The iGaming Chargeback Nightmare: How AI-Powered Fraud Detection Protects Revenue Without Blocking Legitimate Players

An industry-wide problem

From established global sportsbooks to emerging sweepstakes casinos, every operator faces the same threat landscape.

Fraudsters target betting platforms because they operate in high-volume, high-speed, high-value environments. They exploit deposit bonuses, stolen payment credentials and weak identity verification systems. Even prediction markets and social casinos—where real money isn’t directly at stake—are seeing increased fraudulent activity due to in-app currencies and digital wallets.

In this environment, reactive fraud management is no longer enough. Operators need systems that anticipate fraud, learn from data and defend revenue before disputes happen.

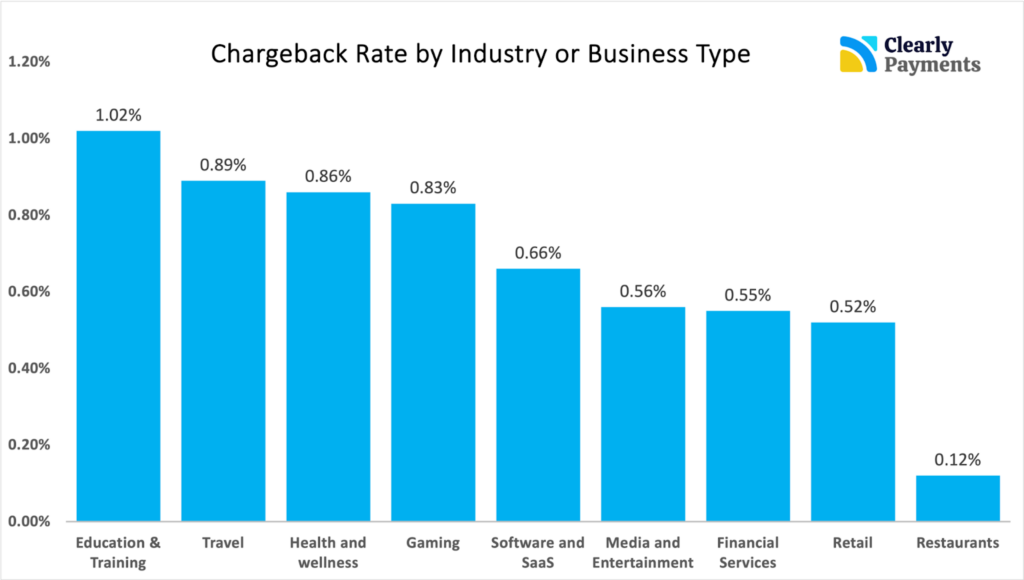

While this chart from Clearly Payments shows chargeback rates of .83% for gaming, Mastercard projects the global chargeback volume to increase by 24% by 2028—a concerning trend.

The rising cost of chargebacks in online betting

Chargebacks are an unavoidable reality in online betting—whether you operate a sportsbook, online casino or social gaming platform. Each disputed transaction represents more than just a single lost wager; it’s a costly chain reaction.

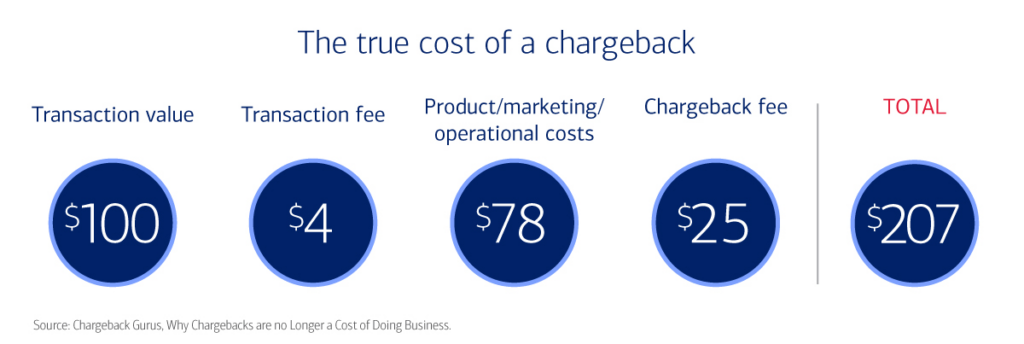

For every dollar lost to a chargeback, operators may pay up to three times that amount once fees, investigation time and lost player lifetime value are added in. A recent study from LexisNexis Risk Solutions states that merchants spend $4.60 for each $1 of fraud loss in a 2025 retail/e-commerce context. Chargeback Gurus put the gaming industry estimate around $2.07 for every $1 for chargebacks specifically, as outlined in the chart below. And that’s before you consider the brand and regulatory implications of high dispute ratios.

In a high-velocity industry where player trust and transaction speed are paramount, the chargeback problem is not just financial—it’s existential.

