In an industry where flashy casino games and high-adrenaline sporting events are the main attraction, a back-end component such as payments can go overlooked. As long as transactions are getting processed, online gaming payments are doing what they’re supposed to be doing—right?

Unfortunately, hyperfocusing exclusively on a “cost per transaction” approach to payments has led many operators astray. Best practice has given way to tunnel vision, where the surface level cost of a transaction has dominated decision making around payments strategy. Prioritizing the cheapest rail or the most widely adopted channel may shave a few basis points off your rate, but this approach creates hidden costs that quickly evaporate margins and produce operational headaches.

In reality, the cheapest payments may lead to the most expensive outcomes. Factors such as exceptions, fraud, player churn and operational complexities drive up the total cost of acceptance drastically—and are often hidden from the monthly transaction report.

But what if many of these costs and risks could be avoided?

In this white paper, we’ll explore a range of factors that drive up the total cost of acceptance—caused by a poor payment experience and disjointed technology systems. By the end of this paper, we aim to make the case that a new breed of modern payments platform can address these challenges and reduce the cost of managing and processing payments.

Key takeaways

- Your total cost of acceptance includes more than just transaction fees. Transaction fees are often the most visible expense, but the real costs of accepting payments include less obvious factors incurred by exceptions. Often overlooked cost-drivers include insufficient fraud protection, limited payment options, a poor user experience, operational inefficiency and downtime due to outages. These less obvious cost drivers can significantly erode profitability.

- A customer’s deposit or purchase success is highly correlated with the payment experience. Preventable exceptions—those that emerge from a customer’s choice to follow through with a deposit or purchase, rather than the result of a technical error—are largely driven by a poor payment experience. These exceptions can be mitigated by optimizing the payment experience to provide the right mix of ease and choice for a wide range of customers.

- Fragmented systems are the root cause of a poor payment experience, and a primary driver of higher acceptance costs. Outdated or disjointed payment integrations often fail to meet today’s consumer demands for flexibility and convenience while also adding back-end complexity. As a result, they generate more exceptions—such as player abandonment, returns and chargebacks—and increase the need for manual intervention, leading to higher overall payment costs.

- A modern and comprehensive payment platform solves the biggest problems impacting total cost of acceptance. By enhancing the payment experience and driving down preventable exceptions, you’ll be able to see ongoing efficiency gains and lower costs. A modern platform enables you to drive down costs by making it quicker and easier for customers to deposit funds and receive payouts, with minimal intervention or player abandonment. This leads to significant cost savings and efficiency.

The status quo transaction fallacy

Payments have undergone a transformation in recent years. Consumers have adopted new payment methods, digital payment channels have proliferated, and new points of failure have bubbled up with each combination.

These new variables have created complexity for operators focused on driving down the total cost of acceptance. A fantastic bonus offer or promotion may have led to customer conversion in the past, but today something as simple as a poor mobile app experience can cause the most willing and able bettor to abandon a deposit and move to a competitor.

Much of the blame for a poor payment experience can be placed on the once-standard reliance on multiple, disjointed payment technologies. Operators once raced to integrate any and all payment methods, resulting in technology “bloat” that cultivated inefficiencies. These disparate systems have failed to meet the changing needs of operators and customers, creating friction and rigidity in the payment experience. Plus, operators in the current, more mature market are now facing pressure to improve operating margins while streamlining and optimizing payments—for both themselves and their customers. Fragmented systems are holding operators back for two key reasons:

- One-size-fits-all payment strategies don’t work.

Failing to offer each customer the right payment options to increase their ability to make a deposit and stick with one app can lead to exceptions and abandonment. Systems built to offer one or two payment options can’t account for the rapidly changing expectations the industry is facing. On the opposite end of the spectrum, platforms with an overwhelming amount of payment options can be confusing. A new customer looking to make their very first deposit might have different needs and preferences than a frequent bettor who is comfortable with the deposit experience. Without optimizing for the right payments mix, operators are risking increased customer abandonment at the deposit or purchase stage. - Exceptions are anything that prevent a completed payment, requiring intervention and increased cost of acceptance.

Old definitions no longer apply to the current online gaming industry. Exceptions go beyond returns and chargebacks, including any payment interaction that requires a manual intervention above and beyond a straight-through process.

This may include issues like login problems that increase customer support interactions, glitches linking a payment method, or a clunky payments UX that drives a player to abandon a deposit effort entirely. Each exception is exponentially more expensive to remedy than the cost of a successful payment and can lead to monumental losses in terms of customer lifetime value.

A belief that these challenges are simply the cost of doing business leads to a string of decisions that can negatively impact the cost of acceptance.

