pricing

One of the most important decisions to make when choosing a payments partner is understanding the different card processing fees. Understanding which pricing models are available and comparing how they’ll affect your rates can make a big difference in your bottom line, especially if you’re dealing with slim margins.

And while many models exist, most payment processors will offer three popular choices: interchange plus, fixed rate and tiered fees. Let’s dive into all three and see which is the best fit for your business.

Why Are Card Processing Fees So Complex?

Before we dig into the differences between card processing fee models, let’s take a look at what they have in common.

All card-based payments are subject to interchange fees. These are the combined fees charged by card networks and banks to run your debit and credit transactions. Interchange fees are driven by several factors, which include:

- Card type (credit or debit)

- Issuing banks

- Category (standard, rewards, business, etc.)

- Network (Visa, MasterCard, etc.)

- Transaction size

- Transaction method (swiped or keyed)

- Type of payment (debt repayment, utility payment, etc.)

Start combining these variables in different ways, and you’ll quickly observe that there can be hundreds of different interchange rates. And considering that rates can change several times each year (including their qualification requirements and categories), it’s easy to see how even the most seasoned finance teams can struggle with deciphering merchant statements.

On top of the interchange rates, you’ll also need to pay your processor. After all, they provide the bulk of the services that allow you to actually accept payments like the user interface, payment channels and a connection to the payment networks. All of these inputs can make card processing fees difficult to fully understand.

Now that we’ve uncovered the root of the complexity, we can return to comparing card processing fees.

Tiered Pricing

The tiered pricing model has existed nearly as long as the card processing industry, and is still the most popular fee option offered by legacy providers. With tiered pricing, your transactions are broken into distinct categories and assigned a predetermined rate for each.

- Qualified

- Mid-Qualified

- Non-Qualified

At first glance, tiered pricing seems like a fairly straightforward model. There are only three buckets! This should make it easy to understand your pricing for different transactions…right?

Not all that glitters is gold

The main issue with tiered pricing is the lack of standardization and transparency across vendors. Each processor has the ability to choose their own tiers and how much they charge per tier. That means that the true cost of your payments is much more convoluted than in other models. A mid-qualified transaction under one processor may fall under non-qualified for another, and there’s no real way to know without asking.

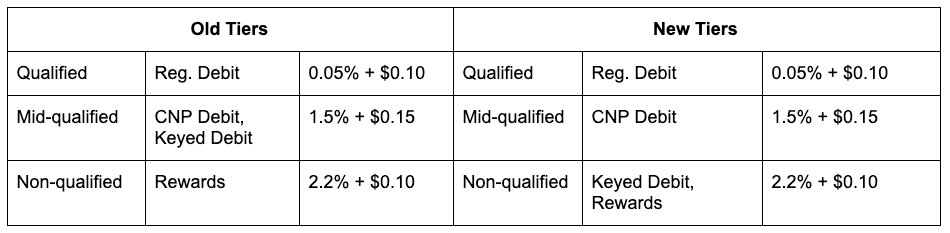

Another common practice by some payments providers is to modify which transactions fall under each tier. Let’s visualize this with a hypothetical change from Processor XYZ:

Technically, the processor can claim that their tiered rates have stayed exactly the same, which is true. But what they don’t mention is that the Keyed Debit transactions have moved from Mid-Qualified to Non-Qualified, driving up your effective rate across all transactions.

When should you choose tiered pricing?

There aren’t many advantages to the tiered model, aside from “I already have it and negotiating a new contract is not on the menu”. Both fixed pricing and interchange plus pricing offer more advantages than tiered, and often at a better effective rate.

Editor’s Notes: To be fair to tiered pricing, this model does work admirably for many companies, and has for many years. Participating in a tiered pricing model is far from Defcon 1, but you should at least compare how your pricing stacks up against the other two models. There are worse pricing models out there too, we just won’t dig into them in this article.

Fixed / Flat Fee Pricing

Fixed rate, or flat fee pricing is the easiest model to understand. You simply pay one rate for all your transactions and call it a day. This usually consists of a percentage, a flat fee, or a combination of both. For example, your processor may charge $0.15 + 2.7%, regardless of what the interchange rate is for each particular transaction.

This pricing model has become increasingly popular as a way to simplify processing, reporting and margin analysis. It protects merchants from fluctuations in interchange rates, and provides a safety net for merchants who are experiencing a shifting payment mix over time (i.e., regulated debit transactions shifting to unregulated.)

When should you get fixed fee pricing?

In many cases, you can find an effective fixed pricing rate that beats both tiered and interchange plus, depending on your payment mix and the number of transactions you process each month. Fixed pricing helps eliminate the guesswork around margins, since you tend to pay one rate regardless of card type.

Fixed pricing is also a model that aligns your best interests with your processors. Unlike with interchange plus, processors are incentivized to offer you least-cost routing and other programs that help keep costs low (and their margins slightly higher).

If you prefer a stable and easy-to-understand pricing model, fixed is likely your best option.

Interchange Plus

Remember earlier when we talked about the hundreds of pricing scenarios for interchange transactions? Interchange plus was developed in response to this, giving merchants transparency (or at least the perception of it) into the cost of each payment. With interchange plus fees, each transaction is subject to the interchange rate plus a fixed rate for the processor (for example, Interchange + 40 basis points.)

In some situations, interchange plus yields the lowest effective processing rate, assuming all other incentives are in place (i.e. least-cost routing, special network programs, etc.) This is advantageous if you process a lot of regulated payments, since the interchange fees for these transactions are capped at a much lower rate than their unregulated counterparts. When choosing this model, it pays to have an intimate knowledge of your customer base, transaction mix and payment trends over time.

Though an attractive model due to its pass-through nature, interchange plus is not free of faults. For one, your processor will make the same amount of margin no matter how your transactions get routed—meaning you may not be getting the best deal on which interchange fees you’re charged. It pays to talk to your payments provider about adding least-cost routing and specialty pricing (i.e. Visa’s Debt Repayment program) to control unexpected costs.

When should you choose interchange plus pricing?

Interchange plus has picked up a lot of steam lately online, and should be considered by businesses who want transparency into the cost of every single payment. It’s a great option for businesses that keep a keen eye on finances and margins, and know which special programs they qualify for.

If you do choose an interchange plus pricing model, be sure to understand if there are any other fees added by your processor to make up for the smaller fixed fee they are getting on each transaction.

Choosing the Right Card Processing Fee Model

There is no obvious answer for which pricing model to choose. None of these options will be the perfect fit for every business, and there are many other factors that may influence your final effective rate for processing. The first step is to understand what your current payment mix looks like by analyzing your statements.

Get started by performing an in-depth merchant statement analysis, either in-house or with free assistance from one of our financial analysts. We’ll help you understand your card processing fees, share valuable insights into your payment mix, and uncover customer trends over time.

Back

Back

Back

Back