Why chargebacks hurt more than you think

A chargeback begins when a player disputes a transaction—often claiming they didn’t make a bet or deposit. The operator must then gather documentation, submit evidence and await resolution. Each case eats into operational bandwidth, compliance budgets and support capacity.

The hidden costs are even greater:

- Dispute fees and penalties: Issuers and payment networks charge $15–$50 per case, even when the operator wins.

- Processing and labor time: Investigating and documenting cases consumes hours from payments, fraud and support teams.

- Player churn: Players mistakenly flagged as fraudulent rarely return, and negative experiences spread quickly across social channels.

- Brand reputation: Frequent chargebacks can trigger acquirer scrutiny and harm licensing relationships.

In short, chargebacks drain money, resources and player trust—all at once.

Lurking operational costs compound the issue

Every chargeback ripples through an operator’s balance sheet. Beyond the obvious financial losses, chargebacks also skew key performance metrics:

- Customer acquisition cost (CAC): Fraudulent sign-ups inflate CAC and distort marketing ROI.

- Lifetime value (LTV): Legitimate players mistakenly blocked or alienated by poor support reduce average LTV.

- Operational cost-to-serve: Manual dispute resolution eats into operational budgets.

AI-driven chargeback management not only mitigates these costs but improves overall efficiency. By automating dispute handling and empowering support teams with data-rich insights, operators can redirect valuable human hours toward higher-impact initiatives, such as player retention and responsible gaming programs.

The false positive problem: When protection becomes a barrier

To stop fraud, many operators tighten risk rules or apply manual holds. But blunt-force prevention can backfire.

When legitimate players are wrongly flagged—what’s known as a false positive—they face declined deposits or delayed payouts. In a market where bettors can switch platforms in seconds, a single false block can mean a lost customer for life.

Overly aggressive fraud filters can be as damaging as the fraud itself. The result? Operators face a difficult tradeoff: protect revenue from chargebacks or preserve a frictionless player experience.

But what if technology could do both?

AI-powered fraud detection: The smart defense layer

Modern fraud isn’t static. Fraudsters test, adapt and exploit weaknesses faster than human teams can respond. That’s why leading operators are turning to AI-powered fraud detection—systems that learn from data patterns, not static rules.

PayNearMe’s AI-driven fraud prevention technology is designed to protect revenue without alienating legitimate players. Instead of relying on rigid velocity checks or blanket restrictions, AI models analyze behavior holistically:

- Device fingerprinting: Detects unusual patterns tied to specific devices or browsers

- Behavioral analytics: Flags abnormal betting or deposit behavior in real time

- Adaptive scoring: Continuously refines fraud thresholds based on emerging threats and verified player behavior

This means legitimate players experience invisible protection—fast deposits, quick payouts and uninterrupted gameplay—while fraudsters are quietly stopped in their tracks.

A better player experience

For players, the best fraud prevention is the kind they never see.

Invisible risk assessment ensures real bettors aren’t slowed by manual verification or rejected deposits. Whether placing a wager before kickoff or spinning a slot reel, the transaction feels seamless.

And when a legitimate dispute arises—for instance, a player’s card was compromised or they genuinely don’t recognize a charge—the operator can respond quickly and confidently, backed by transaction-level forensic data.

The result is a smoother, more trustworthy gaming experience—and a player who stays loyal instead of frustrated.