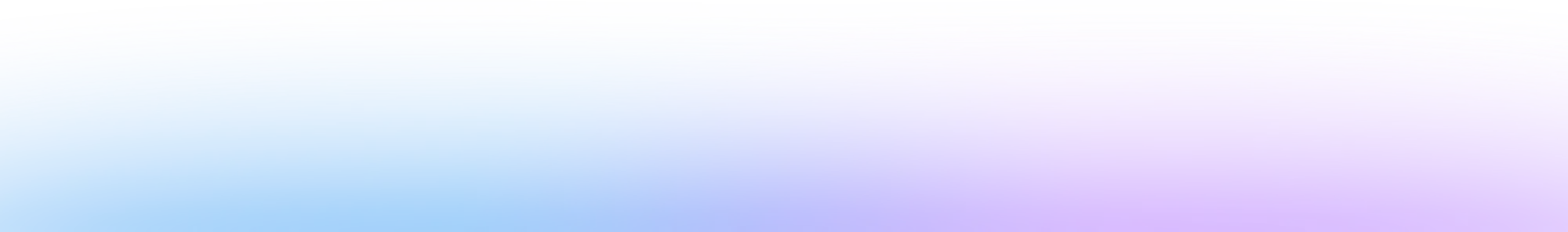

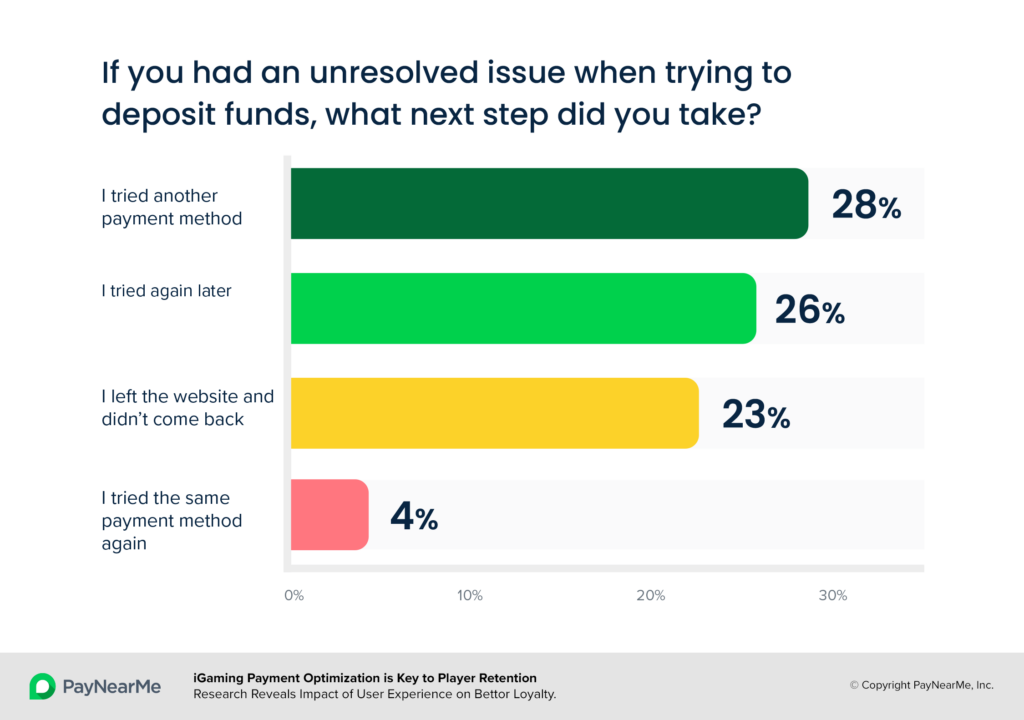

For example, cards and online banking were the traditionally-offered payment methods for the online betting industry. While acceptance rates for cards have risen for gaming transactions in recent years, there’s still a significant chance for declines, especially with tightening risk and fraud rules. There’s also the chance of repeated declines after the first occurs; PayNearMe research found that 27% of customers would try the same payment method again after an initial decline.

Even if a customer doesn’t try the same card again, the decline could have an even more significant long-term cost. The same PayNearMe research showed that 23% of customers would leave a betting or gaming platform and never return after experiencing a decline, costing an operator the lifetime value of that customer.

And then there’s the ever-present chargeback problem. Chargebacks cost much more than the actual returned payment amount once an operator factors in a potential increase in network fees; the operational costs of a risk team reviewing, fighting, and processing chargebacks; and the associated penalties. In fact, the total cost of a chargeback is about two times the cost of the initial charge itself, making a $100 chargeback ultimately cost a business $207. Multiply that by an operator’s typical chargeback rates, and you have an expensive problem.

