COVID-19 Payment Trends

When Utility Bills Get Paid

-

Outside the 9 to 5When given the option to make cash payments 24/7, more than 41% of utility bills were paid outside the standard M-F, 9:00-5:00 hours.

-

Weekend WarriorsA significant number of utility bills (23%) were paid over the weekend, showing that weekdays may not be ideal for all cash payers.

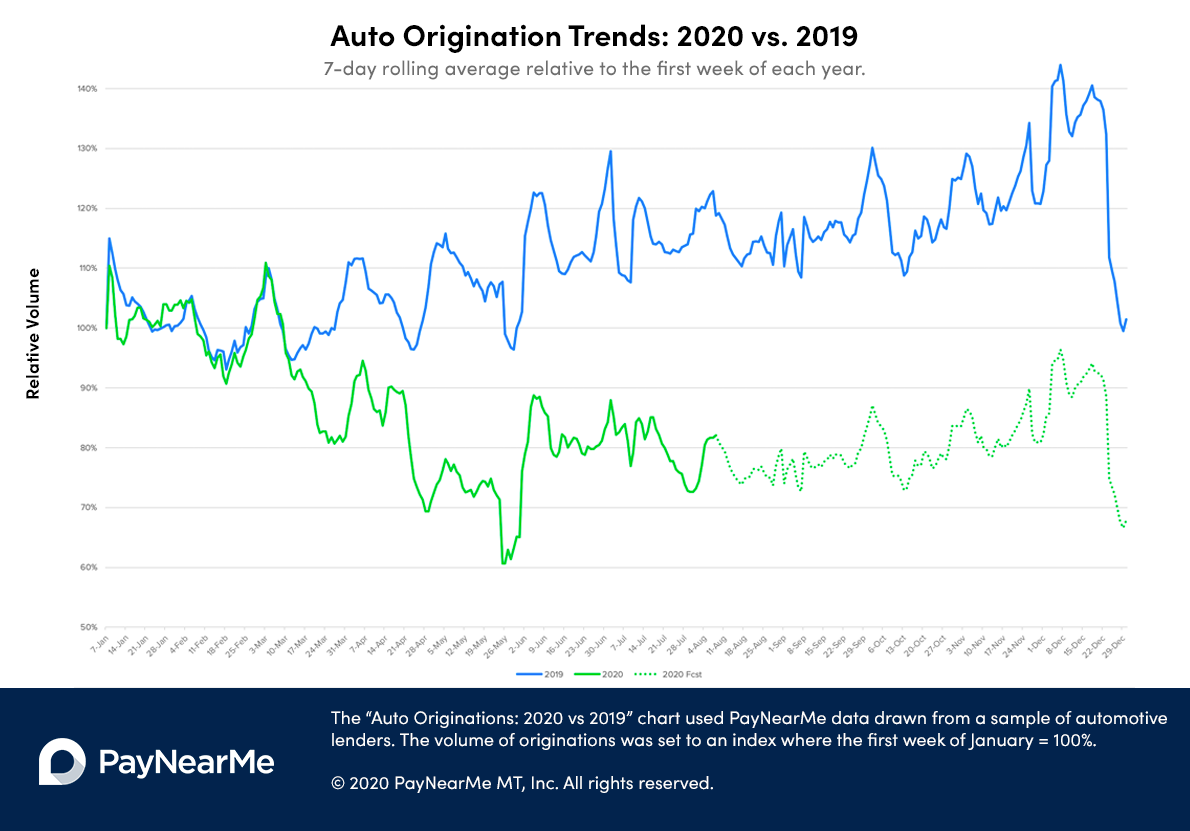

Auto Loan Origination Trends Compared

-

Loan Originations Level OffWe saw a steep decline in auto originations from mid-March through the end of May, with a mild recovery occurring over the summer months.

-

Annual Trends Appear the SameDespite sloping in different directions overall, this year's origination trends look to mimic the boom and bust periods of 2019, giving us a glimpse of what could happen in the rest of 2020.

