The Advantages of Providing a “Pay Online With Cash” Option for Customers

While more and more consumers are choosing to digitize their expenditures, a portion of the population continues to use cash and prefers or needs to have cash as a bill payment option available. Though these consumers prefer to use traditional payment options, it doesn’t mean they are not tech-savvy or don’t own and use a smartphone daily. For customers who prefer cash, your organization should streamline their experience by enabling a pay with cash online option.

Traditionally, cash payments have had distinct roadblocks for merchants. Digitized cash payments mitigate many of these risks, providing a consistent, convenient, customer-focused solution that gives your customers the power to pay as they choose.

The State of Cash Payments

About one-quarter of the US population is unbanked or underbanked. This means they do not have a checking or savings account, or prefer to use an alternative payment methods (e.g. money orders) to make payments.

About one-quarter of the US population is unbanked or underbanked. This means they do not have a checking or savings account, or prefer to use an alternative payment methods (e.g. money orders) to make payments.

Given the sheer size of this population segment, you can be almost certain that a meaningful portion of your customer base prefers to use cash. It’s essential to give these cash-preferred customers access to digital experiences and choice.

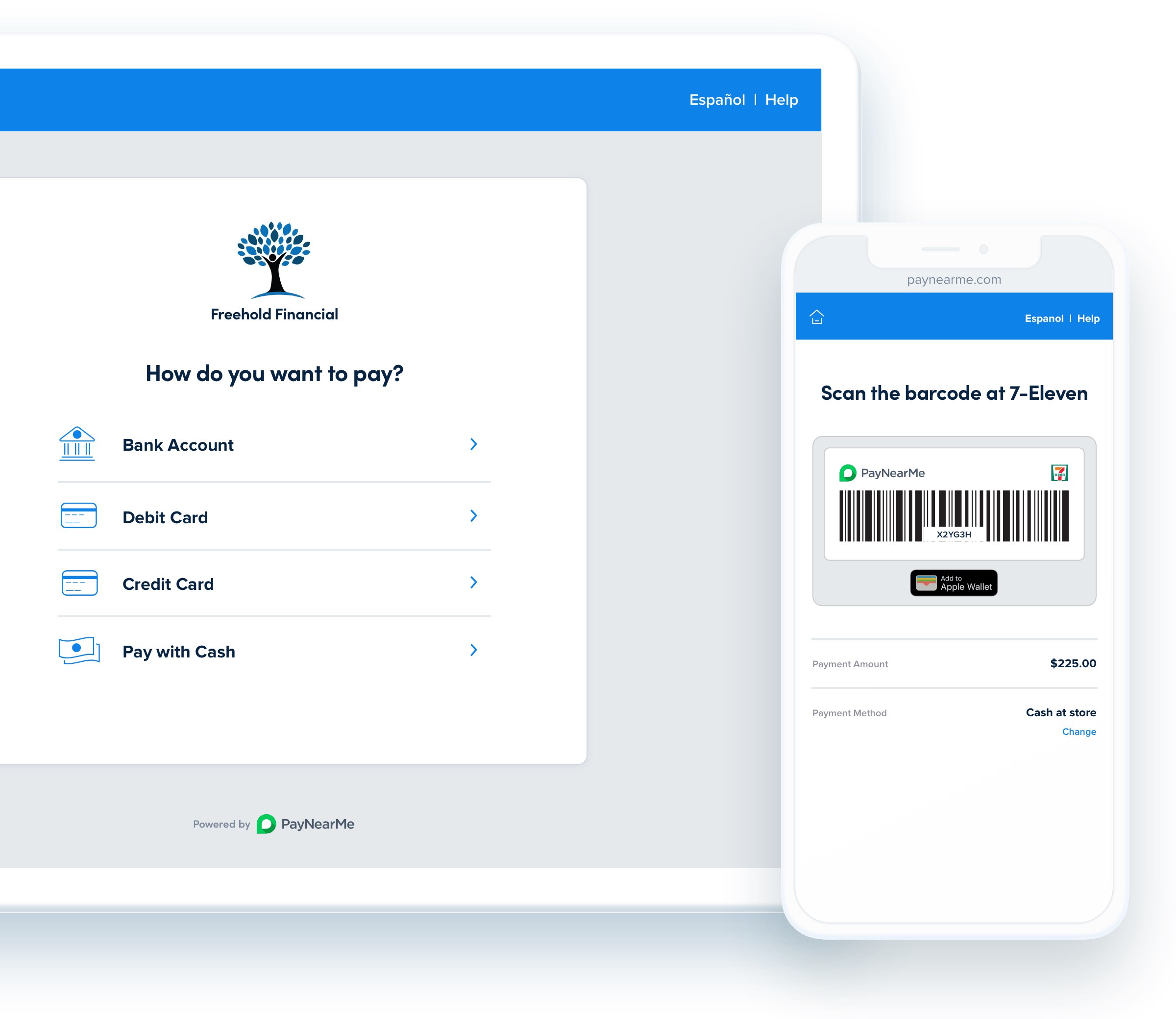

Online cash options allow users to make payments in person at a convenient location using a secure, personalized digital barcode. Here’s how it works:

- The customer is issued a personalized barcode via their mobile device, text message, email or statement.

- The customer goes to any participating store, shows the cashier their barcode, and makes a cash payment.