Similarly, while online banking transfers are a widely-accepted and long-standing payment option in the online gaming industry, these payments can incur a significant amount of risk and hidden cost. The risk of non-sufficient fund (NSF) declines is high with traditional, non-guaranteed online bank transfers, as the delayed settlement can allow a customer’s bank account to become underfunded before the payment settles. Because of this, many operators opt to solely offer a guaranteed online banking payment option, also known as guaranteed ACH. Online banking with guarantee means that operators receive immediate confirmation of a customer’s fund availability, greatly reducing the chance of returns due to insufficient funds.

The bottom line is that the online gaming industry’s traditional or “status quo” payment methods are no longer going to be enough, and the chart above proves it. 34% of survey respondents stated that they’d try another payment method if they experienced a decline on a gaming app. If that customer doesn’t immediately see another tender type they’re familiar with and use regularly—whether it’s card, PayPal, Apple Pay or even cash—that customer may no longer be willing to pay.

Make no mistake: continuously optimizing your payments mix is highly complex and is often a moving target. But the costs of getting it wrong are an even bigger problem in the form of increasing exceptions, player dissatisfaction, support costs, staff intervention, and other issues.

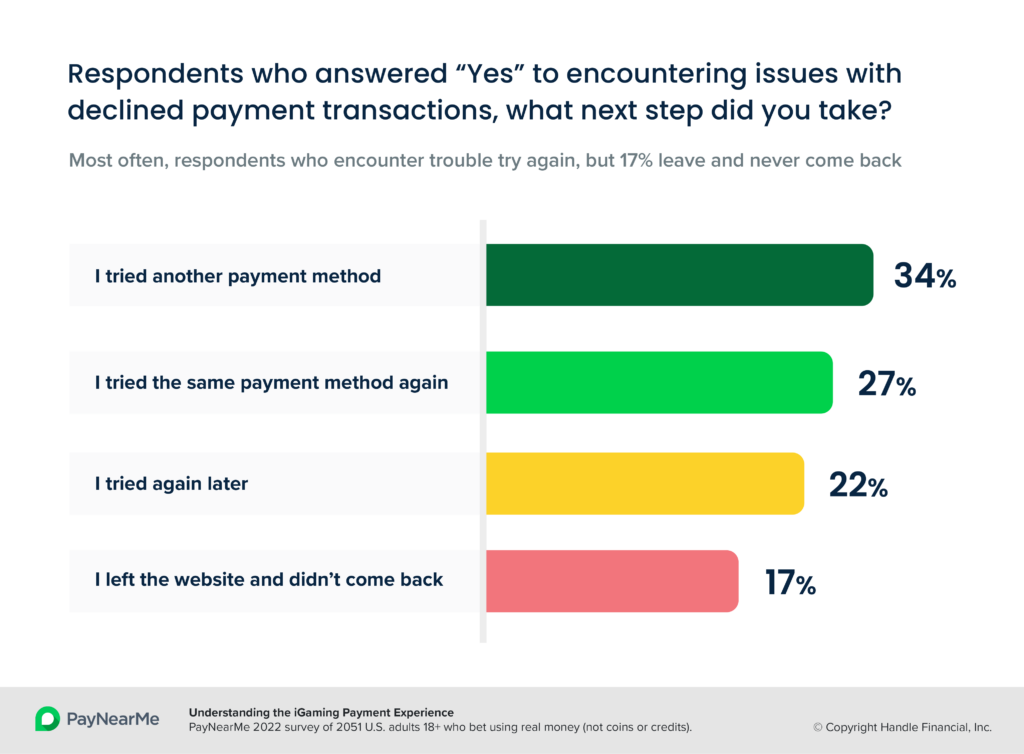

What’s driving your total cost of acceptance

Focusing only on the direct costs of accepting payments can be risky. Those are just ‘tip of the iceberg’ costs that you can readily see. Below the waterline are many other factors that may contribute to your overall cost—particularly with a legacy system.

Consider the following illustration:

Often the costs associated with managing exceptions are submerged, so your business may not realize how much operating expense and risk you are incurring that could be avoided.

Let’s explore the primary components of the total cost of acceptance.

Transaction costs

Base transaction fees are the hard costs imposed when a financial transaction is processed through a payment system. These fees are a standard part of most electronic payment methods, including credit cards, debit cards, bank transfers and digital wallets—and each of those method’s providers will command a share of each transaction.

Every major payment method has its place in your payments mix. That’s why it’s critical to drive customers to the right payment type for them to minimize the total cost of each transaction.

