Entering the Social & Sweeps Casino Space? 5 Things to Consider

As the online betting world continues its rapid expansion, we’re watching a booming new digital gaming vertical—social and sweepstakes casinos—begin to appeal to more and more operators. The reason isn’t difficult to see: the low-stakes, fun and colorful games are attractive to players who are new to online gaming, and the unregulated market is attractive to operators who may also be new to online gaming.

This means there are a lot of operators reaching for a piece of that pie, and they’re doing it as quickly as possible. But how big will the pie get? How many flavors of pie will there be? Will all the pie get eaten before it goes bad? (These are pie metaphors for asking how long player demand will increase, how many different varieties of sweeps games will emerge, and—most importantly—will the sweepstakes market become regulated, making it more difficult to join.)

PayNearMe can’t answer every one of these questions, but we can help with another: what should operators be considering before starting a social or sweeps casino, or expanding their current online gaming business into that space?

1. The legality of their concept

The reason that social and sweepstakes casinos remain unregulated is the very specific way they operate: with technically no real-money gambling (social casino customers play with Gold Coins and can purchase coin packages), or with the ability to participate in sweepstakes promotions with no purchase necessary (where social casino players acquire Sweeps Coins as a bonus with purchased Gold Coin packages, and can redeem those Sweeps Coins for real prizes).

Many operators are jumping into the space as quickly as they can with a game or sweepstakes concept that will differentiate them from the growing crowd, but their haste may result in a concept that could land them in hot water with regulators and have them turned away by partners—especially financial institutions. This is why it’s crucial for operators to consult with a legal team that specializes in gaming compliance and get a legal opinion in writing. While speed to market is enticing, cutting this corner will likely end up slowing operators down in the long run (but we’ll get to more on that later).

2. The risks of entering a “hot” market

All eyes are currently on the social and sweeps space—even the eyes that operators don’t want. Digital fraudsters are increasingly focusing on online betting sites and mobile applications, with the U.S. gaming industry experiencing the highest rate of digital fraud in 2023 at 10.9%, according to a new study from TransUnion. Fraud—and the subsequent chargebacks— will continue to be a challenge for operators, especially those who are new to the industry.

When bad actors catch wind of a new and vulnerable market segment, they’re going to act (badly) while it still remains vulnerable. It’s not hard to notice how many startups exist within the social and sweepstakes vertical, and it’s easy to assume they may not have sophisticated risk and fraud prevention technology in place (yet). Noticing a trend here? Speed to market can be a double-edged sword.

