Case Study: How an Installment Lender Reduces Agent Workload by Over 20 Hours Monthly with PayNearMe

A leading installment lender with over 100 branches across 3 states recognized the urgent need to modernize its payment infrastructure. Faced with rising call volumes, inefficiencies in handling payments traditionally, and increasing ACH fraud, the lender sought a comprehensive solution to streamline operations, improve fraud prevention, and enhance customer experience.

By partnering with PayNearMe, the lender implemented a modern payment stack that introduced diverse payment methods, self-service options, and a secure, API-driven platform—leading to greater operational efficiency, reduced fraud, and a more seamless customer experience.

The Challenge: Outdated Payment Systems and Operational Bottlenecks

Customer Expectations Outpacing Capabilities

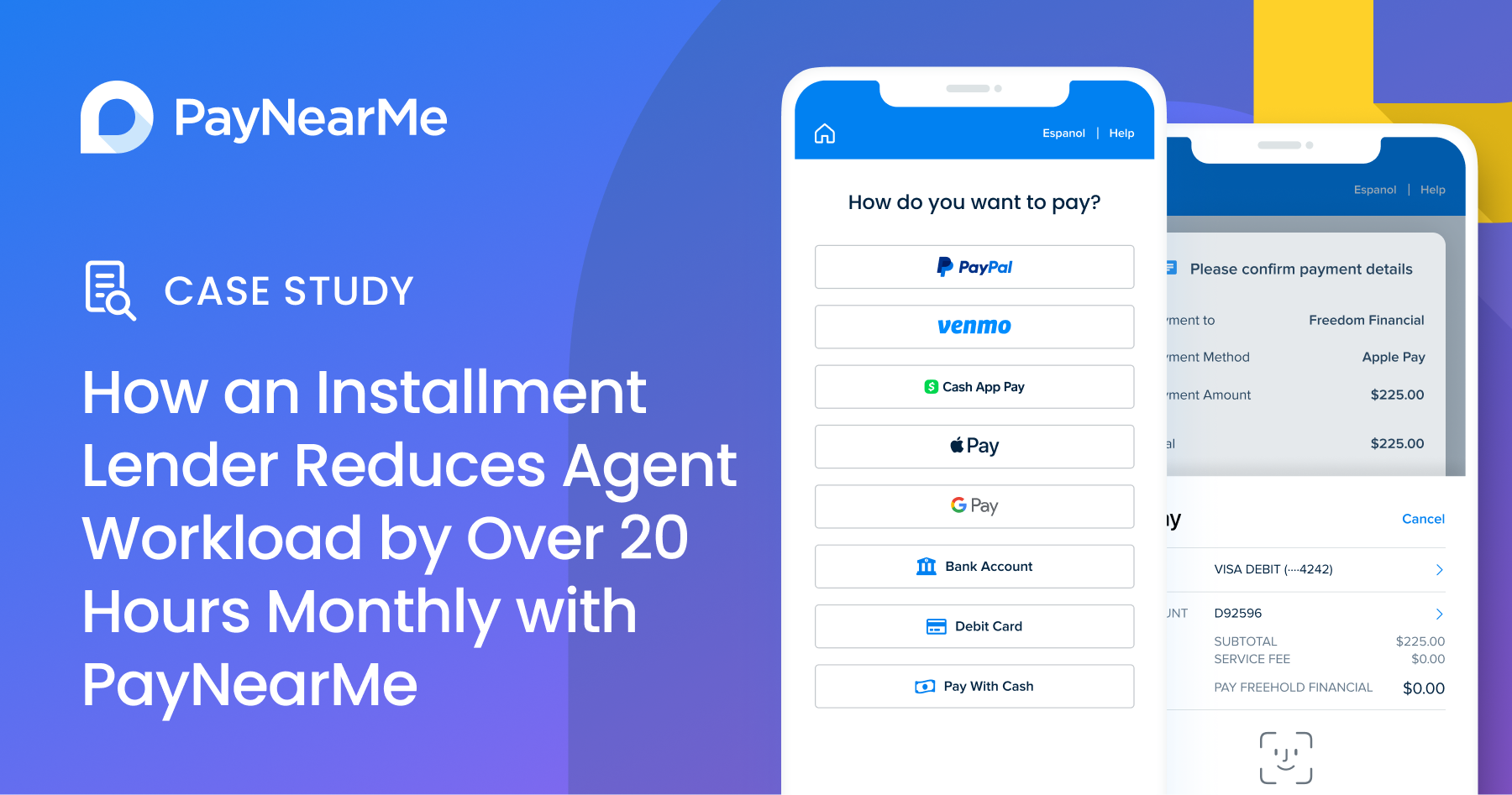

The lender realized that consumer payment preferences were changing, with younger demographics favoring digital wallets such as PayPal, Venmo, Apple Pay, and Google Pay. However, their existing system did not support these payment options, leading to customer dissatisfaction and increased call center interactions for payment processing.

