3 Tips For Getting Your Customers to Pay Their Bills On Time

No matter what type of business you run, there is a good chance that you will have customers that routinely make late payments. Read on to discover why this happens, along with three tips to encourage your customers to start paying you on time.

A survey conducted by Citi shows that “59 percent of Americans have paid a bill late in their lifetime (including credit card, utility, cable, etc.), and 88 percent of those have done so in the past 12 months.”

Half of the survey respondents have paid a utility bill late, while 44 percent have paid a cell phone and telephone bill late. Credit cards and cable bills were paid after the due date by 40 percent of respondents.

According to the Citi survey, the top reasons for being tardy on bill payments were:

- Forgetfulness (61%)

- Lack of available funds (42%)

- Being busy with work and family obligations (39%)

Here are 3 Tips to Get Your Customers to Pay on Time:

1) Have a payment policy and enforce it

Your payment policy should be in writing. Be clear about when payments must be made and the ramifications if payments are late. Depending on how frequently you see late payments, these penalties could include a late payment fee.

For habitually late payers, you may want to reach out to see if there are things you can do to help them make payments on time. A payment plan might be all they need to get back on track. If they continue to be late on payments, let them know that they have three warnings before you have to contact the credit agencies to report the late payments.

2) Send friendly reminders

Since forgetfulness is usually the top reason for late payments as reported by Citi’s survey, sending reminders to your customers by text and/or email can be an effective way to help them make payments on time.

You can automate these messages through services such as PromptAppointment or Trumpia, so that the reminder email or text message is sent a few days before and then again after the payments are due. Be sure to include payment details in the email or text message.

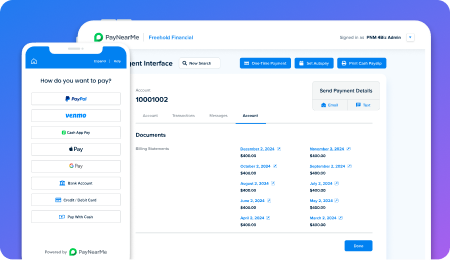

3) Make it simple and convenient for customers to pay you

The easier and more convenient it is for customers to pay you, the more likely they will pay you on time.

Offering flexible payment options is a good start. Some customers may prefer to pay with cash or check, while others may prefer to pay by credit cards, debit cards, or PayPal.

But while many customers can and do make payments online, not all customers are able to pay this way. According to 2013 FDIC National Survey of Unbanked and Underbanked Households, 28 percent of U.S. households (~68 million U.S. adults) are either unbanked or underbanked. This means they either don’t have a bank account or have had to rely on alternative financial services for their needs. Still many more in the U.S. simply prefer to pay with cash due to security and privacy reasons.

The innovation in electronic and online payment platforms now makes it possible to provide those cash-preferring customers with a way to pay that’s just as convenient as using a debit or credit card. This is how PayNearMe is making cash payments as easy as buying a Slurpee at your 7-Eleven store.

Dealing with payment collection is not always a fun activity, but it’s a necessary part of running a business. By following the tips above, you’ll increase your chances of receiving payments on time and keeping the cash flowing in.