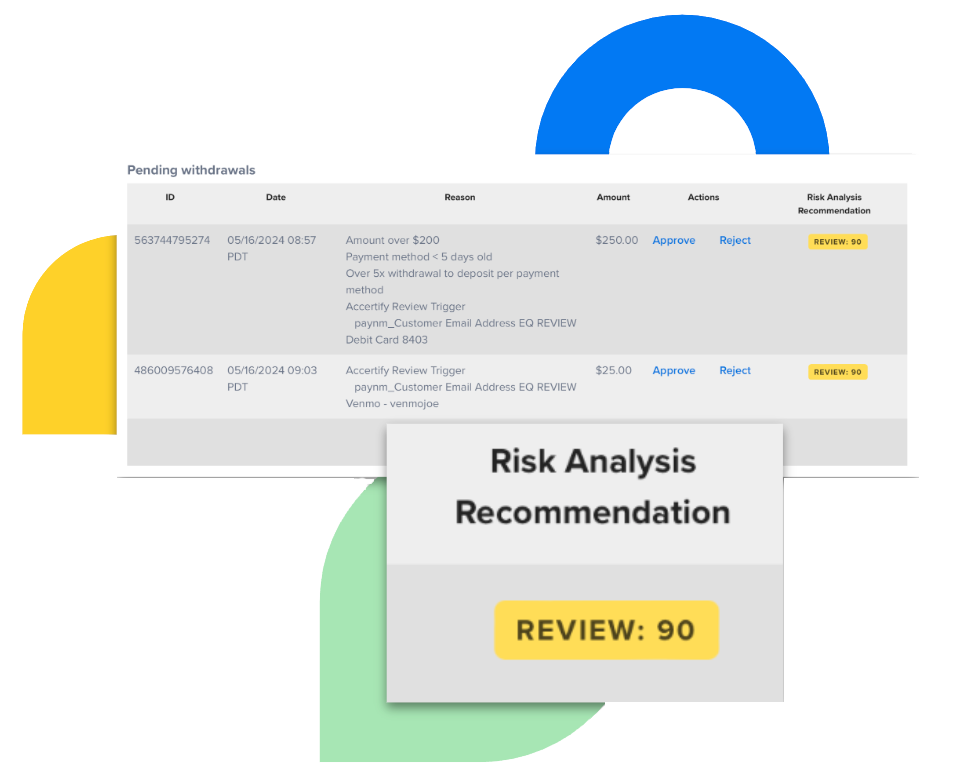

While operators may try to address the problem by simply hiring more staff for risk and fraud teams, it’s a cost-prohibitive and unscalable solution. Operators should turn to their technology vendors for fraud support as an alternative to adding headcount to their risk teams, but they need to align themselves with the right partners that have in-depth knowledge of the gaming industry and the tools in place to protect the operator while providing a safe experience for players.

3. The ways to expedite your time to market

Speaking of speed to market, it’s something that’s top of mind for most social and sweepstakes casino operators. So what’s slowing operators down, and how can they avoid these common pitfalls?

Unsurprisingly, a lot of it stems from compliance. As we mentioned earlier, a legal opinion is a must—especially when operators are enlisting the help of third-party technologies that will need to onboard them. From a payments compliance standpoint, a complete compliance package is needed for legal review, and a written legal opinion is a vital part of that. It takes a good deal of time to secure the letter—not to mention money—so planning ahead is critical.

The legal opinion must be dated within the last 12 months, and operators should make sure it’s addressed to the payment processor they’ll be partnering with, and should list the states they’ll be conducting business in as well as any state restrictions. The legal opinion also must address federal law in addition to state regulations. Having a solid written legal opinion that fits these requirements is crucial; if it gets rejected and needs to be redone, operators can anticipate at least a three month delay in going live.

Other items to consider include an anti-money laundering (AML) audit and documented geolocation/age-verification measures. An AML audit is a thorough review of a company’s AML policies, procedures and compliance practices to determine an operator’s preparedness in preventing money laundering. The AML policy should cover the four basic pillars of compliance, and one of the things it must include is a schedule for third-party review of the policy and its effectiveness. Operators should have, at minimum, an internal AML audit conducted, but a third-party audit will even better solidify their AML requirement when working with financial institutions.

Geolocation and age-verification controls audits are not currently required for social gaming, but some banks will still want to see these measures in place. Securing independent compliance testing or a controls audit from a service such as GLI will help operators speed through the documentation process—and be prepared for the possibility of future regulatory requirements. Having this documentation prepared early is even better, as these audits are often a lengthy process.

