The Disadvantages of Accepting Money Orders

Once favored for their security and convenience, the disadvantages of money orders have surpassed the perks for modern businesses.

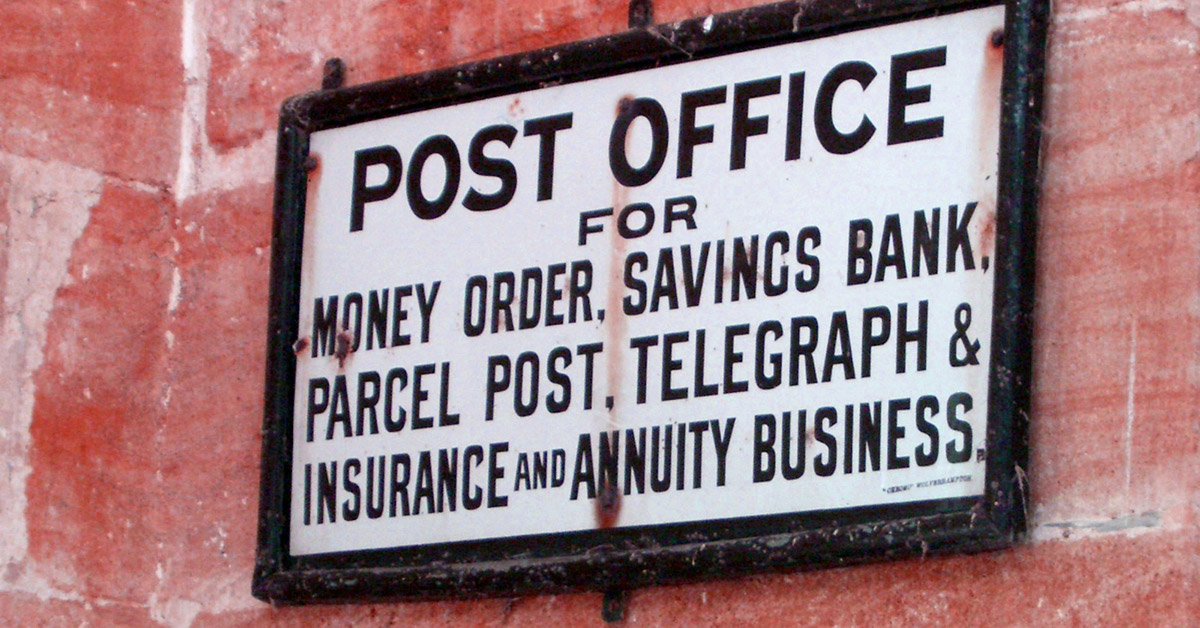

Though long past their peak, money orders continue to be a popular form of payment in the United States. This is especially true for unbanked and underbanked customers that need secure alternatives to pay monthly bills.

The reason money orders continue to be accepted is simple: they offer a relatively safe alternative to carrying around large amounts of cash, and because they are prepaid, money orders offer businesses a low risk alternative to other forms of payment.

Businesses must understand that these advantages don’t come without a catch. Below are four distinct disadvantages you’ll face when accepting money orders from customers.

Money Orders Add Friction

Buying a money order takes work, and adding extra steps to the bill pay process is a recipe for late – or missed – payments. Customers must drive to a physical location, wait in line, speak with someone during business hours, and pay a fee just to secure a money order. And to make matters worse, they have to repeat this process every time they make a payment.

This process may have once been reasonable, but certainly not in the age of smartphones and electronic payments.

Money Orders Take Time

Buying a money order is only half the battle – customers still need to get it to you to complete the process. This leaves you with several unsavory options. The first is snail mail, meaning you’ll need to sit around and wait until the payment arrives before you can get paid. Accepting the payment in person is a bit faster, but now adds another destination for the customer (see point one).

Money Orders Create Inefficiency

Even if you’ve accepted the first two disadvantages as a cost of doing business, consider the soft cost of accepting and processing money orders. Each one needs to be manually processed and attributed to the correct customer account.

Accepting money orders in-person doesn’t leave much to be desired either. This requires staffing someone during business hours to accept and process the payment manually, and handle any customer service challenges that arise along the way.

These are real costs to consider, especially when you are managing a growing business where every dollar (and minute) counts.

Money Orders Are Capped

For reasons we won’t cover today (including money laundering and fraud), most domestic money orders are capped at $1000 each. If your customers owe you even a dollar more than that, they will have to purchase additional money orders to satisfy the balance – and you will have to process each one. This amplifies the three issues stated above, and can cause added frustration for both your customers and your staff.

Solving the Root Problem

The main reason you should stop accepting money orders? More efficient options exist to address the same core challenges. PayNearMe created a secure way to allow customers to quickly and efficiently pay bills with cash at over 62,000+ participating retail locations. The process is as simple as buying a stick of gum in a local convenience store, and the guaranteed payment is securely transferred to your business electronically. Businesses that use PayNearMe can accept cash, while reconciling all transactions (including cards, mobile wallets and ACH) on a single ledger.

Learn how PayNearMe can help you eliminate the need for accepting money orders, and put time and money back in your customers’ pockets and yours.