Additionally, ACH transactions were discontinued due to high fraud rates. Without the ability to block bad actors, the lender faced repeated fraudulent transactions, creating financial losses and operational headaches.

Overcoming Efficiency Gaps and Security Risks

The lack of automation and reliance on call-in and in-person payments put a strain on both customers and employees. With customers frequently calling in to make payments, call center agents were overwhelmed, increasing costs and diverting resources from other critical areas.

Furthermore, the lender relied on cash and check payments, which required manual tracking and in-store processing. This not only created operational overhead but also introduced risks associated with handling and reconciling cash payments.

Technology Disruptions Breaking Trust

The lender’s previous vendor was challenged by API disruptions and frequent downtimes due to unannounced system changes, making them unreliable. Payment reconciliation was time-consuming and complex, requiring extensive manual work. Additionally, the multi-layered nature of debit card processing made it difficult to track errors and reversals, leading to customer frustration and internal inefficiencies.

The Solution: A Modern, Automated, and Secure Payment Infrastructure

To address these challenges, the lender partnered with PayNearMe, implementing a comprehensive payment solution designed to support diverse payment methods, improve security, and enhance self-service adoption.

Empowering Customers with Self-Service & Automation

PayNearMe introduced a broad range of payment options, including:

- Digital wallets: PayPal, Venmo, Apple Pay, and Google Pay

- Debit card payments with a streamlined process for error tracking

- ACH payments with enhanced fraud prevention measures

- Retail cash payment locations through a national network

With these additions, the lender reduced its reliance on their staff to take payments over the phone, giving customers the ability to make payments anytime, anywhere, through their preferred channels.

Additionally, PayNearMe’s Smart Link™ technology provided a frictionless self-service experience. Customers could receive a personalized payment link via text, email, or QR code, allowing them to complete payments without needing to enter a username and password— reducing the number of steps required to complete a payment.

Enhancing Frontline Staff Productivity

To ease operational burdens, PayNearMe introduced an agent interface equipped with Single Sign-On (SSO), enabling employees to process payments efficiently through a unified system.

Additionally, by offering a cash payment solution through a retail network (including CVS, 7-Eleven, and Walmart), customers who previously had to visit physical locations could now make payments at retail locations closer to their homes and beyond normal business hours if needed. This shift eliminated the need for manual cash handling at the branches, allowing staff to focus on higher-value tasks.

Building a Stable and Integrated Payment Stack

PayNearMe’s robust API integration ensured seamless connectivity with the lender’s proprietary loan management system, eliminating the downtime and disruptions caused by their previous vendor.

The new unified payment platform provided real-time reporting and reconciliation, simplifying accounting processes. Additionally, the automated reconciliation system matched payment files accurately, reducing manual work and errors.

By consolidating all payment types into a single platform, the lender streamlined reporting and eliminated reconciliation bottlenecks—a significant improvement over their previous fragmented system.

The Results: A More Efficient, Secure, and Customer-Friendly Payment System

After implementing the PayNearMe platform, the lender experienced measurable improvements across multiple areas.

The implementation of self-service payment options led to a significant reduction in call center volume, with a 17.2% decrease in the first 30 days. This shift not only improved efficiency but also saved an average of 20 hours per branch each month in agent time.

A wider range of payment methods increased customer satisfaction and adoption rates as the lender saw that 22% of payments were completed through self-service channels. Operational costs decreased, as manual cash handling and payment reconciliation were reduced.

Enhanced fraud prevention controls allowed the lender to securely reintroduce ACH payments. This provided confidence in accepting ACH transactions while ensuring a safe and reliable payment experience.

Meanwhile, PayNearMe’s real-time reconciliation and API reliability ensured integrity and maximized uptime.

With the combination of self-service Smart Links, digital wallets, fraud prevention tools, and API-driven automation, the lender successfully modernized its payment infrastructure, driving greater efficiency, security, and customer satisfaction.

Looking Ahead: A Future of Continued Innovation

Building on this success, the lender is now exploring additional ways to optimize recurring payments and autopay adoption, further reducing delinquencies and enhancing customer convenience.

By leveraging PayNearMe’s scalable payment technology, the lender is well-positioned to meet evolving consumer demands while maximizing operational efficiency.

Want to achieve similar results? Learn how PayNearMe’s modern payment platform can transform your payment operations. Schedule a demo today!