Debunking Mobile Wallet Myths: Empowering Lenders to Elevate the Borrower Experience

The new reality in payments is mobile wallets. But why are so many lenders still clinging to outdated payment options that frustrate borrowers and minimize efficiency? Some common misconceptions around usage, security and costs may be keeping lenders from adopting wallets as payment options. But that resistance is also keeping them from gaining critical advantages.

Accepting mobile wallets for bill payment helps improve on-time payments, increase customer satisfaction and lower the overall cost of payment acceptance. Those are compelling wins lending executives should focus on to drive change, so we’re going to debunk some myths about mobile wallets to help lenders better understand the value and opportunity.

TIP: Dive deeper into this topic; check out our webinar on this topic on-demand here.

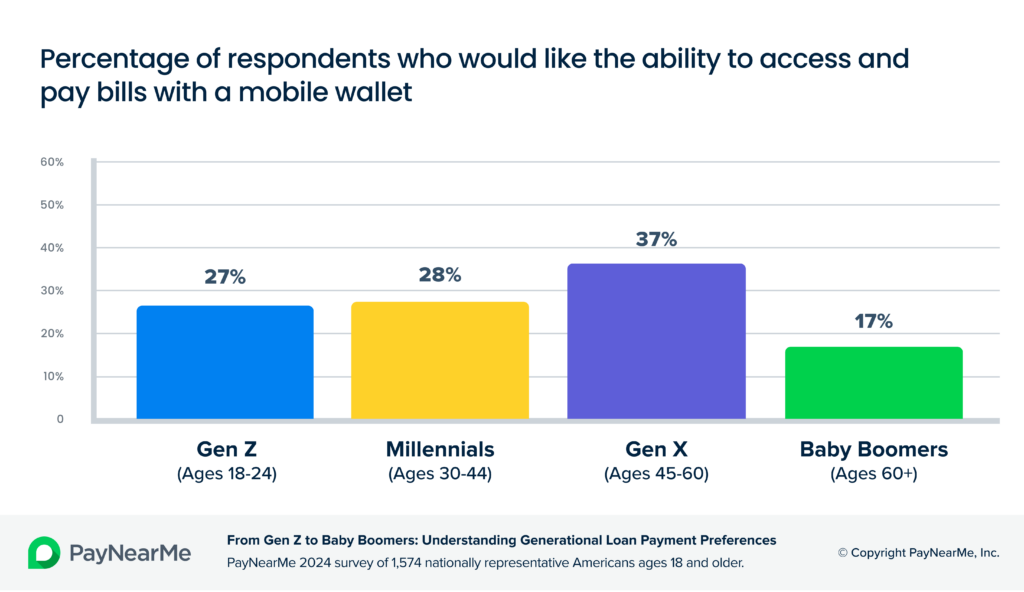

Myth #1: Mobile wallets are only popular with younger generations

FACT: Mobile wallets transcend age barriers.

You may be dismissing the need to accept digital wallet payments thinking that only Gen-Z (ages 18-29) use them, which might represent only a small percentage of your customers. This perception likely comes from the visible tech habits of younger people and how they’re often the focus of marketing campaigns for new technologies.

But that myth does not hold true. Mobile wallets are a product of the digital age, but they are not used exclusively by digital natives like Gen-Z and millennials. PayNearMe’s research into payment trends across generations found that consumers in all age groups have an increasing preference for digital wallets.

For example, Gen-X consumers (ages 45-60), who typically carry the highest levels of debt, also have the highest stress around paying bills. No surprise there. But their anxiety is not necessarily due to cash flow issues but frustration over payment processes that don’t fit their lifestyle. Specifically, this age group prefers using digital wallets such as PayPal or Apple Pay to pay their loans. Yet many lenders support only ACH and debit card payments.

