Leaders in Payments Podcast with PayNearMe CEO Danny Shader (Recording & Transcript)

Listen now:

Transcript:

Greg Myers (GM):

Hi, Danny, thank you for being here. And welcome to the leaders in payments podcast.

Danny Shader (DS):

Great to be here. Thanks for having me.

GM:

Let’s dive right in. Tell our audience a little bit about yourself—maybe where you grew up, where you went to school, where you currently live—a few things like that.

DS:

Sure. I was born in Palo Alto, California, and I live in Palo Alto, California—in fact, probably about 500 yards from where I was born. I was like a salmon that swam back home because I actually grew up in New York and LA, but eventually came back here.

GM:

Wow. Okay, let’s talk about the company PayNearMe. Tell us, what does PayNearMe do?

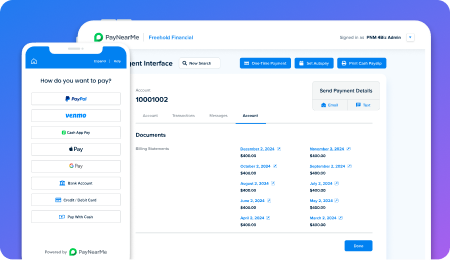

DS:

PayNearMe is a payments platform company. We manage all of the customer interactions for billers, who are our customers. We touch everything that happens between the biller, customer, the biller’s customer service rep and the underlying system of record that’s tracking that customer’s financial relationship with the company.

So we’re processing all the payments; we’re running the payment portal; we’re running the mobile experience; we’re running the IVR; we’re the software that the customer service rep interacts with; we are controlling all the business logic, including who can pay with what form of tender; we’re controlling the auto payments; we’re controlling the engagements, including all the reminders and future-dated transactions; and then we’re processing the cash through our proprietary cash transaction network that is like nothing else in the world.

And then we are insourcing the ACH processing and card processing, and we’re integrating all that into things like Apple Pay and Google Pay.

GM:

Okay, and how long has the company been around?

DS:

The company’s been around for about 12 years. We originally built a cash transaction network, processing cash in a way that’s very unique. And our customers, for whom we were processing cash, said “hey, you do such an amazing job with our cash, why don’t you take over our card payments and ACH payments?”

And I, as the “genius CEO” that I am, I didn’t want to do that and kept saying “no, no, no.” Because in my view, that was a commodity business. And, you know, there’s no way we could compete with very large players. Eventually, one of our customers basically yelled at us and called us not nice things because we didn’t want to take over all their business. So when we finally pushed and asked why they wanted us to do that, the customer said, “well, I just want one vendor to do the whole thing.”

We realized the fact that we’re doing cash uniquely gives us the opportunity to integrate all the ACH and the card payments. Of course once we started doing that, then customers said:

“Well, why don’t you take over the portal? And if you’re doing that, then why don’t you take over mobile. And hey, can you control the CSR relationship too? Can you report to us in an interesting way? Can you implement a flexible business rules engine?”

And so frankly, by doing what you should always do, which is listening to your customers, we were able to transform the company from being a supplier of a component of the whole customer relationship to taking over the entire customer relationship for our customers.

GM:

Okay, and how big is the company?

DS:

We’re processing billions of dollars per year, we’re around 100 people growing rapidly about 50% per year and think we can sustain that for quite a while.

GM:

Okay, and you mentioned billers. Are there specific industries or verticals that you serve?

DS:

Yeah, I think just to zoom way out, there’s been a ton of innovation in commerce payments, right. We hear about that all the time, and you know, nobody starts a new commerce company without doing a pretty killer job at payments.

But about 40% of consumer spend is on things that aren’t commerce, right? So your auto loan, your personal loan, your utilities, what you pay municipalities, your parking tickets, etc. For the most part, unless you’re dealing with the very largest billers, you know, the AT&T and Verizon’s of the world, you’re probably having a pretty crummy experience with that.

In short, the world has advanced dramatically in commerce payments and been fairly stagnant in non-commerce payments. And that’s happened at the same time that there’s been a fundamental shift of consumers paying bills from their bank account, which is what people of my generation—I’m almost 60—did, to what people are doing now. Nearly 75% payments are biller-direct. People are going to the billers and they’re having a really lousy experience.

