Reimagining Payouts for iGaming

“Exceptional customer experiences are the only sustainable platform for competitive differentiation.” – Kerry Bodine

Today, consumers not only want convenience in every aspect of their digital lives—they expect it. The rapid expansion of legal online sports betting and iGaming has led U.S. operators to focus on customer acquisition and compliance first, overlooking the need for a fast and convenient payout experience for their players. In reality, the payout experience plays an important role in retaining customers and sustaining growth.

Payouts, in particular, have been a point of concern, often taking several days to get to players after withdrawals are requested. To fully enjoy their online gaming experiences, players need to know that they can trust their chosen iGaming provider to offer fast and secure payouts using their preferred payment methods.

A research report conducted by Truelayer found that “payment regimes are a key driver for players, whether they are choosing a new gaming provider, allocating deposits or deciding to move on.” Specific to the withdrawals process: “8 in 10 players said fast payouts are important when choosing an online gambling provider.”

What’s the issue?

What makes payouts take longer than expected? Here are a few reasons:

- Slow money movement: Traditional ACH takes two to three days from approval to land in the account; mailed checks can take weeks to arrive.

- Manual approval processes: Operators have to approve withdrawal requests to comply with internal controls, often requiring manual review and intervention.

- Changing preferences: Deposit methods may not align with player payout preferences, requiring additional checks and manual data entry.

Additionally, operators often face other payment challenges outside of the payouts process that can slow them down. These could include:

- Too many point solutions: Having multiple payment vendors means more integrations and multiple prefund accounts, leading to increased operational costs and time-consuming processes.

- Evolving payment rails: Payment rails are constantly changing, and it can be difficult for payment providers (and therefore operators) to keep up. New options such as real-time payments, cryptocurrency, FedNow and payouts via ATM all present opportunities— but also challenges.

- Security and compliance: With any payments solution, it’s imperative that security and compliance are at the forefront; however, these requirements can also slow down a business that isn’t prepared with the right protocols and processes in place. Some areas to consider include anti-money laundering laws, ID verification/KYC, fraud protection and credentials.

All of these complexities can make payouts difficult to automate, slower and more expensive to process.

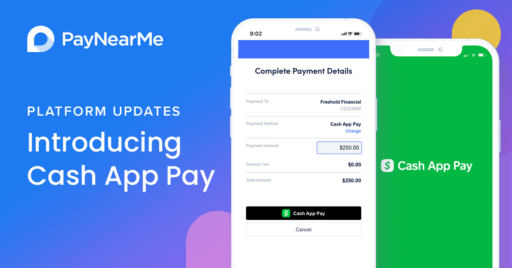

Digital payouts by PayNearMe

PayNearMe helps operators bolster their cashier and reduce integration complexity by offering debit card, ACH, PayPal, Venmo, and cash withdrawals through a single integration to the MoneyLine platform. This helps speed up the payouts process and future-proof operations by trusting an innovative partner with a track record of innovation and an intuitive, easy-to-use platform and payouts process.

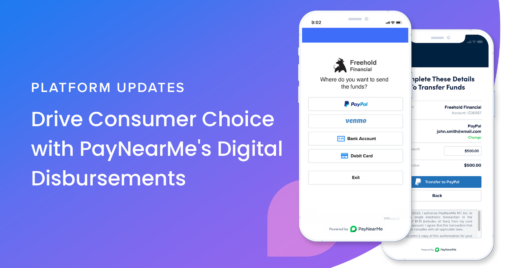

While the configurable nature of MoneyLine allows operators to pick and choose which withdrawal types they would like to make available in their cashier, it’s best to include various popular options to appeal to more players. In fact, 49% of bettors said they would play more and withdraw more often if they had access to their preferred withdrawal type, according to PayNearMe research.

The research also highlights how alternative payment options top the list of preferred withdrawal options for players. The survey found that more than half of bettors (57%) would withdraw funds via PayPal if given the opportunity. A quarter of the 18-34 year olds surveyed shared their preference for Venmo as a withdrawal option. This is evidence that convenient payout options play a crucial role in player retention and revenue growth.