Myth #2: Mobile wallets are only used in e-commerce transactions

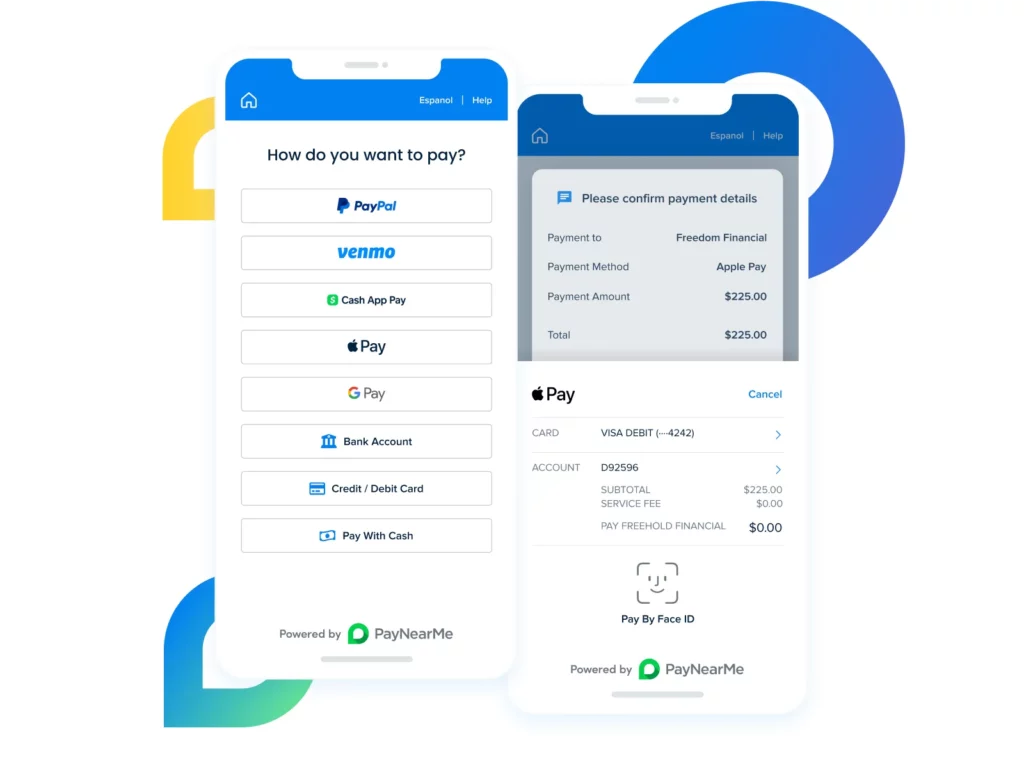

FACT: Mobile wallets can be seamlessly embedded into the bill pay experience.

Mobile wallet adoption has soared as e-commerce and peer-to-peer (P2P) payments have evolved. You may think this isn’t relevant to you, but it’s precisely where you should be paying more attention. Industry leaders like Amazon and Uber have set a new standard for making payments seamlessly easy and flexible, and that has transformed consumer behaviors and expectations.

Lenders who deliver frictionless payment experiences with mobile wallets will attract more loyal, satisfied borrowers. These days, consumers want that same frictionless experience for paying bills. Nearly 60% of consumers we surveyed said they would be very likely or likely to pay their loans with digital wallets. PayPal emerged as the favorite, with 55% of people considering it important to have as a payment option.

It’s been surprising how many people actually use PayPal, Venmo, Google Pay and Apple Pay. We’re seeing a constant upward trend in the forms of payment our customers are using.

Samantha Klein, Operations Manager, Heritage Acceptance Corporation

Clearly, the traditional approach of one-size-fits-all for bill pay no longer works. But one of the primary roadblocks for many lenders is a rigid legacy bill payment system that has not (or cannot) integrate all the major wallet apps consumers are accustomed to using in their daily lives. And updating the system often results in a patchwork of third-party payment platforms that is complicated and costly to manage.

A powerful way to avoid the pitfalls and speed time to market is to partner with a technology partner that provides a single platform that integrates a full range of payment types. With the right platform, you can configure payment options to meet the needs of your business model and payment flows.

Offering more flexible options—including mobile wallets—enables customers to more easily pay on time (one-time or recurring autopay), and the payments settle to the same reconciliation report as traditional payment methods.

Worried about “debt on debt” payments with digital wallets? Consumers often house credit cards in their wallet apps, and those forms of payment can’t be used for paying a loan. With an optimized, modern platform, the wallets can be tightly configured to prevent this scenario, while also pulling in MCC codes and other pertinent data to ensure accurate mapping and reporting for each transaction.

