Five Ways to Reduce Declined & Returned Payments

Increasing on-time payments is challenging enough – but improving your authorization rates also requires minimizing declined and returned payments.

Also known as ‘exception items’, these are payments that are declined because they cannot be processed for some reason. Most commonly, it’s due to insufficient funds in the payer’s account, data input errors (e.g., typos or missing check signature), or technical glitches during the payment process. Other times, payments go through but are later returned due to a chargeback or other reason.

Whatever the cause, every failed or returned payment is costly for billers. In addition to the value of the missed revenue, there’s an operational cost to collect the payment, potential network/bank fees, the risk of future exceptions (or potential default) and an opportunity cost that eats into the productivity of your staff. That makes it imperative to reduce as many of these exceptions as possible.

The cost of failed payments

Before we dive into the ‘fixes’, it can help to understand why it’s so important to reduce declined/returned payments. Obviously, a business needs to avoid lost revenue. But dealing with returned payments can inflict other cost-related impacts as well, including:

- Reduced Cash Flow: Declined payments can turn into delinquencies or defaults that impact working capital.

- Added Fees: Companies may have to pay penalties on returned transactions, on top of the lost revenue. These fees can significantly increase the total cost of acceptance.

- Compliance Risk: Billers need to remain under allowable return thresholds set by various compliance standards (e.g., NACHA, card networks, etc.)

- Disrupted Productivity: Most declined payments require staff time to analyze and resolve the issues, either with customer interactions or fixing IT problems. Billers also need to invest time to develop and document processes and best practices for handling future cases.

- Reputation Management: If payments fail due to a system glitch, it can create a frustrating, even stressful customer experience, and drive up support calls (which are also costly for the business).

Reducing declines & returns

Not all declines or returns can be prevented, but there are tangible ways to help reduce exceptions to minimize the costs and risk to your business. Here are five key strategies you can put into action.

1. Know your customers

The first step in reducing declined payments is understanding your customers in terms of payment behaviors and history. This isn’t KYC in the standard form, but rather a deep dive into your existing customer payment mix and shifts in behaviors. For example:

- What percent of your customers primarily pay using cards, and which types of cards are they currently using? The answer to this question could influence your risk for disputes and chargebacks. Understanding this can help you create rules (either manually or with a tool like PayNearMe Business Rules) to mitigate these risks.

- Do you have a group of customers who have a history of repeated NSFs on their accounts? Consider taking action such as requiring certain payment types that are lower risk, or engage the customer to help them avoid declines (e.g., change their due date, payment plan, etc.).

Using a mix of internal data collection and external verification tools can help your business better understand reasons behind failed payments, and put measures in place to hopefully prevent them.

2. Offer lower-risk payment options

As part of reducing the risk of declined card payments, consider alternative payment methods and channels that can mitigate the risk of exceptions.