Payouts are only as fast as an operator can process them. PayNearMe offers built-in, logic-based rules that help automate more of the approval process so payouts get to players faster. Additionally, operators can reduce fraud with automated checks and lower PCI compliance risk through specified workflows. Finally, logic-based business rules can help streamline and automate processes to lower risk and drive operational savings.

The benefits of digital payouts by PayNearMe

Beyond offering unparalleled choice for consumers, there are additional reasons operators choose to power their withdrawals through MoneyLine.

- Offer instant and same-day disbursement options: Payouts are near instant when sent via debit, PayPal and Venmo, and as fast as overnight with ACH. Cardless Cash at ATM offers same-day payouts.

- Consolidate vendors: Simplify onboarding and implementing new payment tenders with a single integration to the MoneyLine platform.

- Streamline back office operations: Fund all payout options with a single FBO account and develop rules to approve small dollar payouts and speed up delivery times.

- Fast and simple reconciliation: Improve reconciliation with quicker settlement times by clearing funds in minutes.

How it works: A technical look

- The operator provides player data to PayNearMe via API integration.

- The PayNearMe platform accesses key data such as past funding types, enabled push types, funding limits, funding rules and compliance and verification information and passes it back to the operator via webhooks.

- The operator receives the output of this collected data, including payment behavior and history, and the PayNearMe platform options adjust based on this information and any business rules in place.

- PaynearMe’s third-party partners provide address validation and bank validation at specified points during the payouts workflows.

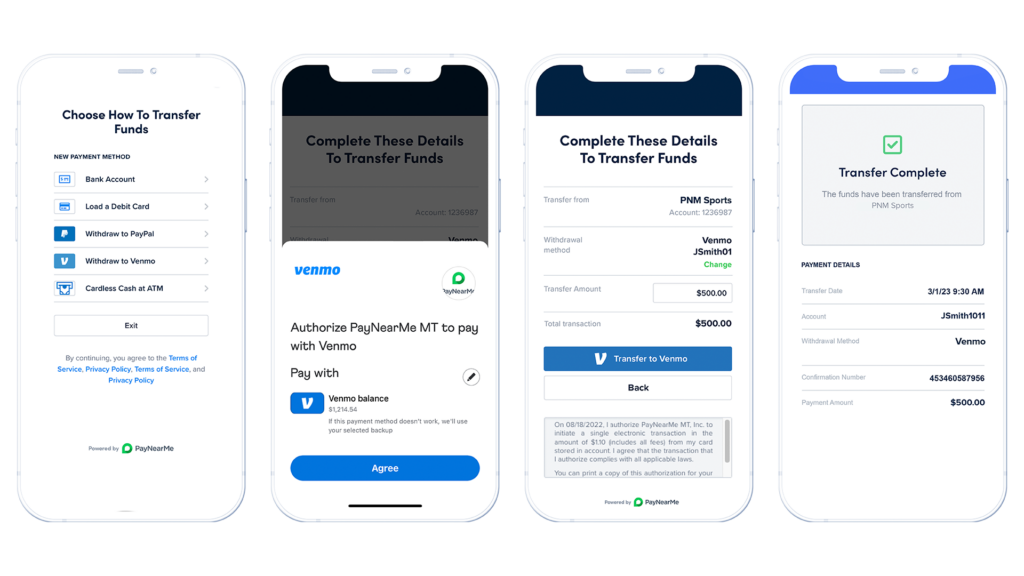

Payouts: Player perspective

From the player’s point of view, the payouts process looks something like this, though the flow depends on the payout method chosen.

The image above illustrates a payout via Venmo. As you can see, the process is quick and easy, with a withdrawal process initiated in only a few clicks.

Getting started today

To learn more about MoneyLine, contact our team or view an on-demand demo of the platform.