- The customer receives a proof of payment, and your business is notified of the guaranteed transaction within minutes.

“Pay with cash online” options are suitable for businesses across industries, including lenders, financial institutions, mortgage servicers, insurance companies, utilities and more.

The Benefits of Online Cash Payments

1. Consistent user experience

Regardless of the industry you operate in, user experience is a key differentiator. To keep your customers satisfied and loyal, it’s crucial that you continue to refine and adapt your product to meet changing demands. Incredibly, 84 percent of companies that work to enhance their customer experience report an increase in revenue.

If your business accepts cards, ACH and cash, ensure your customer experiences a consistent, seamless payment process, regardless of how they choose to pay month-to-month. A online cash option enables cash-preferred consumers to enjoy an experience that’s just as easy, quick, and convenient as electronic payment methods.

2. Financial inclusion

Financial inclusion means ensuring those without access to mainstream banking have affordable and useful alternatives. If you don’t accept cash – or fail to bring your cash payment experience up to modern-day standards – you are potentially not meeting the needs of your customers. Offering the ability to pay with cash, in addition electronic payment types, provides choice, convenience and flexibility for all.

3. Payment choice

The modern consumer wants choice for their purchases. When it comes to making bill payments, they also want to do it their way, on the device they prefer, and with the tender they choose. In addition, they want a consistent user experience no matter how their needs or preferences change over time. Offering payment choice means you’ll have happier customers, and receive more payments on time and in full.

4. Convenience for cash-preferred customers

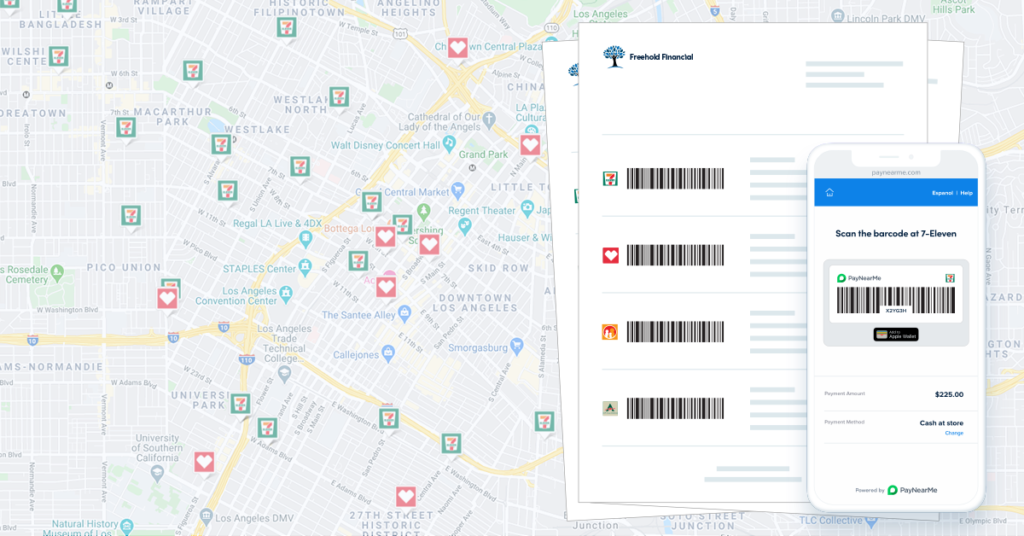

For most businesses today, cash payments have to be processed at a financial institution or your walk-in location. An online cash payment option, in contrast, allows a cash-preferred customer to initiate a payment in a digital channel such as text or email but complete in person at a participating store in their own neighborhood.

With PayNearMe, customers can make cash payments at over 27,000 retail locations across the US. This a convenient solution, eliminating the risk and hassle of unexpected closures, limited hours, wait times, long lines, and parking restrictions. For example, if a customer finishes work at 5:30 PM and their local branch closes at 5:00 PM, they can still make their payment at their local 24-hour retail store.

5. Safety and security

Finally, digitized cash payments are safer and more secure than traditional cash payments made at your branch or office. By adopting a digitized payments process that redirects cash acceptance, you eliminate the risk of holding and transporting cash in your brick and mortar location.

Selecting a Cash Payment Vendor

You are ready to upgrade your customers’ cash payments experience. Now, it’s time to settle on a suitable payments platform. Here are a few key factors to consider in the process:

- Guaranteed payments. Ensure that the platform can guarantee payments without risk of consumer chargebacks.

- Minimized fraud risk. Make sure payments are made directly to you, without third-party involvement or prepaid card loads, to minimize risk from fraudsters for both your customer and your business.

- Widespread footprint. To give your customers the most convenient experience, it’s crucial that your payments partner has geographically diverse retail locations across the country. Some of these locations should be open 24 hours a day, seven days a week.

- Simple reconciliation. Be sure you can receive all your transaction records (cash, cards, ACH, Apple Pay) in a single file.

- “No strings attached.” Finally, ensure your cash solution is user friendly to those who need or want it most, without expiration dates, variable fees, or requirement of a bank account or credit card to use.

Get Started with PayNearMe

With over 27,000 retail locations nationwide, our cash solution is fuss-free, convenient and secure. Using patented barcode technology, we give your customers an easy and streamlined way to pay with cash. You can accept both cash and electronic payments using the same platform, providing a consistent user experience. Contact us today to learn more or request a demo.