4. The benefits of a PAM that understands

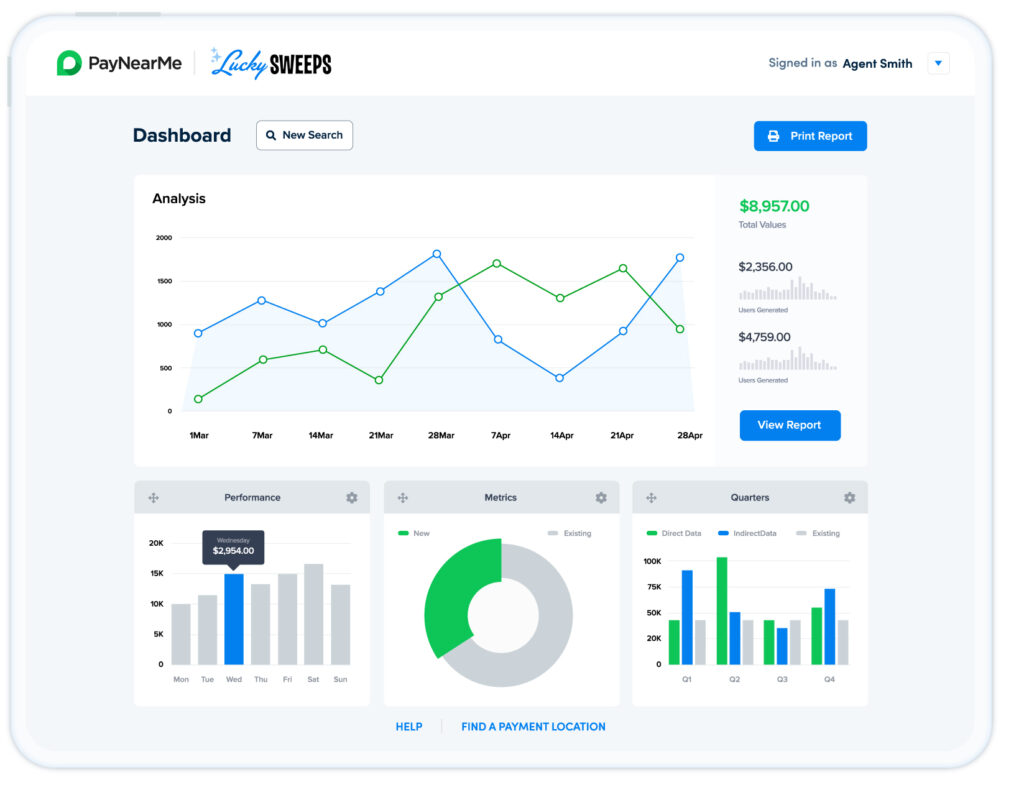

Player account management (PAM) platforms are a huge asset to operators who want to go live quickly. Operators should seek to align themselves with a PAM that has expertise in the social and sweepstakes space, prioritizes best-in-class products, and embraces the latest technologies to deliver great customer experiences. It’s also beneficial to find a PAM that’s forward-thinking in their ability to analyze data, as the insights operators receive from player and payment data can help improve the overall player experience and strengthen an operator’s acquisition and retention tactics.

When operators have the right PAM in their corner, they gain quick access to those technologies and drastically reduce implementation time and costs. Plus, a PAM’s expert team can help navigate the trickier aspects of going live—and doing it the right way.

