Beyond Interchange: Three Ways for BHPH Dealers to Save on Processing Costs

When trying to understand your cost of accepting payments, the first place you’ll likely look is at the big, bold rate advertised on your merchant statement. It’s simple math that allows you to quickly see how much is coming off the top of each payment made. For this reason, many BHPH dealers get hung up on conversations about interchange rates and ACH fees rather than taking a holistic view of payments.

In reality, relying only on this approach misses the big picture and can cost you thousands of dollars extra each month. The true cost of accepting payments can involve dozens of factors, from additional software expenses (e.g. if you need to add a third party texting component) to the soft costs of employee time. The latter can add up in a big way, especially if your employees are spending their time on tasks that could be automated, instead of focusing on activities that can drive new revenue or reduce delinquencies.

Here are three ways you can use smart payment technology to lower your cost of accepting payments.

Automate Payments for Your Best Customers

While a lot of attention gets placed on the cost of collecting payments from delinquent or near-default customers, you can’t ignore the time and effort put into collecting from your most punctual customers. Every call made or received by your staff costs time and money, and there’s a real opportunity cost associated with spending extra time taking payments from your best customers.

Consider ways to identify and engage these customers with automated, self-service payments. For example, you could send a text message to your customers with a one-click payment link (such as a PayNearMe Smart Link) to encourage them to complete payments on their own. SMS messages cost a fraction of the amount of a live agent call and have near-universal acceptance, with cell phone adoption nearing 97% in the US.

Additionally, offering autopay at the time of the automotive sale or loan onboarding process can help automate payments from the get-go, taking a few minutes up front to save countless hours over the life of the loan. Coupled with smart reminders that alert customers when their automatic payment is going through, this tactic can help you receive more on-time payments and stabilize your cash flow.

Reduce (or Eliminate) In-Person Payments

For many dealers, cash and money order payments make up only a small fraction of your customer base—usually in the ballpark of 10-20%. However, these payments can be some of the most difficult and expensive to process. Think about all the barriers in place that make in-person payments so difficult:

- Payments can only be made during your business hours, which may be the same as your customers’ working hours

- Payments must be collected, processed and verified by a cashier, preventing that staff member from engaging in other activities (such as selling on the lot or making outbound collections calls)

- You may have added costs for security if you’re holding onto a significant amount of cash, especially on busy payment days (i.e. a Friday or at the beginning of the month)

- Customers often have to make two trips—one to withdraw cash or money orders, and another to pay you

- You or your staff have to make separate trips to the bank to deposit the funds into your account

- You need to manually reconcile the payments separate from your electronic transactions

The list could go on.

The simple solution to these challenges is to redirect cash payers to a third party, such as using PayNearMe cash barcodes at local 7-Eleven, CVS and Walmart stores. This can be more convenient for your customers, often giving them 24/7 access to make payments at dozens of locations near their homes.

For BHPH dealers, these payments are then digitized and sent directly to a bank account, eliminating the need to accept, store or transport cash from your lot. As an added bonus, cash payments with PayNearMe are guaranteed, meaning they cannot be charged back or returned after the transaction has been completed. This makes cash with PayNearMe an appealing option for customers with a history of insufficient funds errors or card chargebacks.

Simplify Your Back Office Activities

As you continue to add new payment types and channels, the way you reconcile payments needs to adapt. Many accounting departments now need to pull files from multiple systems, along with manual reconciliation efforts for offline payments such as cash, checks or money orders.

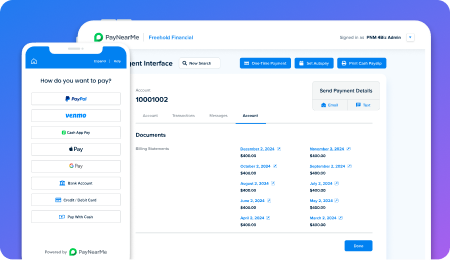

Offering all or most of your payment types in a single platform can help reduce the number of hours spent on reconciliation while making it easier for your finance and accounting teams to automate many of the associated processes.

This can be made even simpler with a smart platform like PayNearMe, which allows configurable file exports to manage complexities around payment types, fees, chargebacks, returns and more. By giving your team better data with more flexibility, you can drastically reduce the time and effort required to reconcile all your payments each day, week or month.

PayNearMe for BHPH Dealers: A Smarter Way to Accept Payments

PayNearMe gives buy here pay here dealers better tools to collect and manage payments, helping you save money across your business. Whether you’re using our reminders and Smart Link technology to drive self-service or our cash at retail option to eliminate in-person payments, PayNearMe has the tools you need to grow your bottom line.

Want to see more? Request a personalized demo today, or view our instant walkthrough.