- Online banking comes in two varieties: guaranteed and non-guaranteed. Each of these options has their own set of pros and cons.

As the name suggests, guaranteed online banking transactions—sometimes referred to as guaranteed ACH—are fully guaranteed by the provider. While this grants an operator peace of mind knowing the transaction is exception-free, it comes at a premium price with a higher transaction fee. Guaranteed ACH payments may be subject to a slightly lower acceptance rate than debit transactions as the provider is taking on the risk.

Non-guaranteed online banking or ACH transactions are less expensive; however, they expose operators to NSF risk if the funds aren’t available to collect from a customer when the transaction settles.

- Debit cards are lower cost and enable operators to see whether a transaction can be processed in real time, but this method can be subject to high rates chargebacks and fraud. Plus, most customers have access to a debit card and are familiar with the option, and these transactions have a relatively high acceptance rate.

- Apple Pay and Google Pay (or pass-through wallets) can house debit and credit cards and process at a debit card cost, and may be a customer’s preferred card option that can improve likelihood of payment while simultaneously offering increased acceptance rates. They may be vulnerable to some of the drawbacks of traditional debit cards, but offer additional layers of security and documentation that improve their reliability for card not present transactions.

- PayPal and Venmo (a mix of pass-through and stored value wallets) are potentially the highest per transaction fee, but for people who store a balance in a wallet, it can be the lowest cost way to enable them to use the funds for making deposits. And according to PayNearMe research, wallets are simply a very popular and preferred method of payment for online gaming customers. If accepting wallets increases retention, or helps you avoid exceptions like ACH declines in online banking, then your end cost for those transactions can be much less.

Lowering the total cost of acceptance is about more than promoting the cheapest rail in your payment flow. It’s about meeting customers where they are and offering flexible options that make it easier for them to pay and reduce the likelihood of exceptions.

Transaction fees are only the tip of the iceberg. With a legacy system, it can take many successful payments to offset the time and cost of resolving just one exception. High exceptions disrupt cash flow, making it harder to manage daily operations, budget effectively or plan for growth.

Now, let’s review the three areas below the line that are often overlooked and can be reduced or prevented altogether by a payment experience management platform.

Exception costs

Exceptions will never be 100% eliminated. And they’re bound to occur more often as consumers push back on rigid processes that make it harder for them to deposit funds to their preferred gaming apps. Let’s look at some common exceptions that can have a ripple effect of added costs—and what operators are doing about it to recapture profits.

First, it’s important to point out the two primary categories that emerge: traditional (or true) exceptions, and experiential exceptions. True exceptions are often the result of customer circumstances. These include chargebacks, NSFs and similar failures. Experiential exceptions are those that emerge from a poor payment experience, often confusing customers enough to forgo the payment altogether. This second type of exception is impacted by the customers ability to pay, making them primary candidates for optimization through payment experience management.

Chargebacks

Chargebacks are a common exception in the gaming world, often initiated when customers notice an unexpected debit or an unfamiliar charge on their bank or card statement. Chargebacks occur for various reasons in the online betting space, but are most commonly associated with criminal or “friendly” fraud. Other times it could be related to a user error, system error, or something more complex.

Chargebacks can be one of the most expensive and challenging payment exceptions to manage. With older player account management or payment systems that have little or no visibility into the data, it can be difficult for the business to respond quickly with the necessary evidence to win disputes. With access to the right data and tools, operators can resolve, and even win, many non-fraudulent chargebacks.

Preventing chargebacks is far more cost-effective than resolving them. Many can be avoided by implementing fraud detection and risk management tools. Unfortunately, legacy systems and simple gateways often lack these features, resulting in more disputes and significantly increasing the total cost of acceptance. Preventing some chargebacks can even be as simple as making sure the name of the business matches the name of the biller on the customer’s card or bank statement.

Reducing and preventing chargebacks is key to reducing the total cost of accepting payments. A modern gaming payment platform, equipped with advanced fraud prevention, visibility and automation, can make a significant difference. By addressing the root causes of disputes, operators not only reduce costs but also enhance the overall payment experience.

Outages and downtime

Unlike many other types of online payments, betting is often time-sensitive. While bills have due dates and e-commerce transactions might have a flash sale, sports betting timeliness can come down to the second. High-volume events are especially important to online sports betting operators, when huge games or tournaments can account for a significant percentage of revenue.

If payment processing goes down during a major sporting event, the cost can be catastrophic, both from a revenue standpoint and from a player loyalty perspective. An outage often makes headlines, and most certainly makes it to social media where players are free to vent their frustrations. While larger operators are often equipped with redundant processing, emerging operators may struggle to integrate multiple providers to prevent high-volume downtime. A payments partner with built-in multi-processor redundancy can be a true asset to operators looking for protection with low development lift.