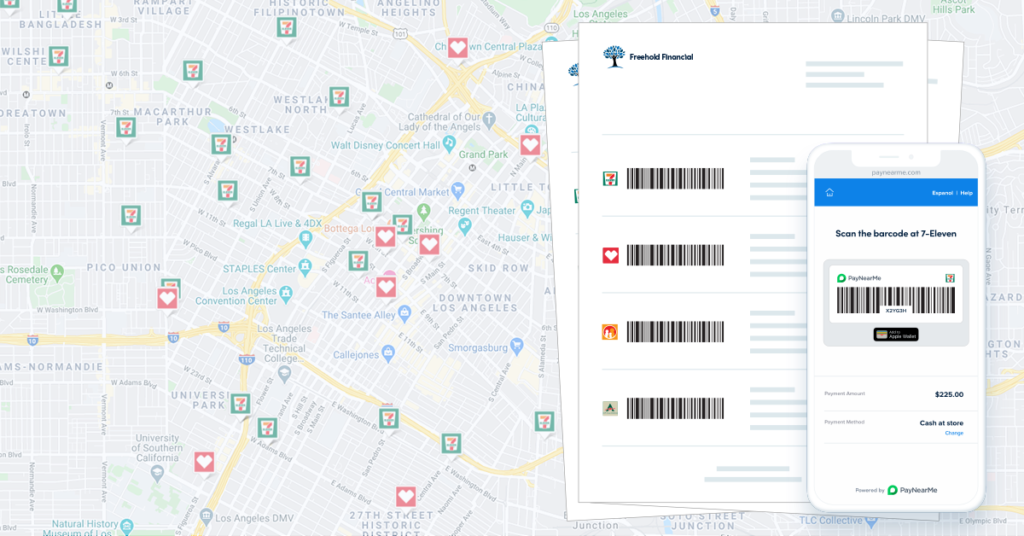

- Accept cash. PayNearMe’s cash at retail provides a guaranteed payment type that cannot be charged back, returned or disputed through a third party. Providing a cash option is also an effective way to improve on-time payments with unbanked customers (often subprime or nonprime borrowers), who may find it easier to pay bills in cash. This enables the convenience of taking cash payments, without many of the risks of onsite cash acceptance.

- Offer mobile wallet payments. Digital wallets (such as Apple Pay, Venmo and Cash App) require customers to add and verify their payment accounts in advance of making a transaction. This helps reduce the risk of an input error or expired account being added. Customers often have to verify each transaction with biometrics or a unique pin, adding an electronic paper trail to each transaction to reduce the risk of fraud or accidental payments.

- Dynamically change payment options. Like in the earlier example of a customer with repeated NSFs, it can help to have your bill pay system restrict payment options to accepting only (verified) debit or cash payments if a customer has repeated NSF errors. Options can be set on a case-by-case basis, or you can take advantage of configurable business rules to automate the process.

3. Improve customer communications

Some declined and returned payments are preventable simply by communicating more clearly with customers. Here are some actions to take:

- Use a familiar business name on statements to avoid confusion. Customers often initiate a chargeback if they don’t recognize a business name on their card statement. To avoid this issue, make sure bill pay transactions display a customer-friendly name for your business. Simply match your merchant account name to your DBA or public brand.

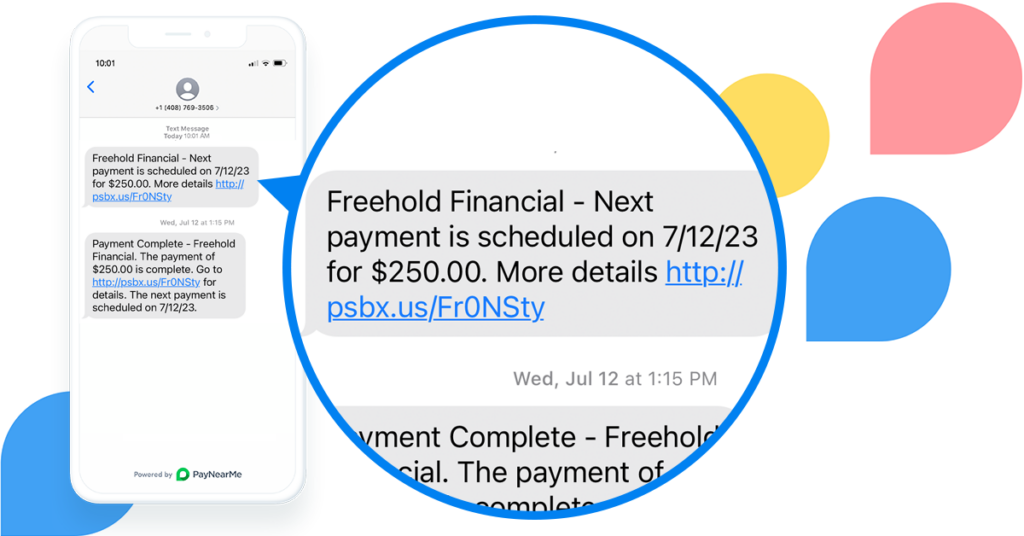

- Set clear expectations for monthly payments. Make it easy for customers to understand and keep track of when a payment is due, how much is due, and any additional charges or fees. For those enrolled in autopay, be sure to let them know which payment account will be charged and when. Providing clear, timely communications can help customers be better prepared to pay bills on time successfully.

- Reach customers using their preferred channels. To help ensure customers actually read important bill pay communications, let them choose how they prefer to receive statements and messages, and their preferred language. And offer payment reminders! 63% of consumers say digital reminders would make it easier to pay bills on time. Enabling people to opt into reminders (via text, email, digital wallets or push notifications) can be effective in reducing declined payments (especially NSF-related).

