Case Study: How First Texas Auto Credit Drove a 275% Increase in Autopay with a Better Payment Experience

First Texas Auto Credit is a Texas-based independent auto finance company dedicated to helping borrowers rebuild credit and achieve long-term financial stability.

The culture behind First Texas Auto Credit

At First Texas Auto Credit, helping customers isn’t just a business model, it’s a mission. With a lean team, President Kevin Lawson credits the company’s continued success to its strong internal culture.

“We’re built on trust, consistency and doing the right thing, every time,” said Lawson. “That’s why we’ve had no turnover, maintained a 4.7-star rating and were named one of the best places to work by ACA for multiple years running.”

From weekly team book clubs to being recognized by the Better Business Bureau as a finalist for the Torch Awards for Ethics, First Texas lives its values. And those values come through in how they treat their customers: as partners on a path to better credit and greater financial opportunity.

“We’re not trying to turn every customer into a repeat buyer. Our goal is to help them graduate, improve their credit and get into something better.”

The need for a better payment experience

Before switching to PayNearMe, First Texas Auto Credit worked with a provider that couldn’t keep up with the demands of their business or customers.

“The tools we needed just didn’t exist with our previous provider,” said Lawson. “A lot of our customers wanted to pay, but many weren’t local and didn’t have an easy way to do that.”

The lack of flexible digital payment options created unnecessary friction. Customers with limited banking access often struggled to pay on time, and those needing certified funds for repossessed vehicles faced delays that strained both customer relationships and internal workflows.

“It wasn’t about cost,” Lawson explained. “It was about the experience. Customers wanted more options, and our team needed a platform that delivered on what it promised.”

Elevating the payment experience with PayXM™

By implementing PayNearMe’s PayXM™ platform for Payment Experience Management, First Texas transformed how payments are handled, for both customers and employees.

Embedding Smart Link™ technology into Emotiv’s text templates, the team now sends one-click payment links that make it easy for customers to pay how, when and where they want.

“PayNearMe has made it easier for our team to do their jobs, and for our customers to stay on track with their payments,” said Lawson. “It aligns perfectly with our values of trust, accessibility and doing right by the people we serve.”

First Texas Auto Credit customers now have access to a full range of modern payment options, including the most popular options their customers choose, debit cards, Apple Pay and even cash at participating retail stores.

“Just a few months ago, we had a customer in the middle of a repossession, but with PayNearMe, they were able to make a cash payment at 7-Eleven and drive off in their car that same day.”

By offering a payment method that met the customer where they were, First Texas not only helped that individual keep their vehicle, but also saved the organization the cost and complexity of a repossession — and avoided the kind of negative experience that could have damaged the customer relationship and First Texas Auto Credit’s reputation.

Real results: Efficiency, engagement and elevated experience

Since implementing PayXM™, First Texas Auto Credit has seen measurable improvements across key metrics, proof that better payment experiences drive real business outcomes.

- Autopay enrollment grew from 4.8% to 18% in just 9 months, a 275% increase, nearing their goal of 20%.

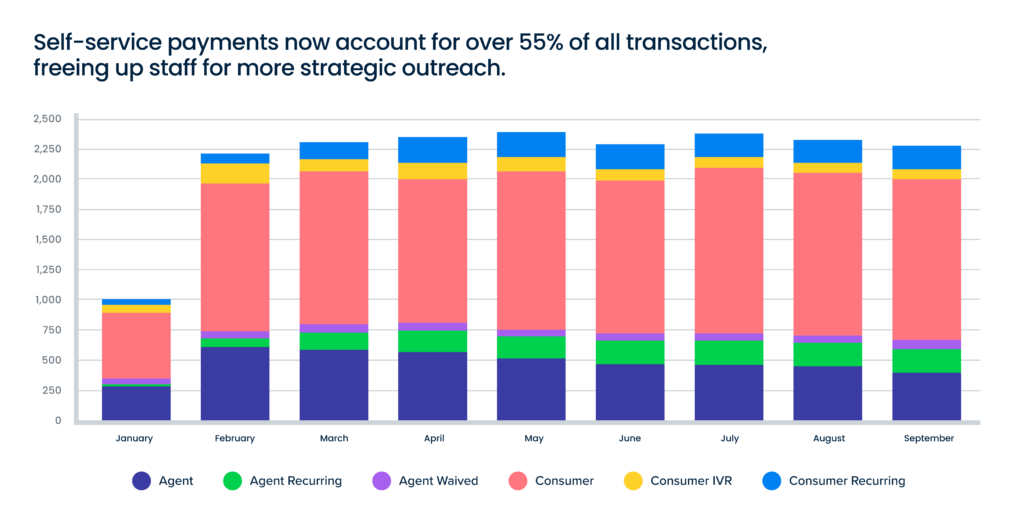

- Self-service payments now account for over 55% of all transactions, freeing up staff for more strategic outreach.

- Agent-assisted payments have steadily declined, reducing manual workflows and increasing team productivity.

- Apple Pay now represents 17% of digital payments, giving customers more flexibility to pay on their terms.

“Our goal was to remove friction and make payments easier,” said Lawson. “PayNearMe has helped us do exactly that.”