Exceptions driven by a poor payment experience

Experiential exceptions introduce more nuance and complexity than traditional exceptions.

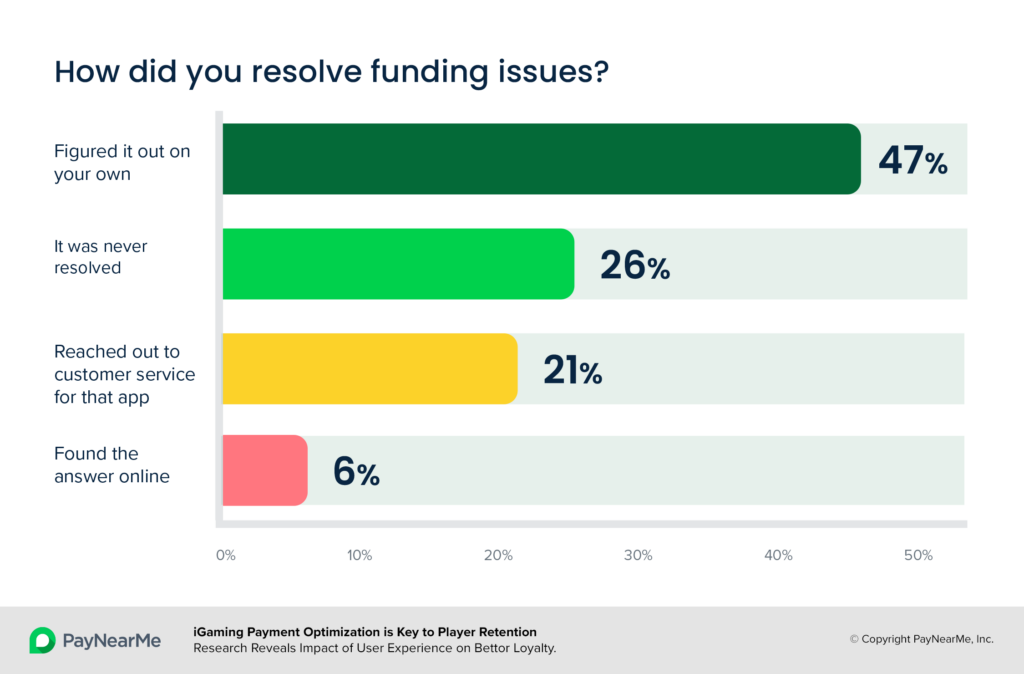

A poor payment experience can create confusion or frustration, leading to preventable exceptions that may require manual intervention from support teams to resolve. For example, a customer that is able and ready to make a deposit but keeps receiving error messaging when trying to link a bank account can lead to a costly customer service interaction or, worse, complete abandonment of the process. As mentioned earlier, PayNearMe consumer research showed that 23% of customers would leave an app and never return if they experienced a payment issue. The goal is to deliver payment experiences that meet a customer’s needs or preferences, ideally preventing them from slipping into an exception or abandonment state.

Consider how the payment experience affects a player’s ability to complete the deposit process. For those who are ready to deposit now, how can you make it as simple and frictionless as possible? Deposits are often a customer’s first impression of an online gaming app’s user experience. When that experience is unpleasant or cumbersome, an operator risks added fees associated with the attempted transaction, lowered brand reputation, and lost lifetime customer value.

Payment journey abandonment

A lackluster payment experience can be a leading cause of betting app abandonment, which hurts operators in more ways than one in the current competitive landscape Here are a few ways this can play out:

- Poor user experience. Consumers expect a seamless payment experience like those in eCommerce. Confusing or complicated deposit processes—too many extra screens, glitching third-party connections, lack of error messaging—can frustrate customers, especially those expecting an easy and entertaining experience. The more time and effort it takes a customer to make a deposit, the more likely they will be to abandon the self-service process or the app/brand entirely.

- Limited payment options. Operators that offer limited payment options create unnecessary friction that can trigger exceptions. And when the majority of operators in the online betting world have now integrated modern, mobile-first payment options such as PayPal, Venmo, Apple Pay and Google Pay, it’s becoming the status quo.