Empowering support and compliance teams

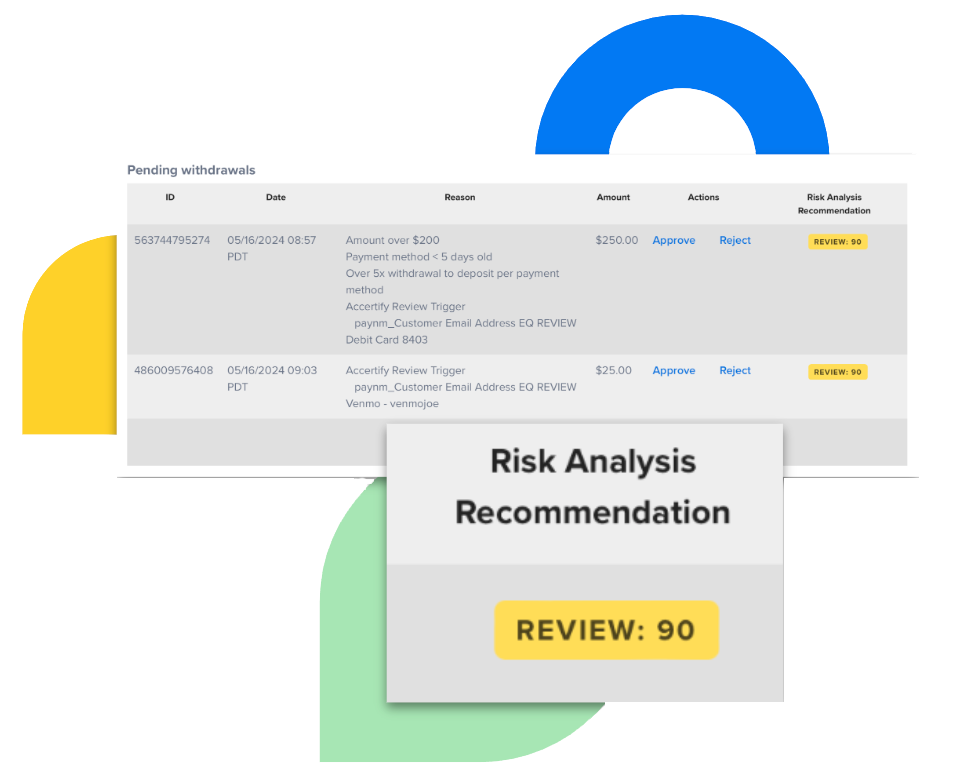

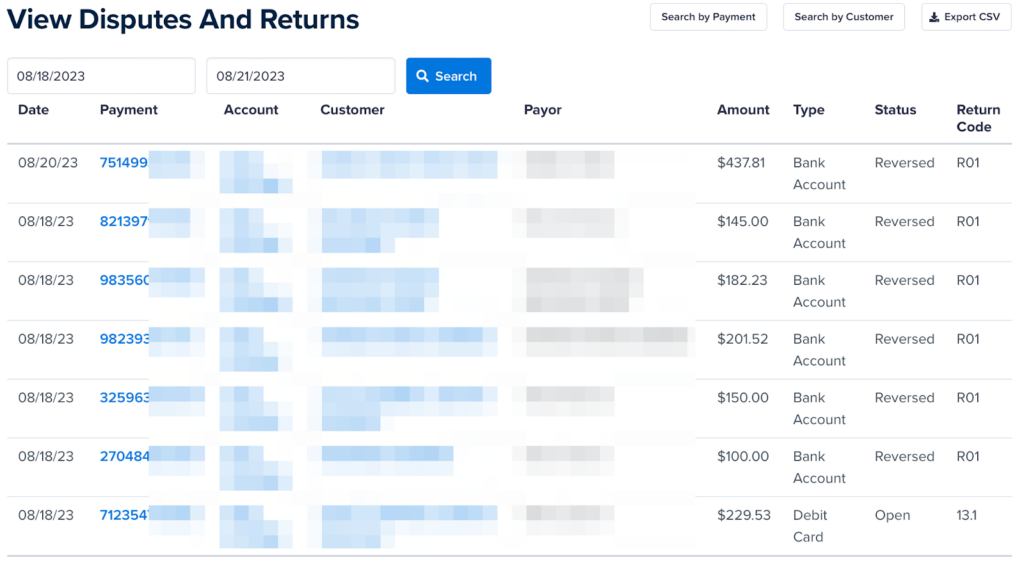

Chargeback management isn’t just about stopping disputes; it’s about handling them efficiently when they occur. PayNearMe’s chargeback features streamline every step of the process, giving operators long overdue visibility and control.

Key capabilities include:

- Dispute chargebacks directly in the platform: Manage chargebacks for all payment types without jumping between systems

- Real-time chargeback statuses via webhook: Teams always know when a dispute is initiated, updated or resolved

- Documentation and legal support: Expert resources help operators build strong cases and recover funds

- Operational efficiency: Clients report an 89% reduction in time spent disputing chargebacks—freeing teams to focus on growth, not paperwork

By centralizing chargeback operations and integrating real-time data, support agents can confidently address “I didn’t make that bet” claims with clear, evidence-based responses.

The PayNearMe advantage

PayNearMe is purpose-built around Payment Experience Management to deliver a truly modern platform for iGaming operators. Its integrated payments and chargeback management tools provide an end-to-end defense system:

- Seamless dispute workflows for all payment types

- Real-time alerts and webhooks for instant visibility

- AI fraud detection that reduces false positives and maximizes revenue

- Expert dispute support backed by legal and compliance resources

- Increased efficiency: Reduce a 45-minute chargeback management process to just 5

The result is a smarter, faster, more resilient fraud management ecosystem—one that protects operators and enhances player satisfaction.

The bottom line: protect revenue without losing players

The online betting industry runs on trust and immediacy. Every second a deposit is delayed, every dispute unresolved, and every legitimate player wrongly blocked chips away at that trust.

Chargebacks will always exist, but how operators handle them defines their competitive edge. The future of fraud prevention isn’t about more restrictions; it’s about smarter intelligence and seamless automation.

PayNearMe’s AI-powered chargeback solution ensures that protection and experience work together, not against each other. By making sophisticated fraud prevention accessible to all, empowering teams with forensic insight and streamlining dispute resolution, operators can finally escape the chargeback nightmare and focus on what matters most: growth, innovation and player loyalty.