Industry Trends in Cash Payments and Hispanic Market Insights

Even as credit and debit cards become more popular and new payment methods like mobile wallets enter the scene, the world’s largest economy still relies on cash more than any other payment method. Cash is still on an up-rise in the U.S., contrary to many predictions. 138 million adults in the US are financially underserved and use cash for all transaction types1.

This webinar looks at the latest payment method statistics survey and demonstrates why cash is still on the rise. Cash constitutes 31% of the value of all transactions based on a study done by the Federal Reserve bank of San Francisco2. It also examines the growing Hispanic market, which has reached 61M in 2018; where average adult age is lower, translating into 17 more years of buying power than non-Hispanics. They also engage in mobile fintech activities more than non-Hispanics and want a platform that is reputable and that they can trust.

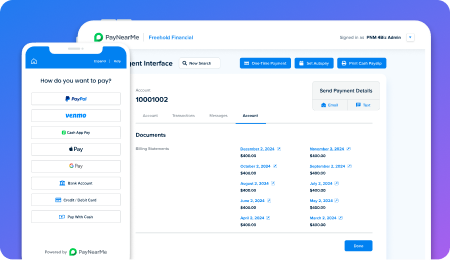

It also takes a look at how moving to cash payment platforms that are mobile-friendly, accredited, compliant, trusted and secure, with anti-money laundering controls ensures simplicity, convenience and peace of mind for consumers making payments and merchants accepting cash.

What if lenders had the means to accept cash remotely? And what if lenders could provide underserved consumers with a mobile or printed cash payment option at thousands of locations, nationwide?

Come and learn why this would empower consumers to pay cash on their own schedule, at a nearby, trusted retailer like 7-Eleven, CVS or Family Dollar. See how you can easily adopt new mobile friendly cash payment solutions for your consumers. This is an exciting possibility… providing your customers the flexibility to turn their phones into cash-payment tools, and making their overall experience in paying off their loans effortless and convenient!

Watch the previously recorded webinar.

Sources:

1. CFSI 2017 Financially Underserved Market Size Study.

2. Federal Bank of San Francisco Understanding Consumer Cash Use: Preliminary Findings from the 2016 Diary of Consumer Payment Choice