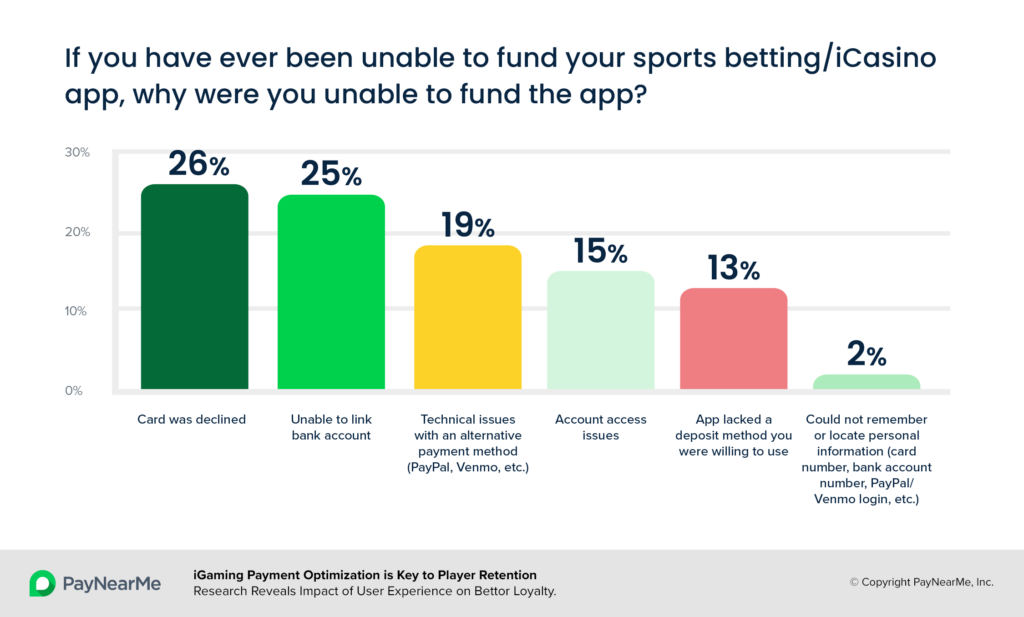

The reality is, no single payment option reigns supreme in iGaming. Individual players have preferences, and every tender type comes with its share of occasional problems that could lead to a poor payment experience (as shown in the chart below). Because of this, operators need to focus on providing the right mix of payment options that will appeal to a wide range of player preferences while balancing out the total cost of acceptance.

- Lack of information and communication. A number of player frustrations that lead to lost loyalty or abandonment are simply due to a lack of clear communication. Operators often fail to provide error messaging after a payment glitch or decline, leaving players in the dark when it comes to next steps or a resolution to a problem. Providing actionable remedies or clear explanations for declines can empower customers to resolve issues on their own, reducing support calls and enabling the successful completion of deposits—and therefore, conversions.

Increased support needs

Payment issues that turn into customer support inquiries are a more common exception than one might think for online betting. Customers may abandon an online payment if they forget their password, find the payment flow confusing, cannot use their preferred payment method, or want to dispute a transaction. These frustrations ultimately translate into higher costs.

Each support call or chat session comes with a tangible cost. According to Gartner, the cost of an average customer service interaction is around $8, while a comparable self-service interaction may cost only $0.10. This 80x increase in cost can be one of the biggest cost drivers for a business, especially as market share increases.

This doesn’t factor in the opportunity cost faced. Each customer support representative who needs to respond to a payment-related issue can’t fulfill another responsibility or handle more complex customer support requests, especially ones for frequent bettors or VIP customers.

Brand and reputation damage

Poor payment experience can lead to far more than increased exceptions—it can damage an operator’s reputation, hinder growth and leave a business struggling to keep up with competitors.

In many cases, the payment experience defines the overall customer experience. Poor payment experiences can do more damage than increasing exceptions. A frustrating or outdated process can create negative sentiment, tarnishing a brand and making it harder to attract new customers or retain existing ones. In a saturated iGaming market where players have an abundance of choice, positive brand reputation is critical.

By partnering with a payments innovator, operators can offer the flexibility and personalization customers now expect. Modernizing your payment process is not just a cost-saving measure—it’s an investment in future revenue and customer loyalty.

The high stakes of exceptions

Controlling exceptions is one of the most impactful levers operators have to reduce operating costs and improve efficiency. Unlike transaction costs, there’s a high number of adjustments that can be made to optimize the payment experience and influence exception rates. But that’s simply not possible when relying on legacy technology providers that don’t offer intuitive, flexible solutions to identify and manage exceptions.

Businesses that rely on decade-old technology risk being outpaced by competitors using the latest capabilities and AI advancements. Legacy platforms lack agility, making upgrades costly and complex, and many emerging operators lack the in-house resources to extend existing systems to leverage modern tools and technologies.