Myth #3: Mobile wallets are not secure

FACT: Mobile wallets have advanced, built-in security features.

Another reason lenders may resist adopting mobile wallet payments is concern that the apps are not secure. Actually, it’s quite the opposite. Leading digital wallet apps have some of the most advanced security protections built in.

Robust features like biometric authentication and tokenization help prevent fraud. For example, when someone keeps cards and stored balances in a mobile wallet, there’s little or no chance of identity theft via the app because only that person’s face can unlock their phone and authenticate transactions.

From a security perspective, the ‘stored value’ approach of leading wallet apps also helps improve authentication rates. Beyond storing cards, wallets like PayPal, Venmo, Apple Pay and Cash App Pay allow users to retain a cash balance. When people use that cash to pay a bill, you can rest assured that it’s ‘good funds’ (like cash) and successfully process the payment. In fact, in our recent webinar, an expert from PayPal noted that their wallet was increasing authorization rates nearly 6% globally.

Myth #4: Mobile wallets are difficult to implement

FACT: It depends, and can be easier than you think.

It’s not surprising that lenders worry that mobile wallets are difficult to implement, especially if they’ve seen the complexities of integrating other new features into their existing outdated systems. Trying to implement third-party wallets into an outdated infrastructure is hard. It will likely require a lot of developer resources and long timelines. And what about the added compliance requirements to meet security and privacy standards? For a busy leader with many plates in the air, it may seem like too much risk and cost to take on.

But the problem is, this hesitation could mean you get left behind by not meeting new market demands. Tackling the challenge in-house may not be feasible, but that’s not the only path forward. Many lenders, just like you, are accelerating progress by partnering with a fintech that is focused on future-proofing their payments roadmap.

The right technology partner can provide a modern platform fully integrated with many payment types including all the major mobile wallets. They also have the expertise to do the heavy lifting of managing payment flows, security, compliance and back-end requirements. You could simply hook in once with one contract and one integration to start reaping the benefits.

Myth #5: Mobile wallets are more costly than traditional options

FACT: Transaction fees are only one part of the overall cost of payment acceptance.

The last myth we’ll tackle is one of the most common misconceptions: accepting wallet payments will drive up costs. It’s simply not true, and here’s why. Typically, when lenders think about keeping costs down, they focus on pushing customers to use ACH, which may have the lowest per transaction fee. But offering only limited options (especially in older systems that are not user-friendly) may be costing more than they realize.

Why? The cost of payment acceptance is much more than the base transaction fee. Think about exceptions such as returns, chargebacks, late and non payments. There are many hard costs associated with resolving those issues that increase the total cost of collections. Savvy lenders know that limiting options like ACH is a short-sighted strategy—embracing mobile wallets unlocks a future of seamless payments and profitability.

Now consider what happens if your cost-reduction strategy is simply to get everyone on recurring ACH. It may seem like you’re collecting at the lowest cost, but payment behaviors have shifted toward mobile wallets, so relying only on ACH will start pushing up the rate of exceptions—and overall costs along with it.

This can happen for multiple reasons. People who prefer to pay with wallets may resist the friction of dealing with other options and delay or skip payments. Or maybe they keep more money stored in a mobile wallet than their bank account (or use a wallet in lieu of a bank), so ACH returns become more likely.

The net effect is that accepting mobile wallets is now an essential part of lowering the total cost of payment acceptance. With the right bill payment platform, you can offer all the major digital wallets (PayPal, Venmo, Apple Pay, Google Pay, Cash App Pay) to meet modern expectations and preferences, and lower costs by reducing exceptions and manual intervention.

Start reducing costs with a mobile wallet strategy

Accepting mobile wallet payments is no longer daunting and risky. With clearer understanding to dispel the myths and the right technology partner, lenders have everything needed to start capitalizing on the advantages.

PayNearMe is the ideal partner, with an optimized modern payments platform and expertise to help lenders simplify implementation for faster time to market, and keep pace with changes over time.

Ready to learn more? Explore the PayNearMe payments platform with our interactive virtual demo or contact us to request a personalized demo.