But they’re going to the billers because the biller system has all the information they need to access in real time. For example, the biller system knows how much they owe. If they make a payment, the biller can credit that payment in real time. None of that’s typically available through the bank website.

Also consumers many times, particularly in this climate, want to switch tender types. So they may pay with a debit card one time, then ACH another time, then cash another time because they’re short [on funds] or they’re overdrawn, and they don’t want the deposit in their bank account to credit their overdraft rather than going to the biller.

And so again, zooming out: there are huge amounts of payments with a lousy payment experience that absolutely need to happen at the biller websites. And the billers themselves typically don’t have the development resources to go get Stripe or Braintree or something like that. And they don’t have any ability to do cash. And they don’t have the ability to build a killer experience unless they are one of the largest builders in the world.

What we do is we fill that gap. We come in, and we have a complete software system that plugs into their system of record and can extract, normalize and relabel information from that system of record and post. We then present that information in ways that our billers want through any payment channel—IVR, web, mobile, customer service agents— and process all the tender types, control all the business logic and do everything else. And they can do that without the biller having to consume very precious development resources that they would probably rather put into something like their risk management system or something else gives them proprietary advantage.

GM:

And you mentioned cash and wanting to go a little deeper there. So let’s do that maybe give a use case, or something that would help people understand why people are paying with cash these days.

DS:

It’s important to understand that about 25% of US households are un- or underbanked. So at 7% or 8% are unbanked, meaning they don’t have a bank account, and then the balance of those folks may have a bank account, but they are routinely going around their bank accounts using alternative financial services.

Maybe they’re using a prepaid debit card, or they’re using a money order or something like that. Or they’re having to—God forbid—go to one of the traditional walk up money transmitters, who are going to charge them a lot of money and make them fill out a form and stand in line and do all that other stuff.

And importantly, this is not going away. There’s, there’s all this discussion about cash going away, but it isn’t going away because huge portions of the population are paid in cash, and they need to pay their bills in cash. Or they’re paid with another form of tender, but they’re pulling cash out in order to make sure that they can absolutely, positively not miss their rent payment or their auto payment or their cable payment or something else that’s essential to them.

That’s not going away. It’s a big part of the economy, even though it’s a subset of the bills that get paid. Instead of doing one of those things that I described, like buying a money order and putting it in an envelope and mailing it, or buying a money order and getting on the bus and waiting in line for 15 minutes at the money center to to pay a bill through a traditional walk up bill payer—who, by the way, is going to charge you some huge upcharge if you want to “expedite the payment”—we have a system where we have integrated into the point of sale terminals at 27,000 US retail locations. This includes all the CVS, 7-Eleven, Family Dollar, and many other locations.

In our system, in an automated fashion the consumer is issued a barcode on their phone or on their bill or in some other means and they just walk up to the checkout line. In the same way that they would pay for a carton of milk, the clerk behind the counter scans the barcode, [the consumer] hands over their cash, and in real time, their account is credited for that payment. So literally before they get to their car in the parking lot, their bill has been paid.

And so basically what we’re doing is turning cash into a full fledged electronic payment mechanism by borrowing the point of sale terminals at all these stores and lending them essentially to these billers.

GM:

I think it’s an interesting model that you have, created where you take on the acceptance of all the different methods and places and you know, you’ve built quite the network. But what would you say differentiates you from your competitors? And do you have I mean, everyone has a competitor, but are there competitors that do everything you do, or they’re just competitors that do parts of what you do?

DS:

There are competitors that do parts of what we do. There are these traditional old line, you know, payment processors. The folks who run those lousy payment experiences, frankly, that we were just talking about. There are some also some up and comers, but nobody has what we have, combining what I’ve just described, like offering all the tenders types, through all the channels, including cash, and the programmable business logic.

I think we’ve made the cash, reasonably clear, but let me describe this business logic problem to you for a second. The more you get to know any of these businesses, the more you’ll find out that they have very specific requirements about how they want payments to work. One of our customers, an auto lender, came to us when they decided to switch from their old line provider to us and said,

“Hey, by the way, we’d like to have a rule—we’d like as many people as possible to pay us by ACH. So favor, in your presentation, recurring ACH. That’s obvious thing that everybody would like to do. Except when a consumer has an NSF, when they bounced their ACH, they’ve now gone from being one of our most economical to our least economical customers. So tell you what: we want a rule that says if the consumer bounces their ACH twice, turn that channel off.”