People costs

Staff-related costs are often not factored into payment costs, but they are a major contributor driving up the total cost of acceptance. Think of “people costs” as anything that requires hands-on interaction. The more people (and time) needed to intervene to handle payments, the more expensive acceptance will be.

- Payment support interactions. When agents are needed to help players navigate the payment flow, deal with errors and declines, or figure out why a payout is taking so long, what should have been a self-serve online deposit or fast payout of less than $0.50 now could cost more than $5.

A poor payment experience can end up incurring more overhead cost for additional support staff, or can pull an operator’s already lean resources away from initiatives like customer acquisition, VIP player programs and retention, and risk and fraud mitigation.

- Complex manual reconciliation. Disparate payment systems can generate separate reports for each exception type (e.g., ACH returns or chargebacks), and provide only minimal transaction data. That may result in many more hours of manual work for your accounting staff, a cost that’s often overlooked as part of the overall expense of accepting payments.

- Manual withdrawal reviews. Operators typically have to approve withdrawal requests to comply with internal controls, often requiring manual review and intervention. This can significantly slow down the payout process and delay winnings from getting to a customer. According to PayNearMe research, 49% of those surveyed would be willing to switch to a different gaming app if it promised faster withdrawals. In addition, the staff needed to maintain the manual review process is another high cost. Instead, logic-based rules can help automate more of the approval process so payouts get to players faster and operators can redirect staff elsewhere.

- Development costs. Legacy payment systems require more maintenance and workarounds than modern systems, creating the need to hire developers to keep the trains running on time. And a standard payments gateway can lack value-added tools that help with critical areas such as risk and fraud or player behavior data management, which then piles on additional development and integration work for extra third-party vendors. These development resources should instead be used to innovate in other areas of the business, such as customer-facing app features that can set an operator apart from the competition.

- Scaling risk & fraud teams. The gaming industry has a comparatively high rate of consumer fraud, with fraud rates surging by 73% from 2022 to the end of 2024. Operators often think they can solve the problem by adding to their risk team headcount, but trying to scale headcount fast enough to match the growth rate of fraud is not a sustainable solution in this case. Instead, operators should look for technology vendors who can offer built-in risk mitigation features, especially payment providers who can stop fraud at the source. Being proactive instead of reactive about fraud can lead to sustainable growth and improved profitability without increasing overhead.

System costs

System costs refer to the operational expenses associated with the tools and applications your business uses to operate successfully. These include payment systems, KYC and compliance tools, player behavior data monitoring, fraud prevention technology and more.

Disjointed, legacy payment systems typically require more integrations and additional tools to perform tasks that modern systems can handle seamlessly. They may require “bolting on” of additional point solutions. This reliance on numerous connections and add-ons increases integration costs and operational complexity. As an alternative, some operators opt to build their own payments ecosystem in house by partnering with multiple payment providers for each tender type. While they may have the resources to do so, it’s an incredibly complex and time-consuming endeavor to develop the technology and manage the vendor relationships that come along with an in-house solution.

By contrast, a modern platform often consolidates functions, enabling greater efficiency and improved outcomes. For instance, it might integrate tools like advanced fraud detection or detailed monitoring features, helping you strengthen your capabilities while reducing the complexity of managing multiple systems. This consolidation not only cuts down on system costs but also improves the overall payment process.

Reduce exceptions and lower the total cost of acceptance

At the end of the day, the goal is to have 100% conversion with no exceptions and no manual intervention. However, legacy systems keep this goal much farther out of reach.

Modern payment platforms offer the tools to reliably accept payments while minimizing costs. By leveraging payment data, operators can gain insights into customer behaviors, allowing them to offer the right payment options at the right time to reduce exceptions and improve efficiency.

Modernizing the payment process doesn’t disrupt business—it streamlines it. With technology doing the heavy lifting, operators can reduce costs and exceptions while freeing staff to focus on more high-value activities.

A modern payments platform enables businesses to deliver the fast, seamless payment experiences iGaming customers have come to expect, increasing conversion and retention.. And with better back-end payment tools, operators can automate more workflows to reduce the cost of managing exceptions when they do occur.

Ultimately, a modern payments solution can solve a business’s biggest payment experience problems and lower the total cost of acceptance.

Tools to prevent exceptions

Fight back against fraud

One of the most intriguing developments in payments is the introduction of new artificial intelligence tools that can identify and mitigate fraud at scale. AI/ML can amplify the speed, efficiency and nuances of fraud detection to better protect the business, while lowering costs and risk. Platforms with modern, flexible APIs and built-in fraud engines can provide a significant boost to fraud and risk management in a rapidly changing digital environment.

In addition, these tools offer the promise of nuance, helping to push good players through the payment process while effectively flagging bad actors.