4. Help avoid agent errors

For customers who make payments by phone, simple typos by call center agents could result in returned payments. For instance, they might key in the wrong payment amount or payment date. It could spark a failed transaction due to incorrect account number, or pre-empt a NSF return or customer-initiated chargeback.

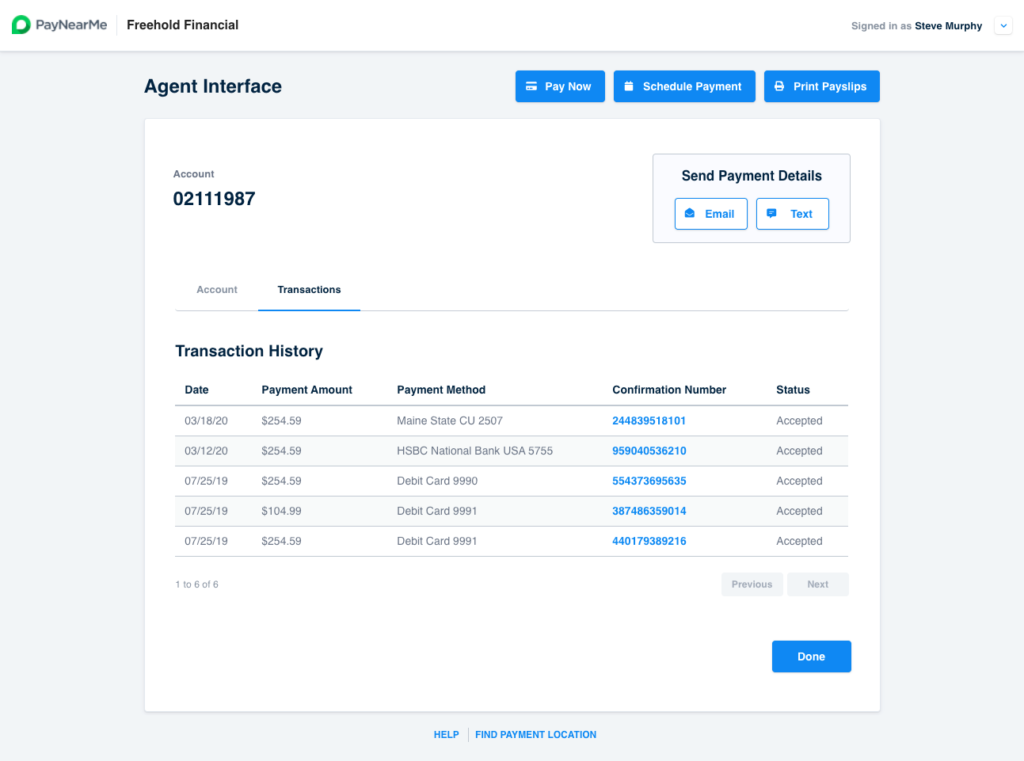

To help reduce this risk, enable technology that lets agents push payment the payment flow to the customer (via text or email), while on the call. For example, with PayNearMe, agents can click a button to push a payment form to the customer, who can type in their card details and payment amount to complete the transaction on their own device right then.

This approach gives customers more control over the pay-by-phone experience, and enables agents to support the payment process without handling the transaction details, to reduce the risk of errors.

5. Keep holistic customer records

Having a complete picture of all interactions with customers can be especially valuable when trying to win chargeback disputes and reduce declined payments. That’s why it’s so important to capture as much information as possible, and manage it all in one place.

Beyond contact information and payment transactions, gather behavioral data to better understand customers and maintain a paper trail of interactions. For example, collect data such as:

- Bill pay history and performance trends

- How they pay (card, ACH, mobile wallet, cash)

- Where they pay (e.g., locations, card-not-present vs. chip card onsite, etc.)

- Autopay enrollment and authorizations

- Engagement history (e.g., text/email messages, call or chat transcripts)

Including this metadata about customers in your system of record can be helpful on many levels – and particularly to help reduce returns and chargebacks. More complete information can make it easier to prove that your charges are legitimate, and that the customer consented to the payment.

Improve authorization rates with PayNearMe

Minimizing the costs and risk of declined and returned payments is essential for business growth. Many of the strategies above can be easily implemented with the help of modern technologies like the PayNearMe platform.

PayNearMe empowers companies with greater control over payment options, streamlined processes to improve collections and reduce exceptions.

See the PayNearMe Platform in Action