Four Reasons Recurring Bill Payments Are Better for Business

In the past decade we’ve seen a significant rise in the prevalence of recurring payments. Part of this is due to increased consumer adoption of electronic payments, while the popularity of Netflix, Amazon Prime, Microsoft Office 365 and others have made recurring billing the norm for subscription services.

A robust recurring payments option allows you to offer a better customer experience, leading to predictable, long-term growth for your company.

Here are four more reasons why making recurring payments easy for your customers is a smart business move.

1. You’ll Get Paid Faster

Late payments are a problem across the board in lending. One study found that late payments cost small to medium-sized businesses (SMBs) $3 trillion a year. While your organization may be better positioned to absorb the costs of late payments than others, it’s likely still costing your business money.

With recurring payments, your customers give you permission to automatically deduct funds from their bank account or to charge their debit card on a set date each month. As a result, you’ll have more timely payments and a more predictable cash flow, which will make financial management and forecasting much easier. This won’t eliminate all delinquent payments, but it will help with a significant portion of the “I forgot to pay” segment of your customer base.

2. You’ll Free Up Business Resources

Better technology can translate into more efficient workflows and increased productivity at your business. This applies to everything from customer relationship management to payment processing.

In fact, 84% of companies who are open to innovation in the payment sector say that automation and new technologies can provide benefits to their business, while 70% of these companies believe it will reduce strain on employees.

When you accept recurring payments, your employees don’t have to send out invoices or contact customers who have late payments. You’ll also reduce transactional payment calls to your contact center.

The recurring payment software automatically collects the amount owed from the customer’s bank or card. This frees up your employees to focus on more important tasks such as handling customers who need help and working on tasks that will grow your business.

3. Recurring Payments Are More Convenient for Your Customers

Accepting recurring payments doesn’t just make sense for your business and your employees; it greatly benefits your customers.

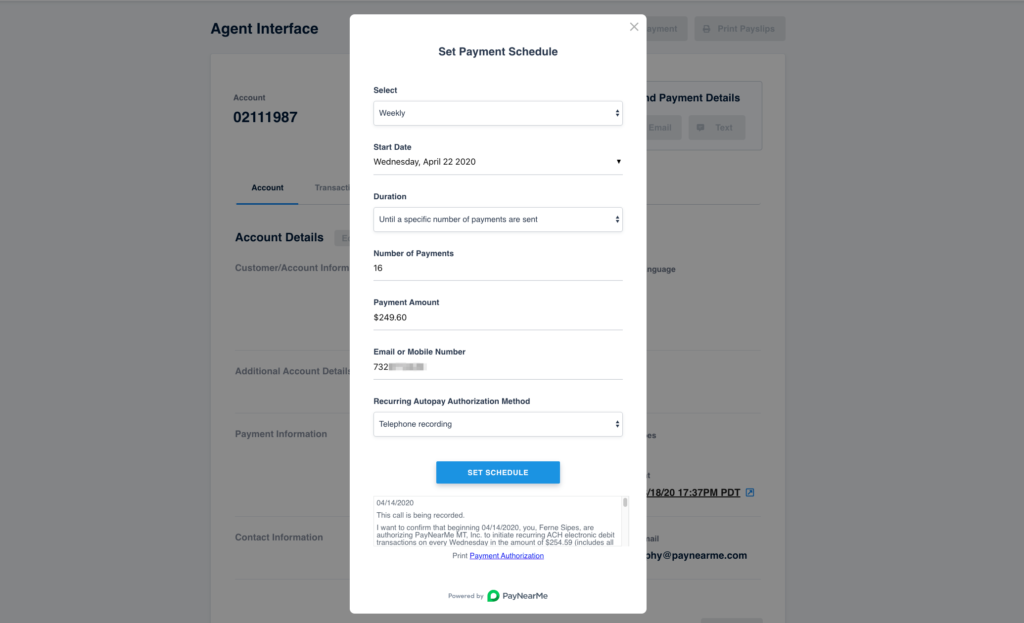

Platforms such as PayNearMe make managing recurring payments is simple. With an agile platform that allows you to customize the functionality you offer your users, you can allow customers to tailor their recurring payments to their needs, including payment frequency, start date, duration and payment amount.

This gives them the freedom to make payments their way, whether they want to pay their amount due early, make extra repayments on their loan balance, or make changes as their budget changes due to temporary circumstances.

But this convenience goes far beyond flexibility. With recurring payments, they can take a “set it and forget it” approach. Once they schedule their recurring payments, they rarely have to worry about missing a payment or dealing with late fees.

4. You’ll Build Stronger Customer Relationships

Today, your customers expect increasingly sophisticated payment solutions. Consumers are accustomed to paying bills online. They want to be able to set up their payment info once and then rely on automated payment features to manage their payments for them.

If you aren’t offering the ease of recurring payments, your customers have to worry about making payments every month and needing to call customer service. Removing this stress can create a better relationship and improve your reputation in the customer’s eyes.

Contact us today to get started or to learn more about how a robust and agile platform can benefit your business.

Back

Back

Back

Back