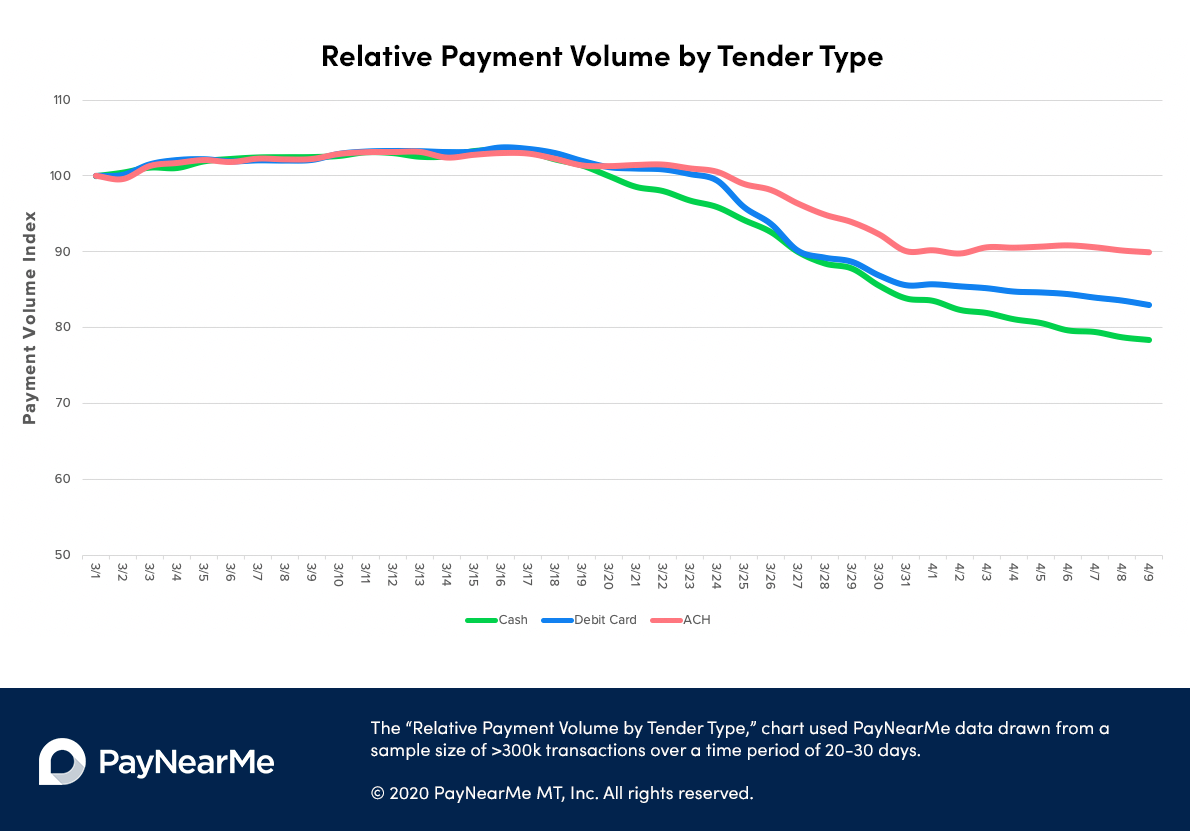

How Payment Types Have Fared in Auto Lending

-

The Stability of ACHOf the three main tender types, ACH payments have remained the most steady for auto loan repayments—possibly due to their prevalence in autopay.

-

Cash Remains ImportantCash payments persisted, suggesting their necessity in spite of social distancing and shelter-in-place mandates.

