The Role of Cash in Internet Gaming

Currently, three states have legalized some forms of Internet-based, real-money gaming: Nevada, New Jersey and Delaware. In each, the decision to legalize was preceded by extensive debate, then followed by the creation of an extensive regulatory framework that tightly controls entry into the industry, and is intended to foster responsible gaming practices by both operators and players.

Because of the high level of regulatory scrutiny and other barriers to entry, only companies capable of complying with the regulations have been cleared to offer legal Internet gaming (otherwise known as “iGaming”).

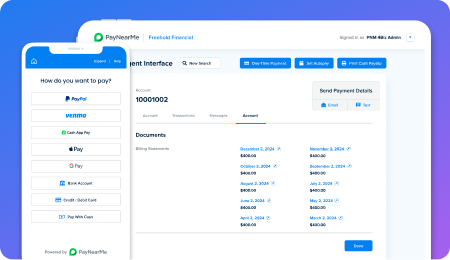

PayNearMe recently began working with iGaming companies who wish to offer their consumers the ability to fund their online accounts with cash. These transactions, where allowed by law, work in the same way that PayNearMe works when used to make a payment for rent, a loan, or an online purchase. This breadth-of-fit demonstrates both the ubiquity of cash and the adaptability of our platform.

Contrary to popular belief, as the Fed has observed, the preference for cash is not limited to those without a bank account or credit card. This is especially true in iGaming, where players prefer to use cash instead of linking their gaming accounts to their personal bank accounts; or where they don’t want to be tempted to borrow, as might happen with a credit card. Most consumers in the “real-world” prefer to play with cash; the same behavior exists online.

Read on to find out more about the iGaming industry, the role of cash, and how PayNearMe plans to operate within the space.

Who’s regulated – operators, third-party partners and consumers

Any entity that wishes to operate an online casino (an “operator”) must meet the strict requirements set forth by their state’s regulatory framework and be approved by the state’s regulatory authorities. Those authorities examine the background of the operator’s principals, their business plans, account opening procedures, funding mechanisms and the technology they intend to implement, among many other criteria.

Operators must demonstrate to regulators how they will prevent money laundering, underage or out-of-state participation, and problem gambling. Third-party service providers and merchant processors like PayNearMe that serve the licensed operators must also undergo strict regulatory scrutiny.

Every consumer who wishes to open an account with an approved operator must provide sufficient documentation to validate he or she is an adult, is located within the state in which the operator is licensed when gambling, and is not on any criminal watch lists. These checks follow stringent processes established by the regulators and are enabled by a range of technology and information vendors – all of whom must also be vetted and approved by the relevant regulatory authorities.

Only if regulators are fully satisfied can an operator commence operations. Few companies can meet these hurdles due to the high level of scrutiny and other barriers to entry.

The buck doesn’t stop at regulations

Once approved by regulators, operators face additional challenges. One challenge is how to enable consumers to fund the accounts from which they place bets. Credit cards have proven unreliable for a number of reasons:

In many cases, credit cards cannot be used to fund accounts because the card networks and/or the card-issuing banks won’t approve gaming transactions.

Most consumers are reluctant to link their gaming activity to card accounts because they prefer to not gamble on credit.

Credit card fraud represents a huge risk to operators so they prefer to offer payment options that are less prone to fraud schemes.

Most operators allow consumers to fund their accounts from a linked bank account. Not surprisingly, however, many consumers are wary of authorizing their banks to transfer funds directly to a gaming operator.

This is where cash comes in

As an alternative to credit, cash represents an ideal funding source for online gambling accounts because there’s no risk of fraud and no direct linkage to credit cards or bank accounts.

As the world’s only real-time cash transaction network, PayNearMe has been selected by many operators because our adaptable technology is well-suited to helping them enforce the parameters that are required as part of the strict framework that regulates the industry.

PayNearMe only serves consumers who have already been approved by the operators. Every time a consumer attempts to load their accounts using PayNearMe at a participating retailer, our system requires authorization from the operator to accept those funds.

Cash is accepted at the register only if the operator approves the individual payments, and only if the attempted transactions do not exceed our independent transaction limit of $500 per day. And because each transaction is authorized by the operators, underage gamblers and problem gamblers who have opted-out with the operators are barred from loading money.

Furthermore, operators notify consumers every time funds are loaded into their accounts. For this reason, if an underage player were to attempt to load an account with cash, the adult account holder would be notified immediately.

PayNearMe only processes account loads in the states in which doing so is permitted by law. Because we only accept cash, operators who use our network face no risk of fraud or chargebacks.

It remains to be seen how extensively consumers will adopt online gaming, and/or whether other states will follow the first three. As we work closely with a variety of reputable operators and regulators, we expect to learn a great deal about this relatively new industry. We look forward to helping operators meet the needs of their consumers in strict compliance with the law, just as we have in the other markets we serve.

As with all of our businesses, we remain extremely vigilant about how iGaming evolves both in and out of the legislative houses and will continue to adhere to our strict code of ethics and compliance.

For more information about PayNearMe’s iGaming policies, check out our FAQs.