What they thought we would do was hard-code that into their implementation. But we never hard-code anything. We come at everything from an operating systems perspective. Our core engineers are former Apple OS people. So we built a rules engine that lets us put all kinds of rules in. One of them is, for example, if an ACH equals NSF two times in X period of time, turn that channel off.

But then that customer said, “…but you know, what, if the customer calls our customer service line, we want the customer service rep to have the ability, at their discretion and up to a certain amount, to turn that channel back on, but change the pricing.” There’s two more rules. And they also wanted, it if it exceeds a certain amount, to require a supervisor’s approval. There’s another rule.

Having the ability, on the fly, to configure different kinds of payment rules, different pricing in different roles, I think is unique to us. I’m not aware of anybody else who’s got the ability to do that. And the reason we’re able to do that, obviously, it’s because increasingly, our customers are handing more and more of that infrastructure over to us to run for them.

I mean, the thing to keep in mind is that nobody has enough developers, right? Except, you know, the hottest tech companies who can turn engineers away. Most people need to use their internal development resources on things that are absolutely unique to their business. In lending, for example, it’s oftentimes things related to their risk models or analysis. They don’t need to spend their precious development resources trying to build a platform infrastructure for payments, when frankly, much of that is going to be shared in common with other customers, as long as it’s customizable and controlled by flexible business logic.

And that’s what we’ve done. Our engineers have created a platform that can then be customized—without engineering—for a wide variety of businesses and government agencies who are trying to deliver a killer payment experience while simultaneously devoting their development resources to the problems that only their developers can solve.

Now, you may ask, why is that important? Why is it important that consumers have a great payment experience? The reason is, if they don’t, or if they don’t have the right reminders, the right engagements, etc., they’re going to either pay late or not pay at all. That obviously is very expensive. Or they’re going to call a customer service agent, and try to reconcile something, and that’s expensive.

But if you can automate it, and make it self-service, and make it great, and make it integrate with their mobile wallet, and do all the reminders, and take any payment any way they want to pay, and do it through every channel they want to use—all of that, ultimately, not just makes for happier customers, but it saves a ton of money for our clients over time.

GM:

Yeah, and I would assume ultimately, after all those scenarios, the customer’s final thing is they leave and go somewhere else.

DS:

Oh, yeah. If they’re not happy, they’ll go. And remember, for most of these kinds of entities, this is the only interaction they have with their customer. So how’d you like to have a recurring relationship with your customer that stinks every month? That is not the way to get loyalty, right?

GM:

Right. Right. Right. So you’re almost in the customer experience business?

DS:

We are. We think of ourselves as an enterprise software company with an integrated payments capability that delivers customer relationship management for our businesses and government agencies.

GM:

How has the COVID world changed things for you guys?

DS:

It’s been a really interesting accelerant for us. Most people know us as a cash system; they’re less familiar with all the other stuff we do. And not surprisingly, in the current world, many people are trying to close their payment windows, because they don’t want that exposure to the population as a whole. So they call us to take over their cash. And then they see everything we’re doing, and they’re like, wow, we want that whole thing. That’s been a huge accelerant for us.

But then there are a couple of really interesting, subtle advantages. One of the things we do is we process all tender types, as I mentioned, through mobile, through the web and through our engagement engine, where we might send a text with a link to payment. Well, we can do that in a way that’s PCI compliant, because we can take those credentials and store them and tokenize them, and never expose them to the customer service agent.

If you’re a biller that sent your customer service agents home, you’re terrified of—or maybe not even allowed to—process cards, because you can’t have a consumer reading their card information to a collector in a non-secure environment—that’s a violation. But instead, if that collector is using PayNearMe, they might just collect the customer’s mobile number and send them a text. [The customer] opens up the text, they pick their form of tender, such as cash, and they get a barcode that they can bring to the store. Or if they pick ACH or cards, they’ll enter their credentials there, we’ll store them in a secure and PCI compliant manner and tokenize them, and the customer service agent can continue to interact with that payer without running any risk of a security violation.

GM:

That’s pretty fascinating.