5. The perks of a modern & diverse payments stack

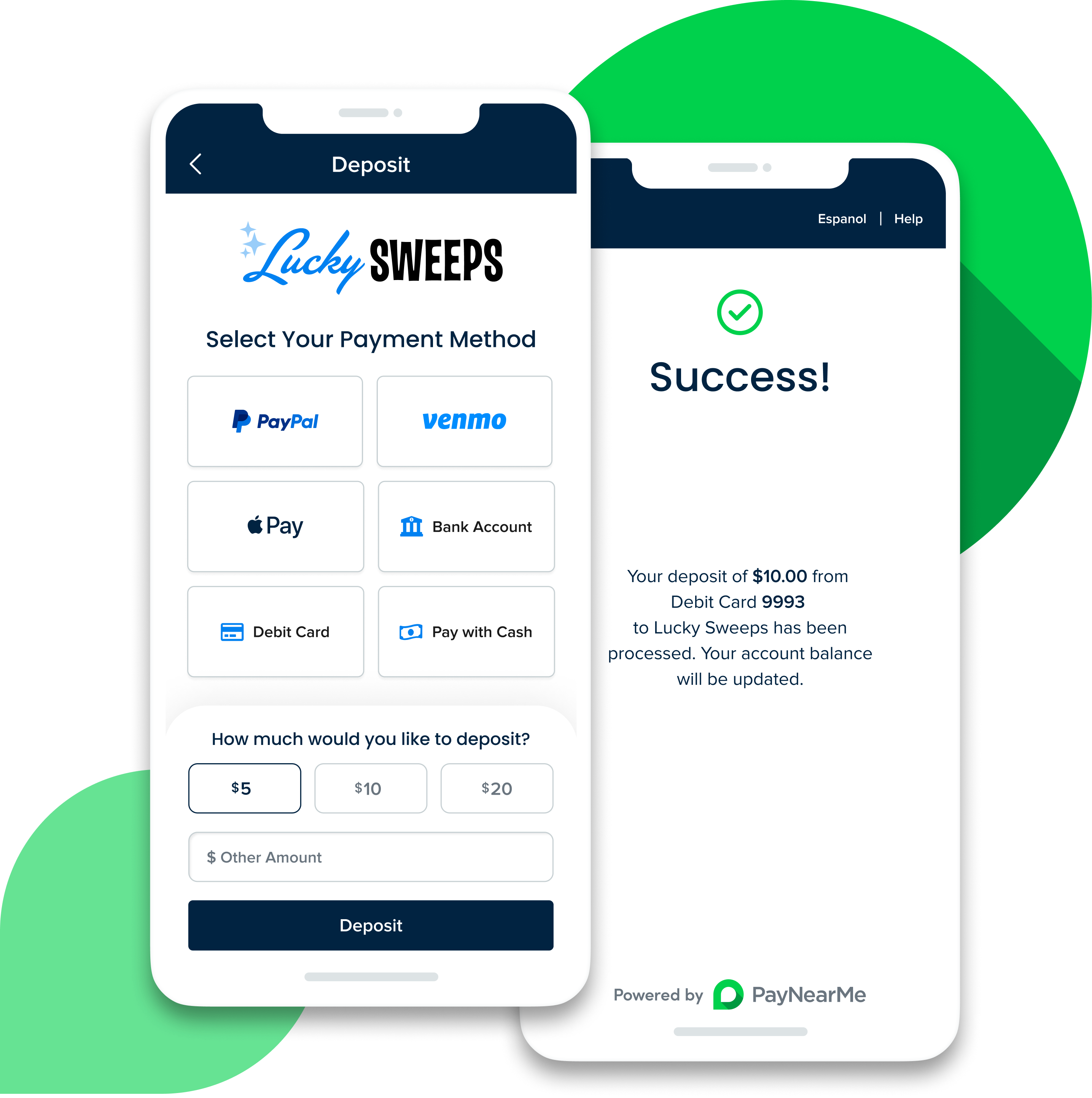

Outdated payment tech stacks are a problem. Social gaming and sweepstakes casino operators often only accept cards and online banking as payment options, or they’ll accept payments through an app store that takes a decent cut of their revenue. Research has shown that 52% of online bettors would make deposits to their app of choice more often if they simply had access to their preferred deposit method. The same research also revealed that PayPal, Cash App, and Venmo were all highly in-demand deposit methods, and that demand is growing.

If operators aren’t currently offering the most preferred deposit and withdrawal methods for players, they risk losing those players to a competitor. For instance, 49% of surveyed bettors stated that they would abandon an app or site for a competitor if they promised faster withdrawals. Players have rising expectations of the payment and payout process within their gaming apps of choice, and operators shouldn’t ignore these expectations.

It’s imperative that operators choose a payments partner with experience in the gaming industry, especially with social and sweepstakes gaming. The right payments partner will understand the specific risks of the category and have the technology in place to streamline the user experience—boosting player satisfaction and retention—while future-proofing operators with the most modern and in-demand deposit and withdrawal methods. In addition, these partners will address the growing fraud problem with tools that safeguard operators and players alike, protecting revenue.

Luckily, the MoneyLineTM platform powered by PayNearMe has all of these capabilities and more.

Trust the MoneyLine platform for iGaming payments

PayNearMe’s MoneyLine platform gives social casino and sweepstakes operators a complete deposit and withdrawal solution that maximizes your revenue by boosting player satisfaction, lowering conversion costs, improving reliability and future-proofing your business. With built-in risk and fraud tools, payment data insight tools, processing redundancy and more, MoneyLine goes beyond a basic payment gateway to lower the cost of business operations while safeguarding players.

To learn more, contact our team or request a platform demo.