Common Payment Fraud in iGaming (and How to Prevent It)

Fraud is a constantly escalating challenge for businesses and consumers, as cybercrime tactics grow more sophisticated and aggressive. Operators are increasingly vulnerable, with iGaming now targeted as the top industry with the highest rate of suspected digital fraud.

What are the primary threats operators need to be tracking – and how can they more effectively combat fraud?

It can be helpful to have a deeper understanding of how common fraud types work, the severity of the impact – and new strategies to help operators protect both their business and legit players. So let’s unpack it.

The most common digital fraud types

Card-not-present fraud

Scammers see card-not-present (CNP) fraud as the “path of least resistance.” Debit card fraud is one of the fastest growing cybercrimes, rising 122% between 2019 and 2022, and card fraud is expected to make up 73% of payment fraud in 2024.

And the problem is only expected to get worse. By 2025, merchant losses from online payment fraud are expected to exceed $206 billion. As Forbes notes, that is “almost 10 times the net income Amazon generated in 2020.”

Fraudsters use a variety of tactics for CNP fraud, for example:

Identity theft

Stolen credit and debit cards may be used to make payments, such as initially funding an iGaming betting account or topping off an existing account. It’s the most prevalent type of fraud affecting younger gamers, with 67% having had their identity hacked.

When legitimate cardholders discover the fraud, they usually report it to their bank to freeze the card and dispute the charges. As soon as the card number is frozen, the fraudulent bettor can’t use it anymore, but it might be too late to stop bets that may already have been covered with the stolen debit or credit balance.

Friendly fraud chargebacks

Also known as ‘first-party fraud’, this type of scam happens more often than operators may realize. While friendly fraud chargebacks are more common in retail, they have grown popular in iGaming for players to claim charges were unauthorized after they lose bets. Or a significant other or family member might not know that person is gambling and dispute charges as suspected fraud.

83% of friendly fraudsters are repeat offenders – 9 times more likely to do it again.

chargebacks911.com

17% of consumers who filed chargebacks were friendly fraud. While that may not sound too severe, consider that large businesses identified that up to 44% of chargebacks were actually fraud. And the problem is not one-and-done. 83% of friendly fraudsters are repeat offenders; once they get away with it, people are 9 times more likely to do it again.

Card testing

Scammers make small digital transactions to test whether the details of a stolen credit or debit card are usable. Once validated, they use it to make larger transactions, or they might sell the card details to other bad actors. It’s especially critical to detect card testing early on before it leads to a more risky attack, such as placing very large bets and collecting payouts before the fraud is identified.

Intensifying the problem is that card testing is often automated with bots, making it harder to detect. The bots test stolen card data while simulating random behaviors typical of players on an iGaming or sports betting site. As a result, even smart security systems can struggle with distinguishing between legitimate bettors and malicious attacks.

Account takeovers

Another type of identity theft, account takeovers (ATOs) are when fraudsters hack into accounts using stolen credentials – a cyber threat that is increasingly targeting iGaming. According to a TransUnion report, U.S. mobile sportsbook users are more than twice as likely to be an ATO victim than non-bettors. And those who deposited $500 or more monthly were three times more likely to become a target for fraud.

Operators also need to watch for potentially fraudulent withdrawals as an ATO tactic. When players make deposits to fund their betting, they typically use that same payment method to cash out winnings. Suppose a legit bettor has $1000 stored, and a fraudster takes over their account. The bad actor might add a small deposit using their own new payment source, and then use that same source to withdraw their deposited amount plus the stored $1000. And once the money is gone, it can rarely be recovered.

Beyond potential financial losses to players, account takeovers can severely damage an operator’s player retention and brand reputation. 76% of consumers said they would abandon a brand due to an account takeover, and nearly three-quarters (73%) of people believe the brand is accountable for ATO attacks. Protecting player privacy and confidential account credentials are table stakes, and ATOs are a breach of trust that players will not tolerate.

Money laundering

An age-old tactic used by bad actors to hide the source of illegal funds, money laundering has now grown very sophisticated in digital payments fraud. Criminals may use laundered money to fund iGaming or sports betting accounts and place bets, and then collect payouts in legitimate money from operators.

Most online businesses are now required to comply with anti-money laundering (AML) regulations, but that does not mean an operator is fully equipped to stop it from happening. For example, a fraudster might use a legitimate ID and bank account number to set up an account, so it clears the onboarding verification processes. But then they use a laundered money source to fund that account.

They might also employ a technique called ‘layering’ to increase the distance between themselves and the illegal source of the laundered money, making it harder to detect. And once players cash out with ‘clean’ money paid by the operator, it reenters the economy (or might be reinvested legitimately in betting), so the original crime is no longer detectable.

Powering fraud prevention with AI

As cyber threats keep evolving, it’s essential for operators to stay a step ahead – and AI and machine learning (ML) are making it easier. AI/ML can amplify the speed, efficiency and nuances of fraud detection to better protect the business, while lowering costs and risk. For example:

- Reduce fraud at scale – Operators can set rules and thresholds for deposits and withdrawals, which can help deter fraudsters, and enable the business to spot suspicious behavior faster. For operators entering a new market with no historical player data, this approach can make a significant difference.

- Flag suspicious events faster – AI/ML can analyze large sets of payments data to detect issues significantly faster than employees can do manually. It enables operators to identify risks faster and tighten rules to stop larger scale fraud schemes before they can gain momentum.

- Identify threatsbefore they happen – ML models can track patterns of payment behavior over time to identify players who may be involved in organized fraud schemes, or who may be most likely to commit ‘friendly fraud’ chargebacks or be a repeat offender.

Strengthening fraud prevention is critical to running a profitable iGaming business, and AI/ML empowers operators with fast, flexible strategies that can keep evolving.

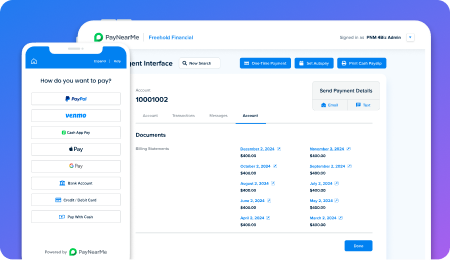

With PayNearMe’s MoneyLine™ payments platform, online sports betting and iGaming operators get the best of both worlds. Along with a powerful and scalable deposit and withdrawal solution for players, MoneyLine helps operators prevent fraud and losses with innovative services, including machine learning and our technology partnership with Accertify.

Accertify intensively verifies player identities and helps identify suspicious activity, giving operators a more comprehensive and effective way to detect and prevent fraud – and more confidently scale.

“Accertify protects many of the largest brands in the world. Our machine learning, device intelligence and user behavior analytics are designed to prevent fraud and abuse while helping to maintain and grow iGaming and sports betting operators’ relationships with their players.”

Mark Michelon, President, Accertify

Prevent fraud and drive profitability

MoneyLine simplifies money movement with a fast, flexible payment experience to boost player satisfaction, while safeguarding the business with sophisticated risk and fraud prevention capabilities.

Learn more about MoneyLine today – view an on-demand demo or schedule a call with one of our experts.