DS:

Yeah, subtle right? Until you start doing it for everybody, then you start realizing that this is a total change in our business. When we just did cash, we were a component of the system. Then after taking over all the forms of tender and doing the integrations and taking more and more of it over, we’re now in this position of being able to do incredibly innovative things that our competitors can’t dream of doing.

GM:

Sure, absolutely. We’re sort of headed down this path already, but let’s talk about where you think the industry is headed in the next two to three years?

DS:

You know, you’re going to hate my answer. But my answer is—I don’t know.

I think what’s happened is that payments has gone from being really stagnant to being super innovative. And I think anybody who could sit here and tell you what’s going to happen in a particular industry segment two or three years from now, is deluding themselves.

What matters instead, I think, is that the vendors who are going to make it are the ones who are going to fundamentally engineer flexibility into their platforms. It is a religious mantra for us that we treat this stuff like an operating system or like a flexible, extensible platform and don’t hard code, or custom code, anything. That way, whichever way our customers want to innovate or the world evolves, we have the highest probability of being able to adjust and meet those demands as they emerge.

GM:

Okay, fair enough. Well, let’s switch gears a little bit and let’s talk about you. Tell us about your journey, how you got to be the CEO there, maybe a little about your background, and sort of your roles and responsibilities there as the CEO.

DS:

Well, let’s talk about how I got here. I’m a serial entrepreneur. I’ve been working for other startups, and now running my own startups for quite a while. The first company I ran was actually a PayPal like company ahead of PayPal.

Back when PayPal was still Confinity, we started what I think was the first p2p payments company called Accept.com. This was back in the first bubble of ’99, when eBay was selling everything and Amazon was selling books, music and video. Amazon, and Jeff, they wanted to be the store where you could buy everything and turned themselves more into a platform, and they needed payments infrastructure. They acquired Accept.com, and I and my team all moved to Seattle, and became Amazon execs. I actually became Jeff Bezos’ first executive shadow. Our code was the beginning of Amazon payments, and I worked there for a while.

Then I left and built a wireless messaging company called Good Technology that competed with Blackberry on non-Blackberry hardware. That was acquired by Motorola. And then I was briefly with another startup and then I started [PayNearMe] almost 12 years ago.

GM:

Okay, and obviously, as the CEO there, maybe talk about what you actually do?

DS:

I think my job is to help set the overall direction and recruit amazing people. And then all the real work, frankly, is done by the amazing folks on my team and the people who work for them. I set direction and break ties and make sure there’s cash in the bank and manage the board. I am proud to say that I am by far, probably the dumbest person on the executive staff at PayNearMe. I’m not saying I’m dumb, I’m just saying we have incredibly smart, capable people driving the various functions of business.

I will admit this to friends and private, which is that I studied engineering, but I wasn’t a very good engineer. But I liked engaging with engineers. And I like engaging on product stuff, even though I’m not necessarily a great product guy. But since I’m CEO, folks have no choice but to talk to me. So I get to engage with them on all these topics that I find fascinating.

GM:

Did you raise money for this business?

DS:

Oh, yeah. PayNearMe’s raised over $100 million dollars today. It’s a very well funded, venture funded business.

GM:

Okay, and what is your view on going out and raising money? Tell us one of the great stories or maybe one of the horror stories if you have one?

DS:

Oh, you know, it’s funny. I think it is true that there is lots of money out there to be invested in great businesses. And the job of the CEO, at least in that domain, is to make sure you’ve picked a great business, and that you can articulate to people why it is a great business and why they should invest in you and in the business.

That has to do with the business fundamentals, with the quality of the team you’ve recruited, and it has a lot to do with your quality as an individual, right? I personally place a high value on integrity and follow through. Our team does that and our company does that, and I think we have that reputation. And for investors who are looking for that kind of team, I think we’re a very good cultural fit, in addition to having a pretty compelling business.

One of the nice things about our businesses is that we essentially never lose a customer, right? Once people have integrated us for cash, for example, there’s really no alternative to what we do. So for the most part, they never go away unless they go out of business. As they give us more and more of their platform to run, they’re even less reluctant to let us go, as long as we don’t do stupid stuff. There are some companies (who will remain nameless) who, after you get embedded with them, they will jack up their prices and jack up the prices and jack up their prices and jam their customers, because they’re stuck with them. We have the opposite view. We take sort of the AWS view of the world, which is what you should try and do is continue to deliver more and more and more and more value and earn the right to retain your customers by the way you treat them. Not by the way you lock them in.

