Cash is Still King: Why Billers Should Provide Digital Opportunities for Cash Payers

Bill payment is now predominantly digital; typically limited to the traditional options of ACH or card payments. Yet many consumers still prefer to pay in cash. How can lenders and billers better serve those customers, and why is it important?

The short answer: to increase on-time payments, it’s critical to make bills and loans easy to pay, and meet customers where they are.

That means enabling their preferred payment types—including cash. But as brick-and-mortar locations continue to fade away, so does the cash payment option for those who want or need to pay bills that way, including unbanked individuals.

While it may seem contradictory in a world gone digital, cash is still going strong. According to the Federal Reserve’s report on consumer payment choices, cash was the third most-used payment type in 2023. The study found that people made an average of 46 monthly payments, and seven of those were in cash.

PayNearMe is seeing that trend as well. In the past few years, our research into payment behaviors has revealed that a considerable number of consumers still want to pay bills with cash.

For lenders and billers, supporting only digital collections may increase the risk of delinquencies, and make it harder to compete for new business. Here we’ll look at some key trends in cash preferences—and more importantly, how billers can meet the need without the expense or risk of opening more offices or hiring more staff.

Cash is preferred by low-income and older consumers

The Fed’s report identified that low-income individuals and those age 55 and older lean toward cash. For example, households earning less than $50,000 a year use cash for more than a quarter (28%) of their payments. That’s more than double the cash usage of households with income over $50,000.

Older generations also demonstrate this preference. Consumers aged 55 and up used cash for 22% of their payments, significantly more than younger consumers who used cash only 12% of the time.

In the context of the report, cash payment was primarily for retail shopping and random spending. But it’s reasonable to expect those same consumers may prefer to pay bills and loans with cash as well. However, that option is rarely available—and that could influence their choice of providers and their ability to pay on time.

Also consider that these demographics may be an audience for subprime, non prime or small loans that make up the portfolio of certain lenders. Finding a solution to meet their cash payment needs may be critical for some companies to remain profitable and attract new borrowers.

Consumers want to pay cash at retail locations

Traditionally, if consumers want to pay a bill in cash, the biller must have a local, brick-and-mortar branch. This requires payers to make time to get to that location during business hours, which may be tough around their work, school or child care schedules. Along with competing demands for their cash flow, the time and distance constraints can lead people to delay or skip payments.

But what if they could pay a bill or loan in cash at stores they already frequent (and are open up to 24 hours), such as Walmart, CVS or 7-Eleven? And would consumers want that?

The answer is a resounding ‘Yes.’ In PayNearMe’s 2024 consumer survey, among those who pay some or all of their loans with cash, a whopping 84% consider it very important or important to be able to pay with cash at a retail location during checkout.

One PayNearMe client, You Drive Auto, reported that they had a customer drive 80 minutes twice a month to make their payments with cash in-person. When they partnered with PayNearMe to offer cash at retail payments, the customer was thrilled that they could simply go to their local 7-Eleven to make the same payment, saving them time and money.

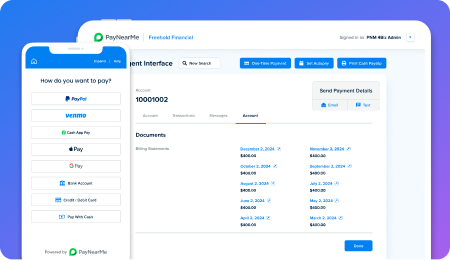

With a modern payments platform like PayNearMe, billers can offer a full range of digital payment types, including an option to pay bills in cash at over 62,000 locations with top retailers across the country.

Consumers are keeping cash balances in digital wallets

Another dimension that has transformed how consumers think about cash payments is the rapid rise of peer-to-peer (P2P) mobile payments. Digital wallet apps like PayPal and Venmo have made it so easy to send and receive cash between family, friends and vendors that many consumers now store cash balances in the apps for future use.

It’s the closest digital equivalent to paying in cash, and now preferred by many consumers for bill payment as well. PayNearMe found that nearly 60% of people surveyed would be very likely or likely to pay their loans with digital wallets.

In our 2023 research, we found that more than half of consumers store money in digital wallets, often $100 or more at any given time. Among apps, PayPal is the most popular, with Venmo, Apple Pay and Cash App Pay also widely in use.

Another important factor is how digital wallets support unbanked consumers. We found that one-third of individuals surveyed store cash in wallet apps. And that number could rise, given 55% of those users said they don’t link their wallet apps to any external funding source, even a prepaid card.

Whether low-income or digital natives, we’re seeing whole generations growing up using mobile wallets to store funds and pay instead of using a bank account (even if they have one). Forward-thinking billers and lenders will want to capitalize on that, as it is expected to become a predominant way consumers prefer to pay.

Simplify digital transformation to serve cash payers

Until recently, modernizing the payment experience has been a lower priority for many lenders and billers, but rising trends in consumer bill pay are changing that. An increasing reliance on digital wallets and a persistent desire to pay via cash underscores that people want more flexible options than bill pay typically provides.

To improve their bottom-line, organizations must prioritize meeting changing consumer expectations. The right fintech partner can make it easy to deliver a range of digital payment options—that can also satisfy cash-payers—in a cost-effective, self-service user flow. And it can satisfy billers with the opportunity to improve acceptance rates, while reducing costly manual work and exceptions.

Learn more about how PayNearMe can help lenders improve their bottom line. Click here to view an instant, on-demand demo.