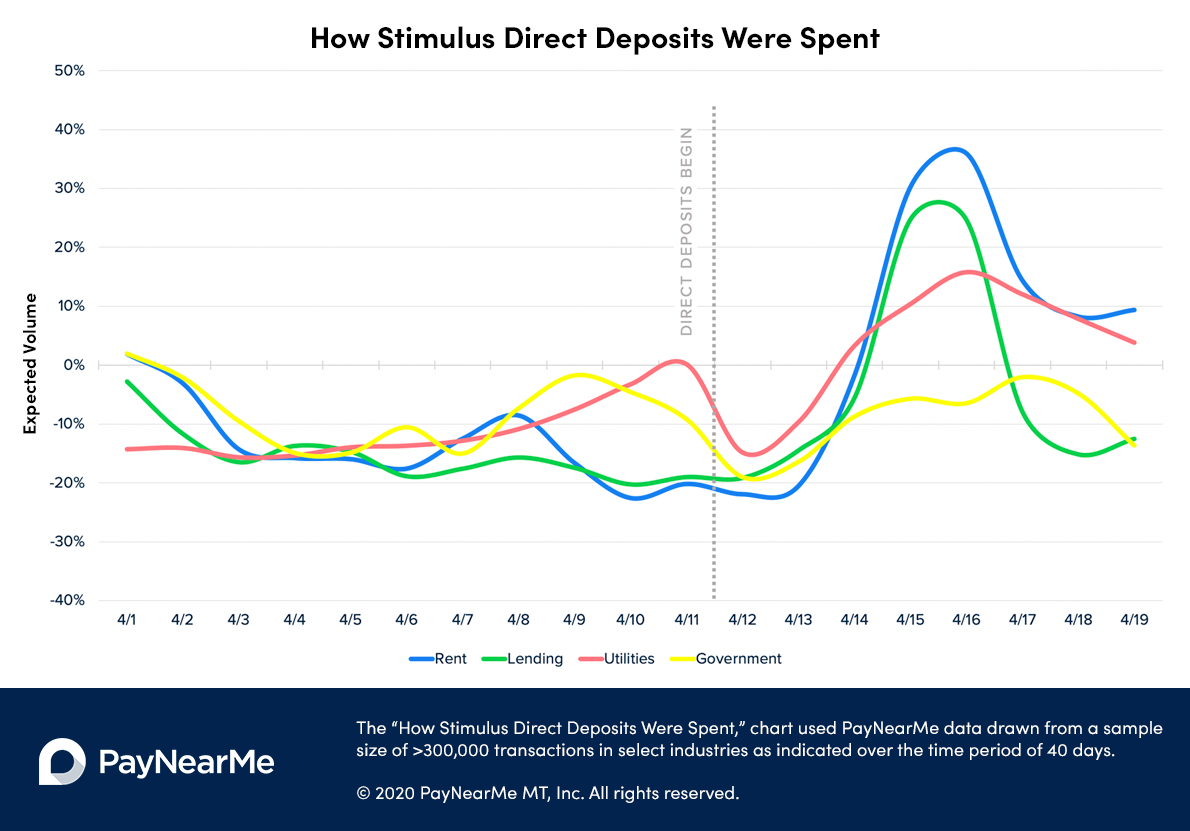

How Stimulus Direct Deposits Were Spent

-

Rent and Loan Repayments See a Big JumpThe largest share of payments were for rent and the repayments of auto & personal loans, with a small bump in utilities.

-

Government Payments Remained Below ExpectationsAfter direct deposits began, payments to the government (e.g. child support) through our network remained slightly below expectations.

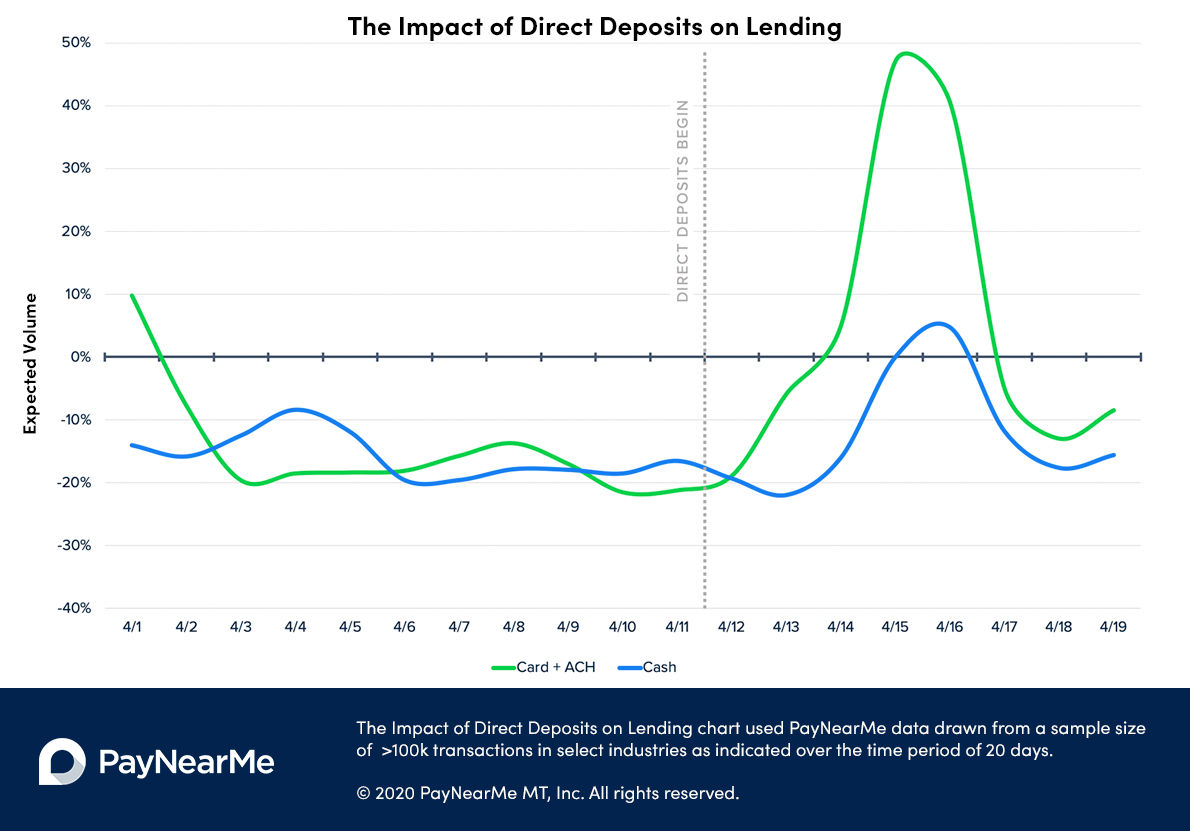

The Impact of Stimulus Payments on Lending

-

Direct Deposits Drive Electronic PaymentsDebit card and ACH payments skyrocketed to nearly 50% above expectations days after the stimulus program direct deposits began.

-

Cash Payments See Modest BoostCash payments saw a modest bump, as some consumers may have converted their direct deposits into cash. For the unbanked and those without electronic deposit, we believe total impact from the stimulus program can not yet be seen.

Hear the breakdown on the AFSA Extra Credit Podcast

*Analysis of a statistically significant sample of millions of bill payments made by U.S. consumers through the PayNearMe network between March 1 and April 17.