Four Reasons Digital Wallets are Better Than Building Your Own App

With over 81% of Americans owning a smartphone, there’s no question that your business needs to adopt mobile bill pay. How you go mobile, however, is a topic of endless debate.

Mobile Web or Native App?

Many believe that mobile web offers the most benefits for both consumers and businesses, offering lower development costs, cross-platform compatibility and less friction (i.e. no downloads or updates.) We tend to agree and have made sure the PayNearMe platform embraces all the benefits that mobile web apps have to offer.

Even with all the benefits of mobile web, you can’t ignore the perks that native apps can bring to the table. They live on the consumer’s mobile home screen, offering constant brand recognition and access to important information even when offline.

However, there’s another option that can help businesses capture the benefits of native apps without going all in.

What is a Digital Wallet?

A digital wallet (also known as an e-wallet) is a mobile application that lets users securely store payment information, card numbers, billing info and other sensitive information securely on their devices. Digital wallets are not only easy to use but are also more secure than traditional physical wallets.

Popular wallets include Apple Pay and Google Pay, included by default with iOS and Android devices, respectively.

How Do Digital Wallets Work?

Unlike the conventional wallets, digital wallets don’t store currencies in a single physical location. Instead, they use secure technology such as tokenization, biometric authentication and encryption to safely store payment information.

Digital wallets can be used in-store at special payment terminals (think tap and pay), or in card-not-present situations online. Because the wallet adds an extra layer of security, consumers don’t have to worry about their sensitive payment information being transmitted online.

Digital wallets have come a long way since their mainstream introduction in the past five years. In addition to holding payment information, they can securely store statements, barcodes, account numbers, payment history and more.

Why are Digital Wallets Better Than Building Your Own App?

Shifting back to our original point, there are several ways that digital wallets can offer all the perks of mobile apps. Apart from simplifying the payment process and giving your customers access to a potentially wide range of convenient payment options, digital wallets add features and functionality that can put your brand in the pockets of your customers without hefty development costs.

1. No Downloads Required

Quite possibly the biggest downside of a mobile app is the initial friction of finding, downloading and setting up the app. Consumers don’t want to download dozens of apps that they only use a handful of times each month.

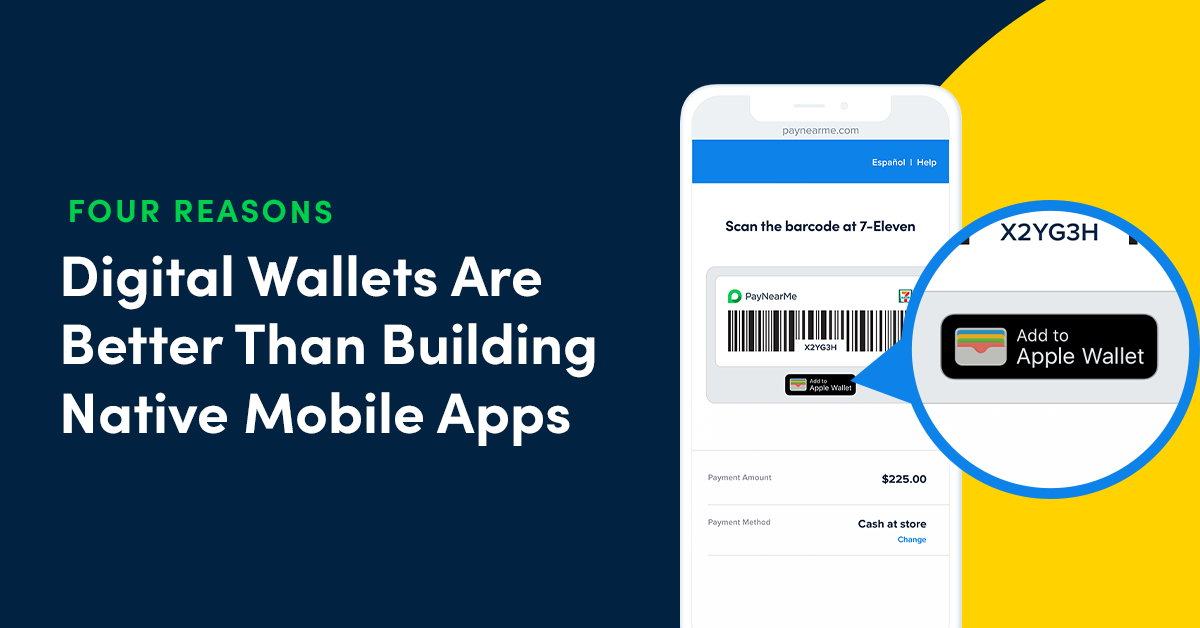

In contrast, most smartphone owners already have access to built-in digital wallets such as Apple Pay or Google Pay. The only step your customers will have to take to add your business is clicking the “Add to Wallet” button on your electronic bills.

Digital wallets then make payments easy, allowing customers to pay you with cards or bank accounts already securely added to their phones. What’s more, these wallets are completely free making it a more appealing solution to consumers.

2. No Maintenance Required

Consumers crave simplicity when it comes to payments, and businesses are no different. Using existing platforms like Apple Pay or Google Pay offers your business a low-cost point of entry into your customers’ mobile devices because of the already-existing infrastructure.

Because the wallet provider is handling security, feature development, app reliability and device compatibility, your business only needs to provide a simple data feed to keep your wallet presence up to date. For PayNearMe users this information is already in into the platform, making it virtually maintenance free for your business.

Besides, they eliminate other costs that the business would have incurred such as producing receipts, physical retail cards, and other printed communications as all of this is now generated from the applications automatically.

3. Integrates Natively with Consumers’ Phones

Another pain point of native apps is compatibility. You need to make sure your app works on different devices, operating systems and versions.

Built-in wallets (mostly) eliminate this issue, since they are developed by the phone manufactures or operating system providers.

4. Enhanced Customer Engagement

A major selling point for native mobile applications is their ability to store data offline and integrate with the device’s built-in notification system. While some web apps allow you to enable notifications, the technology is still new and isn’t nearly as accepted as system notifications.

Digital wallets solve for this by tapping into the phone’s native notification system, allowing your business to send push notifications in addition to text messages or emails.

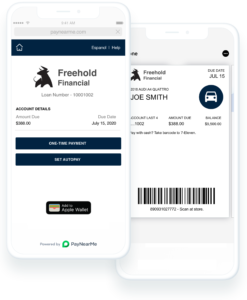

Offline functionality allows your customers to see past payments, due dates and other information stored in your wallet card without having to load a web page.

And adding links to your web app that allow customers to make payments, schedule autopay or retrieve PDF statements are all simple additions that can bolster the experience.

Make Customer Payments Faster and Safer with Digital Wallets

Digital wallets are easily accessible and offer businesses a way to grow without incurring a lot of capital costs. All in all, ensure you get a reputable and experienced digital wallet technology partner who’s a good fit for your business and can adapt and grow with you into the future.

Talk to PayNearMe to see how we can help your business leverage digital wallets today.