Use data to lower risk

Customer payments data is a valuable resource to help prevent risk. Sophisticated payment platforms can combine stored payments data with community data from other resources to build a risk profile for each customer. This risk score can then be used to automate certain processes, improving acceptance rates and payout speed for low-risk customers.

Win more chargebacks with less effort

For the portion of chargebacks that can’t be outright avoided, including friendly fraud, the key is to cut out as much time as possible from the resolution process. Modern platforms make it easier to stay organized, gather evidence and submit dispute responses. In addition, these tools should enable you to track the status of all pending disputes, cutting down the time required to manage the chargeback process.

Emerging operators may not realize there are tools available to help them fight back against chargebacks, leaving money on the table and inviting future chargeback instances from repeat offenders. Smarter chargeback tools give businesses another risk management tool to deter bad behaviors and win more disputes.

Reduce downtime with smarter routing

Downtime is especially concerning because it does not discriminate—even experienced bettors and VIP customers are affected by outages. And downtime can’t just be measured in minutes offline. Instead, operators must consider the time spent by staff fixing the issue, the number of complaints that need to be fielded during the incident, and the efforts required to mitigate the reputational damage done even after the outage is resolved.

Downtime can often occur during the worst possible times, especially when a payment provider isn’t equipped to handle the influx in volume that comes along with a popular sporting event. A platform with multiple redundant processing options, smart routing and proactive monitoring can drastically minimize the occurrence and effects of downtime, ensuring that every customer has an enjoyable betting experience without interruption.

Automate payment optimization with business rules

Chargeback management and disbursement management are often inefficient pieces of business operations. Using data-driven rules can help operators leverage customer behavior and payment information to help reduce the risk of exceptions and chargebacks from the start. For instance, logic rules can identify customers with multiple past chargebacks and preemptively offer alternative payment options. Automated rules eliminate manual intervention, turning what could take hours of staff time into a process completed in minutes.

Experiences to prevent exceptions

Offer more options to improve conversion

Providing more payment types reduces risk, exceptions and delinquencies by meeting customers where they are. For example, offering PayPal may seem more expensive than ACH, but if it eliminates the risk of an ACH return, it’s more economical in the long run.

A modern fintech platform enables operators to accept a full range of payment types, including ACH, cards, digital wallets (PayPal, Venmo, Apple Pay, Google Pay), and even cash at retail locations including 7-Eleven, CVS, Walgreens and others. The goal is to optimize the payments mix for each customer to maximize successful deposits and minimize costs. In addition, the right payments partner will integrate with new tender types as they become available and allow operators to switch them on with no additional development work required, future-proofing their payment strategy.

Hyper-personalize to maximize customer lifetime value

Modern platforms unlock the power of payments data, helping you understand customer behaviors, preferences and trends. These insights allow you to tailor the payment experience to each customer, increasing conversions with the least risk of exceptions.

Once you understand who pays, how and when, you can optimize the interface to prioritize the payment options each customer prefers. For example, data may reveal that customers under 30 favor Venmo over PayPal. You can prioritize displaying Venmo as a primary deposit option, streamlining the process and reducing friction.

In addition, access to player behavioral data allows operators to uncover VIP potential within their customer bases. With AI- and ML-driven tools, operators can identify frequent bettors with low-risk behaviors who would be ideal candidates for VIP programs and higher limits—increasing the lifetime value of their customer pool.

Reclaim your profits by reducing total cost of acceptance

For operators, innovating the payment experience may not seem urgent—but can you afford to keep operating with disjointed systems that drain your profits and slow you down? Efficiency and profitability are essential, yet legacy systems make it increasingly difficult to collect payments at the lowest cost while minimizing exceptions. The real risk isn’t change—it’s standing still while competitors and market demands surge ahead.

How much longer can you afford to let outdated and fragmented systems hold you back, driving up costs and eating into your margins?

A payment experience management platform like PayNearMe empowers you to tackle these challenges head-on. Your customers can make payments or deposits more easily and your payouts will be faster, with significantly less overall cost. Plus, you increase customer satisfaction along the way to drive referrals and repeat business, unlocking higher lifetime player value.

By adopting a modern platform, you unlock the potential for greater efficiency, improved staff productivity, and lasting customer loyalty. From diverse payment options to built-in risk and fraud tools to data insights, a modern platform ensures you’re not just keeping pace—you’re leading the way in delivering better payments experiences for your customers and your business.

We’re a company focused on helping our customers solve business problems. We are excited to help our clients harness the power of the PayNearMe platform to demonstrate it’s more than just simple payment processing.

John Minor, Chief Product Officer, PayNearMe