GM:

Right, right. I think that’s good advice. Maybe talk about one thing that you’re passionate about, that’s work related, and one thing you’re passionate about that’s personal or non work related.

DS:

So on the non-work related side, I am a very passionate fitness swimmer. I swim with a group of middle-aged dads called the Mermaids. We are very active socially and at keeping ourselves in shape. I get to make the t-shirt for the mermaids every year, and I’m excited that I just made this year’s t-shirt, which is entitled “best year ever”. It has little icons of all the wonderful things that have happened, obviously, very sarcastically.

GM:

Quick question about the fitness swimming. Is that like long distance swimming, or what?

DS:

Oh, it’s just a nice way of saying I’m not very fast. I swim with some people are very fast, so I like to think that I’ve been good cardio shape. But nobody’s gonna put me in any races and expect me to do particularly well. But you know, in our case, we’re plus or minus 2500 yards per swim, and it’s broken up into different sets of different stuff. Oftentimes, the sets are now named after people in our group. We have a guy named Daniel Mitts so we have a Wandering Mitts that we do, or a Sands-wich named after one of my investors, Greg Sands. We put them all together, and it gets us enough yards to keep us in cardiovascular shape.

GM:

Okay, gotcha, gotcha. Let’s talk a little bit about people coming into this industry. If you listen to the podcast, I ask this question a lot, because I really like to get answers from people who’ve been in the space and are at senior levels. When I started in the space 15 years ago, payments was just payments, there wasn’t a lot of investment. It wasn’t the hot sexy industry to be in.

Now it’s much different with so much money being invested. We’ve come up with this word FinTech, and kids can actually learn this in college and get degrees in FinTech. It’s become very popular. So what would your advice be to someone who’s just starting their career or just graduating and want to get into payments? What would your advice be to them?

DS:

Well, actually, my meta advice about tech in general, is you really can’t engineer your career. Like I said, I’m almost 60, and when I came out of business school in ’89, it was only the nerds like me who wanted to do tech. And at that point, “tech” meant maybe enterprise software, operating systems, Microsoft Office and products like that, and semiconductors. Nobody would have thought it would have meant hailing a cab or you know booking a ticket or you know, all the other stuff that it’s evolved.

My assertion is, like I said before, I don’t think we have any idea what this is gonna look like 20 years from now. I recently got a Peloton, and that’s such a great product, but it’s also such a fascinating combination of entertainment, fitness hardware, software and the internet. Who would have anticipated that?

If you’re building your career to try to figure out where the stuff is going, I think you’re wacky. I think what makes more sense is to work on stuff you really think is cool, with people you really like. Because if you do those things, you’re going to do really well, you’re going to work really hard. And if you do work really hard, and it’s fun, you’re going to do well. And if you do well, your network is going to propel your career forward.

I think optimizing in general on those things, since we’re in a rising tide anyhow, it will just let you go along with whatever emerges and fascinates you. And it by the way, if that happens to continue to be things in FinTech, you can stay in FinTech. But you might find that FinTech turns into something else in the same way that other things turn into FinTech. I think that’s the best plan. Certainly, that’s what I’m telling my daughters.

GM:

I think that’s some great advice. Well, we’ve covered a lot about PayNearMe and you and the industry as a whole. Is there anything else you wanted to add before we wrap up?

DS:

I think it’d be useful to make clear, you know, who we think is the best possible fit for us. We want to engage with any of the people who are listening who are typically managing recurring billing, where they don’t necessarily want to go out and custom code their own payments platform by buying components and cobbling things together. If they’re handling recurring payments through multiple channels, and they want to increase their payment volume, decrease the customer service calls, and spend their engineering resources on things that are proprietary to their business, then we want to talk to them.

GM:

Okay, perfect. Well, Danny, thank you so much for being here, I know your time is very valuable. So I want to be sensitive to that. But thank you so much for being on the show today.

DS:

Oh, I really appreciate it. Thanks so much for having me. It’s been really fun.