Recap: Looking Back on a Year of Remote Lending

No one could have predicted that we’d be hitting the one-year mark for social distancing, remote work and stay at home orders. Lenders across the country have had to completely update their business models to account for contactless operations and remote work.

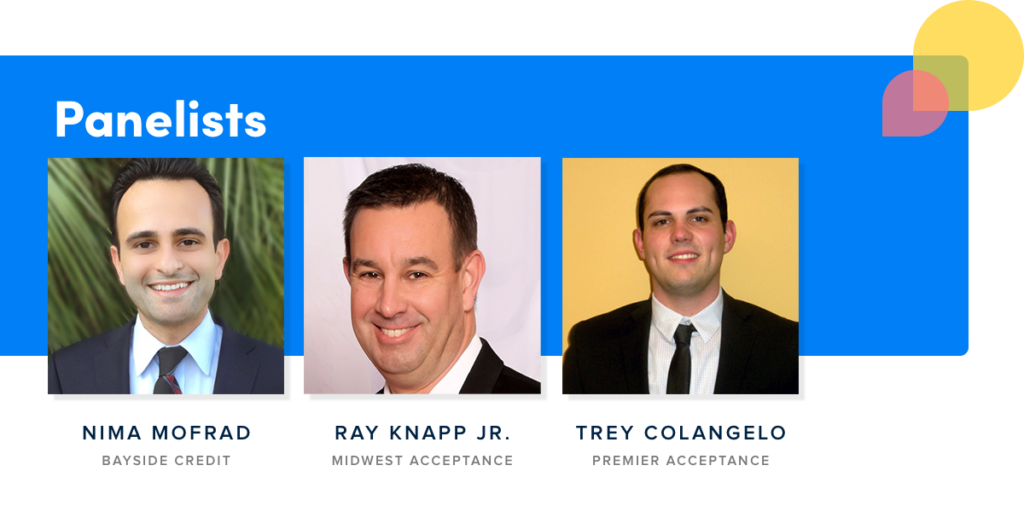

We invited panelists from several lenders across the country to share their experiences over the past year.

About our panelists:

- Nima Mofrad, COO of Bayside Credit – Located in Irvine CA, Bayside Credit specializes in the subprime segment of auto finance and has been a PayNearMe customer since 2015.

- Ray Knapp Jr., COO and Director of Finance at Midwest Acceptance Corporation – Midwest Acceptance is finance company in the Saint Louis area that specializes in subprime and non-conforming auto loans in the state of Missouri. Midwest Acceptance Corporation has worked with PayNearMe since 2018.

- Trey Colangelo, General Manager of Premier Acceptance – Based out of Indianapolis, IN Premier Acceptance is a non-prime/sub-prime auto lender in the Midwest. They have been partners with PayNearMe for about four years.

Below are some of our favorite answers and insights from the panel, condensed for readability. You can watch the full recording here.

Let’s backtrack about a year or so ago. Seemingly overnight, the country entered lockdown and many businesses had to shift to remote work. What were some of the first steps that you took to maintain continuity at your business?

Nima: In California, the governor ordered lockdowns pretty quickly for all nonessential businesses. The first thought that came to minds was, “how do we avoid any type of service interruption for our dealer customers and our borrowers?”

We ensured that we were able to give our staff access to all the systems and tools needed to be able to continue to perform their work functions while working from home. This meant providing access to laptops, VOIP phones, working with ISPs to ensure good internet connections, and much more.

Most importantly, we wanted to ensure it did everything in an orderly way as far as sending employees home and preparing them for remote work with confidence. It was a scary time for everyone, and it was important to let employees know that we had a plan and that things would be okay.

Beyond that, it was reaching out to investors, creditors and lenders to share our plan and keep business running.

How did you support your employees to get them ready for remote work?

Ray: We were in a similar situation where we had never had anybody work from home before. It was all new to everybody. We have a tight-knit group of around 30 employees who were used to being in the office every day and seeing each other. Then suddenly nobody is seeing anybody. It was tough on everyone mentally at first, and difficult for the teams to collaborate.

The first thing we did was introduce Microsoft Teams. The team absolutely loved it. They were using it for video chatting and felt much more connected than by just picking up the phone.

We also built in some things to keep up comradery, such as virtual happy hours and inspirational daily emails. People enjoyed getting these daily emails around 3pm, which included inspirational poems and thoughts of the day and similar content. People jumped in and really took ownership of keeping our culture alive.

What changes did you make in the past year that you plan to keep today?

Trey: Giving our staff the ability to work remotely when needed is something we plan to continue moving forward. If there’s an emergency, an unforeseen family situation or something else keeping employees away from the office, we now have the capability and processes in place to allow them to work from home successfully.

In terms of customer service, we had already started to introduce electronic signatures for many documents leading up to 2020. When the pandemic started, we accelerated that and have since gone to 100% electronic signatures on documents.

Regarding payments, we were previously allowing customers to come to our office to make payments with check or money order. We had already stopped taking cash in our office thanks to PayNearMe.

But once everything closed down, we shifted to an all-remote payments environment. We do not plan on reopening the office for public foot traffic outside of appointments with customers as needed.

Most customers love that they don’t have to come to our office or visit a notary to complete paperwork and can continue to work with us by making payments online or with cash at local stores with PayNearMe.

What surprised you most about the past year?

Ray: I have to say that one of the things I was really surprised at was customer resiliency. Most of our customers found a way to make sure they made their payments. Now sometimes payments were a little bit late, but they’d call us, and we would be flexible and work it out.

We were expecting things to be much worse, but our customers continued to find a way to make things work.

I was pleasantly surprised by the willingness of our employees to adopt new technologies and adapt to working from home. They accepted the challenges and did whatever it took to stay productive and positive.

What’s one piece of advice that you would like to share with other lenders and dealers that are listening (or reading) this right now?

Trey: Stay positive and be patient. We are all at a time that we have never experienced before. Everyone has to make adjustments, whether at work or in their personal lives. Being patient, being positive and working is important to keeping things together. If not for lenders we wouldn’t have dealers, and vice versa, and without employees and customers we wouldn’t be able to continue at all.

Nima: Focus on your team. For every business, people are the backbone of the company. Sure, we had many changes that affected our business. But all of our employees had to deal with significant changes in their individual lives too. Suddenly we had kids studying at home now, elderly family members living at home that were afraid to leave the house, and many other concerns.

It’s important to be there for your people beyond the basic “employee-employer” dynamics. Being supportive, offering flexible hours and treating our employees well has had a really positive effect on our business this past year, despite everything going on around us.

There’s always a way to persevere and to make it through. I think our people are a big part of that.

Ray: Take the obstacles we’ve been given and figure out how to come out stronger on the other side. All the positive things that have come of this, such as supporting your team on personal matters or being flexible with working hours, these are the things we need to continue doing. For example, if your team members can’t get to the office because of an injury, let them have a work from home setup to make things easier on them. It is going to make your business better in the long run.